Get the free Non-borrower Contribution Form

Get, Create, Make and Sign non-borrower contribution form

Editing non-borrower contribution form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-borrower contribution form

How to fill out non-borrower contribution form

Who needs non-borrower contribution form?

Understanding the Non-Borrower Contribution Form: A Comprehensive Guide

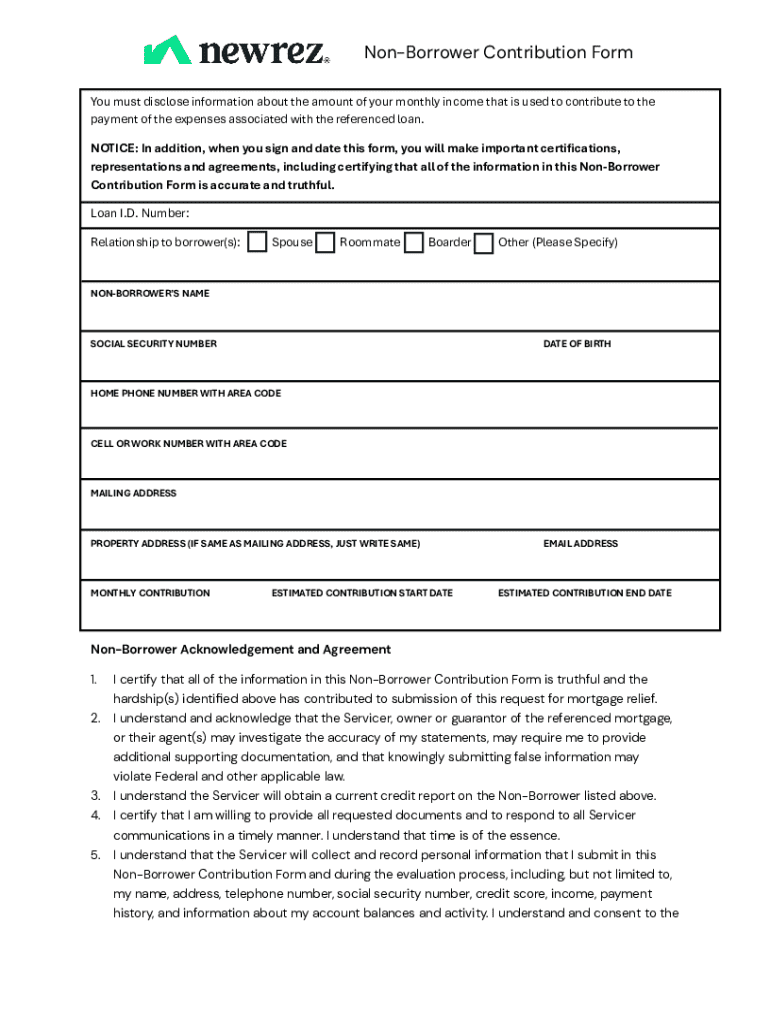

What is a Non-Borrower Contribution Form?

A non-borrower contribution form is a pivotal document used primarily in financing and mortgage applications where individuals who are not applying for credit provide financial support or contributions toward a purchase. This form serves to declare and verify the contributions made by non-borrowers, ensuring that they are appropriately documented for lenders or financial institutions. It becomes a critical piece in assessing the financial landscape of a mortgage application.

The importance of the non-borrower contribution form cannot be overstated, particularly in scenarios where the borrower’s income may not suffice for loan approval. By clearly outlining the non-borrower’s contributions, this form enhances the borrower’s financial picture and improves their chances of securing necessary funding.

Key features of the Non-Borrower Contribution Form

The non-borrower contribution form contains several essential elements that ensure clarity and comprehensiveness, including:

Understanding the language and terms used within the form is vital, as specific legal and financial jargon can impact the compliance and acceptance of the document.

Who needs to complete the Non-Borrower Contribution Form?

The non-borrower contribution form is targeted at individuals who are willing to provide financial assistance to a borrower without themselves taking on the mortgage or loan. This could include family members, friends, or any other parties who wish to help a borrower secure their necessary funding.

This form may be applicable in several common scenarios, such as:

In each case, having the non-borrower contribution form completed properly enhances transparency and clarifies the financial relationships involved.

Benefits of using the Non-Borrower Contribution Form

Utilizing the non-borrower contribution form simplifies the documentation process significantly. By formalizing contributions, it reduces ambiguity and provides proof of financial backing, which lenders often require. Moreover, this form positively influences the borrower’s financial profile.

Some specific benefits include:

Ultimately, the inclusion of a correctly filled out non-borrower contribution form can be the difference between an approved or denied mortgage application.

Steps to fill out the non-borrower contribution form

Gather necessary information

Before beginning to fill out the non-borrower contribution form, it’s crucial to gather all required documentation and information. Necessary items include proof of the contribution (like bank statements or transfer receipts), personal identification for both the borrower and the non-borrower, and any additional forms requested by the lender.

This step ensures that you have a complete picture from the outset, streamlining the process and preventing delays.

Completing the form

When filling out each section of the non-borrower contribution form, adhere to the following guidelines:

Reviewing the form

Before submission, it is paramount to conduct a thorough review of the completed form. Look for any inconsistencies, missing information, or errors that could affect processing. Taking a moment to ensure accuracy not only prevents delays but also emphasizes the professionalism of the submission.

Common challenges in completing the form

Completing the non-borrower contribution form can come with its set of challenges. One of the most common issues is misunderstanding the required documentation needed for validation of contributions. This can lead to delays in processing and potential mishaps in approval.

Additionally, if the non-borrower's financial situation isn't clearly outlined, lenders might dismiss the contributions as insignificant, causing issues with loan applications.

To overcome these challenges:

Submitting the non-borrower contribution form

Once the non-borrower contribution form is completed and reviewed, the next step is submission. There are multiple methods to choose from, which can include:

After submission, it's essential to follow up to confirm receipt and provide any additional information if requested. Each lender may have different timelines for processing the document, so being proactive is key.

Interactive tools for managing the non-borrower contribution form

pdfFiller provides an array of interactive tools to assist users in managing the non-borrower contribution form effectively. The platform allows users to edit and sign documents hassle-free. With features such as real-time collaboration, several contributors can work on the form simultaneously, ensuring all necessary inputs are captured.

Additionally, the ability to save forms and templates for reuse streamlines the process for future contributions or repeat users. This functionality not only enhances efficiency but also maintains consistency in documentation.

FAQs about the non-borrower contribution form

Whenever dealing with financial documentation such as the non-borrower contribution form, numerous questions can arise. Some of the most common inquiries include:

By addressing these common concerns, potential users can navigate the application process with greater confidence.

Related documents and forms

In conjunction with the non-borrower contribution form, several related documents may be required to complete a mortgage application thoroughly. These can include:

Filling out these documents accurately and entirely provides lenders with the comprehensive information necessary to process the mortgage application.

Testimonials and use cases

Many individuals and teams have successfully navigated the complexities of the non-borrower contribution form process, leading to more favorable outcomes for their mortgage applications. For example, a couple seeking to purchase their first home received significant assistance from a family member through the non-borrower contribution form. This streamlined their application, improving their financial profile and ultimately securing favorable mortgage rates.

Users report that the thoroughness of the non-borrower contribution form enhances their credibility with lenders and lessens the stress typically associated with the mortgage application process. Such testimonials illustrate the form's vital role in facilitating smooth real estate transactions.

Feedback and continuous improvement

Engaging with the non-borrower contribution form process not only assists in immediate financial goals but also paves the way for continuous improvement. User feedback on the effectiveness and clarity of the form is essential. This input helps refine the document management experience further, ensuring it meets the evolving needs of borrowers and non-borrowers alike.

At pdfFiller, user suggestions are taken seriously, with ongoing efforts to enhance the platform based on the real-world experiences of its users. Whether it’s improving document templates or providing clearer instructions, embracing user feedback is a cornerstone of developing efficient and user-friendly documentation tools.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify non-borrower contribution form without leaving Google Drive?

How can I get non-borrower contribution form?

How do I fill out non-borrower contribution form using my mobile device?

What is non-borrower contribution form?

Who is required to file non-borrower contribution form?

How to fill out non-borrower contribution form?

What is the purpose of non-borrower contribution form?

What information must be reported on non-borrower contribution form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.