Get the free Matching Gift Program

Get, Create, Make and Sign matching gift program

How to edit matching gift program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out matching gift program

How to fill out matching gift program

Who needs matching gift program?

Mastering the Matching Gift Program Form: A Comprehensive How-to Guide

Understanding matching gift programs

Matching gift programs are initiatives established by employers that make contributions to nonprofit organizations, effectively doubling or even tripling employees' charitable donations. These programs incentivize giving while also allowing employers to engage in corporate social responsibility efforts. By matching donations, companies amplify their philanthropic impact, fostering a culture of giving among their staff.

For donors, matching gifts enhance their contributions, allowing them to maximize the benefit of their generosity. Nonprofits, on the other hand, can significantly boost their fundraising potential through these programs, helping them to meet funding goals and expand their reach. This synergy between donors and nonprofits creates a powerful ecosystem of giving and support.

Importance of the matching gift program form

Using a matching gift program form is essential for streamlining the submission process for donors. Properly filling out this form ensures that matching contributions are verified and processed efficiently, preventing miscommunication and delays. For nonprofits, adopting a standardized form enhances fundraising efforts and increases the likelihood of receiving matched funds.

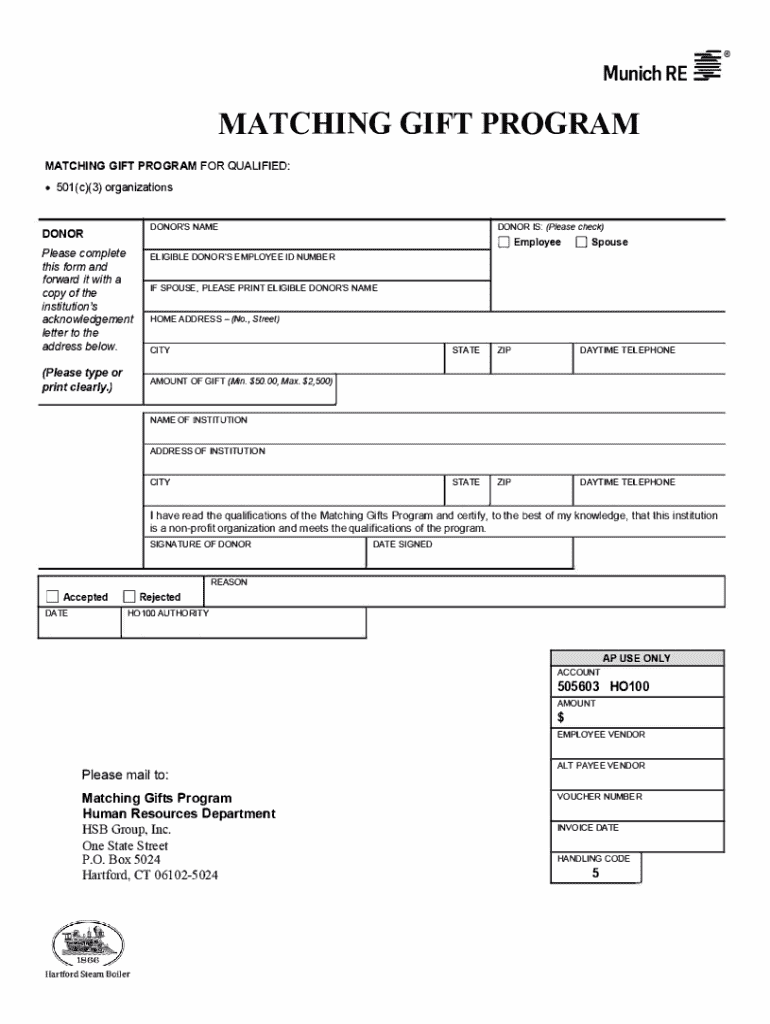

A successful matching gift program form includes specific details that facilitate processing. Key components include accurate donor information, nonprofit details (like the tax ID), and donation specifics such as the amount and date of the gift. For clarity and effectiveness, forms should be easy to read, structured simply, and compatible with both paper and electronic submission methods.

Types of matching gift program forms

Matching gift forms can be categorized primarily into paper forms and electronic formats. Paper forms offer a traditional approach, allowing donors to physically fill out and submit their information. However, this method can lead to processing delays and potential errors if the forms are improperly submitted or lost.

In contrast, electronic forms provide a more efficient method for submission. They can be easily filled out and submitted online, reducing physical paperwork and speeding up the matching donation process. Companies and nonprofits can also utilize online platforms that integrate directly with their systems to manage submissions collectively.

Filling out the matching gift program form

Completing a matching gift program form requires specific information from both the donor and the nonprofit. Donor details typically include the donor's name, contact information, and employer. Conversely, nonprofits should provide their tax ID, organizational details, and any specific instructions necessary for the matching process.

Here's a step-by-step guide to streamline your form completion:

When it comes to common mistakes, donors should be extra vigilant. Incomplete information, choosing incorrect submission methods, or failing to sign the form can delay the processing of matching gifts significantly.

Utilizing technology to enhance matching gift submission

Taking advantage of technological tools like pdfFiller can greatly simplify the process of completing, signing, and managing matching gift forms. This platform allows donors to edit PDFs and eSign documents directly, reducing the risk of errors and miscommunication while ensuring that all necessary details are accurately filled out.

Team collaboration is also enhanced through platform features that allow fundraising teams to work together seamlessly on form submissions. Integration with corporate matching gift software can further streamline the submission process, making automatic form submission a reality and eliminating many manual handling steps involved in matching gift requests.

Managing and tracking matching gifts

Nonprofits should adopt best practices for managing submitted forms and tracking matching gifts effectively. Following up with donors to confirm receipt and to reinforce appreciation can enhance donor relationships. Moreover, adopting a system to record and track submitted forms can help nonprofits stay organized and understand their fundraising landscape better.

Utilizing matching gift databases can significantly aid nonprofits in identifying eligible companies and potential donors. Access to both free and paid tools can help organizations tap into a wealth of information regarding matching gift opportunities, thus maximizing their fundraising potential.

Inspiring examples of matching gift forms

Case studies of organizations that effectively utilized matching gift forms can provide insight and inspiration. One such organization implemented a visually engaging matching gift form that included statistics on the impact of donations. Adding testimonials from beneficiaries also enhanced the emotional connection of the form, driving higher submission rates.

Another successful campaign featured a dedicated section for matching gifts in their newsletters and on their website. By making it a focal point and including clear instructions along with compelling visuals, this nonprofit saw a significant increase in matching gift submissions, demonstrating the power of strategic communication.

Additional tools and resources

Navigating matching gift submissions requires access to the right resources. Various websites and tools are available to assist donors and nonprofits in understanding and completing matching gift forms seamlessly. From templates to comprehensive guides on matching gift processes, these resources can empower users to engage more effectively.

Building relationships with corporations is also crucial. Nonprofits should engage potential corporate partners proactively, discussing matching gift opportunities and exploring collaboration avenues that can lead to mutual benefits. Networking strategies can include attending industry events and workshops focused on corporate philanthropy.

Special considerations for donors and nonprofits

For donors, it’s important to verify match eligibility directly with their employers. They should check the details regarding the matching gift process, necessary forms, and procedures required to ensure correct matching contribution amounts. Tools provided by companies, like online portals, can greatly assist in this verification.

For nonprofits, cultivating relationships with corporate partners is essential. Strategies for discussing matching gifts include emphasizing the benefits to both the company and the community, showcasing past successful initiatives, and fostering an ongoing dialogue about social responsibility efforts.

Engaging with your audience

To effectively promote matching gift forms, nonprofits should employ various marketing strategies. Utilizing emails, social media, and in-person events can create awareness about matching gifts and ensure donors understand the impact their contributions can have when maximized through matching contributions.

Educating donors on the importance and benefits of matching gifts must go beyond mere statistics. Sharing stories of how past matching contributions led to significant outcomes can inspire greater participation and commitment among supporters, ultimately translating to higher fundraising success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get matching gift program?

How do I edit matching gift program in Chrome?

How can I edit matching gift program on a smartphone?

What is matching gift program?

Who is required to file matching gift program?

How to fill out matching gift program?

What is the purpose of matching gift program?

What information must be reported on matching gift program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.