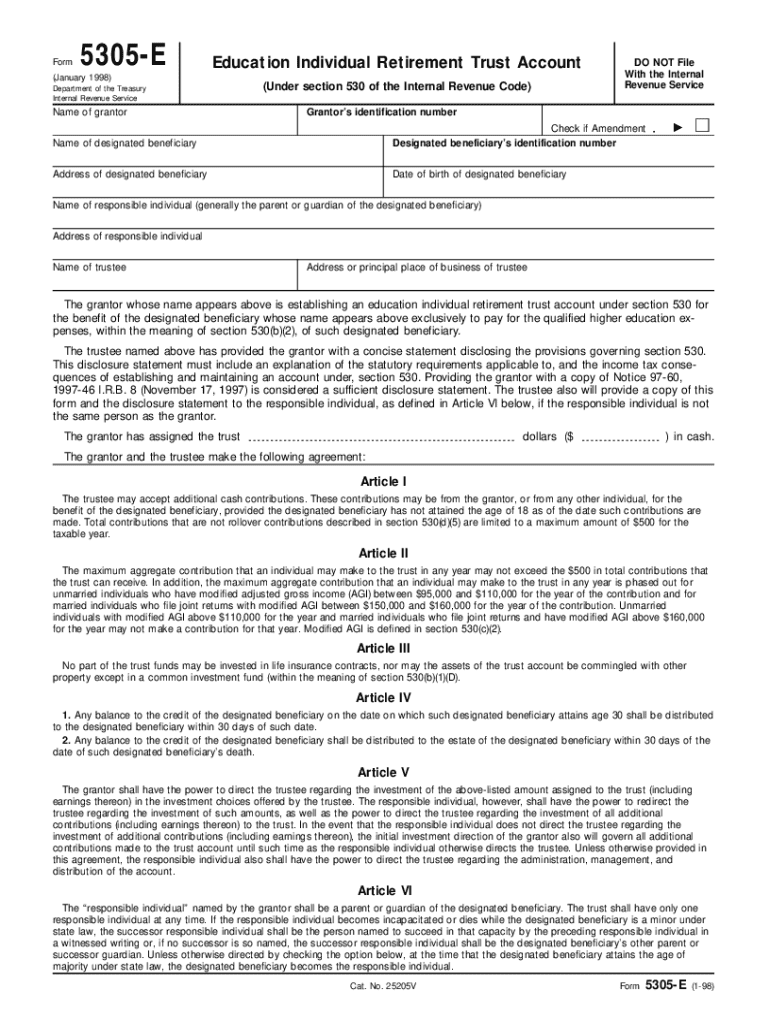

Get the free Form 5305-e

Get, Create, Make and Sign form 5305-e

How to edit form 5305-e online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5305-e

How to fill out form 5305-e

Who needs form 5305-e?

Comprehensive Guide to Form 5305-E: Everything You Need to Know

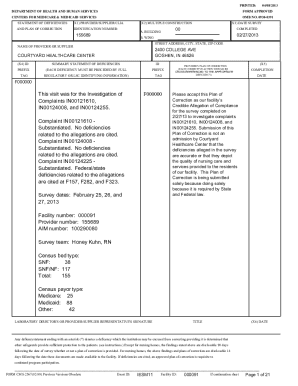

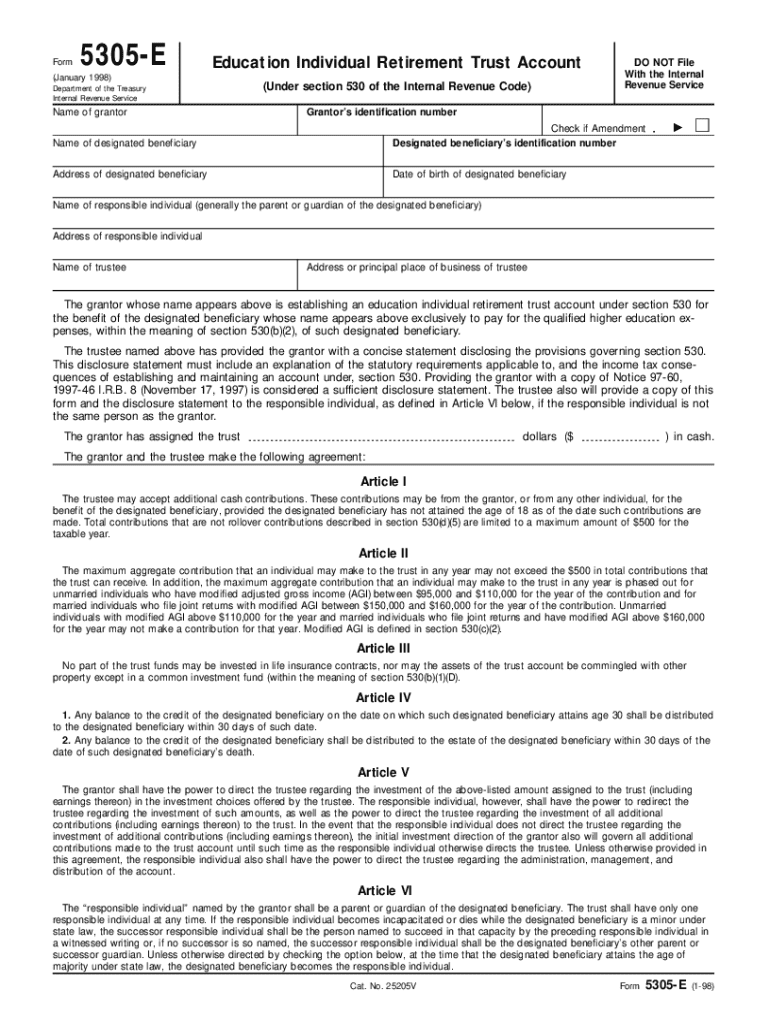

Overview of Form 5305-E

Form 5305-E is a vital document used primarily for establishing a Simplified Employee Pension (SEP) plan for self-employed individuals and small business owners. Its significance lies in its ability to provide a straightforward method for businesses to contribute to their employees' retirement savings, facilitating tax advantages for both the employer and the employee. When considering this form, the most common scenarios include small businesses looking to offer retirement benefits without the complexity of traditional pension plans, or sole proprietors seeking to maximize their retirement contributions.

Key features of Form 5305-E

Form 5305-E includes essential components that need to be understood by anyone intending to use it. At its core, the form outlines eligibility criteria, contribution limits, and the responsibilities of both the employer and the employee involved in a SEP plan. Furthermore, it delineates important dates and deadlines, such as the timeline for filing the form, which is typically aligned with the tax filing deadline of the business, allowing extensions of up to six months in certain circumstances.

Step-by-step guide to filling out Form 5305-E

Before diving into filling out Form 5305-E, adequate preparation is crucial. Gather all necessary documentation, including your business's EIN, information about eligible employees, and details of any financial agreements like savings limits. Each section of the form is designed to collect specific information.

After completing the form, take time to review it thoroughly. Common pitfalls often include calculation errors in contributions and missing signatures. A meticulous review can save considerable time and avoid potential issues with the IRS.

Editing and customizing Form 5305-E with pdfFiller

Utilizing pdfFiller to manage Form 5305-E presents numerous benefits. The cloud-based editing capabilities allow users to fill out the form seamlessly from anywhere, ensuring flexibility and convenience for busy entrepreneurs. The platform also provides interactive tools for document management, highlighting options for annotations and text additions that streamline the completion process.

Managing your forms with pdfFiller

After signing Form 5305-E, effective management of your documents is essential. pdfFiller provides organized storage solutions, allowing for efficient retrieval of past forms. Users can categorize their documents based on date, type, or status, creating a streamlined filing system that saves time.

Frequently asked questions about Form 5305-E

As you navigate the complexities of Form 5305-E, you may encounter common questions. Some frequent queries pertain to eligibility for contributions, deadlines for form submission, and the implications of incorrectly filed forms. Providing clear answers to these questions can save users time and reduce anxiety around compliance.

Referencing additional resources such as IRS guidelines and pdfFiller's customer support can further assist users in addressing their concerns.

Why choose pdfFiller for your document needs?

Selecting pdfFiller as your solution for managing Form 5305-E and other essential agreements offers a unified document management experience. The platform not only simplifies the editing and signing process but also elevates team collaboration, making it an ideal choice for businesses of all sizes.

Getting started with pdfFiller

Creating an account with pdfFiller is the first step toward simplifying your document management. The registration process is straightforward, requiring only essential information to get you started. Once you are registered, you'll find a user-friendly interface that guides you through the available features.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 5305-e directly from Gmail?

How do I edit form 5305-e straight from my smartphone?

Can I edit form 5305-e on an Android device?

What is form 5305-e?

Who is required to file form 5305-e?

How to fill out form 5305-e?

What is the purpose of form 5305-e?

What information must be reported on form 5305-e?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.