Get the free Credit Application for a Business Account

Get, Create, Make and Sign credit application for a

How to edit credit application for a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application for a

How to fill out credit application for a

Who needs credit application for a?

Credit application for a form: A comprehensive how-to guide

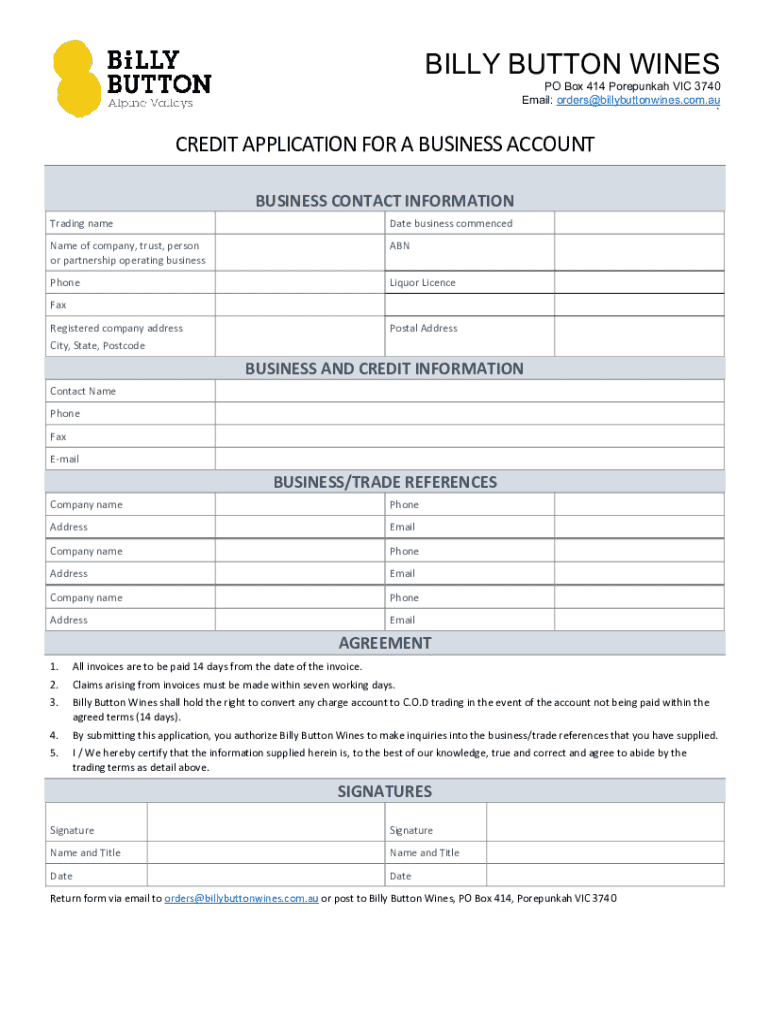

Understanding credit applications

A credit application serves as a formal request for credit from lenders, allowing an individual or business to demonstrate their financial history and stability. Its purpose is to gather crucial data that lenders need to assess the risk of extending credit. Depending on the context, there are personal credit applications, typically used by individuals for personal loans, and business credit applications, designed for companies seeking credit from financial institutions or service providers.

The distinction between personal and business credit applications is significant. Personal applications focus on individual financial details, such as income and credit history, while business applications delve into company-specific financial information, ownership structure, and operational history. Understanding these elements is essential for the appropriate completion of a credit application for a form.

Types of credit application forms

When applying for credit, knowing which form to complete is crucial. Personal credit application forms usually include sections for basic identification information, employment details, and financial data. Commonly required information includes your Social Security number, income statements, and details of existing debts.

Business credit application forms differ by necessity as they require more detailed information about the business operations. Essential elements to consider in B2B applications include the business’s legal structure, tax identification number, and operational years. This additional data assists lenders in assessing the viability and reliability of the business.

Key components of a credit application for a form

Gathering the essential information before starting your credit application is paramount to simplify the process. For personal applications, you must compile your personal identification data, including your Social Security number, date of birth, and contact information. You'll also need financial information like your total income, current debts, and any assets that may lend credence to your application.

Legal considerations, such as those outlined by the Fair Credit Reporting Act (FCRA), are critical. The application must come with proper consent forms and disclosures to allow the lender to conduct a credit check, underscoring the importance of compliance. Neglecting these legalities can lead to complications, including the rejection of your application.

Step-by-step guide to completing a credit application

Before filling out your credit application, it is crucial to prepare all necessary information. Begin by gathering the required documents, such as proof of income (payslips or bank statements), and a list of current debts or financial obligations. A well-structured checklist can help ensure you don’t miss any critical data points.

When filling out the application form, pay careful attention to each section. Much like filling out a tax form, accuracy is paramount. Take your time to avoid common pitfalls such as typos or incorrect data entries, which could cause unnecessary delays in processing your application.

After completion, you should review your application. Check for completeness and ensure that everything is accurate. It's wise to have someone else look over your application as a second opinion can potentially catch mistakes you might have missed.

Digital solutions for credit applications

In the age of technology, utilizing online forms offers substantial advantages over paper submissions. Electronic submissions are faster, often come with auto-fill capabilities that save time, and significantly reduce the risk of losing documents. Digital solutions streamline the process by automatically validating your entries, thus enhancing efficiency.

pdfFiller exemplifies an effective tool for managing credit applications. With features such as PDF editing, electronic signatures, and collaboration tools, it simplifies the process of completing and submitting credit applications. Users can seamlessly manage documents in one cloud-based platform, ensuring that all data is securely stored and easily accessible.

Additionally, automation in credit applications can lead to a significant improvement in processing time. Automated workflows can help organize submissions, keep track of application statuses, and even set reminders for follow-up actions, reducing the administrative burden associated with manual tracking.

Expert tips for successful credit applications

Tailoring your credit application to the specific requirements of different lenders increases your chances of approval. Research each lender’s expectations, and adjust your submitted documents accordingly. This could mean providing additional documentation or addressing particular concerns that lenders might have about your creditworthiness.

While filling out a credit application, avoid common mistakes such as omitting vital contact information or misrepresenting financial data. These errors can lead to application denial, and understanding the credit review process can help clarify what happens after the submission. If you encounter rejection, be proactive by requesting specific reasons for it and taking steps to rectify the issues in future applications.

FAQs about credit applications

If you suspect fraud when processing a credit application, several signs might alert you. Duplicate information, inconsistencies in financial data, or sudden changes in contact details warrant caution. If fraud is suspected, promptly notify the lender and follow their protocols for reporting these concerns.

If your application is denied, don’t be disheartened. There are steps you can take to respond positively. This includes understanding the reasons for denial and working to improve your credit profile based on that feedback. Keeping track of multiple applications can be daunting; however, utilizing tools and systems for organization can help manage your submissions effectively.

Summary of the credit application process

Completing a credit application efficiently requires an understanding of its components and the steps involved. Accurate and timely submissions can significantly impact your chances of loan approval and establishing creditworthiness. Embracing digital solutions, like those offered by pdfFiller, can enhance your experience, making the process straightforward and manageable.

As you navigate the complexities of credit applications, remember that preparation and attention to detail are vital. Taking advantage of tools that streamline your workflow not only saves time but also ensures that your documentation is well organized — essential for a successful application process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit application for a?

How do I edit credit application for a online?

How do I edit credit application for a on an iOS device?

What is credit application for a?

Who is required to file credit application for a?

How to fill out credit application for a?

What is the purpose of credit application for a?

What information must be reported on credit application for a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.