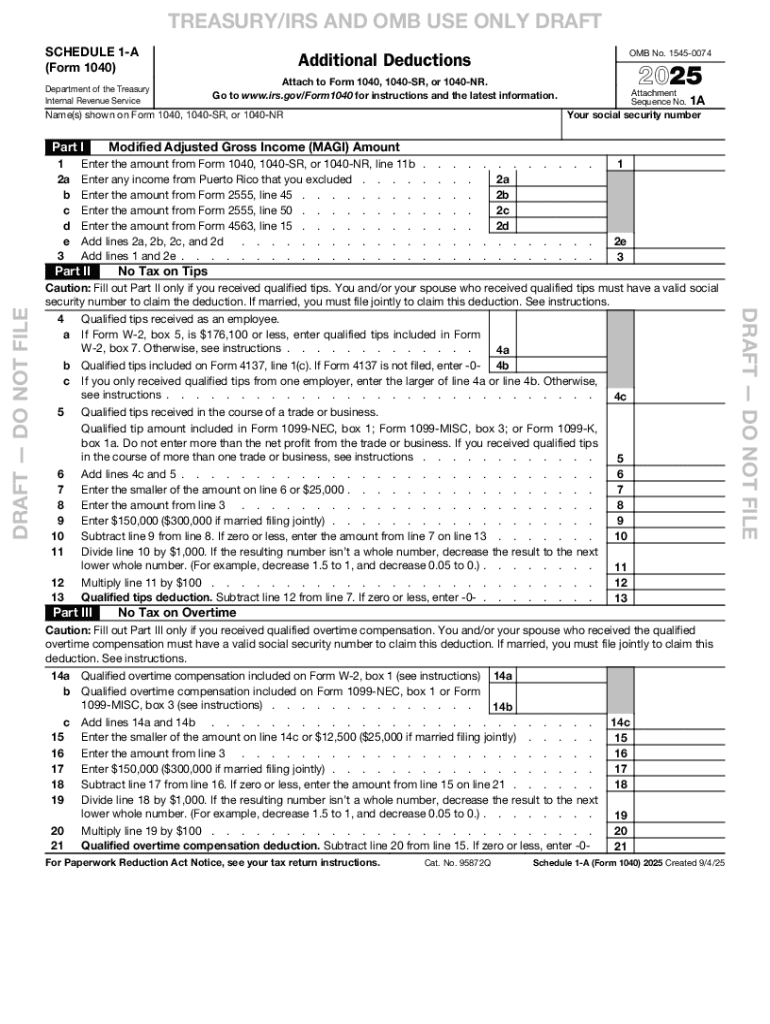

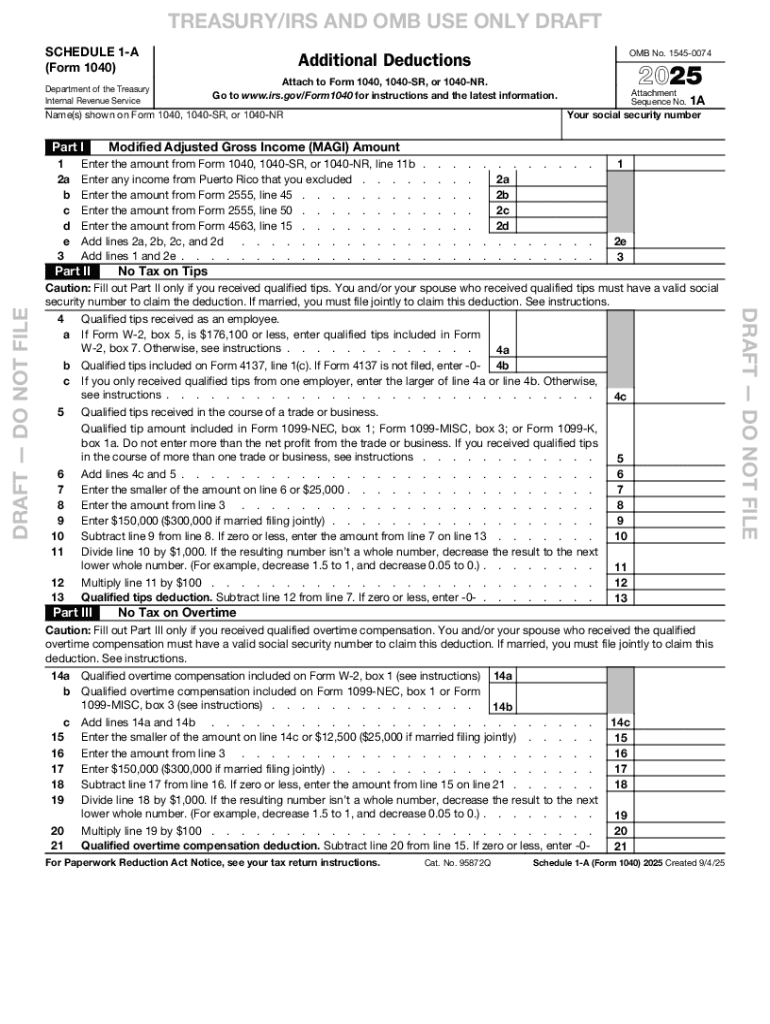

IRS 1040 Schedule 1-A 2025 free printable template

Get, Create, Make and Sign IRS 1040 Schedule 1-A

Editing IRS 1040 Schedule 1-A online

Uncompromising security for your PDF editing and eSignature needs

How to fill out IRS 1040 Schedule 1-A

How to fill out schedule 1-a form 1040

Who needs schedule 1-a form 1040?

Comprehensive Guide to Schedule 1-A Form 1040

Overview of Schedule 1-A

Schedule 1-A is a crucial form that accompanies Form 1040 during the tax filing process. It is specifically designed for reporting additional income and adjustments to income that may not be captured directly on the main tax form. Understanding and accurately completing Schedule 1-A is essential for taxpayers to ensure compliance with tax laws and maximize their refund potential.

In the context of Form 1040, Schedule 1-A serves as an extension of the information reported, allowing for a more comprehensive portrayal of your financial circumstances. This form is particularly significant as it highlights not only additional income sources but also provides a mechanism for applying specific adjustments that can directly affect your taxable income.

Key differences between Schedule 1 and Schedule 1-A include the specifics of the income types and adjustments reported. While Schedule 1 covers standard adjustments and additional income, Schedule 1-A focuses on more complex issues, allowing a more streamlined way to report the intricacies of diverse income streams.

Who needs to file Schedule 1-A?

Several categories of taxpayers are required to file Schedule 1-A. Primarily, self-employed individuals must file this schedule to report their business income or losses accurately. Those who earn additional income beyond regular wages, such as rental income or royalties, also need to include this information on Schedule 1-A. Ensuring compliance by identifying the correct filing requirements is essential.

Eligibility criteria for specific adjustments may include having educator expenses, student loans, or contributions to retirement plans. Taxpayers should review eligibility closely, as the adjustments claimed can significantly reduce their taxable income and increase potential refunds.

Breaking down Schedule 1-A components

Section 1: Additional Income

Schedule 1-A primarily consists of two sections, the first of which is dedicated to reporting additional income. Types of income reported in this section include business income or loss, rental and royalty income, unemployment compensation, and other assorted income categories. Accurate reporting in this section is critical to avoid penalties and ensure correct tax liability.

Section 2: Adjustments to Income

The second section of Schedule 1-A focuses on adjustments to income. Adjustments play a vital role in reducing the amount of income that is subject to taxation. Categories of adjustments include:

Special considerations for specific taxpayers

For expats and foreign income filers

Expats and taxpayers reporting foreign income have unique considerations when filing Schedule 1-A. It is essential to report foreign income accurately, considering the tax implications that may arise in both the U.S. and the foreign country. Moreover, understanding the ramifications of foreign tax credits and deductions is vital to avoid double taxation.

For self-employed individuals

Self-employed individuals encounter unique challenges in accurately reporting their business income. Without the structured environment of traditional employment, categorizing personal expenses as business expenses can often be a gray area. Keeping meticulous records of income and expenses is crucial, as documentation is key when substantiating claims made on Schedule 1-A.

How to file Schedule 1-A: Step-by-step instructions

Step 1: Gather necessary documentation

Before commencing the filing process for Schedule 1-A, gather all necessary documentation to support the reported income and adjustments. Essential documents include income statements, receipts for expenses, and previous tax returns. Establishing an organized filing system will streamline the preparation process.

Step 2: Fill out Section 1 (Additional Income)

Carefully fill out Section 1, where you will report any additional income. It's vital to ensure all sources of additional income are accounted for, backed by appropriate documentation. For instance, if you have business income, make sure to include all revenue streams related to your business operations.

Step 3: Fill out Section 2 (Adjustments to Income)

Next, move on to Section 2, devoted to adjustments. Sit down with each type of adjustment—whether it’s educator expenses or HSA contributions—and calculate the amounts you are eligible to claim. Documentation will often be required to substantiate these claims, so keep tax-related paperwork accessible.

Step 4: Transfer totals to Form 1040

Once both sections are completed, transfer the totals to Form 1040. Cutoff points exist, such as whether you’re itemizing deductions or taking the standard deduction; ensure these are clearly noted. It’s also critical to double-check your calculations, preventing any mistakes that might delay your refund or complicate your tax situation.

Common mistakes to avoid when filing Schedule 1-A

Taxpayers often make avoidable errors that may lead to complications or missed deductions. One frequent mistake is overlooking the types of income that need to be reported on Schedule 1-A, especially when additional income comes from irregular sources. Missing documentation can significantly affect calculations and may raise flags during audits.

Not taking advantage of allowable deductions and adjustments is another common pitfall. Many taxpayers simply aren't aware of what they qualify to deduct, leading to larger tax liabilities. Specific difficulties can arise for expat filings and self-employed individuals due to the intricacies involved.

FAQs related to Schedule 1-A

Numerous misunderstandings often arise regarding the filing of Schedule 1-A. Clarifying key points can aid taxpayers in navigating the complexities involved. For instance, do you qualify for various income adjustments? Taxpayers should consult updated IRS resources or seek professional help when uncertainties arise.

Additionally, it’s essential to stay apprised of changes in tax laws that could impact Schedule 1-A filings, ensuring that you report accurately and take full advantage of available adjustments.

Key takeaways for effective filing

The process of filing Schedule 1-A can appear daunting, yet understanding its critical components and processing steps can significantly ease the burden. Maintaining organized records, ensuring no income types are overlooked, and thoroughly documenting claims can lead to a smoother completion of your tax return.

By putting these practices into place, you enhance your chances of maximizing your refund and complying with tax regulations, ultimately ensuring peace of mind during tax season.

Making use of pdfFiller for your Schedule 1-A needs

pdfFiller offers comprehensive document management solutions that are particularly beneficial for handling your Schedule 1-A form. Users can seamlessly edit PDFs, eSign documents, and collaborate with others on their tax preparations, all from a cloud-based platform that is accessible anywhere.

The features provided by pdfFiller simplify the process of filling out, editing, and managing Schedule 1-A effectively. The platform's user-friendly interface helps ensure all fields are correctly completed, reducing the likelihood of errors and omissions.

Additional resources for tax preparation

While this guide offers a comprehensive overview, additional resources can further enhance your understanding and execution of the tax filing process. IRS publications serve as a valuable reference point, offering updated information on tax laws and forms. Moreover, using online calculators can help estimate tax liabilities accurately.

For those looking for more personalized assistance, enlisting the help of professional tax preparers or using specialized software tools can significantly aid in navigating the complexities inherent in filing Schedule 1-A.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in IRS 1040 Schedule 1-A without leaving Chrome?

How do I complete IRS 1040 Schedule 1-A on an iOS device?

How do I fill out IRS 1040 Schedule 1-A on an Android device?

What is schedule 1-a form 1040?

Who is required to file schedule 1-a form 1040?

How to fill out schedule 1-a form 1040?

What is the purpose of schedule 1-a form 1040?

What information must be reported on schedule 1-a form 1040?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.