Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Comprehensive Guide to Credit Card Authorization Forms

Understanding credit card authorization forms

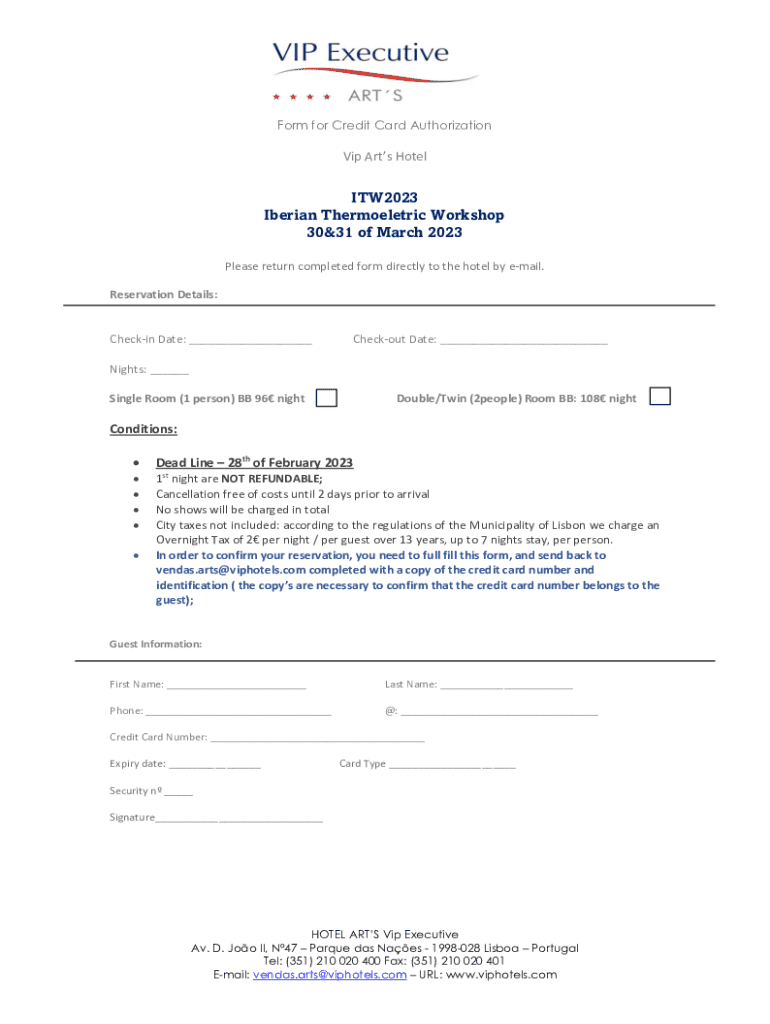

A credit card authorization form is a legally binding document that allows a business to charge a customer's credit card for goods or services. It's a crucial mechanism in the payment industry that provides an official approval for various transactions. Essentially, when a customer fills out this form, they grant the business permission to process payments using their credit card information.

The primary purpose of these forms in transactions is to establish clear consent from the cardholder, ensuring that charges are made with agreement from the user. This consent minimizes disputes and enhances trust between the customer and the business, which is vital in sectors plagued by chargebacks or fraudulent activities. For businesses, having a credit card authorization form means fewer financial risks and a better safeguard against potential losses.

Preventing chargebacks is a major importance of authorization forms. A chargeback occurs when a customer disputes a transaction, and if a business cannot provide proof of authorization, they risk having the funds reversed. By employing a credit card authorization form, businesses can mitigate this risk while ensuring that their transactions are secure.

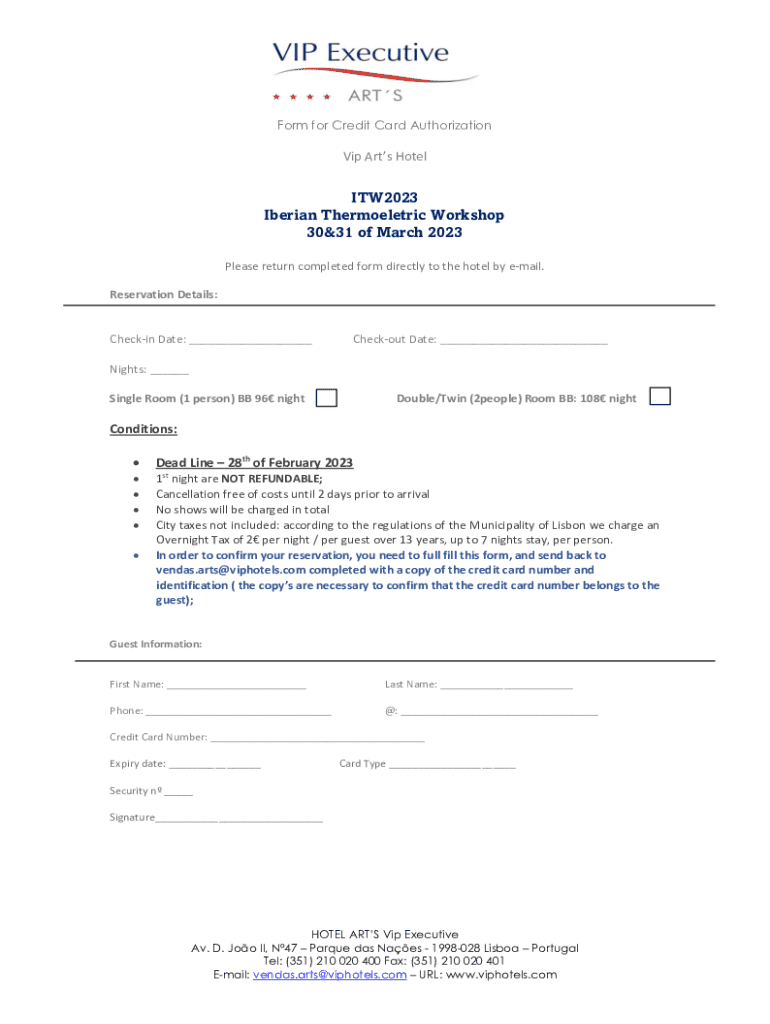

Components of a credit card authorization form

A well-structured credit card authorization form must include several essential elements to ensure it meets legal and procedural requirements. These components not only protect the business but also instill confidence in the customer regarding the transaction. The primary elements that should be included are:

Optional elements might include additional information such as the CVV number and billing address. Including these details can reduce fraud potential and further assure that the transaction is legitimate.

Benefits of using credit card authorization forms

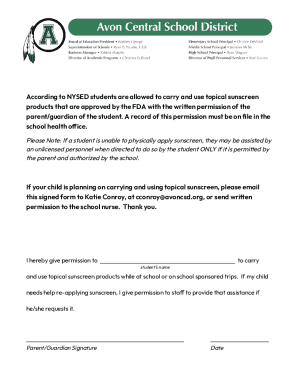

Utilizing credit card authorization forms offers numerous advantages for both businesses and customers. One of the most significant benefits is the enhanced protection against fraud and chargebacks. When disputes arise, having a signed authorization form serves as evidence that the customer consented to the transaction, giving businesses an upper hand during disputes.

Additionally, these forms enhance customer trust and security. Customers are more likely to engage with businesses that demonstrate a commitment to secure payment practices. Knowing their information is handled responsibly reassures customers and can lead to increased loyalty.

Moreover, credit card authorization forms streamline payment processes for businesses. They simplify record-keeping and payment tracking, making financial management easier. With platforms like pdfFiller, businesses can automate this process, reducing the chances of errors and speeding up transaction times, ultimately benefiting both parties.

When to use a credit card authorization form

There are specific scenarios where utilizing a credit card authorization form becomes essential for sellers. This is particularly true in industries heavily reliant on advance bookings, such as hospitality, where customers may need to guarantee a reservation. Therefore, businesses like hotels often require these forms to secure future payments.

Other industries that benefit from authorization forms include e-commerce, subscription services, and any business model involving recurring payments. Here are some key scenarios where sellers should utilize authorization forms:

It's also crucial for businesses to have a protocol for immediate authorization, such as in services rendered on-site, ensuring staff have the necessary permissions without delay.

How to create effective credit card authorization forms

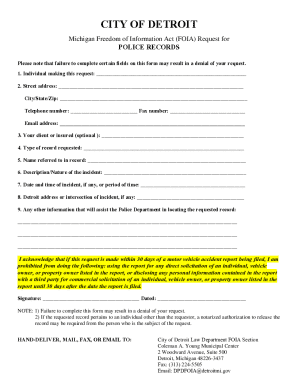

Creating a credit card authorization form involves several steps to ensure it meets both operational needs and compliance requirements. Start by outlining the information that needs to be collected, ensuring that you cover all essential elements previously discussed. Once you have a draft, review it thoroughly for clarity and ease of use.

Here’s a step-by-step guide to designing your form:

Customizing the form to your business's unique requirements helps enhance user experience. For instance, businesses in the restaurant industry may include additional fields to capture reservation details.

Managing and storing authorized forms securely

Once you've collected signed credit card authorization forms, managing and storing them securely becomes paramount. Best practices for storing these forms include using a secure document management system like pdfFiller, which encrypts documents and allows controlled access. Sensitive customer information must be safeguarded against unauthorized access.

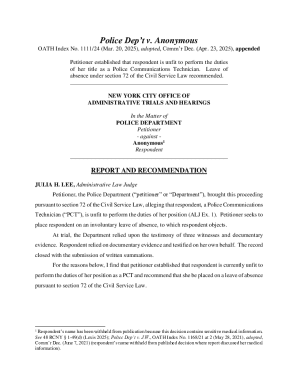

Document retention policies are also essential as they dictate how long these forms should be kept. Generally, it's recommended to retain authorized documents until the payment is complete and the transaction can no longer be disputed. Compliance with relevant payment processing laws governs your duration and method of storing these forms, ensuring both legality and security.

Common questions about credit card authorization forms

Several questions frequently arise regarding the use of credit card authorization forms. One that often comes up is whether businesses are legally obligated to use them. While not universally mandated, many sectors benefit significantly from implementing these forms for liability protection and risk mitigation.

Another common inquiry relates to the absence of a CVV section in some forms. Businesses may choose not to include this field due to privacy concerns or a strategy to lower the length of the form, although this practice could potentially increase vulnerability to fraud. Understanding 'Card on File' is also pertinent; it refers to businesses keeping a customer's card information securely stored with prior consent for future transactions, impacting how companies handle recurring payments.

Downloadable resources and templates

At pdfFiller, we understand the importance of providing users with the necessary tools to effectively manage credit card authorization forms. That’s why we offer free downloadable templates that you can access and customize according to your business requirements.

These templates are designed to be user-friendly, allowing businesses to easily edit, sign, and manage their credit card authorization forms. Simply find a template that suits your business needs, personalize it, and keep it organized within our cloud-based platform for smooth access and management.

Related topics and further reading

To enhance your understanding of payment processing, consider exploring related topics that impact your business. Learning about basic concepts in payment processing can provide insights into the industry landscape and improve your financial strategies. Keeping abreast of tips for reducing chargebacks is also critical, as this directly influences your bottom line.

Furthermore, understanding payment gateways and their roles in transactions is paramount for ensuring a seamless payment process with robust security. Engaging in these topics will empower you to make informed decisions regarding payment procedures and customer interactions.

Interactive tools for better document management

Utilizing interactive tools, such as the features provided by pdfFiller, can significantly enhance your experience in document management. The platform allows for easy editing and eSigning of credit card authorization forms, making it convenient and efficient.

Collaborating on documents becomes straightforward with tools for teams, ensuring that staff members can access, share, and work on forms in real time. Understanding cloud-based document management solutions helps businesses streamline operations and maintain organization. By leveraging these features, you'll improve transaction consistency and customer satisfaction.

Most popular forms and templates

Stay updated with currently trending forms related to financial transactions, including various credit card authorization forms utilized across industries. You’ll find that many companies opt for specific formats that cater to their operational needs, and having access to the most popular templates allows you to stay competitive in your business practices.

Thank you for your interest

Thank you for exploring this comprehensive guide to credit card authorization forms. Here at pdfFiller, we aim to empower individuals and teams with the tools they need to effectively manage documents easily and securely. We encourage you to engage further with our platform for more insightful resources and templates tailored to your specific needs. Stay connected for the latest updates and offerings!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit card authorization form in Gmail?

How do I make edits in credit card authorization form without leaving Chrome?

Can I create an electronic signature for the credit card authorization form in Chrome?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.