Comprehensive Guide to Bureau of Internal Revenue Forms

Overview of Bureau of Internal Revenue forms

Bureau of Internal Revenue (BIR) forms are essential documents that taxpayers in the Philippines must complete to comply with tax regulations. These forms serve various purposes, such as calculating tax obligations, reporting income, and requesting refund claims. The accurate submission of BIR forms is pivotal for maintaining tax compliance and avoiding penalties set by the Bureau.

The importance of these forms extends beyond compliance; they provide a structured method for the government to track financial data and ensure that taxpayers contribute their fair share to the economy. Key types of forms typically include tax returns for individuals and businesses, information returns to report various income types, and other specific forms tailored to different transactions.

Identifying the right Bureau of Internal Revenue form

Identifying the appropriate BIR form is crucial, as each form serves a distinct purpose. There are several categories of forms, widely classified into individual, business, and miscellaneous tax forms. For individuals, common forms include the Form 1040 for income tax returns and Form 1099 for various types of income reporting. In contrast, businesses typically use Form 1120 for corporate income tax returns and Form 941 for quarterly payroll taxes.

Understanding what each form requires helps taxpayers avoid errors and file accurately. Different situations require specific forms; for instance, freelancers must complete 1099 forms to report earnings from contract work, while employers use W-2 forms to report employee wages. Therefore, matching forms to individual or business needs is imperative to streamline the filing process.

Accessing Bureau of Internal Revenue forms

Accessing BIR forms has been made easier through the Bureau's official website, which hosts a comprehensive collection of all necessary forms. By navigating to the forms section, users can find the appropriate document in various formats, including PDFs that can be filled online or printed for submission.

Additionally, platforms like pdfFiller enhance this accessibility by providing users with advanced tools for quick form retrieval. Users can search for specific forms using keywords, facilitating a faster and more efficient process. The benefits of using an online platform include the ability to track changes in forms, access templates, and streamline the management of documents.

Filling out Bureau of Internal Revenue forms correctly

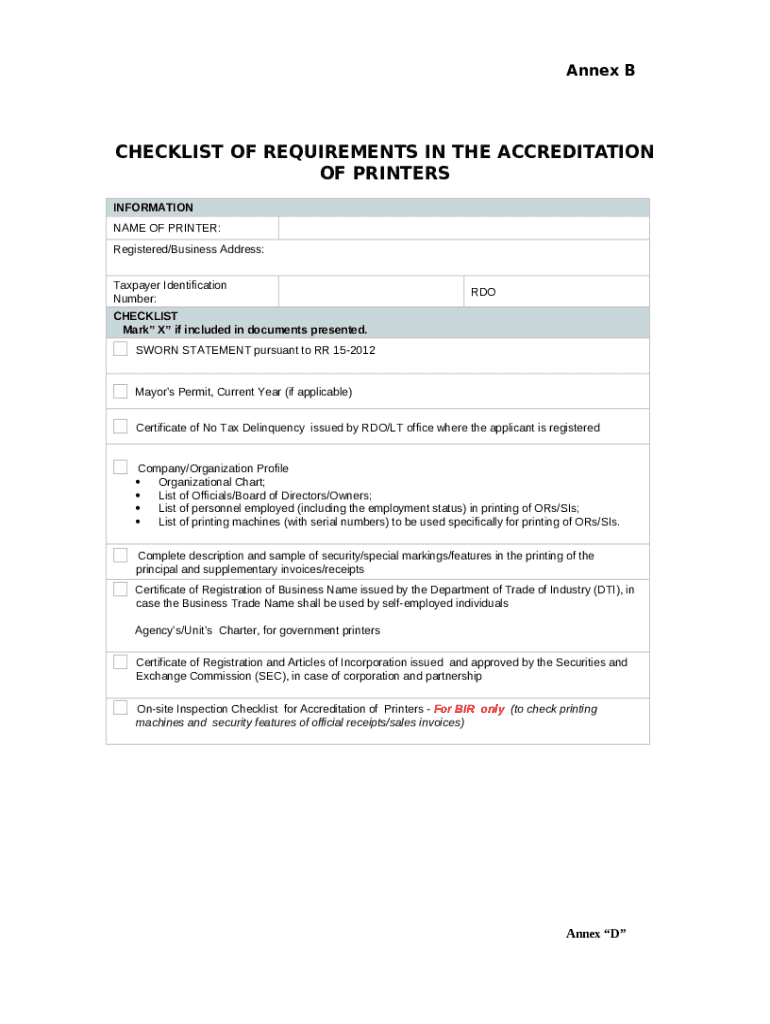

Filling out BIR forms accurately is essential for compliance. The process begins with gathering the necessary information, including personal identification details such as Tax Identification Number (TIN) and financial data like income totals and expenses. Ensuring you have supporting documents, like previous tax filings and income statements, will streamline the process and reduce the chance of errors.

Using a tool like pdfFiller simplifies the process of completing these forms. The platform provides editing tools, including text editing and image insertion features that allow users to clarify their entries effectively. However, several common mistakes should be avoided, such as overlooking critical fields, misreporting income or deductions, and failing to follow specific instructions for each form.

eSigning and managing your Bureau of Internal Revenue forms

The process of electronically signing forms using pdfFiller is straightforward. Users can complete their forms and add an eSignature seamlessly within the platform. The main advantages of eSigning over traditional methods include enhanced security, as electronic signatures add a layer of protection against fraud, and significant time savings, as forms can be signed and submitted instantly.

Furthermore, pdfFiller provides features that allow users to monitor the status of submitted forms. This way, individuals and teams can keep track of any pending submissions or responses required from BIR, ensuring all documentation stays organized and accessible.

Collaborating on Bureau of Internal Revenue forms

Collaborating on BIR forms is made easy through pdfFiller, where users can share forms for collaborative completion. By inviting team members to review and edit forms, the potential for errors is greatly reduced. The platform also offers commenting features, allowing collaborators to provide feedback and suggestions directly on the documents.

Best practices for collaboration include setting clear deadlines for form completion and tracking changes and versions so that everyone involved is on the same page. This organized approach ensures that when forms are finalized and submitted, they are accurate and comprehensive.

Submitting Bureau of Internal Revenue forms

Submitting BIR forms can be completed through various options, including electronic submission via authorized online portals or traditional mail methods. Each submission method has specific requirements and guided procedures to adhere to, especially regarding the accompanying documents needed.

To ensure compliance, it’s crucial to stay aware of submission deadlines. Missing deadlines can result in penalties or interest charges, which can be costly and can derail good financial practices. Thus, using tools within pdfFiller to set reminders and alerts for filing dates can aid in maintaining timeliness.

Managing your Bureau of Internal Revenue form archives

Effectively managing your completed BIR forms is essential for maintaining accurate tax records. pdfFiller allows users to organize their forms within a centralized archive, facilitating easier access and retrieval of documents when needed, especially during audits or inquiries from the Bureau.

Best practices for maintaining tax records include regularly updating your archives, implementing consistent naming conventions for your files, and securing your sensitive information through cloud storage solutions that ensure data protection. This organized approach aids in creating a reliable system for tracking tax-related documents.

Key considerations and tips for using Bureau of Internal Revenue forms

Staying updated on changes to forms and submission requirements is vital for all taxpayers. The BIR often revises forms and procedural guidelines, and having the latest information helps ensure that submissions are compliant. Utilizing alerts and reminders for important filing dates also aids in timely compliance.

Moreover, exploring features within pdfFiller that enhance long-term document management can also be advantageous. Features like easy form duplication, audit trails, and robust security measures make pdfFiller an invaluable tool for efficiently managing BIR forms.

Benefits of using pdfFiller for Bureau of Internal Revenue forms

Using pdfFiller as a centralized document management solution for Bureau of Internal Revenue forms offers an array of benefits. Its seamless user experience allows for easy document creation, editing, eSigning, and collaboration, all from one cloud-based platform.

The multifunctionality of pdfFiller enhances productivity, enabling users to manage their forms efficiently. With the added benefit of cloud-based solutions, individuals and teams can access their documents from anywhere, ensuring they remain organized and compliant with BIR regulations. This powerful combination helps facilitate a streamlined approach to form management, making the process less cumbersome and more efficient.