Get the free Beneficiary Designation Form – Pension Fund

Get, Create, Make and Sign beneficiary designation form pension

Editing beneficiary designation form pension online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation form pension

How to fill out beneficiary designation form pension

Who needs beneficiary designation form pension?

Understanding the Beneficiary Designation Form for Pension Plans

Understanding the Beneficiary Designation Form

The beneficiary designation form is a critical document for anyone enrolled in a pension plan. This form allows you to specify who will receive the benefits from your pension plan after your death. It serves not just as an instruction; it is a legally binding document that determines the distribution of your hard-earned retirement funds. Understanding its role is paramount in effective pension planning.

The importance of this form cannot be overstated. It ensures that your intentions are carried out, providing peace of mind that your loved ones will receive their due entitlements. Key terms associated with this concept include 'beneficiary'—the person(s) you choose to inherit your benefits; 'pension'—the retirement fund designed to provide you with income after you retire; and 'designation'—the formal act of naming someone as your beneficiary.

Why designating a beneficiary is crucial

Designating a beneficiary in your pension plan is essential for several reasons. First, it provides clarity regarding who will inherit your pension benefits, thereby avoiding any potential conflicts or confusion among family members. Without a designated beneficiary, your pension benefits may default to your estate, which complicates distribution and can prolong the process due to probate.

The consequences of not naming a beneficiary can be significant. For instance, the absence of a clear beneficiary may result in your pension benefits being subjected to extensive legal challenges or court decisions, leading to delays and financial distress for your loved ones. Furthermore, selecting the right beneficiary not only affects immediate heirs but also impacts your overall legacy, shaping how your life’s work supports those you care about.

Types of beneficiaries in pension plans

In pension plans, beneficiaries are categorized into primary and contingent beneficiaries. A primary beneficiary is the first in line to receive the pension benefits upon your passing. Conversely, contingent beneficiaries are designated to receive the benefits only if the primary beneficiary predeceases you or is otherwise unable to claim the benefits.

When choosing your beneficiaries, consider legal and financial factors. Some pensions may have specific regulations governing who can be named as a beneficiary, especially for spousal designations. Additionally, the choice of beneficiary can have tax implications for them, making it crucial to evaluate both your current situation and future changes.

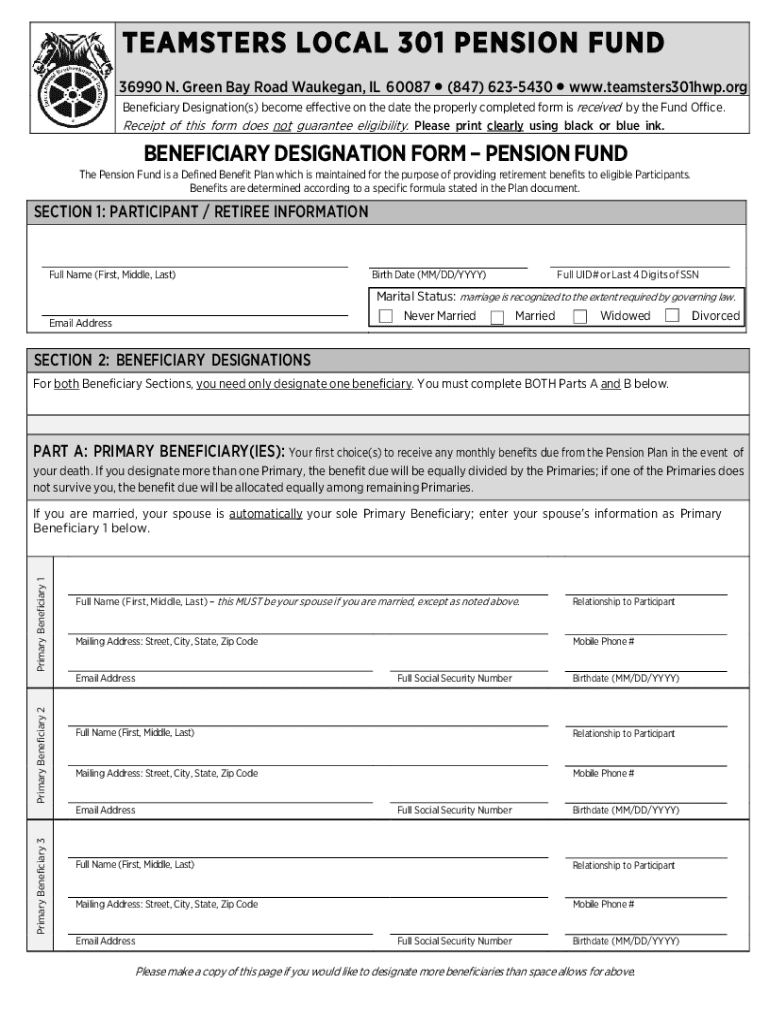

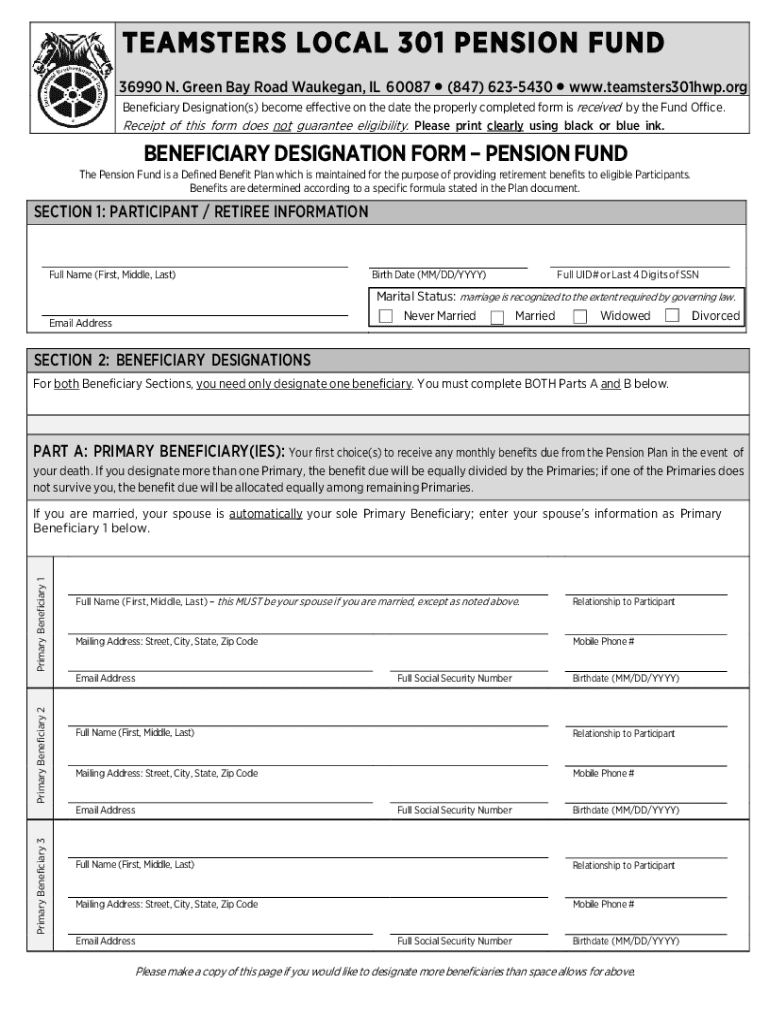

Step-by-step guide to completing the beneficiary designation form

Completing the beneficiary designation form requires a few straightforward steps. First, gather all necessary personal information, which typically includes your name, address, and Social Security number, alongside details about your pension plan. This preparation helps ensure you have everything you need on hand.

While filling out the form, pay close attention to each section and follow the specific instructions provided. A common mistake to avoid is not being clear about who you want your beneficiaries to be. Be specific when listing their names and their relationship to you. After completing the form, the submission process is crucial; usually, it involves sending the document to your pension plan administrator via mail or secure web submission.

Changing your beneficiary

Life events such as marriage, divorce, or the birth of a child often necessitate changes to your beneficiary designations. Recognizing when to revisit and adjust your designations is vital in ensuring that they remain relevant to your current circumstances. To amend a beneficiary designation, you typically need to fill out a new designation form and submit it according to the guidelines provided by your pension plan.

Keeping beneficiary designations up to date is not just a matter of legality; it is a moral obligation to ensure your family gets the intended financial support during difficult times. Regular reviews can prevent unnecessary complications down the road.

Key considerations when designating a beneficiary

Several crucial considerations come into play when designating a beneficiary. For instance, understand the tax implications for different types of beneficiaries—spouses may qualify for tax-free transfers, whereas other beneficiaries might face taxation on the benefits they receive. Moreover, state laws affect beneficiary designations. In some jurisdictions, a spouse may have a legal claim over the pension benefits, regardless of what is recorded on the form.

Family dynamics also significantly influence beneficiary designations. Changes such as marriage, divorce, or the death of a desired beneficiary necessitate immediate review and possible revision of your designations to ensure that your assets are distributed according to your wishes and free from disputes.

Interactive tools for managing your beneficiary designation

Managing your beneficiary designation doesn’t have to be cumbersome. Tools like pdfFiller offer an array of document management features designed to simplify this process. From editing and signing documents online to organizing your completed forms, pdfFiller streamlines your experience, making it easy to manage all related documents from a single, cloud-based platform.

Not only does pdfFiller ensure you have access to interactive document forms, but it also enables seamless collaboration. Teams can work together to make edits, obtain approvals, and manage submissions effectively. The convenience of electronic filing also helps in keeping your records organized and readily accessible.

Frequently asked questions (FAQs)

As with any important financial decision, questions about the beneficiary designation form often arise. Common queries include the legal requirements for naming a beneficiary, how to ensure that your designation is valid, and what steps to take if there are issues with form submission. Being knowledgeable about these aspects can save you from potential headaches later.

Understanding these FAQs will empower you to navigate the requirements associated with the beneficiary designation form more confidently.

Related resources

For further assistance and to enhance your awareness regarding pension management, several valuable resources are available. Access templates for various forms, including updated beneficiary designation forms, guides on pension management best practices, and educational materials focused on estate planning. These resources can help ensure you make informed decisions regarding your retirement planning.

Stay connected with pdfFiller

Engaging with our community through newsletters or webinars provides a wealth of knowledge and ongoing support for your documentation needs. Visit our forums to connect with others who are navigating the same processes, and don't hesitate to reach out to our support teams for guidance on document forms. Also, keep an eye out for updates on new features designed to enhance your experience with our platform.

About pdfFiller

At pdfFiller, our mission is to provide user-friendly document solutions that simplify paperwork for everyone. Our cloud-based platform enables seamless document creation, editing, and management to cater to both individuals and teams. We strive to enhance your experience with efficient tools designed to meet all your documentation needs and have numerous testimonials from satisfied users who maximize their productivity with our tools.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find beneficiary designation form pension?

Can I sign the beneficiary designation form pension electronically in Chrome?

Can I create an electronic signature for signing my beneficiary designation form pension in Gmail?

What is beneficiary designation form pension?

Who is required to file beneficiary designation form pension?

How to fill out beneficiary designation form pension?

What is the purpose of beneficiary designation form pension?

What information must be reported on beneficiary designation form pension?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.