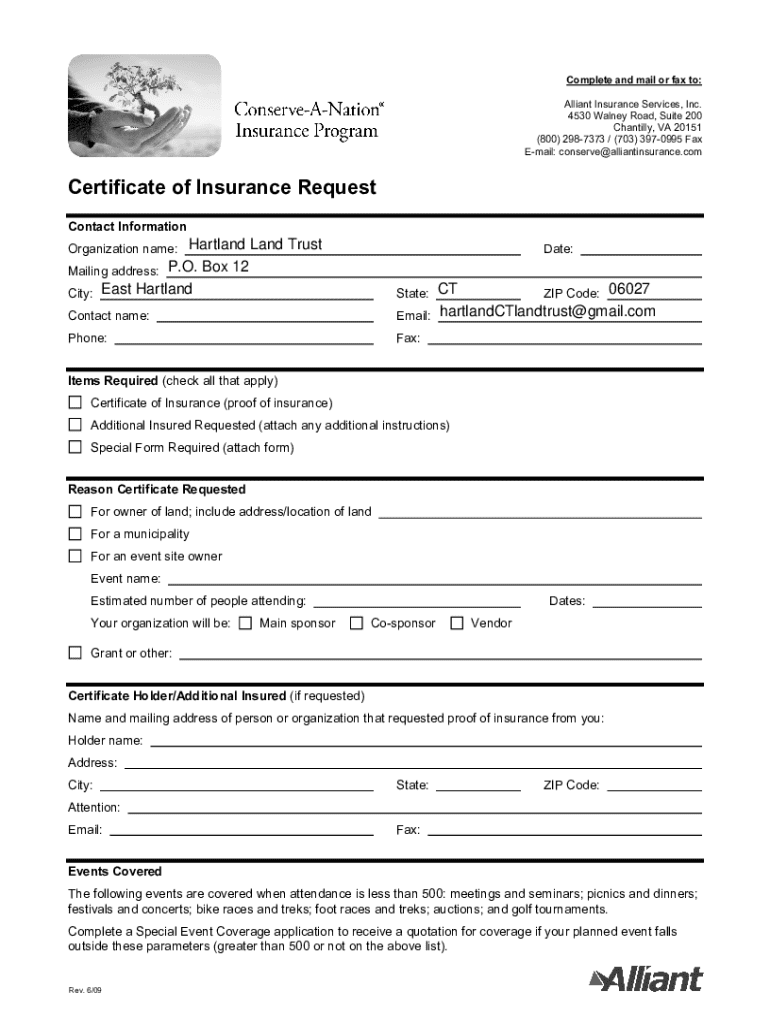

Get the free Certificate of Insurance Request

Get, Create, Make and Sign certificate of insurance request

How to edit certificate of insurance request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of insurance request

How to fill out certificate of insurance request

Who needs certificate of insurance request?

Everything You Need to Know About the Certificate of Insurance Request Form

Understanding the certificate of insurance (COI)

A Certificate of Insurance (COI) serves as a crucial document indicating that an individual or a business holds insurance coverage. Often, it is requested by clients, vendors, or regulatory bodies to provide proof of insurance. This document acts as a snapshot of the insurance policies involved, summarizing pertinent details such as the types of coverage, limits, and the effective dates of the policies.

COIs are vital across numerous industries, from construction to healthcare, providing reassurance against potential liabilities. For instance, contractors frequently need COIs to confirm their liability insurance when bidding on construction projects. Similarly, event organizers often request COIs from vendors to safeguard against accidents or incidents that might occur at an event.

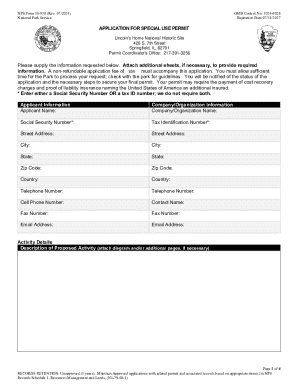

Common scenarios requiring a COI include securing leases for commercial spaces, applying for permits, or establishing relationships with new clients. In all cases, these certificates ensure that parties are adequately protected against financial losses stemming from unforeseen circumstances.

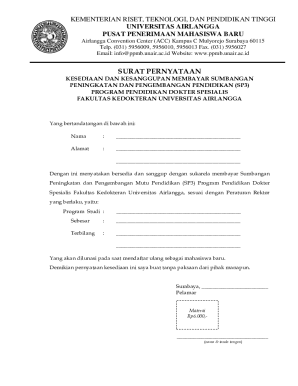

The certificate of insurance request form

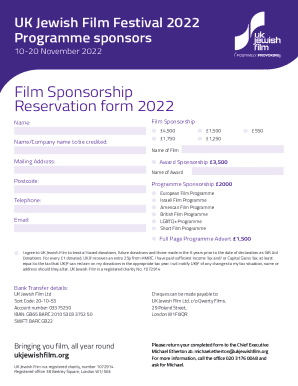

A Certificate of Insurance Request Form is the primary means for businesses and individuals to request a COI from their insurance provider. This form collects essential information needed to generate a precise and effective COI. By providing comprehensive details about the request, the insurer can accurately fulfill the coverage needs specified.

Key components of a COI request form typically include:

Why businesses request a COI

Businesses request a Certificate of Insurance for several pivotal reasons. First and foremost is risk management, as COIs help protect against potential liabilities that could result from operational mishaps. When companies undertake contracts or work with vendors, they want assurance that proper insurance is in place to bear the costs associated with incidents that may arise.

Another vital reason businesses require COIs is to comply with contractual obligations. Many clients or projects demand proof of insurance coverage before work can commence. Failing to provide a valid COI can result in lost opportunities or reputational damages.

Lastly, possessing a valid COI is crucial for maintaining compliance with regulatory standards in various industries. Nonprofits, for example, often encounter specific requirements for insuring their events or programs, which are frequently outlined in grant stipulations or legal mandates.

How to fill out a certificate of insurance request form

Filling out a Certificate of Insurance Request Form may seem daunting, but following these step-by-step instructions can simplify the process:

Common mistakes to avoid when completing the COI request form include providing inaccurate details, neglecting to specify required coverage limits, or forgetting to include entities designated as additional insured. Taking the time to double-check your entries can save delays in obtaining your COI.

Ways to submit your COI request

After completing the COI request form, you need to determine the best method for submission. Here are several effective options:

Tracking your COI request

Once you've submitted your COI request, it's important to monitor its status. You can track your request through several methods including:

If your COI isn’t received on time, reach out immediately to your insurance provider. Inquire whether there were any issues and provide any necessary follow-up documentation promptly.

Understanding COI fees

Requesting a COI can incur costs, depending on the policies involved. Typical fees might include administrative costs charged by insurers for processing the request. Additionally, the type of coverage needed can significantly affect the total cost of insurance.

Factors determining the cost of insurance coverage typically include:

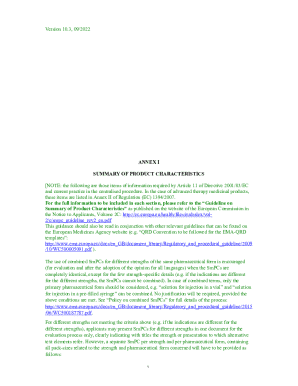

Special considerations for various industries

Insurance requirements can significantly differ across industries. For example, in construction, contractors often need comprehensive liability policies and may require specialized coverages like builders’ risk insurance to cover property while under construction. In contrast, healthcare providers frequently must navigate complex regulations and ensure malpractice insurance is in place.

When it comes to small businesses versus corporations, small enterprises often have more lenient COI requirements due to lower risks. However, as businesses scale up, insurers may require more extensive coverage due to exposure to larger liabilities. This variance emphasizes the necessity for tailoring COI requests to suit industry-specific needs.

Template & sample COI request forms

Utilizing templates can significantly ease the process of requesting a COI. Sites like pdfFiller offer free downloadable COI request form templates, allowing users to customize them based on their specific requirements. Customization may include adding a company logo, adjusting the coverage limits, or providing additional insured provisions as necessary.

When creating or editing templates, focus on preserving fields that gather essential data while leaving flexibility for specifics that may vary from request to request. Ensuring clarity and usability can optimize the process for everyone involved.

Frequently asked questions about COI requests

Understanding common queries related to COI requests can help demystify the process. For example, it typically takes about 5-10 business days to receive a COI after submission, depending on the insurer's workload. Essential details in a COI include the type of coverage, the policy numbers, limits of liability, and the insurance provider’s contact information.

Another frequent question is regarding the recipients of the COI. Generally, the COI must be sent to any parties stipulated in contracts or agreements, often including clients, contractors, or stakeholders requiring verification of insurance.

Insurance coverage considerations

When requesting a COI, it is imperative to understand the types of coverage available. Common types include general liability, which protects against claims of bodily injury and property damage; professional liability, which covers claims arising from professional negligence; and workers’ compensation, which safeguards businesses against employee injuries.

Determining the proper coverage limits for your business is equally critical. This often involves evaluating the potential risks associated with your operations and industry norms. Consulting with an insurance professional can provide valuable insights into the recommended limits tailored to your unique business needs.

Managing your certificates of insurance

Efficiently managing multiple Certificates of Insurance (COIs) is crucial for ensuring compliance and mitigating risks. Businesses should establish a systematic approach to organize, store, and track COIs to avoid lapses in coverage.

Best practices for keeping track of COIs include maintaining an up-to-date log of all current certificates, setting reminders for renewal dates, and utilizing digital tools for easy access. Tools like pdfFiller facilitate efficient management, allowing users to categorize, edit, and retrieve COIs whenever necessary.

Utilizing pdfFiller for COI management

pdfFiller provides users with robust features to edit Certificate of Insurance Request Forms seamlessly. With its user-friendly interface, individuals can easily fill out, customize, and even eSign COI forms quickly, ensuring speedy approvals.

Additionally, collaboration tools available on pdfFiller enable teams to work together effectively. Team members can comment, review, and track versions of the COI forms, promoting transparency and communication in the management process.

Support and resources for further assistance

For those requiring further assistance in navigating COI requests, reaching out to insurance experts can provide invaluable guidance tailored to your industry. Many insurance providers maintain comprehensive online resources, including help centers and FAQ sections, to address common questions and facilitate the request process.

Utilizing resources found on pdfFiller’s platform can enhance the overall experience, equipping users with the tools needed for effective document management. Whether you need templates, tips, or direct assistance, these resources are designed to empower users in managing their insurance documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find certificate of insurance request?

How do I edit certificate of insurance request in Chrome?

How do I complete certificate of insurance request on an Android device?

What is certificate of insurance request?

Who is required to file certificate of insurance request?

How to fill out certificate of insurance request?

What is the purpose of certificate of insurance request?

What information must be reported on certificate of insurance request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.