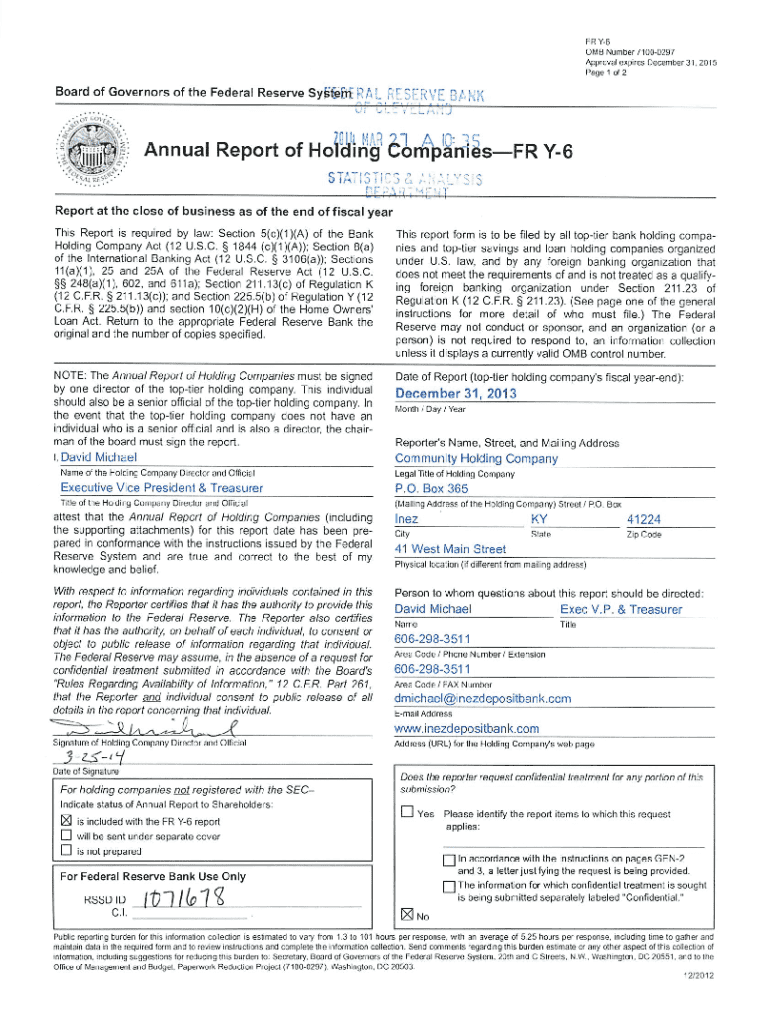

Get the free I Annual Report of Holding CompaniesFR Y-6

Get, Create, Make and Sign i annual report of

How to edit i annual report of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out i annual report of

How to fill out i annual report of

Who needs i annual report of?

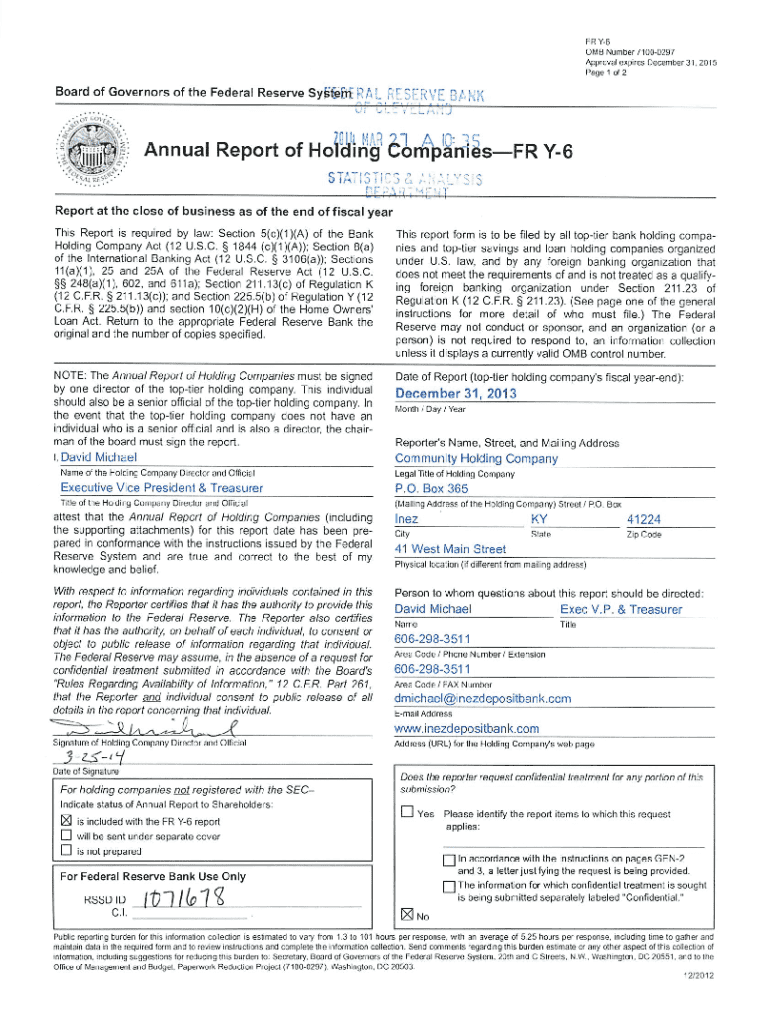

Comprehensive Guide to the Annual Report of Form

Understanding the annual report of form

An annual report of form provides a snapshot of a company's financial health and operational results for a fiscal year. The primary purpose is to inform shareholders, stakeholders, and the general public about the organization's performance. This comprehensive document often serves as a vital communication tool helping businesses highlight successes and outline challenges faced during the year.

Filing an annual report is crucial as it meets legal requirements, especially for corporations, and helps build transparency and trust with investors. A well-structured annual report can significantly influence a company's reputation and credibility in the marketplace.

Types of annual reports

Annual reports can vary widely based on the nature of the organization. Business annual reports typically focus on financial performance, while nonprofit annual reports emphasize impact and fundraising outcomes. Furthermore, reports may differentiate by industry sector; for instance, technology companies might include detailed R&D expenditures, whereas retail might emphasize supply chain efficiency.

As more reports move online, organizations are increasingly choosing digital formats over traditional print. Digital formats facilitate interactive elements and easier dissemination among stakeholders, whereas print remains valuable for formal presentations and physical distribution.

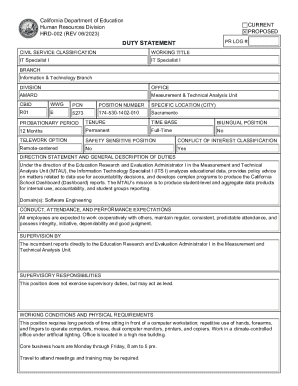

Essential information required for the annual report

When preparing an annual report of form, certain critical information must be included. Corporate details, such as the name, address, and identification numbers, set the stage for legal identification. Financial statements play a central role, offering insights into the organization’s fiscal health.

The balance sheet provides a snapshot of assets and liabilities, while the income statement reveals profit and loss over the period. A cash flow statement is essential to understand liquidity and capital movement. Additionally, management discussions highlight strategic decisions and future planning, addressing challenges faced and growth opportunities.

Step-by-step guide to completing the annual report of form

Creating a comprehensive annual report requires diligent preparation. Start by gathering necessary documentation, including financial records, governance structure, and other supporting details. This foundational step ensures that all the required information is at hand to create a well-rounded report.

Using tools like pdfFiller can significantly streamline the editing, signing, and collaboration aspects of report creation. The online platform offers a range of editing features that allow users to modify PDFs and prepare them for filing effortlessly. With cloud storage, documents are safeguarded and easily accessible from anywhere.

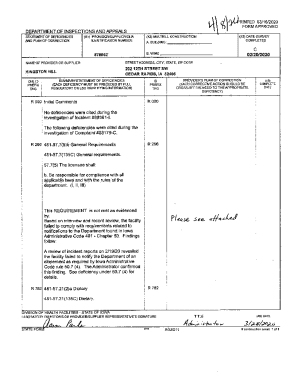

Filing your annual report

Filing deadlines vary by state and entity type, so it's imperative to stay aware of regulations to avoid penalties. It's important to determine your filing method early on, as options include e-filing, in-person submissions, and mailing documents to the appropriate state office.

E-filing is increasingly popular due to its efficiency and convenience. Many portals allow you to complete and submit your reports without any physical paperwork. pdfFiller supports various filing methods, making it easy to choose the right option tailored to your circumstances, whether electronically or physically.

Common questions about annual reports

A variety of questions often arise regarding annual reports. One crucial concern is the repercussions of failing to file; late filings can lead to fines and other penalties. Most jurisdictions allow limited changes post-filing, but knowing the specific rules is important.

Retrieving filed annual reports is generally straightforward, requiring a request to the applicable state office. It's crucial to know the fees that may be associated with filings to prepare accordingly.

Special considerations for different entity types

Understanding the unique filing requirements for different entity types is essential. Nonprofit organizations often have distinct forms and may need to explain their mission and impact clearly. Corporations, such as C-Corps and S-Corps, have different financial reporting requirements. Limited Liability Companies (LLCs) face less stringent reporting mandates, but compliance is still critical.

Each entity type must adhere to specific guidelines to remain in good standing. This not only protects the organization from penalties but also fosters greater trust among stakeholders.

Tips for effective annual report preparation

Best practices for organizing financial statements can streamline the annual report process. Clear headings and logical flow ensure stakeholders easily understand the company's financial performance. Visually engaging elements like infographics and charts can also enhance engagement, breaking down complex data into digestible insights.

Writing a clear management discussion requires balancing technical details with accessibility, allowing diverse readers to grasp key messages without required financial expertise. Emphasizing achievements, lessons learned, and future plans adds depth to the analysis.

Leveraging your annual report for future planning

Annual reports provide significant insights that can inform strategic decisions. By analyzing trends and articulating successes and challenges, organizations can develop actionable plans for future growth. Sharing these reports with stakeholders fosters transparency and can attract potential investors or partners.

Furthermore, utilizing your annual report as a marketing tool allows businesses to showcase achievements and corporate social responsibility initiatives. This not only enhances brand reputation but also creates stakeholder engagement.

Frequently asked questions about using pdfFiller for annual reports

Users often question pdfFiller's compatibility across web browsers. The platform is designed to work seamlessly on major browsers, ensuring accessibility for all users. Additionally, security is a top priority; robust encryption safeguards user data during the filing process.

Another common inquiry involves the ability to create template annual reports for multiple years. pdfFiller allows users to save templates, making it easy for organizations to adapt documents annually without starting from scratch.

Additional resources and tools for annual reporting

Accessing the right tools and templates can simplify the annual reporting process. pdfFiller offers a range of templates suited for various business needs, allowing users to customize reports while adhering to legal standards. Utilizing external resources can further aid compliance and enhance quality.

Guidelines on financial reporting standards are essential to ensure accuracy. Consulting regulatory bodies and financial advisors can provide insights that delineate specific requirements applicable to your organization’s context.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send i annual report of to be eSigned by others?

How do I fill out the i annual report of form on my smartphone?

How do I edit i annual report of on an iOS device?

What is i annual report of?

Who is required to file i annual report of?

How to fill out i annual report of?

What is the purpose of i annual report of?

What information must be reported on i annual report of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.