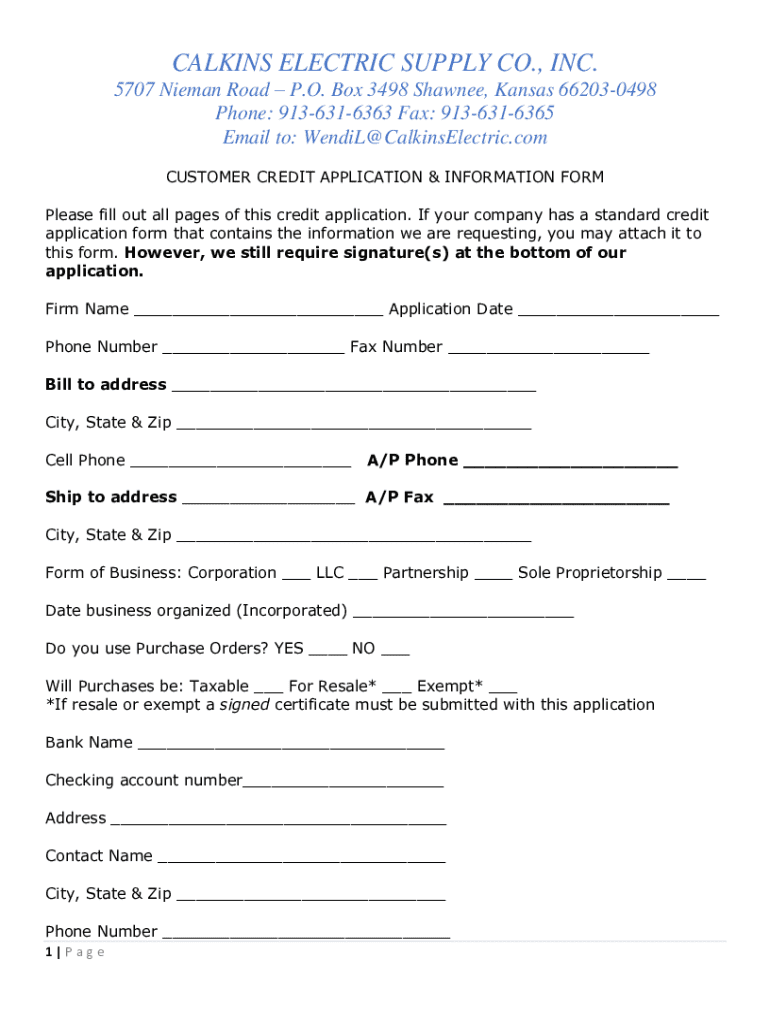

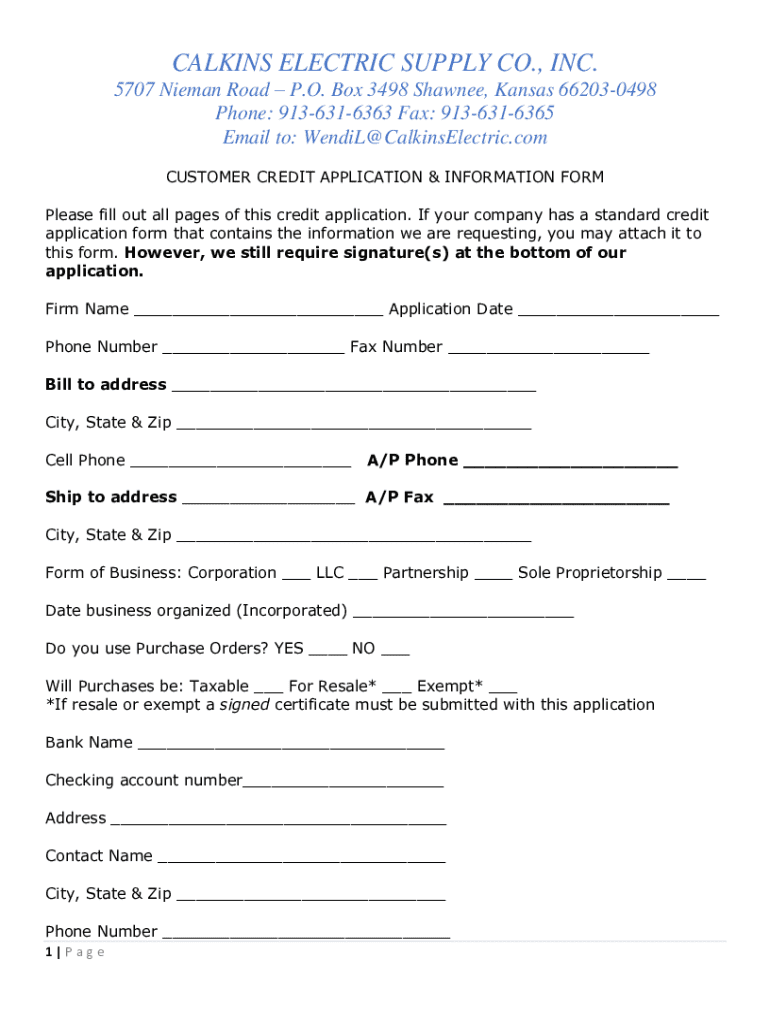

Get the free Customer Credit Application & Information Form

Get, Create, Make and Sign customer credit application information

Editing customer credit application information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out customer credit application information

How to fill out customer credit application information

Who needs customer credit application information?

Understanding the Customer Credit Application Information Form

Overview of customer credit application

A customer credit application information form is a crucial document that businesses utilize to assess the creditworthiness of potential clients. This form gathers essential information to determine whether to extend credit and under what terms. By evaluating the provided data, companies can minimize risks associated with extending credit, ensuring that they remain financially secure while fostering customer relationships.

The importance of customer credit applications for businesses cannot be overstated. They serve as a first line of defense against potential losses due to defaulting customers. Moreover, a thorough credit application process allows businesses to make informed decisions based on consistent metrics, facilitating smarter lending practices. This leads to higher approval rates of trustworthy customers and better overall financial health for the business.

Essential components of a customer credit application

A well-structured customer credit application contains several essential components. First, comprehensive personal information is needed, including the applicant’s name, address, and contact details. This data not only helps businesses identify the applicant but also allows for the verification of their identity against public records.

Next, financial information is critical. This section typically includes employment details and income sources, which provide insight into the applicant's ability to repay debts. It's also essential for applicants to disclose any existing debt obligations, as this impacts their overall financial health and creditworthiness. Furthermore, obtaining consent for credit checks is a necessary legal step that protects both the business and the applicant.

Step-by-step guide to filling out the customer credit application

Filling out a customer credit application can be straightforward if you follow a structured approach. First and foremost, prepare to complete the form by gathering required documents, such as identification, proof of income, and property ownership records. Understanding each section of the form eliminates confusion and aids in providing accurate information.

When filling out personal information, ensure accuracy in data entry, as mistakes can lead to delays or mismatches during the credit evaluation process. Common mistakes include misspelling names or providing incorrect contact details. After completing this section, move on to providing your financial information, where you'll need to detail your employment and income sources while itemizing any significant debts upfront.

Interactive tools for managing your credit application

Using dynamic online tools can streamline the process of filling out a customer credit application. pdfFiller’s online form editor, for instance, allows users to easily create, edit, and manage credit application forms. This cloud-based platform is designed for accessibility from any device, making it convenient for both individuals and teams.

The step-by-step workflow for editing and submitting forms is user-friendly, enabling applicants to fill in their details systematically. Additionally, collaboration features allow team members to review, comment, and adjust the application together, enhancing accuracy and efficiency. All these tools not only save time but also contribute to a higher quality submission.

Understanding the review process of your application

Once the customer credit application is submitted, an essential next step is understanding the review process. Businesses typically evaluate applications through a multi-step process, which may include credit checks, verification of provided information, and analysis of financial statements. The timeline for approval can vary based on the volume of applications and the complexity of information provided.

In some instances, applications may be denied due to insufficient income, high existing debt, or negative credit history. If an application is denied, it is crucial to understand the reasons and rectify any issues that may be affecting your creditworthiness, such as disputing errors in your credit report or addressing outstanding debts.

Safeguarding against fraud during the application process

Fraud during the customer credit application process can pose significant risks to businesses and applicants alike. It's crucial to be vigilant and identify any signs suggesting that an application may not be legitimate. Common indicators include discrepancies in personal information, unusual email addresses, or incomplete applications.

To protect personal information, applicants should only share details through secure channels and ensure that they are using verified business contacts. If fraudulent incidents are suspected, it's imperative to report these situations immediately to the issuing company and local law enforcement. This proactive approach helps in safeguarding personal data and minimizing potential impacts.

Frequently asked questions (FAQs)

As you navigate the customer credit application process, you might encounter several common questions that warrant clarification. For instance, many applicants wonder how long it typically takes to process a credit application. On average, reviews can take anywhere from a few hours to several days, depending on the thoroughness of the submission and the lending institution's backlog.

Another frequent inquiry revolves around credit score requirements. These can vary significantly by lender but can sometimes start from scores as low as 620 for certain types of loans. Applicants might also wonder about co-signers: yes, many institutions allow co-signers which can help improve chances of approval. If you haven’t heard back about your application, it’s recommended to reach out to the lender for a status update.

Troubleshooting common issues in credit applications

As with any process, applicants may encounter challenges while completing their customer credit applications. If you suspect fraud, it's imperative to validate the authenticity of the application through direct communication with the lending organization. Furthermore, ensuring that you check your email inbox regularly is vital; sometimes, important updates can filter into spam or junk folders, leading to missed communications.

In situations where an application cannot secure funding, exploring alternative options can provide pathways to resolution. Consider whether you can improve your credit profile by addressing issues or perhaps seek assistance from credit counselors who can provide tailored advice on improving your credit standing.

Maximizing your chances of approval

To enhance your chances of credit application approval, there are several proactive steps worth considering. One of the most effective approaches is to present a solid application that accurately demonstrates your income history and financial stability. Additionally, maintaining a good credit score is essential; regularly monitoring your credit report and making timely payments can positively influence lending decisions.

Utilizing resources available on platforms like pdfFiller can also lead to stronger credit applications. Accessing templates and guides specifically tailored for customer credit applications can streamline the process, ensuring all necessary documentation is included, ultimately boosting your chances of securing credit.

Continuing to manage your credit relationship

After submitting a customer credit application and receiving approval, ongoing management of your credit relationship is crucial. Regularly updating your information with the financial institution can prevent issues down the road, such as lapses in communication or discrepancies in your file. This becomes particularly important if you experience changes in your financial situation, such as job transitions or significant purchases.

Understanding how to manage your credit reports and monitoring them frequently adds an additional layer of security. You have the right to access your credit report annually without charge, enabling you to keep a pulse on your credit health and address any inconsistencies or inaccuracies proactively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my customer credit application information in Gmail?

How can I send customer credit application information to be eSigned by others?

How do I edit customer credit application information on an Android device?

What is customer credit application information?

Who is required to file customer credit application information?

How to fill out customer credit application information?

What is the purpose of customer credit application information?

What information must be reported on customer credit application information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.