Get the free 2025 Dues Invoice

Get, Create, Make and Sign 2025 dues invoice

How to edit 2025 dues invoice online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 dues invoice

How to fill out 2025 dues invoice

Who needs 2025 dues invoice?

A Complete Guide to the 2025 Dues Invoice Form

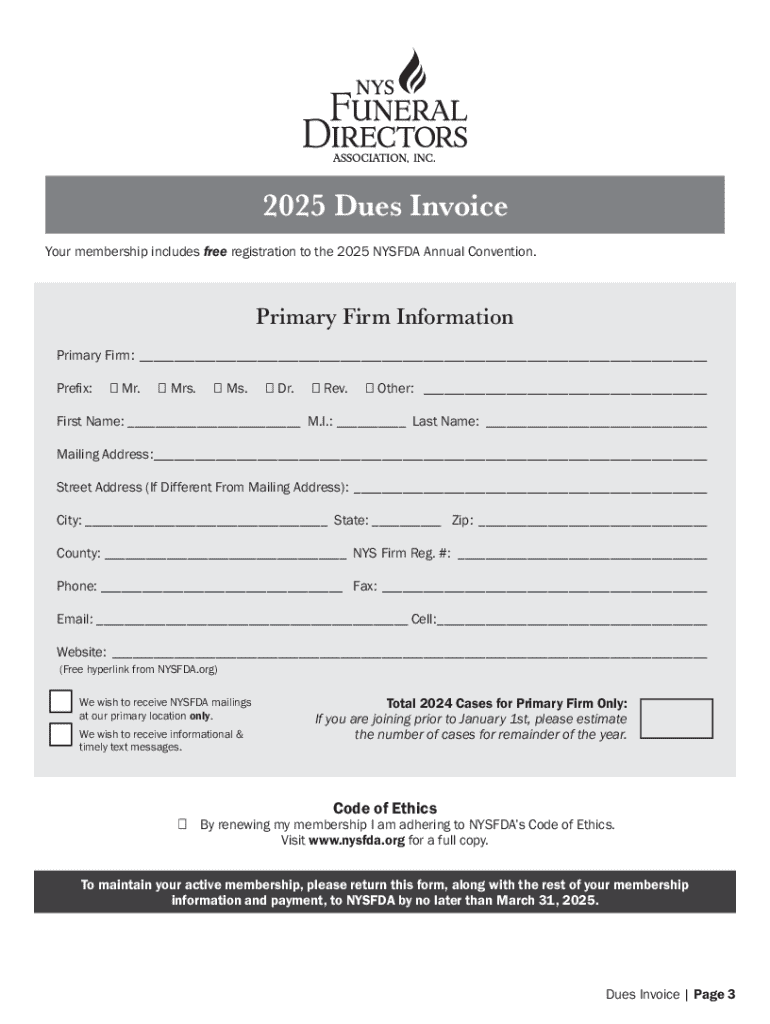

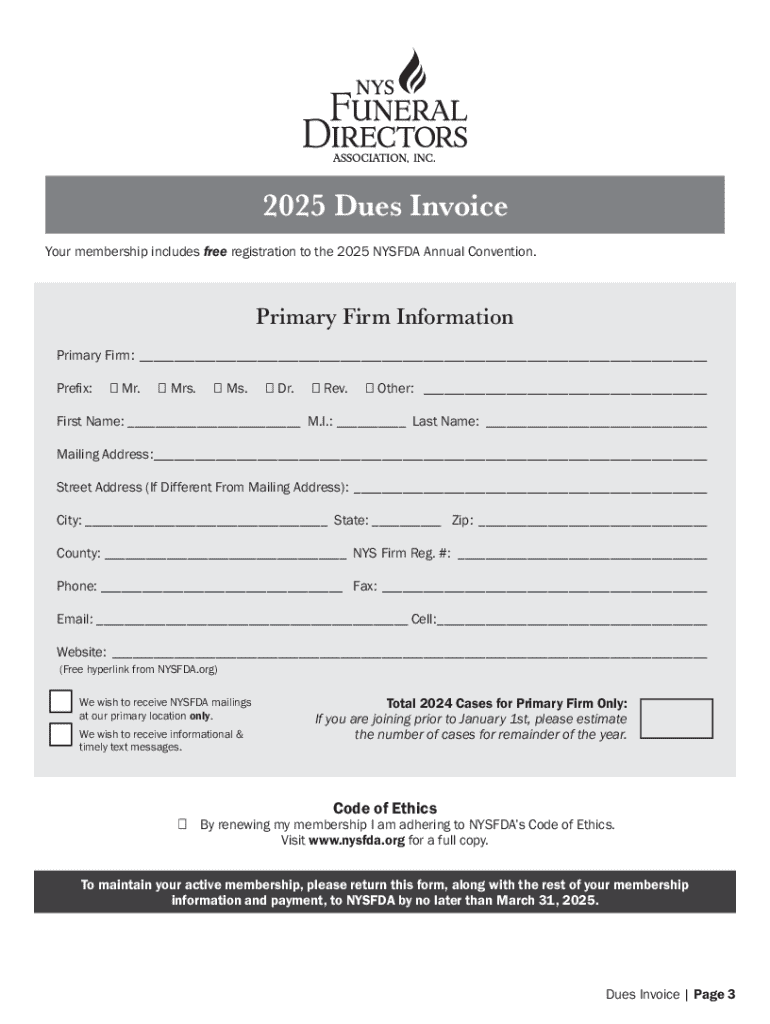

Overview of the 2025 dues invoice

The 2025 dues invoice is a crucial document utilized by organizations to manage and collect membership dues efficiently. This invoice not only itemizes the dues owed but also streamlines the entire invoicing process, making it simpler for both members and administrative teams. Accurate management of dues invoices is vital as it directly affects cash flow and organizational budgeting. Digital forms like the 2025 dues invoice form improve accuracy and reduce manual errors, ensuring that payments are tracked and managed seamlessly.

Utilizing a digital format allows for quicker dissemination and can be filled out from any location. This flexibility enhances user experience, allowing members to complete their invoicing responsibilities efficiently, whether at home or on the go. The ability to electronically sign and submit forms also speeds up processes that once took days or weeks.

Understanding the dues invoice process

The dues invoice process involves a clear lifecycle that ensures organization and efficiency in collecting payments. This process typically begins with the creation of the dues invoice, which should reflect accurate payments owed by each member. Once created, the dues invoices are then issued to members, marking an essential phase where communication plays a key role.

Following issuance, the payment collection phase begins. Members are expected to pay their dues by the stipulated deadlines, which for 2025, are outlined in the invoice. Key deadlines often include a final submission date for dues payments, after which late fees may apply or services may be affected. Staying abreast of these deadlines ensures organizations can maintain healthy financial management.

Accessing the 2025 dues invoice form

To access the 2025 dues invoice form, navigate to the pdfFiller platform. The user-friendly interface provides quick links to essential forms, making it easy for members to find what they need without extensive searching. Simply visit the pdfFiller home page, and utilize the search bar or browse the available forms under the relevant category.

To ensure smooth access, users should be familiar with pdfFiller’s navigation tips. Forms can be filled out on various devices, including desktops, tablets, and smartphones, supporting formats like PDF and DOCX for convenience. This wide accessibility contributes to an efficient document management experience.

Step-by-step guide to filling out the 2025 dues invoice form

A well-completed invoice enhances professionalism and reliability. Follow these steps to ensure your 2025 dues invoice is filled out correctly:

Editing and customizing your dues invoice form

Once your dues invoice is completed, you may find the need to make edits. With pdfFiller, you can easily modify any fields after initial completion. If you need to add comments or special notes to clarify information, pdfFiller's platform allows for such customizations effortlessly.

Utilizing templates for future invoices can streamline your workflow, allowing members to reuse common formats each year or for specific events. Saving these templates can make subsequent years much easier, eliminating the need for repetitive tasks and saving valuable time.

eSigning your 2025 dues invoice

Electronic signing of your dues invoice further legitimizes the document. To eSign your 2025 dues invoice, use the designated option within pdfFiller during the form completion process. This feature is crucial, as it means that your submission holds legal validation in the context of agreements.

Once signed, the system allows you to send the signed invoice directly from pdfFiller, ensuring that the completed document reaches its destination without delay, enhancing both tracking and follow-up.

Collaborating with team members on the dues invoice

Collaboration is vital for organizations where multiple members may need to interact with the dues invoice. pdfFiller includes features that facilitate this collaboration by allowing users to share the document with team members easily. By setting specific permissions for each collaborator, you can control who edits, comments, or views sensitive information.

Tracking changes made by collaborators is another useful feature. This ensures that all modifications are recorded and can be accessed later, thus enhancing accountability and reducing misunderstandings. With these collaborative tools, managing dues invoices becomes a team effort.

Managing your dues invoice records

Proper management of your dues invoice records is essential for future reference and financial auditing. Within pdfFiller, users can store and organize invoices in a manner that allows for easy retrieval and access. Establish a consistent naming convention that makes finding specific invoices straightforward.

Moreover, accessing past invoices and payment history will give insights into membership trends and financial performance. If required, exporting invoice data for financial tracking purposes can help organizations maintain accurate records and generate reports.

Troubleshooting common issues with the 2025 dues invoice form

As with any digital platform, you may encounter technical issues while handling the 2025 dues invoice form. Common problems could range from form fields not saving correctly to issues with electronic signatures. When facing such challenges, review your browser settings or clear your cache.

If problems persist, pdfFiller provides effective customer support to help resolve issues quickly. Users can reach out to the support team through the pdfFiller platform for prompt assistance, ensuring that your invoice management process continues smoothly.

Frequently asked questions (FAQs)

When using the 2025 dues invoice form, members often have several questions. One frequent query is concerning changes to the dues amount already specified on the invoice. To address this, your organization should outline clear procedures for such requests.

Another common question is about requesting a waiver for dues. Members should be informed about the specific criteria and process for exemption requests. Lastly, in cases where members do not receive their invoice, having a clear protocol for re-sending invoices ensures that dues are collected without undue delay.

Key features of pdfFiller related to invoice management

pdfFiller boasts several features that enhance invoice management capabilities. Integration with various financial management platforms means users can streamline their financial processes effectively. This can include syncing member dues with accounting software to ensure accurate records.

Moreover, the platform offers user-friendly tools designed specifically for document handling. This includes features for editing and collaborating, as well as robust security measures to ensure sensitive member information is protected throughout the invoicing process.

Important links and quick access

To make navigating the pdfFiller platform easier, it's beneficial to utilize direct links to relevant sections for document management. Access resources for tutorials, support documents, and customer service contact information to ensure you have all necessary tools at your fingertips. These resources foster a more efficient experience as you work with your 2025 dues invoice form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2025 dues invoice without leaving Google Drive?

How do I edit 2025 dues invoice straight from my smartphone?

How do I edit 2025 dues invoice on an iOS device?

What is dues invoice?

Who is required to file dues invoice?

How to fill out dues invoice?

What is the purpose of dues invoice?

What information must be reported on dues invoice?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.