Get the free 720 Congress

Get, Create, Make and Sign 720 congress

How to edit 720 congress online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 720 congress

How to fill out 720 congress

Who needs 720 congress?

Comprehensive Guide to the 720 Congress Form

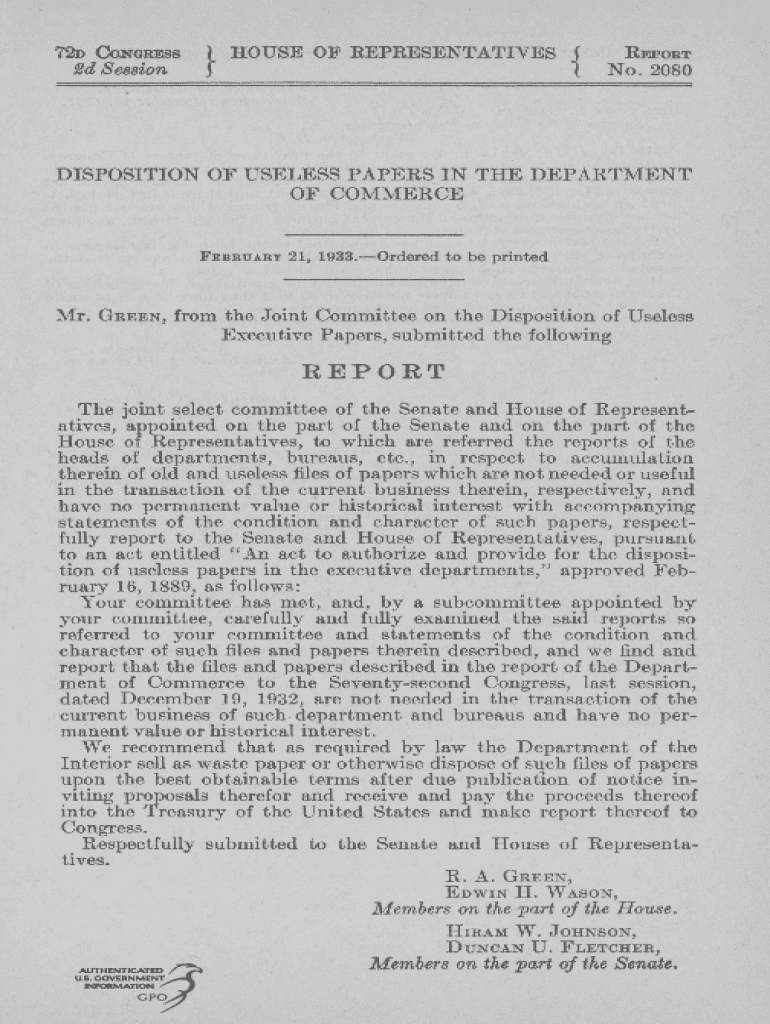

Overview of the 720 Congress form

The 720 Congress form plays a vital role in the management and reporting of various information related to taxation and compliance standards. Understanding its purpose is essential for individuals and businesses alike who aim to stay compliant with federal obligations. This form acts as an integral tool for reporting excise taxes due on specific products, ensuring both transparency and accountability.

The key stakeholders in the deployment of the 720 Congress form include business owners, tax professionals, and government officials. Business owners utilize the form to ensure they are meeting their tax obligations, while tax professionals often help their clients navigate the complexities associated with this document. Government officials depend on the accurate information provided to uphold regulatory compliance.

Detailed breakdown of the 720 Congress form

The structure of the 720 Congress form is designed to facilitate easy navigation and comprehension. The form includes several sections, each serving a unique role in documenting excise tax information.

Typically, the form encompasses sections such as: 1. **General Information** - Contains basic identification details. 2. **Tax Liability Calculation** - Where users calculate their excise tax based on product sales. 3. **Payment Information** - Details on payment methods and deadlines. 4. **Signature Section** - Where users affirm that the information is accurate.

Step-by-step guide to filling out the 720 Congress form

Filling out the 720 Congress form can seem daunting, but with proper preparation, it becomes manageable. Start by gathering essential documents and information such as your business's EIN, sales records, and previous tax returns. A checklist can help streamline this process and ensure you have everything necessary before proceeding.

As you navigate the form fields, pay careful attention to the instructions for each section. Common pitfalls include miscalculating tax liabilities or providing incorrect business information. To ensure accuracy, double-check all entries against your supporting documents before submission.

Recommended practices for ensuring accuracy include: 1. Calibrate all mathematical entries. 2. Avoid guessing; if unsure, seek clarification on each field. 3. Consider using a reliable PDF editor to track changes and assist in completing the form.

Editing and managing the 720 Congress form

Editing the 720 Congress form is simplified with pdfFiller, a user-friendly tool that allows for seamless modifications. Accessing the form on pdfFiller involves searching for the template within the platform, where you can utilize various editing tools to revise entries as needed.

The editing tools available on pdfFiller include text edits, field additions, and formatting options, allowing users to customize the form to their specific needs. Additionally, users can maintain an organized workflow by collaborating with team members, sharing the form for input, and benefiting from real-time collaboration features.

Signing the 720 Congress form

The eSigning process for the 720 Congress form is straightforward within the pdfFiller platform. Users can simply click the designated eSignature area, enabling them to add their digital signature easily. It's crucial to understand the legal validity of eSignatures, as they are recognized as legitimate and binding under various jurisdictions.

This digital signing capability not only enhances efficiency but also ensures a secure method to finalize documents. Hence, signing the form digitally saves time compared to traditional methods while maintaining the integrity of the submission.

Troubleshooting common issues with the 720 Congress form

Despite best efforts, mistakes can happen when completing the 720 Congress form. Identifying common mistakes such as incorrect figures or missing fields can prevent delays in processing or potential fines. Frequent errors include: - Incorrect calculations of excise taxes. - Omissions in signature areas. - Misrepresentation of business details.

To correct mistakes efficiently, utilize the editing features available in pdfFiller. If support is needed, the platform offers resources and assistance to guide users in resolving issues swiftly.

Frequently asked questions (FAQs) about the 720 Congress form

Users often have questions about the 720 Congress form, including technical details, submission guidelines, and compliance regulations. Curating a list of common inquiries can ease user concerns. For instance, one prevalent question involves what to do if a filed form contains errors.

In answering common questions, addressing concerns about deadlines and consequence of late submissions is equally important. Expert insights can provide in-depth responses, ensuring that users have a comprehensive understanding of their obligations concerning the 720 Congress form.

Best practices for managing the 720 Congress form

Managing the 720 Congress form requires diligent filing and record-keeping processes. Establishing organized digital storage methods is critical for easy retrieval and compliance with auditing standards. Employ cloud-based solutions for improved accessibility and collaboration, allowing teams to work in harmony.

To maintain compliance and audit readiness, consider the following best practices: 1. Regularly update your records to reflect current information. 2. Conduct periodic reviews to ensure filings are accurate. 3. Utilize tagging and categorization systems to enhance clarity in document management.

User testimonials and case studies

The effectiveness of the 720 Congress form usage can be illustrated through real-life experiences. Users have reported significant time savings and improved accuracy when utilizing pdfFiller. One case study involved a small business that transitioned from paper-based submissions to digital forms, leading to a 30% reduction in processing time.

Moreover, teams reported enhanced communication and collaboration, as team members could simultaneously edit and provide feedback in real-time. These testimonials underscore the value of using pdfFiller in managing the 720 Congress form effectively.

Additional tools and features available on pdfFiller

Beyond the 720 Congress form, pdfFiller offers additional tools and features that elevate the overall document experience. Integration capabilities allow users to connect with other applications, streamlining workflows across different platforms.

Additional functionalities such as automated reminders for deadlines and analytics to track form submissions enhance user engagement and compliance. These tools provide comprehensive support, ensuring users can create, manage, and streamline their forms efficiently, making pdfFiller a holistic solution for document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in 720 congress without leaving Chrome?

How do I edit 720 congress on an Android device?

How do I fill out 720 congress on an Android device?

What is 720 congress?

Who is required to file 720 congress?

How to fill out 720 congress?

What is the purpose of 720 congress?

What information must be reported on 720 congress?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.