Get the free Marine Carriers Insurance Claim Form

Get, Create, Make and Sign marine carriers insurance claim

Editing marine carriers insurance claim online

Uncompromising security for your PDF editing and eSignature needs

How to fill out marine carriers insurance claim

How to fill out marine carriers insurance claim

Who needs marine carriers insurance claim?

Marine carriers insurance claim form: A comprehensive guide

Understanding marine carriers insurance

Marine carriers insurance is a specialized form of insurance that protects against losses or damages associated with the transportation of goods over waterways. As global trade continues to expand, this type of insurance becomes crucial for businesses that rely on shipping for their operations. It provides financial coverage in case of risks like theft, cargo damage, or equipment failure, ensuring that businesses can recover from setbacks.

The significance of marine insurance in global trade cannot be overstated. It acts as a safety net for companies engaged in import and export activities, allowing them to mitigate the financial risks tied to international shipping. Different types of coverage under marine carriers insurance include:

When to use a marine carriers insurance claim form

Identifying when to use a marine carriers insurance claim form is essential for ensuring that you take timely action after an incident. Various scenarios may prompt you to fill out this form. Recognizing these situations can save time and help facilitate smoother claims processing.

Common scenarios requiring a claim include:

Overview of the marine carriers insurance claim process

The marine carriers insurance claim process involves several critical steps that need to be followed meticulously to ensure a successful claim. It's important to approach this process methodically, as proper documentation and adherence to procedures can significantly affect the outcome of your claim.

Here’s a step-by-step breakdown of the claim process:

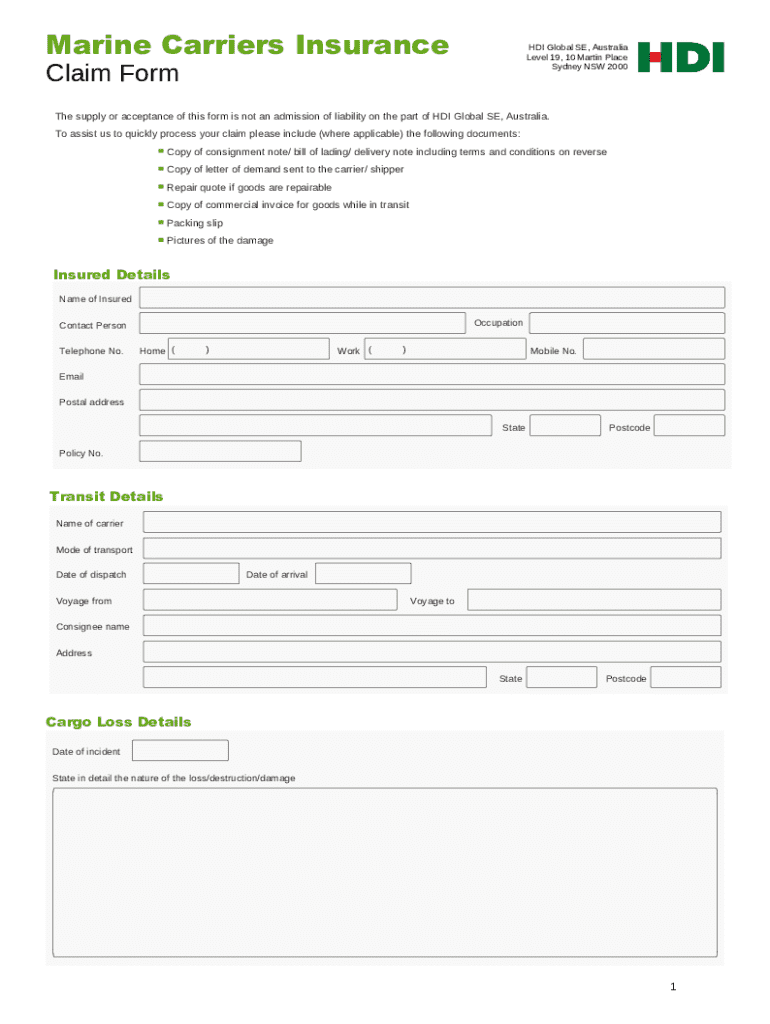

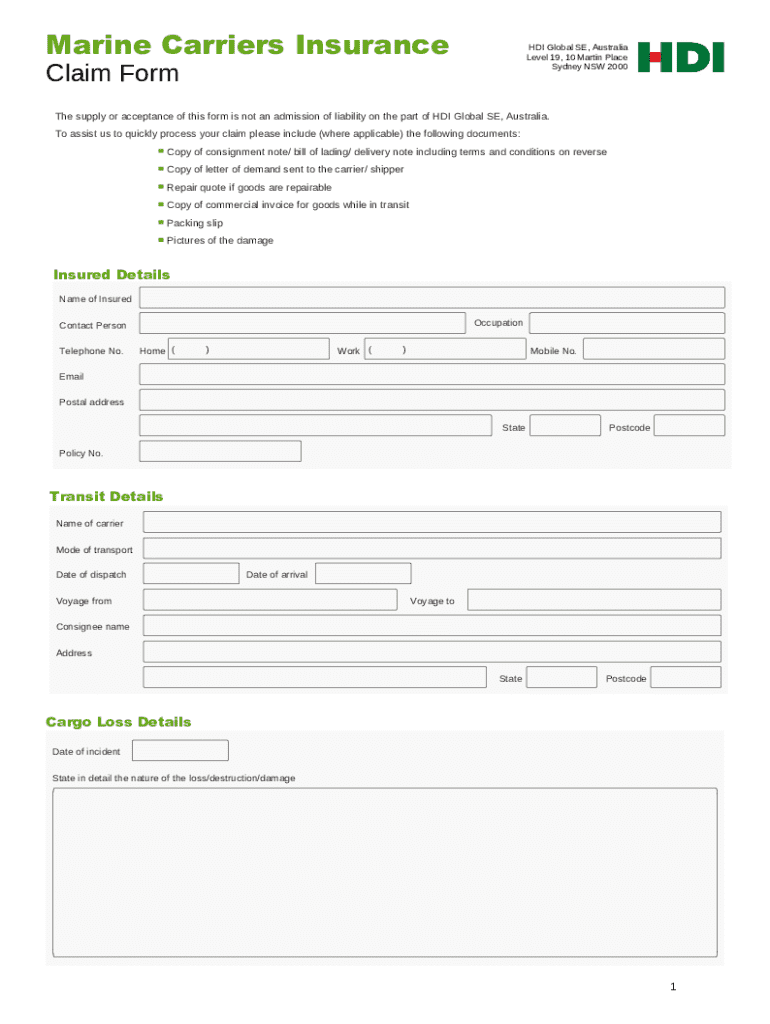

Essential elements of the marine carriers insurance claim form

Completing the marine carriers insurance claim form accurately is key to ensuring a smooth claims process. There are essential elements that must be included to support your claim effectively. Being thorough and precise in this section can help mitigate misunderstandings with your insurer.

Key information to include in your claim form:

Common mistakes to avoid when filling the form include: failing to provide complete information, neglecting to attach documentation, and missing deadlines for submission.

The role of interactive tools in claim submission

In the realm of insurance claims, interactive tools can enhance the efficiency of the submission process. Utilizing platforms like pdfFiller offers a seamless way to manage your marine carriers insurance claim form and associated documentation. These tools support the overall workflow, making the submission process intuitive and user friendly.

Here’s how pdfFiller aids in claim management:

Detailed instructions for filling out the marine carriers insurance claim form

Filling out the marine carriers insurance claim form requires careful attention to detail. Following established guidelines will ensure that no crucial element is overlooked, minimizing the chance of delays in processing your claim.

Here’s a step-by-step guide:

Tips for successful claim approval

For a successful claim, ensuring that you have all necessary documentation in order is of utmost importance. Your insurer will rely on accurate information and clear evidence to assess your claim promptly. Understanding best practices when submitting a claim can streamline this process.

Consider these tips:

After submission: What to expect

Once you submit your marine carriers insurance claim form, it’s essential to understand the subsequent steps. The claims processing timeline can vary significantly depending on the complexity of the claim and the insurer’s procedures.

Expect to follow specific procedures post-submission:

Frequently asked questions

Throughout the claims process, many individuals have recurring questions that can lead to confusion. Addressing these queries head-on can empower you to navigate your claim more effectively.

Common questions include:

Conclusion and further assistance

Navigating the world of marine carriers insurance claims can be complex, but understanding the claims process empowers you to take control. If you find yourself facing challenges or need additional assistance, consider seeking legal advice for complex claims to ensure your rights are protected. Utilizing tools like pdfFiller can also streamline your documentation process and aid in effective claims management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the marine carriers insurance claim form on my smartphone?

How can I fill out marine carriers insurance claim on an iOS device?

How do I complete marine carriers insurance claim on an Android device?

What is marine carriers insurance claim?

Who is required to file marine carriers insurance claim?

How to fill out marine carriers insurance claim?

What is the purpose of marine carriers insurance claim?

What information must be reported on marine carriers insurance claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.