Get the free Application for Interbank Giro

Get, Create, Make and Sign application for interbank giro

How to edit application for interbank giro online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for interbank giro

How to fill out application for interbank giro

Who needs application for interbank giro?

Application for Interbank Giro Form: A Comprehensive Guide

Understanding interbank giro transactions

Interbank Giro is a reliable electronic payment system that facilitates the transfer of funds between different banks. This method is prevalent in many regions, especially within Southeast Asia, where it has become a standard for businesses and individuals alike. The primary purpose of Interbank Giro is to streamline payment processes for regular transactions, such as salary disbursements, utility bills, and other recurring payments.

Unlike traditional methods such as checks or cash transactions, Interbank Giro provides a faster, more secure alternative that eliminates the possibility of physical loss or theft. Furthermore, the transaction is recorded digitally, providing both parties with proof of payment. This reliability makes Interbank Giro essential for both personal financial management and organizational operations.

The necessity of the application for interbank giro

There are numerous scenarios where an Interbank Giro application becomes a necessity. For instance, businesses paying their employees’ salaries or an organization managing recurring bills needs to formalize the payment request through an application. This document not only ensures that the financial transactions are authorized but also stipulates the terms under which the payments are made, such as frequency and amounts.

By utilizing the Interbank Giro for payments, individuals and organizations can enjoy several benefits. Primarily, it enhances cash flow management by scheduling payments to align with cash availability. Additionally, the automation of transactions reduces administrative burdens, freeing time for other important business functions.

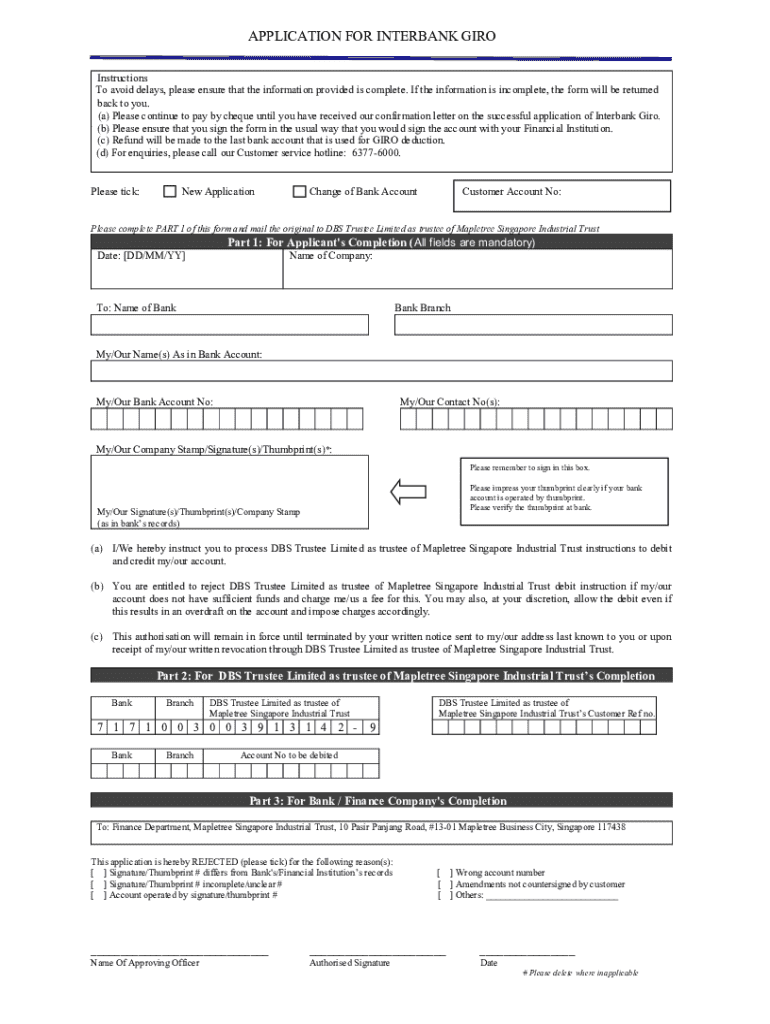

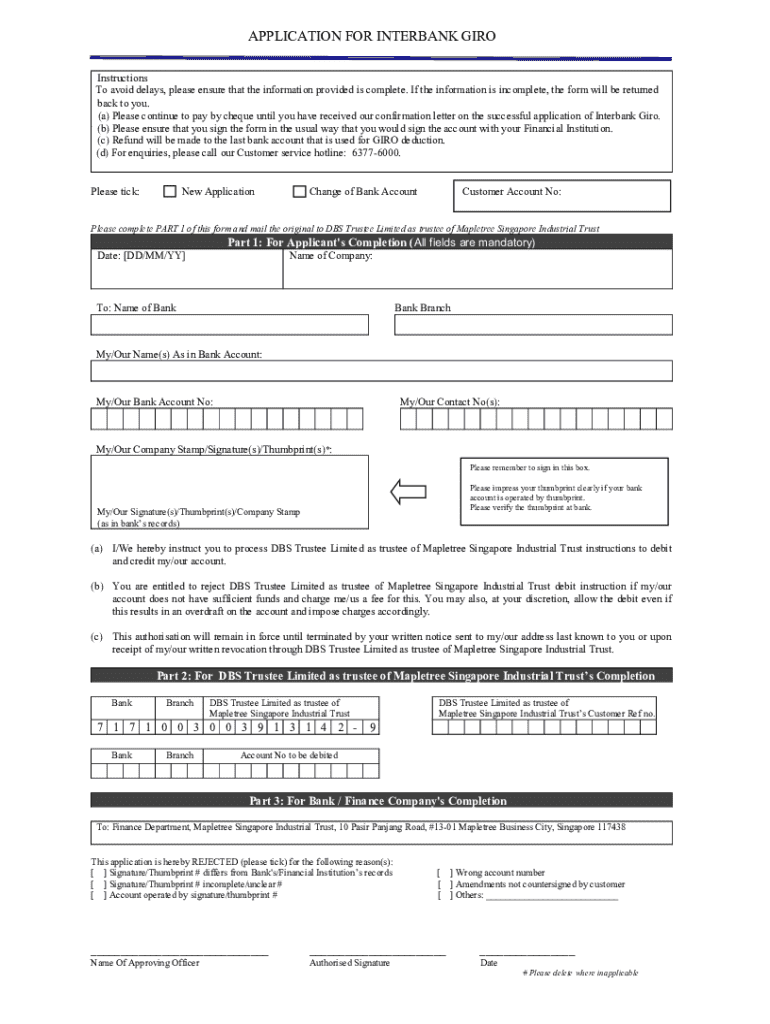

Preparing to fill out the interbank giro application

Before diving into filling out the Interbank Giro application, it's essential to gather the required information and documentation. This preparation enables a smoother and more accurate completion of the form, which can significantly reduce processing time.

Fundamentally, you will need personal identification details, which can include your NRIC number, passport details, or any government-issued identification. You must also have your bank details at hand, specifically your account number and branch code, as these are critical to ensure funds are allocated correctly during transactions.

Additionally, understanding any legal and compliance considerations is crucial, especially if you are representing a business. Each organization might have specific requirements dictated by regulatory bodies governing financial transactions.

Step-by-step guide to complete the interbank giro form

To access the Interbank Giro application form, you can find it directly on your bank’s official website or use platforms like pdfFiller that offer multiple formats, including PDF, online versions, and printable copies. This flexibility allows you to choose the option that best suits your needs.

When filling out the form, start with the personal information section. This includes your name, address, and contact details. Next is the bank details section, where you will input your account number and branch code accurately. Finally, the transaction information section requires you to define the amount, frequency, and purpose of the transactions you intend to perform through the Interbank Giro.

Common mistakes to avoid include misplacing decimal points in amounts, providing incorrect account details, and failing to review the application thoroughly before submission. Make it a habit to double-check your entries!

Editing and customizing your application

Often, applicants may need to make adjustments to their forms. Utilizing pdfFiller’s user-friendly editing tools makes it easy to modify information contained within your application without having to start from scratch. The platform allows you to add, delete, or modify sections as needed, helping you maintain completeness and clarity.

For collaborative efforts, pdfFiller facilitates sharing the application with team members for review. Collaborating ensures that all necessary voices are heard, and crucial feedback can be gathered before finalizing the document. Use features that allow comments or suggestions to achieve a polished final product.

Signing your application for interbank giro

Once your application is completed and reviewed, the next phase is signing the document. pdfFiller provides various eSignature options that enable you to legally sign your application online. This approach not only saves time but also ensures that the document remains secure and valid.

To sign the document, simply follow the prompts on the pdfFiller platform. Ensure that the signature used meets your bank’s requirements, as some institutions have specific validation standards for electronic signatures. After signing, save the document securely before submission.

Submitting your application

After completing your application for Interbank Giro, it’s crucial to submit it correctly. Depending on your preference, you can send your application in person, submit it online via digital banking channels, or mail it directly to your bank branch. Whichever method you choose, ensure that you retain a copy of the application for your records.

Confirming your submission is vital. After submission, verify with your bank to ensure the application is processed. This typically involves checking your application status online or through customer service. Understanding the next steps will help you stay informed regarding when the transfer is activated.

Managing your interbank giro overview

After submitting your application, managing it becomes equally significant. Tracking the status allows you to remain informed about whether your request was approved or if any issues arose during processing. Regularly follow up with your bank if you face delays, as proactive communication can often resolve minor hiccups swiftly.

In case you need to revoke or modify your submitted application, make sure to review your bank’s specific processes for doing so. This often entails filling out a modification form or contacting customer service for guidance.

Frequently asked questions (FAQs)

As inquiries surrounding the Interbank Giro application arise frequently, it’s beneficial to address some common questions. Many users wonder about the processing time for applications; this can vary from bank to bank, and typically ranges between a few hours to a couple of business days.

Another common concern involves the types of transactions that can be processed through the Interbank Giro. Generally, this service supports a variety of personal payments and business transactions, including utility bills, loan repayments, and even salary disbursements. Lastly, some applicants worry about security; the Interbank Giro provides robust encryption and regulatory standards to secure transactions effectively.

Leveraging pdfFiller for future document needs

As you navigate through the process of the Interbank Giro application, consider how pdfFiller can enhance your overall document management strategy. Beyond this specific application, pdfFiller offers a diverse range of document solutions tailored for various needs, whether for businesses or personal use.

Utilizing a cloud-based document management platform means you can access your documents from anywhere, allowing for greater flexibility and productivity. With pdfFiller, integrating document management into your daily operations becomes seamless, empowering you to create, edit, eSign, and collaborate without hassle.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify application for interbank giro without leaving Google Drive?

Can I create an electronic signature for the application for interbank giro in Chrome?

Can I edit application for interbank giro on an iOS device?

What is application for interbank giro?

Who is required to file application for interbank giro?

How to fill out application for interbank giro?

What is the purpose of application for interbank giro?

What information must be reported on application for interbank giro?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.