Get the free Pt-100 Petroleum Business Tax Return 1023

Get, Create, Make and Sign pt-100 petroleum business tax

Editing pt-100 petroleum business tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pt-100 petroleum business tax

How to fill out pt-100 petroleum business tax

Who needs pt-100 petroleum business tax?

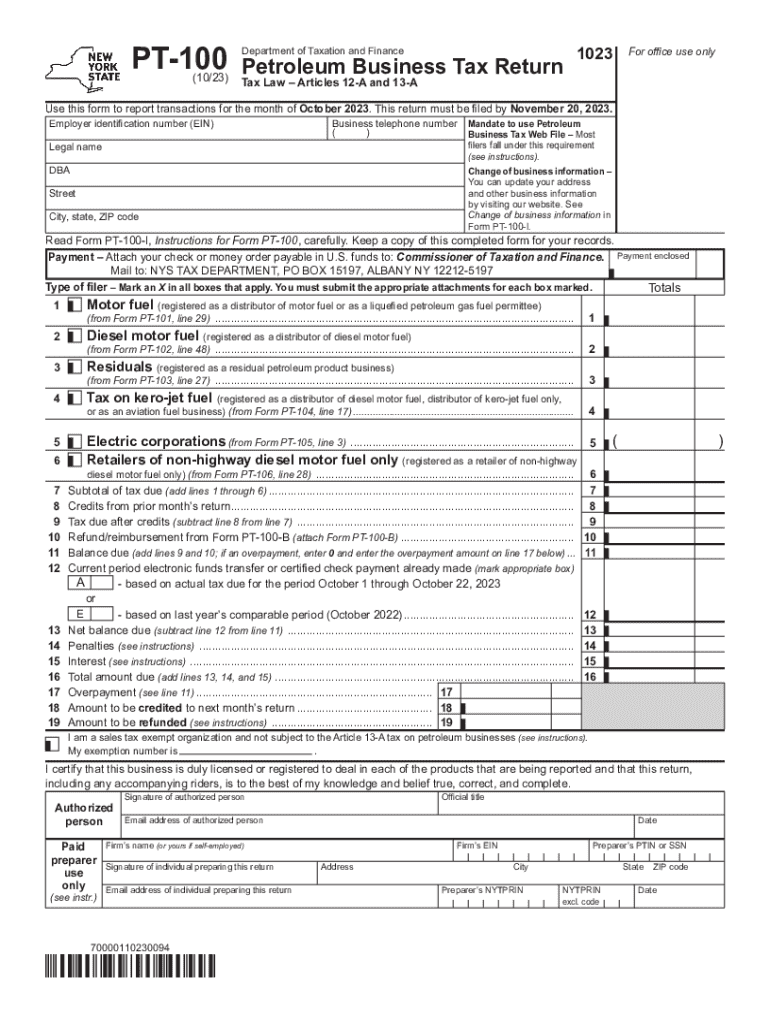

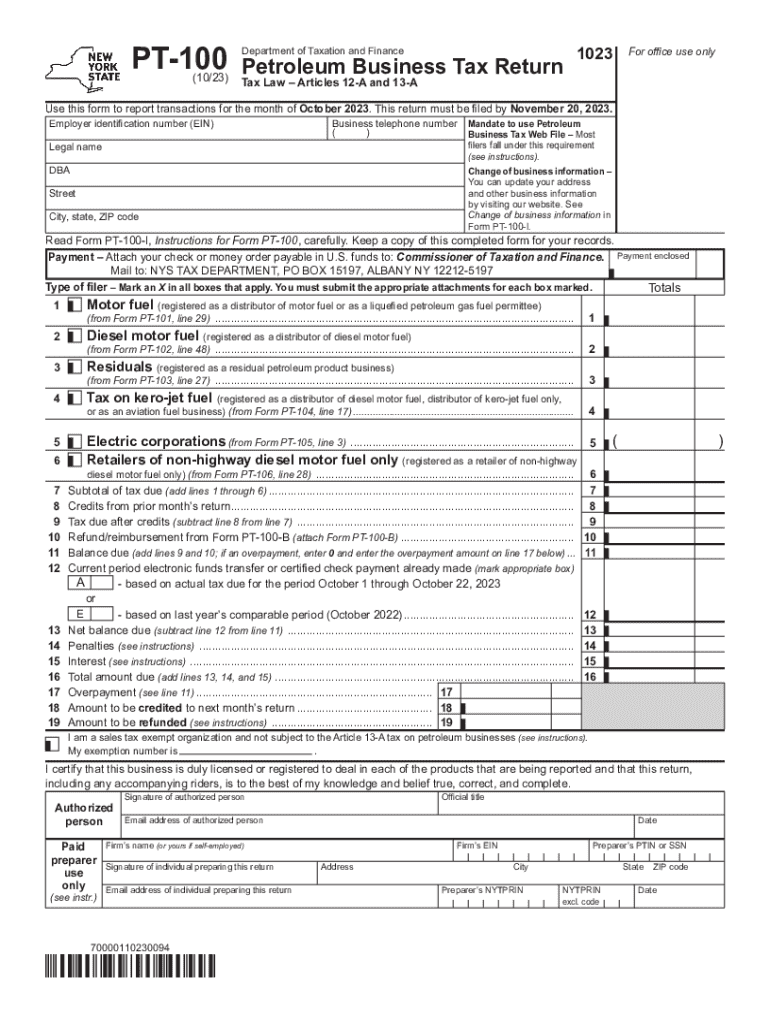

Understanding the PT-100 Petroleum Business Tax Form

Overview of the PT-100 petroleum business tax form

The PT-100 Petroleum Business Tax Form is a critical document for businesses operating within the petroleum sector. Its primary purpose is to ensure compliance with state taxation regulations related to petroleum products. Filing this form correctly is vital for avoiding penalties and ensuring your business can operate smoothly. Many industries utilize petroleum products, including transportation, manufacturing, and heating, which makes understanding this form essential for various businesses.

To determine who must file the PT-100 form, businesses should consider their activities. Companies that engage in the refining, distribution, or sale of petroleum products are required to file. This includes wholesalers, retailers, and even those operating at a smaller scale, such as independent gas stations. Understanding whether your business is included is the first step in navigating the complexities of petroleum taxation.

Understanding the details of the PT-100 form

The PT-100 form is structured to collect relevant information from businesses regarding their petroleum activities. It consists of several sections that guide the filer through different aspects of their business operations. The standard sections include business identification, product types, gross receipts, and tax calculations. Familiarizing yourself with these sections will help ease the process of completion.

Common terminology used within the PT-100 form includes terms like 'refined petroleum products', which refer to those products derived from crude oil through refining processes. Understanding terms like 'gross receipts' is equally important, as this refers to total income before any deductions. Moreover, relevant tax regulations can vary by state, impacting how the PT-100 is completed and submitted. Businesses should remain up-to-date with any legislation affecting the petroleum tax landscape.

Step-by-step guide to completing the PT-100 form

Completing the PT-100 form can seem daunting, yet breaking it down into manageable steps can simplify the process. Start by gathering all required business identification details, including your business name, address, and federal tax ID. Accurate financial information must also be compiled, such as total sales, tax collected, and any exemptions your business qualifies for.

Filling out each section thoughtfully, pay attention to required numerical fields, ensuring all calculations are accurate. For example, when reporting gross receipts, double-check entries against your financial records to avoid errors. As you navigate the form, keep a few tips in mind: first, always review guidelines specific to your state. Second, maintain clarity and consistency in the information you provide. Common pitfalls include providing incomplete information or failing to verify the accuracy of figures reported.

Digital solutions for managing the PT-100 form

Using digital tools like pdfFiller can significantly enhance the process of filling out and managing the PT-100 petroleum business tax form. One of the major benefits of employing pdfFiller is its ability to allow users to access their forms from anywhere, which is particularly advantageous for businesses with multiple locations or remote teams.

The platform provides a user-friendly interface that enables users to edit and fill out the PT-100 form online. Its eSigning capability streamlines the approval process, allowing you to gather signatures from stakeholders without the need for physical meetings. Furthermore, the interactive tools available on pdfFiller promote collaboration, ensuring team members can work together on the document in real time, which enhances accuracy and efficiency.

Submitting your PT-100 form

Once the PT-100 form is completed, the next step is submission. E-filing has become a popular choice due to its convenience and speed. The online submission process typically involves scanning your completed form, accessing your state’s tax authority's online portal, and following the prompts for electronic filing. Be mindful of deadlines throughout this process; missing them can incur unnecessary penalties.

If you prefer traditional methods, mail-in options remain available. Preparing the form for mailing involves ensuring all information is correctly entered and printed legibly. In-person submission may also be an option, allowing for direct communication with tax officers if questions arise. Familiarize yourself with submission guidelines, including whether any form of payment is necessary at the time of submission or if it can be deferred.

What happens after submission?

After submitting your PT-100 form, it's important to understand what follows. The review process typically involves your local tax authority assessing your submission for accuracy and completeness. Accurate tracking of your submission status becomes essential, which can often be accomplished through your state’s tax portal. Regularly check in to ensure that your form is being reviewed in a timely manner.

You should also be prepared for potential follow-ups from tax authorities. They may request additional information or clarification regarding specific entries on your form. Promptly addressing these requests is crucial to avoid delays in processing. Remaining engaged during this stage can facilitate smoother interactions and assist in resolving any issues quickly.

Getting help with the PT-100 form

Understanding the complexities of the PT-100 form can sometimes feel overwhelming. Fortunately, numerous resources are available to assist filers. The website of your state tax authority typically has a dedicated section featuring FAQs that address common concerns. Utilize this resource to clarify any doubts you may have about the filing process.

For personalized assistance, consider contacting tax support services, who can provide expert guidance tailored to your business. Additionally, language assistance programs are often available, ensuring that non-English speakers can access the necessary information without barriers. Engaging with industry professionals can also offer deeper insights and tailored advice regarding specific queries related to the PT-100 and broader petroleum taxation issues.

Maintaining compliance beyond the PT-100 form

Filing the PT-100 isn't just a one-time task; it represents a component of maintaining broader tax compliance. Businesses in the petroleum sector must often fulfill other monthly filings and schedules to adhere to tax regulations. Familiarize yourself with any other forms you may be required to submit regularly, as neglecting these could have repercussions.

One best practice involves keeping accurate records of all transactions and tax-related documents, thereby facilitating any audits that may arise in the future. Staying organized not only simplifies compliance but also protects your business from potential issues with tax authorities down the road. Investing in effective record-keeping strategies should be considered a priority well after the submission of the PT-100 form.

Engaging with the community

Engagement with the larger community of petroleum business tax filers can provide valuable insight and support. Various online forums and discussion groups exist where businesses share their experiences and strategies for successfully navigating the PT-100 form. Connecting with peers can help demystify the process and foster a sense of collaboration.

Additionally, it is beneficial to stay updated on any changes or new regulations impacting tax compliance in the petroleum sector. Regular participation in these community-driven discussions can help where necessary and share feedback with regulatory bodies to enhance the PT-100 process further.

Navigating the petroleum business tax landscape

The PT-100 form is just one part of the broader petroleum business tax landscape. Numerous other related tax forms and reports may apply depending on your operations, such as motor fuel tax forms. Keeping abreast of these requirements is vital to maintaining compliance and efficiently managing your tax filings.

It’s crucial to monitor updates and changes in legislation that affect petroleum taxation as these can directly impact your filing responsibilities and strategies. Engaging with updated tax legislation not only ensures compliance but can also provide opportunities to minimize tax liabilities. Understanding where the petroleum tax landscape is heading can give your business a strategic advantage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify pt-100 petroleum business tax without leaving Google Drive?

How do I complete pt-100 petroleum business tax online?

Can I create an eSignature for the pt-100 petroleum business tax in Gmail?

What is pt-100 petroleum business tax?

Who is required to file pt-100 petroleum business tax?

How to fill out pt-100 petroleum business tax?

What is the purpose of pt-100 petroleum business tax?

What information must be reported on pt-100 petroleum business tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.