Get the free Direct Deposit Authorization Form

Get, Create, Make and Sign direct deposit authorization form

Editing direct deposit authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct deposit authorization form

How to fill out direct deposit authorization form

Who needs direct deposit authorization form?

Understanding Direct Deposit Authorization Forms: A Comprehensive Guide

Overview of direct deposit authorization forms

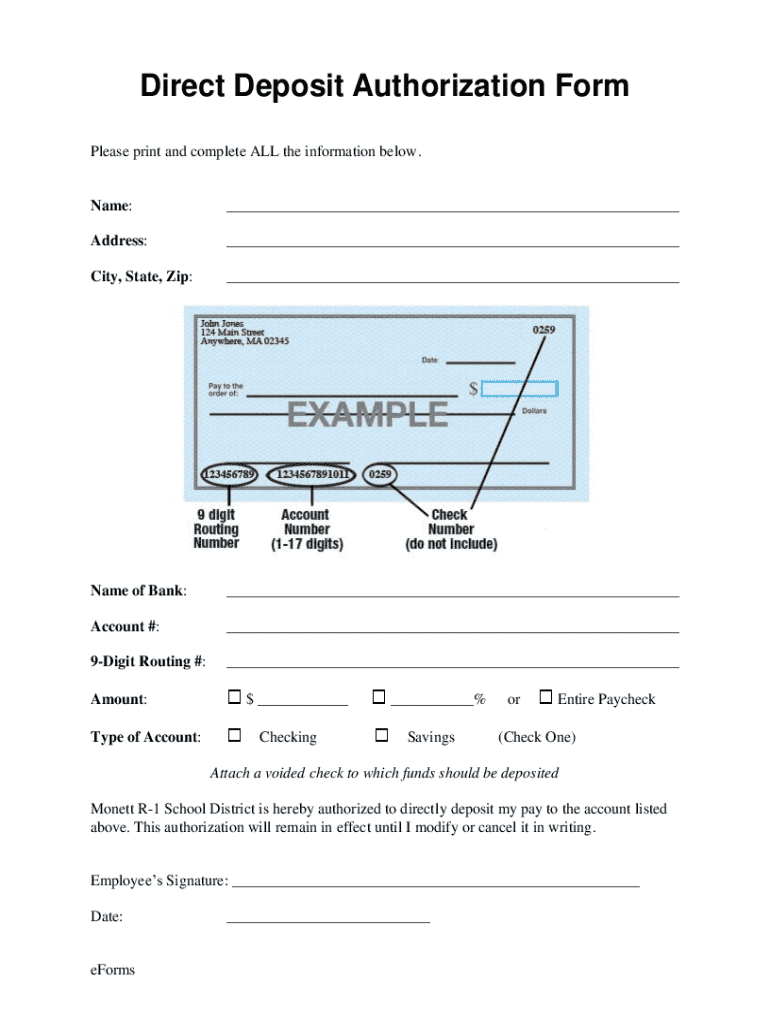

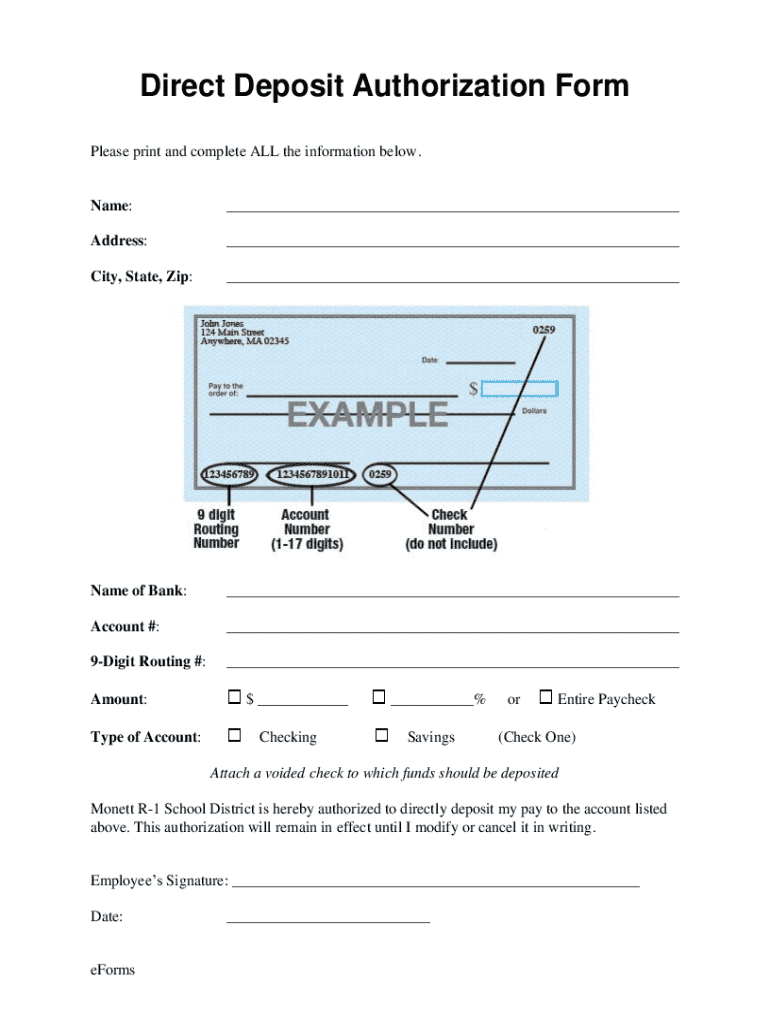

A direct deposit authorization form is a document that allows individuals to authorize their employer or another payer to deposit funds directly into their bank account. This form is essential in facilitating payroll and payments efficiently and securely.

The importance of direct deposit is significant in today's fast-paced financial ecosystem. It ensures that payments are deposited promptly, eliminating the risks associated with lost or stolen checks and reducing the need for physical check handling.

One of the key benefits of using a direct deposit authorization form is its ability to automate payment processes, offering convenience for both the payer and payee. It also enhances employee satisfaction, as funds are readily available without the waiting period associated with check clearance.

Understanding the components of the form

Direct deposit authorization forms typically consist of several critical components that ensure smooth processing. These elements are crucial to ensure accuracy and compliance from both parties.

Authorization statement

An authorization statement is a crucial part of the form, serving as a legal agreement between the payer and payee. It outlines the agreement’s terms, emphasizing the need for consent and protecting the privacy of the individual by ensuring that their banking information remains confidential.

Steps to fill out the direct deposit authorization form

Completing a direct deposit authorization form can seem daunting, but by following methodical steps, it becomes simple and straightforward.

Editing and customizing the form

For those looking to personalize their direct deposit authorization form, there are tools available that simplify this process. Using pdfFiller, individuals can easily edit and customize the form as needed.

Managing your direct deposit authorization

Once submitted, individuals must be proactive in managing their direct deposit authorization. This may include updating information or withdrawing consent if necessary.

Signing and securing the direct deposit authorization form

As with any legal document, signing the direct deposit authorization form is a critical step. Understanding the methods of signing—traditional versus electronic—can enhance the security and efficiency of the process.

Frequently asked questions (FAQs)

Many individuals have queries regarding direct deposit authorization forms, from misconceptions to troubleshooting common issues related to payment deposits.

Best practices for using direct deposit authorization forms

Utilizing direct deposit authorization forms effectively involves following best practices to ensure a smooth experience.

Conclusion: The role of pdfFiller in streamlining form management

pdfFiller enhances the process of creating and managing direct deposit authorization forms by providing users with tools that make document handling seamless. From filling out the forms to signing and managing documents in the cloud, pdfFiller empowers individuals to work efficiently.

The streamlined experience offered by pdfFiller not only saves time but also ensures that important authorization processes are conducted securely and efficiently.

Interactive tools

Leverage pdfFiller's resources, including templates and editing tools, to simplify your experience with direct deposit forms. Access interactive features to manage your forms effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my direct deposit authorization form in Gmail?

Can I create an electronic signature for signing my direct deposit authorization form in Gmail?

How can I edit direct deposit authorization form on a smartphone?

What is direct deposit authorization form?

Who is required to file direct deposit authorization form?

How to fill out direct deposit authorization form?

What is the purpose of direct deposit authorization form?

What information must be reported on direct deposit authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.