Get the free Credit Card Payment Form

Get, Create, Make and Sign credit card payment form

Editing credit card payment form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card payment form

How to fill out credit card payment form

Who needs credit card payment form?

Understanding the Credit Card Payment Form: A Comprehensive Guide

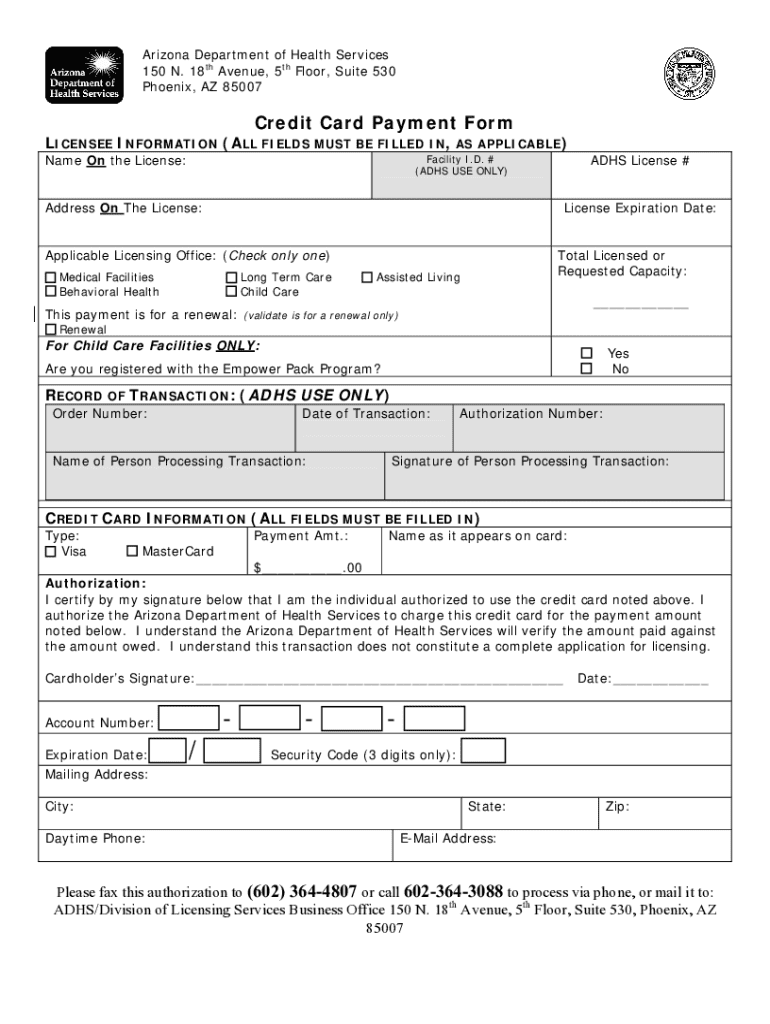

Understanding the credit card payment form

A credit card payment form is a crucial document used by businesses and individuals to securely collect payment information. Its primary purpose is to facilitate transactions by capturing essential details about the cardholder and the card itself, ensuring seamless processing of payments. This forms a backbone of e-commerce and financial dealings. Without a structured payment form, processing credit card transactions could lead to inefficiencies or even security breaches.

Effective credit card payment forms are particularly significant in the booming e-commerce sector, where trust and security are paramount. A well-designed form minimizes errors and enhances user experience, which can directly influence conversion rates. Many companies implement various features, including user-friendly interfaces and mobile compatibility, making payment processing simpler and faster for customers.

Common uses of credit card payment forms

Credit card payment forms are versatile tools used across varied sectors. One of the primary applications is for online purchases, where customers input their payment details to complete transactions on e-commerce platforms. Subscription services, too, rely heavily on these forms, allowing users to pay recurring fees without repeated data entry. Businesses also utilize credit card payment forms for fundraising events. Non-profits often include them on their websites to facilitate donations smoothly.

Moreover, B2B transactions frequently involve credit card payment forms, simplifying purchases and contracts between companies. For in-person events, like restaurants or concerts, these forms have evolved into digital solutions, allowing attendees to make secure payments with a few taps or clicks on their smartphones, showcasing their importance across different settings.

Essential components of a credit card payment form

Understanding the essential components of a credit card payment form is vital for effective implementation. Ideally, a form should start with gathering cardholder information. This includes the cardholder’s full name, billing address, and contact details to ensure a smooth transaction process. Accurate information helps avoid issues such as chargebacks or failed transactions.

The core payment information section is crucial, requiring the credit card number, expiration date, and CVV code. This data allows the business to process payments securely. Additionally, having an authorization section where users can provide a signature or check a box affirming their acceptance of terms is necessary; this legitimizes the transaction. Including a 'terms and conditions' agreement checkbox is also a common practice, ensuring customers understand and agree to the stipulations before processing their payments.

Step-by-step guide to filling out a credit card payment form

Filling out a credit card payment form accurately is essential to ensure successful transactions. Here’s a step-by-step guide to help users navigate this process efficiently. Start by gathering all necessary information, as having everything handy can significantly reduce filling time and mistakes. Legibility and clarity, especially for personal information, are vital.

Next, complete the cardholder information fields with precise details and move on to the payment section. Enter the credit card number, expiration date, and CVV code with utmost care, ensuring everything is typed in correctly. Tips for avoiding common mistakes include double-checking the information entered and looking for errors like transposed numbers. Before submission, review the filled-out form for accuracy, guaranteeing all information is correct and updated.

Lastly, providing the necessary authorizations is crucial, such as signing or checking any agreement boxes. Following these steps can minimize errors and enhance the overall experience, making transactions smoother for everyone involved.

Security measures for credit card payment forms

Security is a paramount concern when it comes to credit card payment forms. Businesses must implement robust security measures to protect sensitive customer data. Utilizing encryption and secure payment gateways is effective in safeguarding information during transactions. Encryption converts user data into a coded format, making it unreadable to unauthorized users, thus ensuring privacy.

Moreover, adhering to PCI compliance standards is essential for any company that processes credit card transactions. This set of security guidelines is designed to protect card information, requiring businesses to implement various safety measures. Additionally, educating customers on recognizing secure transactions can foster confidence. Awareness about secure websites (indicated by HTTPS and padlocks) is crucial for ensuring that their data remains safe while using credit card payment forms.

Editing and customizing your credit card payment form

Customization is vital in ensuring that a credit card payment form accurately reflects a business’s branding and functional needs. Using tools like pdfFiller allows users to edit and personalize their forms effortlessly. They can add specific fields that align with their operational requirements or branding elements such as logos and colors to create a cohesive brand image.

Moreover, companies might need to incorporate additional questions or fields depending on their specific needs, whether to gather more information or for compliance purposes. By utilizing pdfFiller’s editing tools, businesses can create a tailored experience for customers, enhancing their transaction experience significantly.

Digital signing and verification process

The digital signing process has revolutionized credit card transactions, providing a quicker and often more secure method for authorizing payments. E-signatures offer various benefits, including ease of use and legal validity, making them an attractive option for businesses. This verification process ensures that the customer has consented to the transaction, which is vital for minimizing disputes such as chargebacks.

Adding an e-signature using pdfFiller is straightforward. Users can create an e-signature using their touchscreen devices or by uploading a digital signature image. The process is legally binding in many jurisdictions, further reinforcing the legitimacy of the credit card payment form. Understanding the legal implications of e-signatures helps businesses and customers feel secure in their decision to conduct transactions digitally.

Managing and storing completed credit card payment forms

Effective management of completed credit card payment forms is essential for maintaining organized transaction records. Within the pdfFiller platform, users can securely store forms, ensuring that sensitive information is protected. This cloud-based solution provides accessibility to authorized staff, enabling them to retrieve forms and information whenever necessary.

Furthermore, easily retrieving past transactions and forms allows businesses to access historical data effectively. This capability can enhance customer service, addressing inquiries or complications that arise related to past payments, thereby promoting customer satisfaction and loyalty.

Understanding the legal considerations and regulations

Navigating the legal landscape surrounding credit card payment forms is critical for businesses. Payment processing laws can vary significantly across jurisdictions, making it essential for companies to understand their local regulations. This knowledge ensures that businesses handle sensitive information responsibly and reduces the risk of legal complications.

Typically, businesses must adhere to strict record-keeping requirements concerning completed forms and transactions. This oversight not only protects the organization but also establishes accountability. Understanding limitations and responsibilities surrounding credit card payment forms is essential for maintaining compliance and trust with customers.

Frequently asked questions (FAQ)

Here are answers to some common questions about credit card payment forms. Customers often wonder what happens if there’s an error in their submission. Generally, if a mistake occurs, it's crucial to contact the business immediately to rectify the situation.

Another frequently asked query concerns the security of credit card information. Customers should always ensure they’re using secure websites and are aware of signs indicating safety. Many also question the legal standing of electronic credit card payment forms. Yes, they are legally binding in most situations. Lastly, multiple uses of a credit card payment form depend on the control mechanisms businesses set up; usually, they are valid for single transactions only.

User experiences and testimonials

User experiences with pdfFiller reveal a transformative impact on how businesses manage payments. One success story involves a small restaurant that streamlined their payment processes using pdfFiller’s interactive templates. Customers reported a smoother experience making reservations and payments, contributing to enhanced customer satisfaction rates.

Feedback indicates that users appreciate the convenience and speed of digital payment forms, especially during peak service hours. By utilizing pdfFiller, companies can reduce transaction times and minimize errors, further increasing operational efficiency.

Additional tools and resources

For businesses looking to create effective credit card payment forms, pdfFiller offers interactive templates that simplify the process. These resources enable quick customization and streamline the integration of payment processes within various e-commerce platforms. Strategic enhancements can drastically improve payment handling across teams, providing clarity and reducing errors during the transaction process.

Leveraging these tools not only promotes a better user experience but also strengthens financial management. Companies can refine their payment operations, ensuring that employees are equipped to handle customer transactions efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit credit card payment form online?

Can I create an electronic signature for the credit card payment form in Chrome?

How do I edit credit card payment form on an iOS device?

What is credit card payment form?

Who is required to file credit card payment form?

How to fill out credit card payment form?

What is the purpose of credit card payment form?

What information must be reported on credit card payment form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.