Get the free New Rule Requiring Disclosure of Attorneys/Consultants ...

Get, Create, Make and Sign new rule requiring disclosure

Editing new rule requiring disclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new rule requiring disclosure

How to fill out new rule requiring disclosure

Who needs new rule requiring disclosure?

Understanding the New Rule Requiring Disclosure Form: A Comprehensive Guide

Overview of the new rule requiring disclosure form

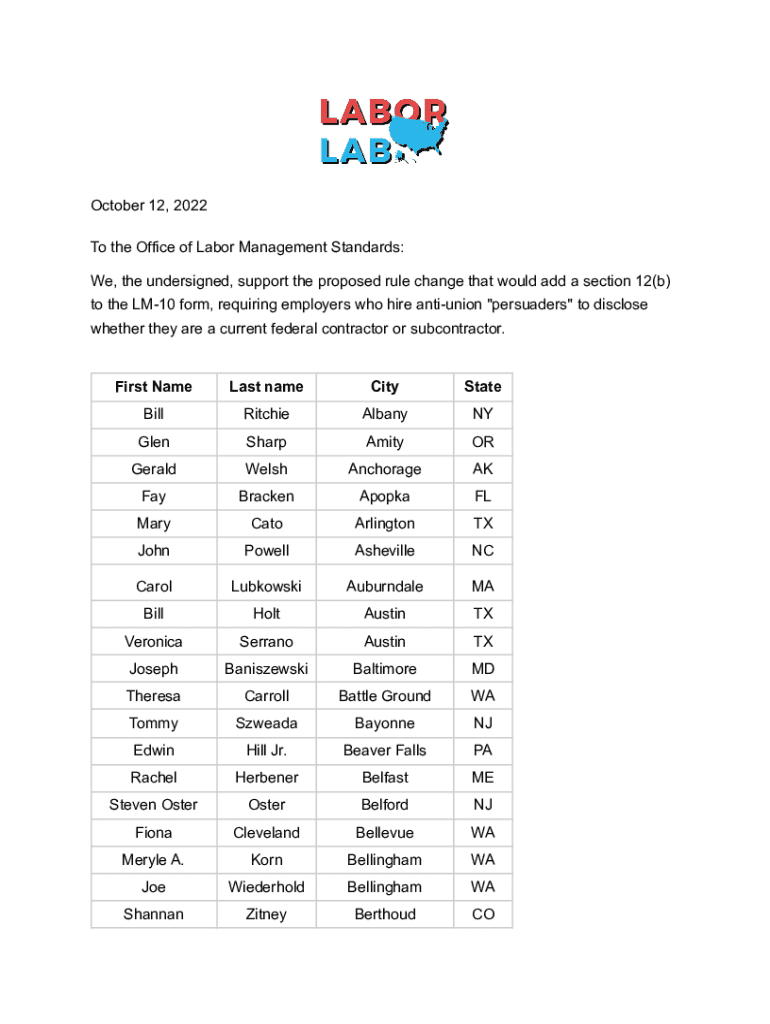

The new rule requiring disclosure form, which is pivotal to enhance corporate transparency, mandates certain entities to provide detailed information about their ownership and management structures to federal authorities. This regulation is part of the Corporate Transparency Act, designed to combat financial crimes such as money laundering and tax evasion by increasing scrutinization of reporting companies.

Under this rule, individuals and businesses should understand the broader implications of their disclosures, as it not only promotes transparency among corporations but also facilitates law enforcement agencies' efforts to track illicit financial activities. Key deadlines for compliance vary by entity type, but it’s crucial to prepare ahead of time to avoid penalties.

Understanding the disclosure requirements

To comply with the new rule, specific disclosures are mandatory. Entities must provide information about their beneficial owners, including full names, dates of birth, addresses, and identification numbers such as Social Security or passport numbers. Moreover, the rule outlines precise formats and guidelines to ensure standardized submissions.

Additionally, it’s essential to recognize who is required to submit these disclosures. This encompasses a wide range of entities: corporations, limited liability companies, and partnerships formed in the United States, with few exemptions for certain types of companies, like large, publicly traded firms. Compared to previous obligations, where simplistic annual reports sufficed, this new disclosure requirement is significantly more rigorous, reflecting an evolution in regulatory demands.

Steps to prepare for the new disclosure rule

Preparing for compliance with the new rule begins with a systematic approach to ensure that you meet all necessary requirements.

Modifying and managing disclosure forms

Once disclosures are submitted, you may need to modify them in the future as circumstances change. pdfFiller provides tools to easily edit and update previously submitted disclosures, ensuring that your records are accurate and current.

Keeping track of future obligations is equally important. By utilizing pdfFiller’s features, such as automated reminders and eSign capabilities for digital signatures, managing your disclosure documents becomes streamlined. This allows teams to collaborate effectively on compliance matters, no matter where they are located.

Common challenges and solutions

Individuals and teams may encounter several challenges when navigating the new rule requiring disclosure form. Issues often arise with understanding the detailed requirements or facing technical difficulties when submitting disclosures digitally.

To address these challenges, utilizing pdfFiller’s resources, such as templates and support options, can be invaluable. Implementing recommended best practices, like maintaining clear communication within teams, can support effective management and submission of all necessary documentation.

Implications of non-compliance

Failing to comply with the new rule can result in severe penalties, including substantial fines and potential criminal charges. Real-life enforcement actions have illustrated the seriousness of these implications, highlighting that regulatory bodies are actively pursuing non-compliant companies.

For instance, recent cases have seen companies fined tens of thousands of dollars for incomplete or inaccurate disclosures. To avoid falling into similar traps, it's crucial to be proactive in understanding and adhering to the new requirements.

Best practices for ongoing compliance

Continuously monitoring changes in disclosure requirements is an essential part of maintaining compliance. The regulatory landscape can shift, and being informed will prevent pitfalls associated with outdated practices.

Moreover, keeping documentation updated through a centralized solution like pdfFiller aids in quick access to required forms. This cloud-based platform allows for efficient management of disclosures, ensuring that all pertinent information is easily retrievable when necessary.

Related resources and tools

pdfFiller offers a robust suite of document creation and management features that directly support compliance with the new rule requiring disclosure form. Users can access customizable templates tailored specifically for these disclosures. Furthermore, testimonials from satisfied users demonstrate how pdfFiller has streamlined their compliance processes, allowing them to focus on their core business operations.

Appendices

For those seeking additional clarification, a glossary of terms related to the new disclosure requirements is available. This resource can assist individuals and businesses in navigating the complex language often associated with regulatory compliance.

Moreover, a frequently asked questions section will address common queries regarding the overall rule and the disclosure forms to further aid understanding.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit new rule requiring disclosure on an iOS device?

How do I complete new rule requiring disclosure on an iOS device?

How do I complete new rule requiring disclosure on an Android device?

What is new rule requiring disclosure?

Who is required to file new rule requiring disclosure?

How to fill out new rule requiring disclosure?

What is the purpose of new rule requiring disclosure?

What information must be reported on new rule requiring disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.