Get the free Non-profit Corporation Annual Report

Get, Create, Make and Sign non-profit corporation annual report

How to edit non-profit corporation annual report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-profit corporation annual report

How to fill out non-profit corporation annual report

Who needs non-profit corporation annual report?

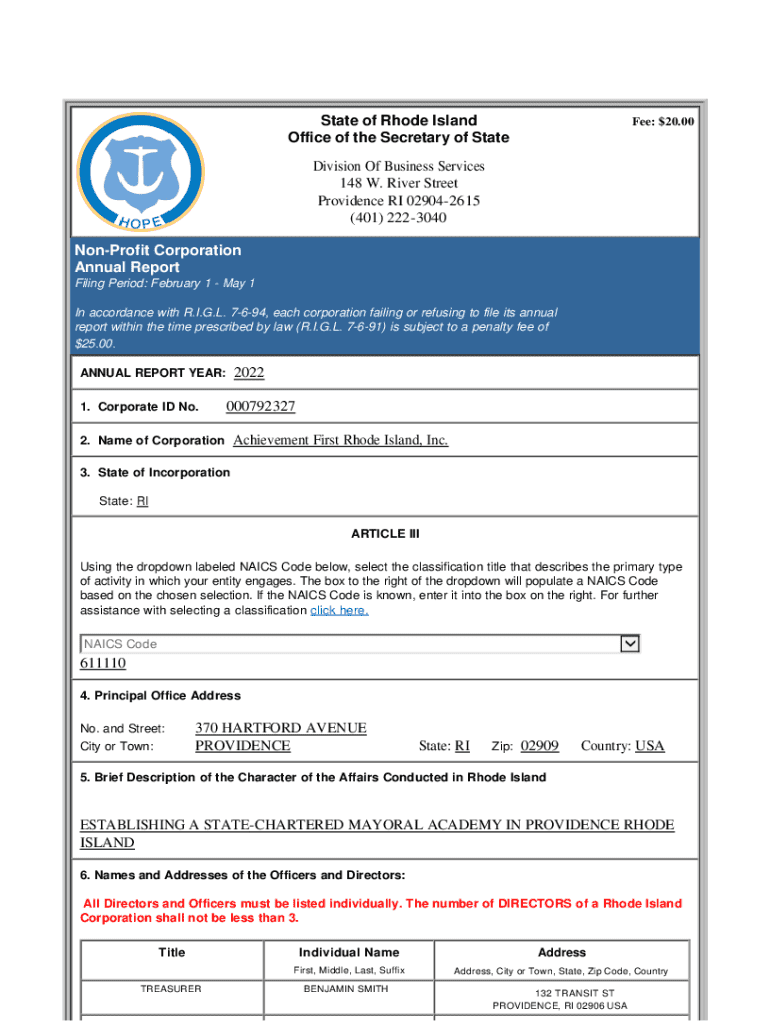

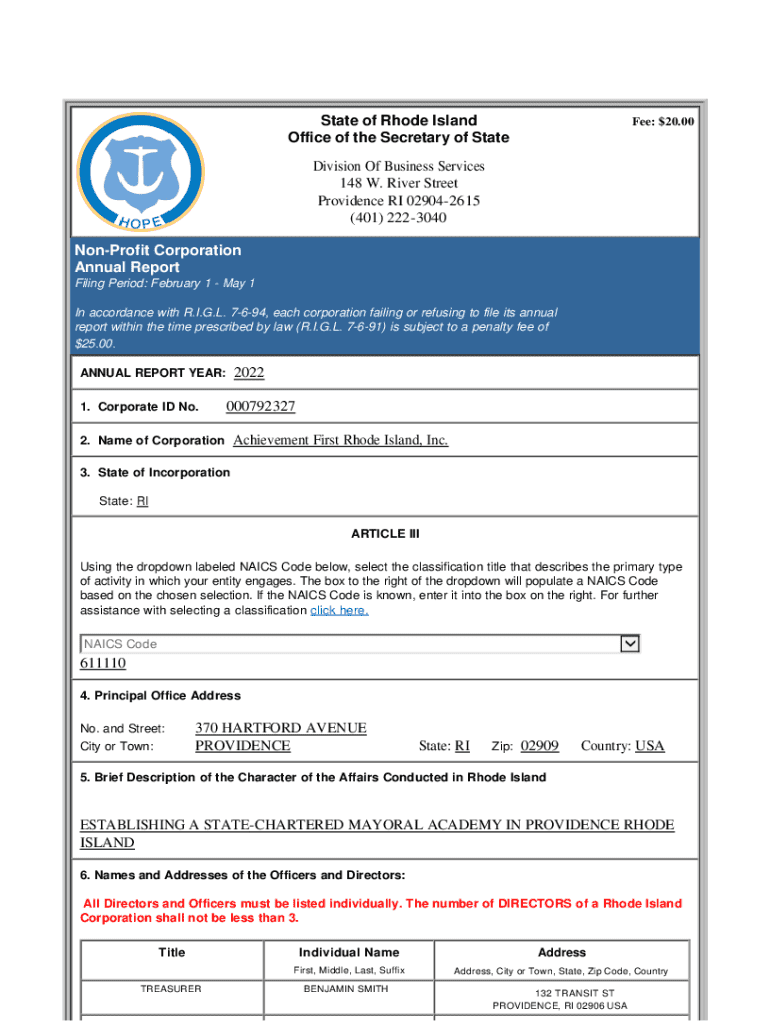

Understanding the Non-Profit Corporation Annual Report Form

Understanding the non-profit annual report

A non-profit corporation annual report is a crucial document that encapsulates the financial and operational activities of an organization over the past year. It serves not only as a record of achievements and fiscal health but also as a vital tool for transparency and accountability to stakeholders, including donors, members, and the communities served. For non-profits, this report demonstrates commitment to the mission while showcasing responsible stewardship of resources.

The purpose of the annual report extends beyond mere compliance; it fosters trust and credibility. When non-profits present accurate and insightful data, stakeholders are more likely to continue their support, enabling programs and services to flourish. Thus, crafting a non-profit corporation annual report is not merely a task but a strategic opportunity.

Key components of the non-profit annual report

A well-structured non-profit annual report contains several key components that convey the organization's mission, accomplishments, and financial information. The first essential element is a clear mission and vision statement. This defines the organization’s core purpose and aspirations, offering readers an immediate understanding of the non-profit’s focus and initiatives. These statements guide all reporting and outreach strategies.

Next, detailing major accomplishments provides insight into the organization’s impact. Highlighting key successes from the year—such as community projects or fundraising milestones—allows stakeholders to see tangible results of their support. To effectively showcase these accomplishments, use quantifiable metrics where possible, alongside narratives that demonstrate the journey taken to reach these goals.

Preparing your non-profit annual report

The preparation of a non-profit annual report begins with crafting a detailed plan. This plan should outline the objectives of the report and identify critical information needed. Developing a timeline for gathering content, financial data, and narratives is essential for timely completion. Collaboration across teams—finance, program management, and communication—is usually necessary to provide a complete picture of the year’s activities.

Choosing the right format is equally vital. A digital report can enhance reach and allow for interactive elements, while a hard copy may serve as a tangible leave-behind for key stakeholders. Each format has its merits, and organizations must weigh the pros and cons based on their audience. Additionally, effective design and layout are crucial for readability; utilizing templates from resources like pdfFiller can help streamline this process.

Filling out the non-profit corporation annual report form

Once the necessary information is organized, accessing the non-profit corporation annual report form, especially through platforms like pdfFiller, is a straightforward process. The first step is locating the correct annual report form on the website. Users can easily navigate to the forms library to find their state's specific requirements and download the form.

After obtaining the form, interacting with it involves filling out required fields in a comprehensive manner. pdfFiller offers various tools that allow for editing, signing, and annotating the document directly. For those unsure about how to proceed, a detailed walkthrough available within the application can guide users through each required field and any additional documentation necessary.

Submitting your annual report

The submission process for the non-profit corporation annual report generally involves e-filing, which has become the preferred method due to its convenience. When using platforms like pdfFiller, users are equipped with detailed instructions for submitting forms electronically. This online process often includes built-in security measures to protect sensitive information during submission.

After submitting the report, it’s crucial to confirm that the submission was successful. Many states provide confirmation receipts or tracking numbers to verify submission. Keeping a copy of the filed report in your records ensures that the data remains accessible for future reference and provides peace of mind regarding compliance.

Best practices for a standout non-profit annual report

To ensure your organization’s annual report captures stakeholder attention and successfully communicates key messages, it is crucial to follow best practices. First, building an audience is essential. Engaging stakeholders with compelling content—such as success stories, testimonials, and impact metrics—will resonate more deeply than simple data dumps. Distributing the report widely through various channels, including email newsletters and social media, will enhance exposure.

Transparency in reporting cannot be overstated. Addressing challenges alongside successes fosters credibility. By openly discussing areas of struggle or lessons learned, organizations demonstrate maturity and commitment to growth. Additionally, crafting effective calls to action within the report can inspire future donations and volunteer involvement. The annual report should not only function as a recap of the past but also as a platform for envisioning future initiatives.

After submission: maintaining compliance

Even after submitting the annual report, non-profits must stay aware of ongoing reporting requirements. Depending on the organization's size and scope, additional disclosures or updates may be required throughout the year. Keeping stakeholders informed, whether through quarterly updates or newsletters, helps maintain engagement and transparency.

Moreover, leveraging the annual report for future success should be a goal for every non-profit organization. Use the report as a powerful tool to advocate for more funding, present at community meetings, or share internally to motivate staff and volunteers. A well-crafted report can also provide insights that guide strategic planning for the coming years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my non-profit corporation annual report directly from Gmail?

How can I send non-profit corporation annual report for eSignature?

How do I complete non-profit corporation annual report on an iOS device?

What is non-profit corporation annual report?

Who is required to file non-profit corporation annual report?

How to fill out non-profit corporation annual report?

What is the purpose of non-profit corporation annual report?

What information must be reported on non-profit corporation annual report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.