No-fault MVA Claim Information Sheet: A Comprehensive How-To Guide

Understanding no-fault insurance

No-fault insurance fundamentally alters how automobile insurance claims are managed after a motor vehicle accident (MVA). Under this system, each party involved in the accident receives compensation from their insurance, regardless of fault. This can help expedite the recovery process, reducing the need for lengthy legal disputes over liability.

No-fault insurance laws vary from state to state. Some states fully implement no-fault policies, whereas others adopt a hybrid model, allowing for both no-fault and tort claims. For instance, New Jersey is a no-fault state that requires drivers to carry personal injury protection (PIP) insurance, which covers medical expenses regardless of who caused the accident.

New Jersey: Personal Injury Protection (PIP) is mandatory.

Florida: Pure no-fault system with limited options for suing.

California: Hybrid system allowing for traditional liability claims.

Understanding the nuances of no-fault insurance is vital when filing an MVA claim. The process can enhance the handling of claims, but it also comes with its own set of rules and restrictions, particularly regarding coverage and the types of damages recoverable.

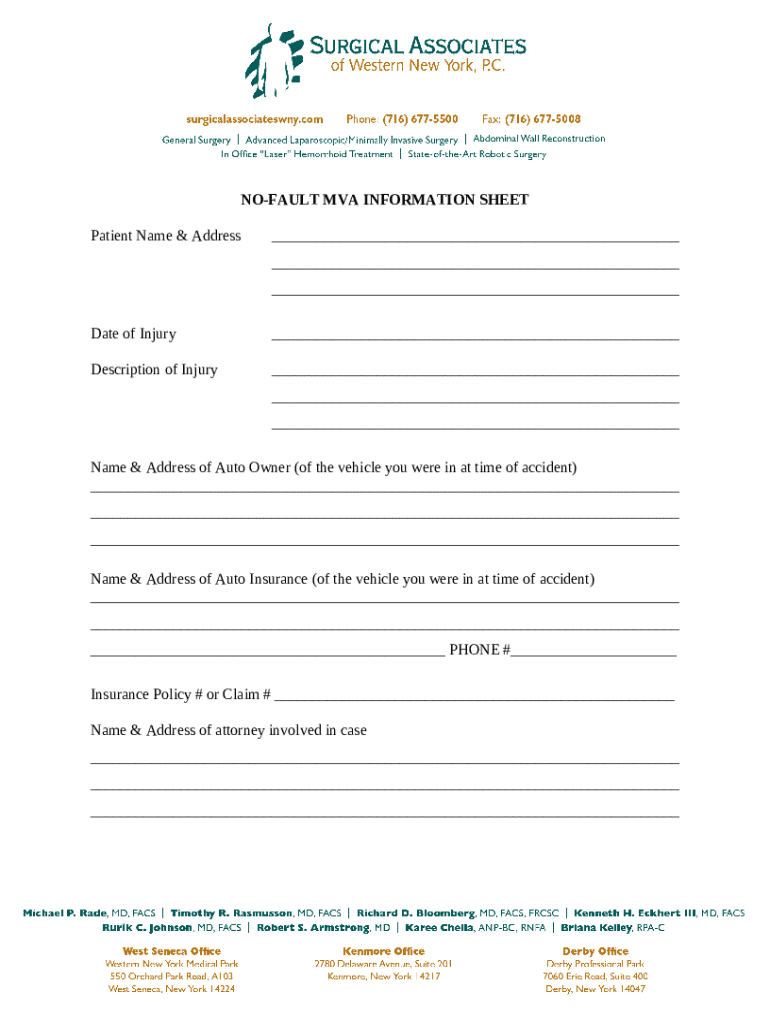

The no-fault MVA information sheet: Purpose and importance

The no-fault MVA information sheet serves as a critical document that outlines necessary information when filing a no-fault claim following a motor vehicle accident. This form collects essential data, including information about the vehicles involved, the parties’ insurance details, and specifics of the accident, which are crucial for processing the claim efficiently.

Understanding why this form is necessary not only helps you comply with local regulations but also ensures that you maximize your entitlements under your state’s no-fault laws. You will need this form in common scenarios such as seeking medical benefits, filing for lost wages, or addressing property damage claims.

Seeking medical benefits for injuries sustained.

Claiming lost wages due to the accident.

Addressing property damage claims with your insurer.

Ultimately, having a well-organized and comprehensive no-fault MVA information sheet can make a significant difference in the outcome of your claim, ensuring timely payment of benefits.

Step-by-step guide to filling out the no-fault MVA information sheet

Filling out the no-fault MVA information sheet requires careful attention to detail. Start by gathering all necessary information and documents to streamline the process.

Preparing your information

Ensure you have the following documents at hand to fill out the information sheet completely:

Driver's license information of all parties involved.

Insurance details for each vehicle involved.

Medical records or bills related to the accident.

Accident report from local law enforcement.

Having these documents prepared helps create a smooth filling process, which is crucial for accuracy and completeness.

Filling out each section of the form

As you begin filling out the form, pay attention to each section, which typically includes the following:

Personal details of the drivers involved.

Vehicle information including make, model, and registration details.

Insurance information, including policy numbers.

Accident specifics, outlining facts like time, date, and location.

Avoid common mistakes such as providing incorrect information or leaving fields blank, as these can result in delays or denials of your claim.

Example of a completed form

To illustrate the successful completion of a no-fault MVA information sheet, consider the following example. Each section should be completed clearly:

[Insert visual example here or a description of a filled-out form showing how it should look based on guidelines.]

Interactive tools for managing your no-fault MVA claims

Digital platforms like pdfFiller provide a suite of interactive tools to assist you in managing your no-fault MVA claims effectively.

Online tools available on pdfFiller

pdfFiller allows users to quickly import and edit PDF documents to create custom forms that meet their specific needs, including the no-fault MVA information sheet. The tools are designed for ease of use, ensuring that even those with minimal tech experience can navigate them effortlessly.

How to import and edit PDF documents

You can easily upload your existing PDFs to the pdfFiller platform and make any necessary edits directly on the document. This feature is particularly beneficial for modifying pre-existing forms or templates.

eSign functionality: Steps to sign your form electronically

To electronically sign your no-fault MVA information sheet, follow these simple steps:

Upload your document to pdfFiller.

Navigate to the signature field.

Choose to draw, type, or upload your signature.

Place your signature in the correct location and save the document.

This functionality not only speeds up the process of submitting your claims but also adds a layer of convenience, allowing you to complete the entire procedure from any location.

Collaboration features: Working with others on your claim

pdfFiller also provides collaboration tools that allow you to invite others—such as legal representatives or family members—to view and edit your documents. This can prove invaluable when gathering information from multiple sources to support your claim.

Managing your documents and forms

Once your no-fault MVA information sheet is completed, effective document management becomes crucial. Properly storing and organizing your forms not only ensures you have access when needed but also protects sensitive information.

Storing your no-fault MVA information sheet

With pdfFiller, your documents are stored securely in the cloud, allowing you to access them anytime, anywhere. This is particularly beneficial if you need to reference your information after submitting a claim or if an issue arises later.

Best practices for document management

To effectively manage your documents, consider the following best practices:

Organize documents by category—insurance claims, medical records, and correspondence.

Create a backup of all documents on a separate device or cloud service.

Regularly review your stored documents to ensure relevance and accuracy.

These practices not only simplify retrieval but also minimize the stress associated with managing multiple forms and records.

Accessing and sharing your completed documents

pdfFiller allows you to share your completed documents directly with the associated parties. This capability can streamline the claims process, as stakeholders can receive necessary documents without any delays.

Common questions and challenges

Navigating the no-fault claims process can present several challenges and questions. Understanding common queries can ease the experience.

Frequently asked questions (FAQs)

Some of the most common questions include:

What if my claim is denied? If your no-fault claim is denied, you can initiate the internal appeal procedure with your insurer, or consider seeking legal advice.

How to appeal a no-fault insurance decision? Follow the appeal guidelines outlined in your insurance policy and gather supporting documentation.

Preparing for potential issues can make you feel more confident as you move through the claims process.

Troubleshooting common issues

Addressing common issues such as trouble filling out the form can typically be resolved with the help of pdfFiller’s customer support and user-friendly tools.

Additional technical difficulties with digital tools can often be resolved through online resources, community forums, or direct support from the service provider.

Staying updated: Changes in no-fault regulations

The landscape of no-fault insurance is continuously evolving as states adapt their legislation based on new data and feedback.

Current trends in no-fault insurance

Analyzing current trends in no-fault insurance is vital for maintaining compliance. Recent patterns indicate that states may be revising fee schedules and coverage limits as the insurance market evolves.

It's beneficial to monitor updates provided by your state’s department of banking and insurance to stay informed.

Recent legal changes impacting MVA claims

Legal assessments of no-fault insurance often lead to adjustments in legislation that may affect claim handling, eligibility, and damage recovery. Staying abreast of these changes can ensure your claims remain valid.

Resources for keeping informed

Refer to reputable legal and insurance websites or subscribe to newsletters for timely updates on any modifications to no-fault regulations in your state.

Utilizing support resources

Accessing customer support through pdfFiller proves invaluable when navigating complex no-fault claims. Often, users can find immediate assistance via the platform’s help center.

Connecting with legal advisors

If you face more complicated cases or pushback from insurance agencies, connecting with legal advisors can provide clarity. They can offer insights specifically tailored to the statutes and regulations governing your situation.

Importance of professional help for complex claims

Understanding the statute and the internal appeal procedure is crucial when handling complex claims. Professionals can guide you through these legal intricacies, helping you present the strongest case possible.

Final steps after submitting your no-fault MVA information sheet

After submitting your no-fault MVA information sheet, various next steps are essential for successful claim management and follow-up.

What to expect after submission

Post-submission, your insurance provider will begin evaluating your claim. Expect to receive notifications about approvals or requests for additional information within the stipulated review period.

Key follow-up actions

Be proactive by checking in with your claims adjuster. Keeping a record of interactions mitigates the chances of miscommunication.

Keeping records of your submission

Ensure that you maintain copies of all documents submitted and any correspondence with the insurance company. This can greatly simplify any future discussions regarding your claim.

User testimonials and success stories

Reflecting on real-life experiences regarding navigating no-fault claims can provide valuable insights. Many individuals have reported increased claim process efficiency after utilizing tools from pdfFiller.

These success stories often emphasize the importance of being organized and well-informed when pursuing a no-fault claim. Using these tools helped users submit accurate, formatted documents that align with insurance requirements.