Get the free Form Adv

Get, Create, Make and Sign form adv

Editing form adv online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form adv

How to fill out form adv

Who needs form adv?

A Comprehensive Guide to Form ADV for Investors and Advisors

Understanding Form ADV

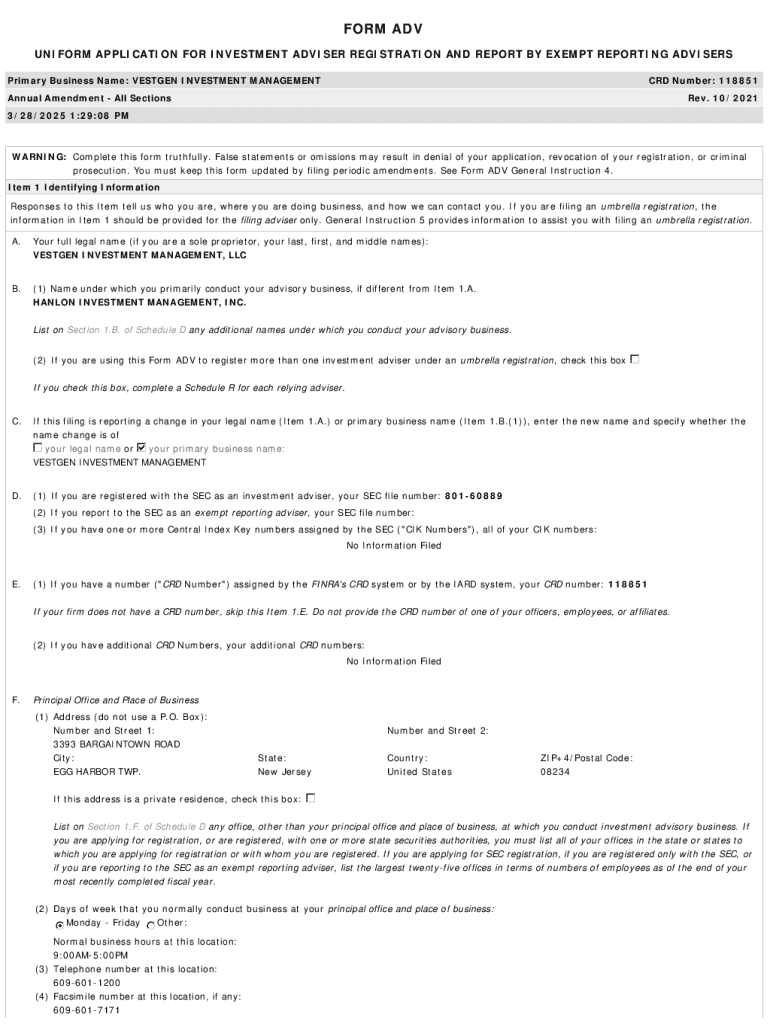

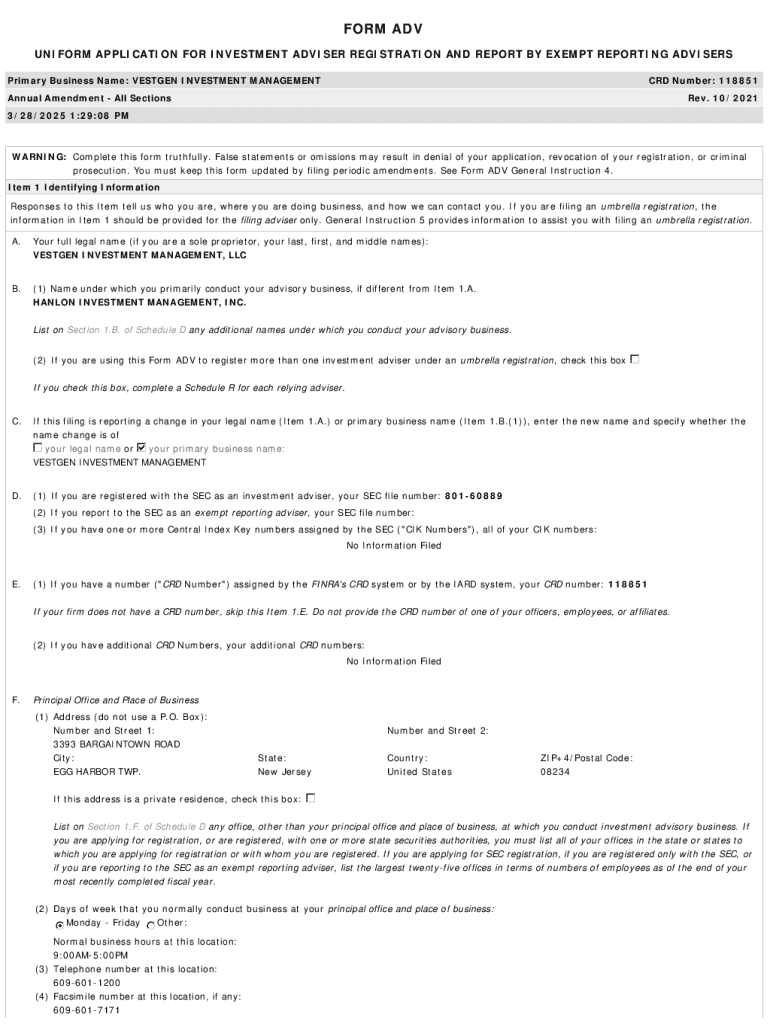

Form ADV is a critical regulatory document that financial advisors in the United States must file with the Securities and Exchange Commission (SEC) and state regulators. It serves to provide transparency in the financial advisory industry, ensuring that both investors and advisors are safeguarded. This form lays out crucial information regarding the advisory firm's services, fees, and business practices, empowering investors to make informed decisions about their financial futures.

For investors, understanding Form ADV is vital as it highlights essential details about potential advisors, including their qualifications and any disciplinary history. For financial advisors, filing this form is not just a regulatory requirement but also a chance to clarify their services and build trust within the client-advisor relationship.

Navigating the structure of Form ADV

Form ADV is divided into two main parts: Part I and Part II, each serving distinct functions that are critical in providing a panoramic view of an advisory firm.

Part I requires firms to disclose basic information about themselves, including their name, address, and contact information, alongside details regarding their ownership and the types of advisory services offered. In contrast, Part II provides more in-depth narratives concerning services, fees, and potential conflicts of interest, allowing investors to gain a deeper understanding of what to expect.

Detailed guide to Part of Form ADV

Exploring Part I of Form ADV begins with examining the basic information, which includes the firm's name, physical address, and any relevant contact multi-channels. Next comes essential ownership details, outlining who owns the firm and how it's structured, whether it's a sole proprietorship, partnership, or corporation.

Understanding the types of advisory services offered is crucial for an investor. This section categorizes services into various offerings, ranging from personalized financial advice to portfolio management. Lastly, look closely at fees and compensation; this detail informs clients how the firm charges for its services, be it through assets under management, flat fees, or commission-based layering.

Navigating Part of Form ADV

Part II of Form ADV presents an item-by-item breakdown of valuable insights. Items 1 through 8 detail the nature of services provided, general principles of the firm—a critical area for prospective clients. Furthermore, these items reveal how the advisor’s fees align with the services offered.

Items 9 to 18 delve deeper into ethical practices and potential conflicts of interest. Investors must critically assess this section as it addresses how advisors manage possible conflicts that may arise from their compensation structures or relationships with third-party entities. Transparency in these areas ensures a more ethical engagement with financial advisors.

How to access a firm's Form ADV

To successfully access a firm's Form ADV, investors can utilize several channels. The most straightforward method involves navigating through the SEC’s EDGAR database, where public filings are readily available. This platform provides a user-friendly environment to find detailed disclosures of various firms.

Alternatively, state regulatory agencies also play a crucial role in disseminating Form ADV. Depending on the state, these agencies may offer additional resources or insights into local advisory firms. A state-by-state guide can help investors to identify exactly where to find the necessary filings.

Downloading and reviewing online

Accessing Form ADV online and downloading it for review is a simple process. Start by visiting the SEC’s EDGAR database. Using the search feature, input the firm’s name or SEC file number to locate the corresponding Form ADV filings. By selecting the relevant document, users can download it as a PDF, making it easy to store and review later.

For further assessment, consider using tools such as pdfFiller to manage these documents effectively. Once downloaded, pdfFiller allows users to edit, annotate, and sign documents, ensuring that any necessary changes can be made before sharing or filing them with other stake-holders.

What Form ADV doesn't tell you

While Form ADV provides crucial insights, it is essential to recognize its limitations. One notable gap is the lack of real-time updates on complaints or client experiences, which could be crucial in evaluating the quality of service from a financial advisor. Potential investors should not rely solely on this document but should consider arranging in-person meetings to ask pertinent questions directly.

Additionally, investors should look for red flags that may not be explicitly mentioned in Form ADV. This includes understanding a firm’s reputation within the industry, their approach to client satisfaction, and any external reviews that may provide context about the advisor's performance.

Tips for effectively reading and understanding Form ADV

To effectively read and understand Form ADV, investors should focus on significant fee structures and potential conflicts of interest. Being keen on how fees are structured can significantly affect investment returns; therefore, understanding whether fees are percentage-based, flat, or commission-related can be crucial.

Moreover, avoiding common misinterpretations is just as crucial. Investors must scrutinize the language used, as vague terms can often mislead. It’s also essential to evaluate overall firm quality beyond the written disclosures. Look for indicators of a firm’s commitment towards equity, inclusion, and diversity which are often evident in their mission and organizational goals.

Visualizing financial advisors: Top financial advisors by city and state

Finding the right financial advisor means going beyond Form ADV. Using an interactive map of top financial advisors by city and state can facilitate easier navigation in choosing an advisor. By visualizing the landscape, investors can identify notable firms in their area and evaluate them based on the services they offer and their reputation.

When comparing services regionally, it’s essential to look for characteristics specific to that locale. Different regions might demonstrate differing strengths; for instance, some may focus on retirement planning, while others excel in investment management or tax strategies.

Choosing a financial advisor: Factors to consider beyond Form ADV

Choosing a financial advisor involves weighing factors beyond Form ADV disclosures. Personal compatibility with the advisor is paramount; trust and comfort levels can significantly influence the financial advisory relationship. A positive rapport often nurtures better communication and more personalized service.

Additionally, research beyond Form ADV by reading reviews and seeking referrals can add layers of understanding regarding an advisor’s real-world performance. Look for recommendations from individuals within your network who share similar financial goals or experiences. Ultimately, ensuring the advisor’s reputation aligns with your expectations can lead to a more successful partnership.

Frequently asked questions (FAQs) about Form ADV

How often is Form ADV updated? Typically, advisors must update their Form ADV at least annually or whenever there are material changes in their practices. This regular updating requirement ensures that clients receive the most current information regarding their advisors.

What happens if a financial advisor has a series of complaints? If providers receive multiple complaints, it may affect their registration status or eligibility to continue operating. Prospective investors should scrutinize this element in their decision-making process.

Can clients influence the contents of Form ADV? While clients cannot alter the form itself, feedback and experiences can prompt advisors to update their disclosures and improve their practices based on client needs.

Tools and resources for managing financial documents with pdfFiller

Managing financial documents, such as Form ADV, can be streamlined through effective tools like pdfFiller. This platform empowers users to edit PDFs effortlessly, ensuring that necessary edits can be made without hassle. Users can also benefit from the eSigning features, allowing documents to be signed securely across teams or individual users.

Moreover, pdfFiller's collaborative features enable multiple users to work on documents simultaneously, making the overall administrative process smoother. For managing disclosures like Form ADV, pdfFiller's functionality can help ensure that all stakeholders have the most up-to-date information available easily.

Step-by-step instructions on managing your Form ADV

Start with uploading Form ADV to the pdfFiller platform, making document management straightforward. In the system, you can edit and annotate the form as needed, ensuring all details accurately reflect your advisory practices. If eSignatures are required, pdfFiller allows users to include them with ease, making it efficient for client approvals.

Once the necessary edits are made, sharing the form becomes simple. Users can easily send files via secure links or email, offering convenient access to clients or stakeholders. By utilizing templates within pdfFiller, you can create personalized versions of Form ADV and other financial documents, further simplifying the administrative journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form adv?

Can I create an eSignature for the form adv in Gmail?

How do I fill out form adv on an Android device?

What is form adv?

Who is required to file form adv?

How to fill out form adv?

What is the purpose of form adv?

What information must be reported on form adv?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.