Get the free Personal Cash Flow Statement

Get, Create, Make and Sign personal cash flow statement

How to edit personal cash flow statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out personal cash flow statement

How to fill out personal cash flow statement

Who needs personal cash flow statement?

Your Comprehensive Guide to Personal Cash Flow Statement Form

Understanding the personal cash flow statement

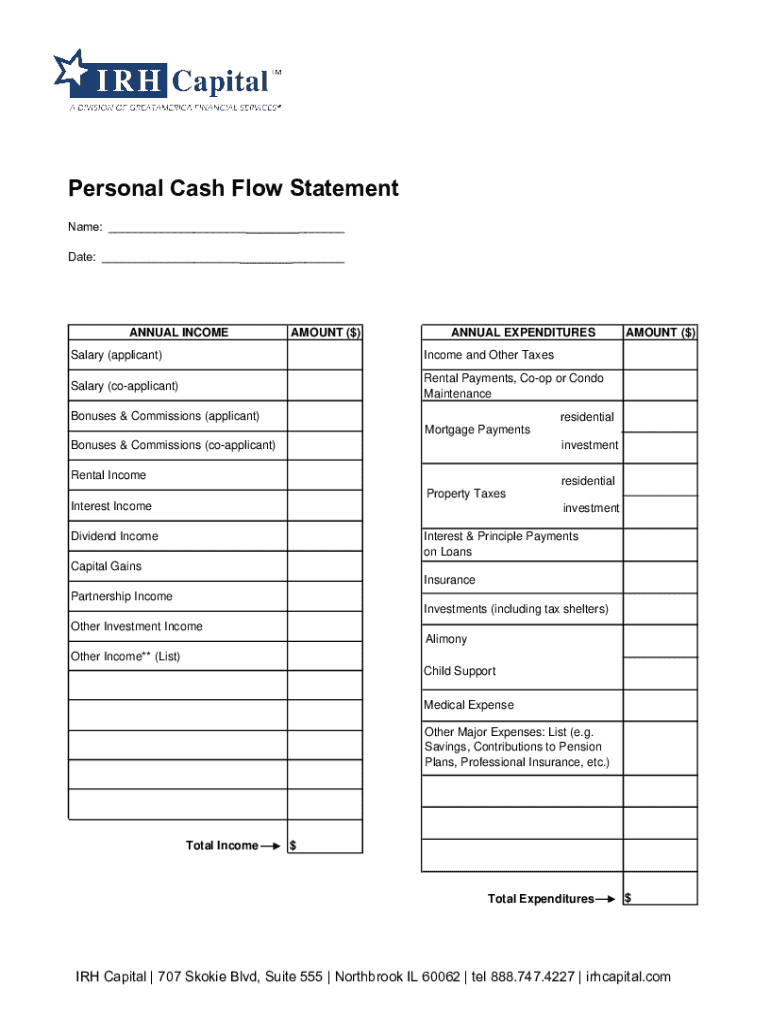

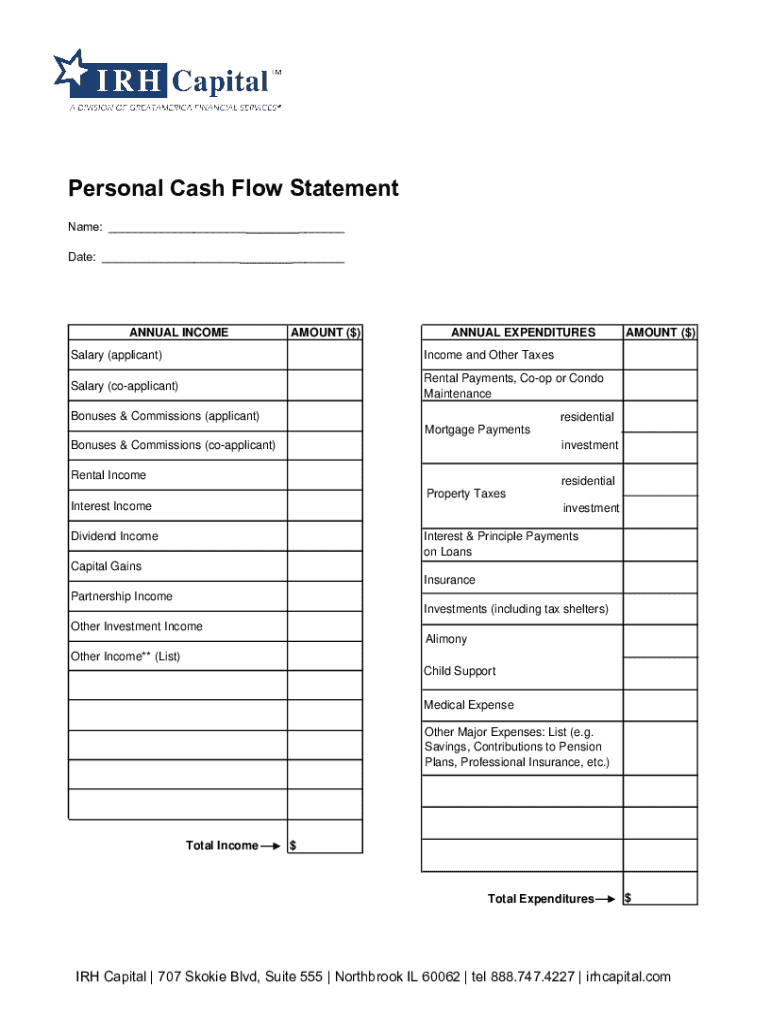

A personal cash flow statement is a financial document that records the inflow and outflow of cash in your personal finances over a specific period. This statement allows individuals to evaluate their cash position, determining whether they are living within their means or overspending. Tracking cash flow is vital for achieving personal financial health, as it provides visibility into your financial habits and can inform better financial decisions.

Key components of a personal cash flow statement include cash incoming (all sources of income) and cash outgoing (all expenses). By analyzing these components, you can make informed decisions on budgeting and spending, ultimately leading to improved financial stability.

Why you need a personal cash flow statement

Maintaining an accurate cash flow statement yields numerous benefits that directly contribute to your financial well-being. Firstly, it enhances your budgeting and financial planning capabilities. Understanding where your money comes from and where it goes provides a foundation for creating a more effective budget.

Secondly, tracking your income and expenses helps identify spending habits and trends. By recognizing these patterns, you can pinpoint areas where you may be overspending or where you could cut back. finally, the documentation serves as a valuable tool for making informed decisions regarding savings, investments, and major purchases, enabling financial goals to be reached more efficiently.

Getting started with your personal cash flow statement

Creating a personal cash flow statement begins with deciding its frequency—monthly or annually. A monthly cash flow statement is typically more effective for monitoring short-term financial behaviors, while an annual statement provides a broader perspective on your finances across the year. Choosing the right format—manual or digital—is also crucial in the process. Manual methods may involve traditional spreadsheets, while digital options, such as dedicated software or platforms like pdfFiller, streamline the process and enhance accessibility.

Key components of the personal cash flow statement

A personal cash flow statement begins with the opening balance, which represents your starting amount of cash on hand at the beginning of the period. This figure sets the stage for tracking cash movement throughout the specified time frame. Following this, cash incoming documents all sources of income, including salary from your primary job, returns from investments, or earnings from side hustles. It's essential to factor in all reliable income sources, and if you possess irregular income, estimating these amounts conservatively is key.

The total incoming cash is derived from summing all income streams to establish a clear overview of your overall cash intake. This foundational information paves the way for analyzing your cash outgoings, which comes next in the cash flow analysis.

Detailed breakdown of cash outgoing

When detailing cash outgoing, categorizing your expenses simplifies management. Fixed expenses encompass it necessary payments, including rent or mortgage, utilities, and fixed subscriptions. In contrast, variable expenses represent fluctuating costs like groceries, dining out, and entertainment, which can be adjusted as needed. Lastly, discretionary spending includes non-essential items that are purely for enjoyment but can significantly impact your financial health when uncontrolled.

Summarizing all expenses provides the total outgoing cash, which must then be compared against the total incoming cash to assess your financial standing.

Analyzing your monthly cash balance

Once total incoming and total outgoing cash figures are calculated, you can assess your monthly cash balance. The calculation is straightforward: subtract total outgoing cash from total incoming cash. The resulting figure will indicate a surplus (positive balance) or a deficit (negative balance). This analysis is critical, as it reveals whether you are living beyond your means or if you have the flexibility to save for future needs.

If you find yourself with a negative cash balance, it's essential to develop strategies to manage this situation effectively. Consider reevaluating discretionary spending or adjusting your fixed expenses to ensure your financial obligations are met, allowing for more room in your budget.

Closing the month’s cash flow statement

At the end of the analysis period, determining the closing balance is crucial. This figure, established by adjusting your opening balance with total incoming and total outgoing cash, encapsulates your financial position at the month's end. Once calculated, report and document your findings for future reference. This record serves as a baseline for subsequent months, enabling effective comparison and evaluation of financial progress over time.

Key strategies for managing cash flow

A realistic budget reliant on cash flow insights is pivotal for maintaining financial health. To optimize your cash flow management, consider implementing strategies to cut unnecessary expenses and look for ways to increase your income. Identifying areas of discretionary spending that can be minimized, such as dining out less or exploring cheaper entertainment options, can bridge potential deficits. Additionally, leveraging skills for freelance opportunities can provide additional income streams.

Moreover, techniques for forecasting your future cash flow with estimates of upcoming expenses and anticipated income changes will prepare you for potential financial challenges ahead, ensuring that cash management continues to align with your financial goals.

Advanced insights on cash flow management

Cash flow forecasting is a strategic tool that allows you to predict future cash movements based on existing financial data. To create an effective forecast, analyze historical cash flow patterns and factor in expected changes in income or expenses. Be aware of the distinctions between a cash flow statement and other financial reports, such as balance sheets and income statements. Each document serves different purposes, but understanding them enables you to make informed financial decisions.

Cash and cash equivalents play a foundational role in this equation. Knowing the differences between these categories will help clarify your overall liquidity position, ensuring you can meet financial obligations and seize investment opportunities as they arise.

Using templates for personal cash flow statements

Utilizing templates for your personal cash flow statement simplifies the creation process while promoting accuracy and efficiency. Platforms like pdfFiller offer an array of templates specifically designed for cash flow management. These templates often include built-in formulas and structures that make filling out and updating your statement a breeze.

Accessing and utilizing these templates requires minimal steps, ensuring users can develop their cash flow statements quickly and efficiently, allowing more time to focus on actual financial management.

FAQs about personal cash flow statements

Preparing and utilizing a personal cash flow statement often raises questions. Common queries include what aspects should be included in the statement and what should be left out. For example, items such as investments and regular salary payments are crucial, whereas one-off donations or gifts might be better excluded for accurate cash flow tracking.

Clarifying terms such as cash equivalents is fundamental to fully grasping cash flow dynamics. Understanding that cash equivalents include assets easily convertible to cash, such as marketable securities and treasury bills, is crucial for accurate personal financial assessment.

Features of pdfFiller relevant to personal cash flow statements

pdfFiller enhances the personal cash flow statement experience through various features designed for ease of use. Its eSigning capabilities allow for document validation and recognition, ensuring your personal finances are securely documented. Additionally, collaboration features facilitate teamwork for individuals managing joint finances—an essential aspect for couples or teams managing shared expenses.

Advanced editing tools enable users to customize cash flow statements as per individual needs, paving the way for a tailored financial approach that incorporates personal financial nuances successfully.

Explore more financial topics

Delving into the realm of personal finance doesn't stop at cash flow statements. Explore associated guides on budgeting techniques, financial planning, and investment strategies to broaden your financial literacy. Utilizing resources-rich platforms allows you to connect with community forums where individuals share experiences and advice on maintaining financial health, further enriching your personal finance journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify personal cash flow statement without leaving Google Drive?

How can I get personal cash flow statement?

How do I fill out personal cash flow statement using my mobile device?

What is personal cash flow statement?

Who is required to file personal cash flow statement?

How to fill out personal cash flow statement?

What is the purpose of personal cash flow statement?

What information must be reported on personal cash flow statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.