Get the free Nebraska and Local Sales and Use Tax Return

Get, Create, Make and Sign nebraska and local sales

How to edit nebraska and local sales online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska and local sales

How to fill out nebraska and local sales

Who needs nebraska and local sales?

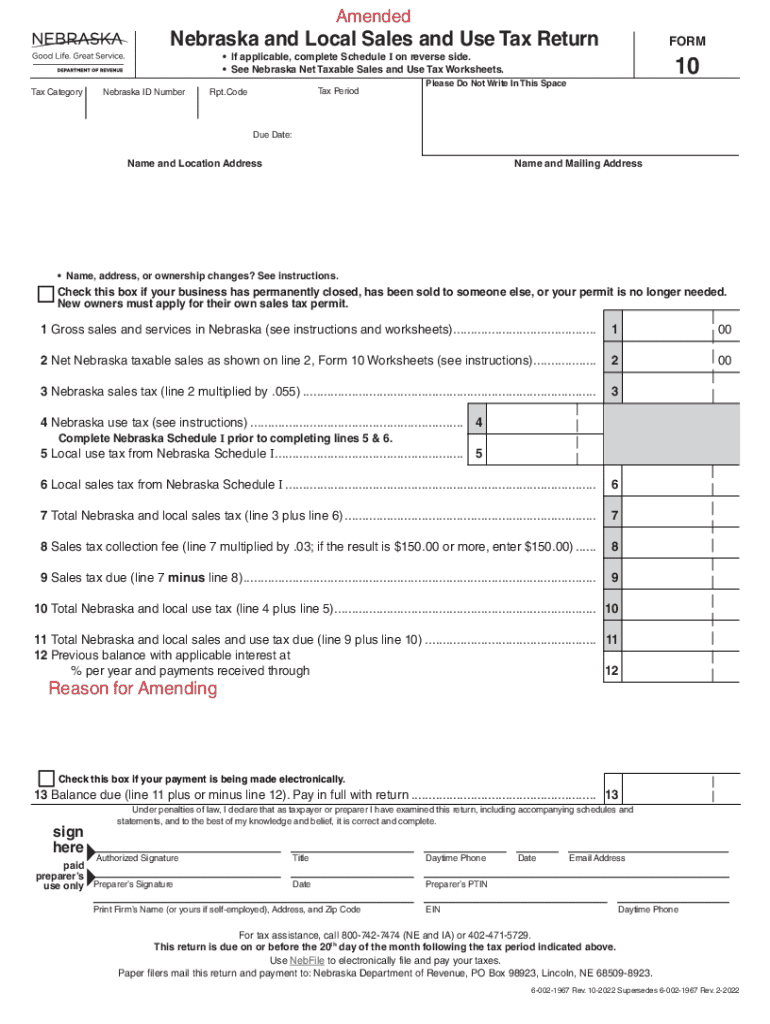

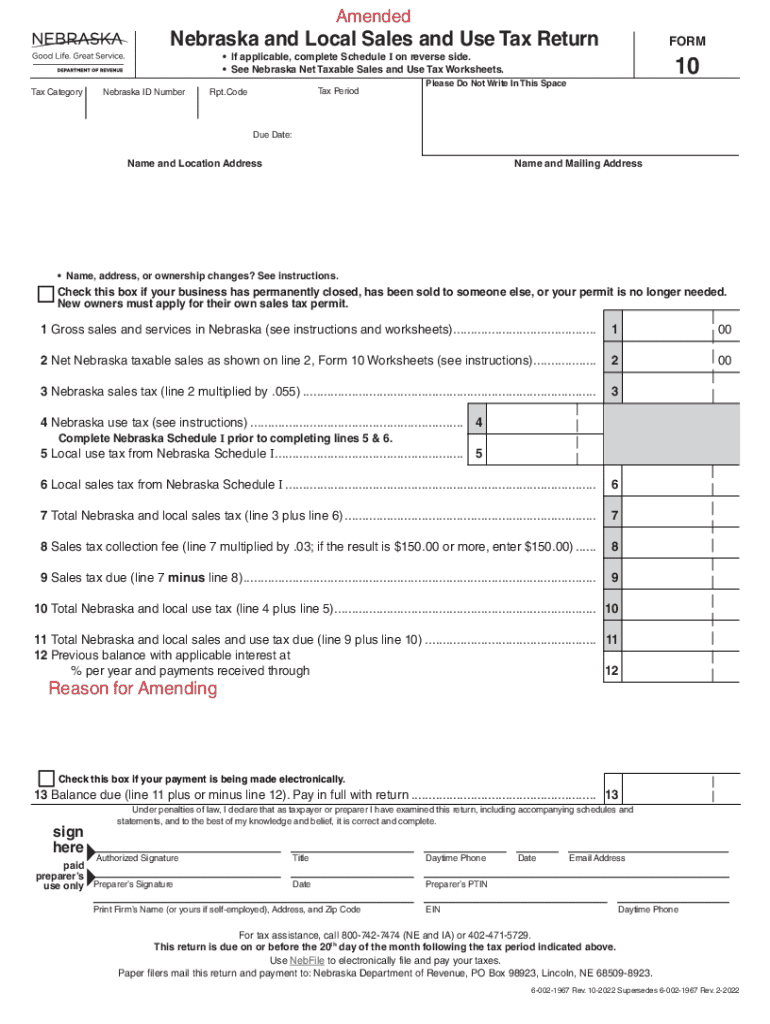

Nebraska and local sales form: A comprehensive guide to navigating sales tax documentation

Overview of sales tax forms in Nebraska

Nebraska imposes a state sales tax, and understanding how to fill out sales tax forms is essential for residents and business owners alike. The revenue generated from sales tax is crucial for local governments, funding everything from education to infrastructure projects. Therefore, it’s vital for taxpayers to be well-informed about their obligations. For Nebraska residents, local sales forms are indispensable in ensuring compliance with state tax code while maximizing available exemptions.

Key components of Nebraska sales forms

Nebraska sales forms include essential sections that capture vital information regarding the transaction. Each component serves a purpose, from identifying the seller and buyer to detailing the nature of the sales transaction. Understanding the intricacies of these forms allows taxpayers to avoid common pitfalls.

Various local sales forms can be used depending on the specific purpose, including retail sales tax forms used by businesses to remit taxes and exemption certificate forms utilized by buyers claiming sales tax exemptions. Each form requires distinct information relevant to its purpose, underscoring the need for accurate and detailed completion.

Step-by-step guide to complete the Nebraska local sales form

Successfully filling out the Nebraska local sales form demands careful attention to detail. The following steps break down the process to ensure compliance and accuracy.

Step 1: Gathering necessary documentation

Collecting the appropriate documentation is the first step in completing your local sales form. Ensure you have identification and business licensing to validate your status as a seller. Additionally, gather previous tax documents to provide context and reference for your current submissions.

Step 2: Filling out the form correctly

When you start filling out the form, be sure to break down each section methodically. Providing correct information in each area prevents issues later on. Use careful pacing to check for typographical errors or inaccurate data, and always double-check numerical entries related to sales amounts.

Step 3: Editing and verification

After filling out the form, review it thoroughly for accuracy. One useful tool for this process is pdfFiller, which offers various features to edit forms digitally. Utilizing these tools can significantly reduce human error and ensure your submissions are precise.

Tips for eSigning and submitting Nebraska sales forms

When it comes to signing and submitting your Nebraska sales forms, understanding the options available can streamline the process significantly. Digital signatures are legally accepted, making them an efficient choice for most taxpayers.

Choose your submission method according to what is most convenient for you—considering both online submissions or in-person filings. Ensure to be aware of upcoming deadlines for submissions to avoid penalties and ensure compliance with local tax regulations.

Interactive tools available on pdfFiller

pdfFiller provides numerous interactive tools that enhance your experience when completing the Nebraska and local sales form. Form previews allow you to see what your completed document will look like before submission, minimizing uncertainty.

Moreover, pdfFiller's editing tools enable real-time modifications, and its collaborative features allow multiple users to work together efficiently. This makes it an ideal platform for teams managing tax documentation.

Managing your sales tax documents effectively

With the growing number of sales tax documents, maintaining organization is critical. pdfFiller offers features that simplify document storage and retrieval, ensuring you can access your forms at any time.

Tracking changes and viewing document history are essential for compliance audits or disputes. Effective document management reduces the risk of errors and keeps your business operating smoothly.

Resources for Nebraska sales tax and forms

Nebraska tax authorities provide vital resources for understanding sales forms and the sales tax system. Utilizing official state guidelines can clarify requirements and reduce confusion.

For further assistance, residents can turn to FAQs specific to Nebraska sales forms or reach out to local tax authorities for personalized guidance. Knowledge is power when it comes to navigating your tax responsibilities effectively.

Related forms and their importance

Various forms complement the Nebraska and local sales form, ensuring comprehensive tax compliance. For instance, sales tax exemption forms help businesses claim exemptions effectively, while use tax forms secure proper reporting of purchases made outside Nebraska.

Understanding these related forms allows businesses to navigate their tax duties without unnecessary complications. It's essential to familiarize oneself with the nuances of each form to understand its function and importance in the broader financial landscape.

Navigating local sales regulations in Nebraska

Local jurisdictions within Nebraska exercise varying sales tax regulations, making it crucial for businesses to comprehend local compliance nuances. Each area may have its own rates and rules which can affect sales tax calculations.

Failure to adhere to local regulations can result in fines or loss of business licenses. Engaging with local commerce departments and understanding community regulations promotes a smoother operational experience.

Customer support and additional assistance

When navigating the complexities of Nebraska and local sales forms, knowing where to find support is invaluable. pdfFiller provides customer support options for users needing assistance with form-related questions or troubleshooting.

Accessing learning resources and tutorials through pdfFiller can empower users to tackle their forms more confidently, ensuring a streamlined process and enhancing overall understanding of the sales tax documentation required in Nebraska.

Form preview and interactive features

Using pdfFiller, users can view a sample Nebraska local sales form, gaining insight into what to expect when completing their own documents. The platform offers customization features that allow users to adjust forms according to their specific needs, ensuring that every aspect is tailored correctly.

This user-centric approach simplifies the process, helping individuals ensure compliance while providing the flexibility needed to manage different forms effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify nebraska and local sales without leaving Google Drive?

How do I execute nebraska and local sales online?

How do I complete nebraska and local sales on an iOS device?

What is nebraska and local sales?

Who is required to file nebraska and local sales?

How to fill out nebraska and local sales?

What is the purpose of nebraska and local sales?

What information must be reported on nebraska and local sales?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.