Get the free Form 990-ez

Get, Create, Make and Sign form 990-ez

How to edit form 990-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-ez

How to fill out form 990-ez

Who needs form 990-ez?

Form 990-EZ Form: A Comprehensive How-to Guide

Understanding the Form 990-EZ

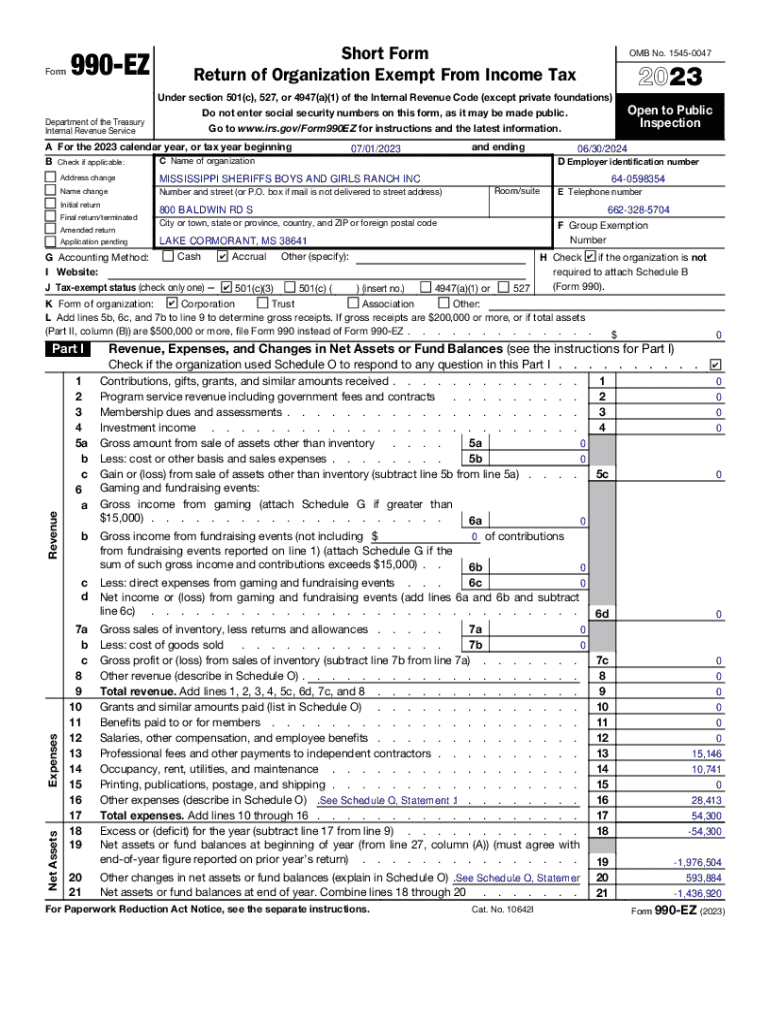

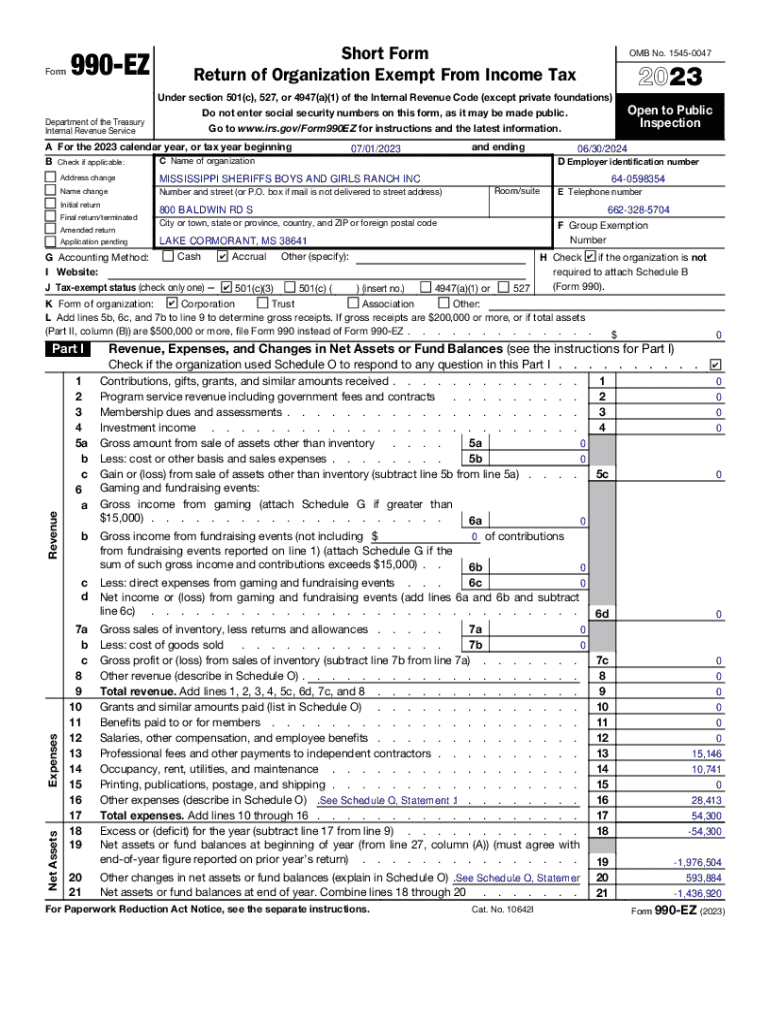

Form 990-EZ is a streamlined tax filing option for small to mid-sized nonprofit organizations whose gross receipts are under $200,000 and total assets are less than $500,000. This form plays a crucial role in ensuring transparency and accountability among nonprofits while allowing them to maintain their tax-exempt status without overwhelming paperwork. Unlike the full Form 990, which is complex and detailed, Form 990-EZ simplifies the reporting process while still providing necessary financial information to the IRS and the public.

One key distinction between Form 990 and Form 990-EZ is the level of detail required. While Form 990 demands extensive disclosures and supplemental schedules, Form 990-EZ focuses on critical components, enabling smaller organizations to report their activities more efficiently. This simplification serves to empower smaller nonprofits to comply without getting bogged down in extensive bureaucratic processes.

Who needs to file Form 990-EZ?

Eligibility for filing Form 990-EZ primarily revolves around the organization’s financial thresholds. To qualify, your nonprofit must have gross receipts under $200,000 and total assets below $500,000 by the end of the tax year. Organizations meeting these criteria are encouraged to file Form 990-EZ because it reduces the reporting burden compared to the more exhaustive Form 990.

Additionally, filing Form 990-EZ allows organizations to save time and focus their energies on their missions rather than navigating complex tax regulations. This efficiency is especially beneficial for nonprofits that operate with tight budgets and limited staffing.

Key components of Form 990-EZ

When filling out Form 990-EZ, it is essential to understand its structure. The form comprises several sections that capture different aspects of the organization's financial status and activities. Here’s a closer look at the form's key components:

Familiarizing yourself with these components before starting the form can prevent errors and streamline the process. Each section builds on the organization's overall financial picture, required for compliance and transparency.

Filling out Form 990-EZ: Step-by-step instructions

To successfully complete Form 990-EZ, it's crucial to prepare your financial data systematically. Start by gathering all financial records, including bank statements, revenue documentation, and expense receipts. A methodical approach will help avoid overlaps and missed information, which are common pitfalls in the filing process.

Once you have organized your financial data, begin filling out the form. Start with the header information, including the organization’s name and tax identification details. Next, methodically report revenue, outlining contributions and grants accurately. When addressing expenses, categorize them by function to ensure clarity for the IRS. Finally, complete the balance sheet and other required disclosures—maintaining attention to detail throughout this section is critical.

Common mistakes and how to avoid them

During the tax filing process, organizations frequently encounter common mistakes that can jeopardize their compliance status. For example, using outdated financial records can result in inaccuracies or misreporting, which could trigger IRS scrutiny. Neglecting to verify calculations can also lead to discrepancies that undermine the credibility of your filing.

By remaining diligent and observant, you can mitigate the risks associated with common filing errors and ensure a smoother submission process.

Filing Form 990-EZ

Once your Form 990-EZ is completed, it's time to file it. Organizations have two main filing options: e-filing and paper submission. E-filing has gained popularity due to its efficiency and automatic processing by the IRS, which can lead to faster acknowledgment of your filing.

Using pdfFiller for e-filing offers a streamlined experience; the platform provides tools that simplify document preparation and submission. Regardless of the method chosen, organizations should be aware of important deadlines. The standard due date for Form 990-EZ is the 15th day of the fifth month after the end of your organization’s accounting year. Extensions may be available, but it's essential to understand the implications of late filings, as these can result in penalties and interest.

After filing: what’s next?

After submitting Form 990-EZ, it’s important to grasp what happens next. The IRS initiates a review process to ensure the accuracy and completeness of the filing. If the IRS identifies discrepancies or requires additional information, they may contact the organization for clarification. Understanding this review process enables organizations to be prepared for potential follow-up actions.

Additionally, record-keeping is vital for future compliance. Organizations should retain copies of their filed forms for at least three years from the filing date, as this aligns with IRS record retention guidelines. Establishing a structured approach to organizing financial documents will simplify future filings and audits, ensuring your organization maintains its nonprofit tax returns smoothly.

Special considerations

Nonprofit organizations should stay informed about any recent changes in tax laws that may affect Form 990-EZ. Legislative updates can influence filing requirements or eligibility thresholds, making it crucial for organizations to remain proactive in understanding their obligations. Keeping abreast of these changes ensures that your organization remains compliant with current regulations.

Additionally, organizations may have specific questions or concerns regarding Form 990-EZ. Some common inquiries include understanding when they qualify for exemptions or how different revenue sources impact filing. Addressing these questions early can foster greater clarity as organizations approach the filing process.

Leveraging pdfFiller for enhanced document management

pdfFiller streamlines the process of filling out Form 990-EZ and ensures that organizations can manage their documents effectively. With pdfFiller, users can easily edit and customize their form entries, ensuring all data is accurate. The user-friendly interface allows nonprofit workers to correct errors quickly without needing to start anew.

Utilizing these tools enables organizations to maximize their efficiency and meet regulatory requirements without unnecessary complexity.

Summary of benefits of using Form 990-EZ

Filing Form 990-EZ brings numerous advantages to nonprofits. By utilizing this simplified form, organizations can maintain their tax-exempt status while demonstrating financial responsibility and transparency to donors and stakeholders. This transparency may positively impact funding opportunities, ultimately advancing the organization's mission.

In conclusion, adopting appropriate forms like Form 990-EZ paired with a supportive platform like pdfFiller empowers nonprofits in managing their tax obligations while concentrating on their core missions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 990-ez online?

Can I create an eSignature for the form 990-ez in Gmail?

How can I edit form 990-ez on a smartphone?

What is form 990-ez?

Who is required to file form 990-ez?

How to fill out form 990-ez?

What is the purpose of form 990-ez?

What information must be reported on form 990-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.