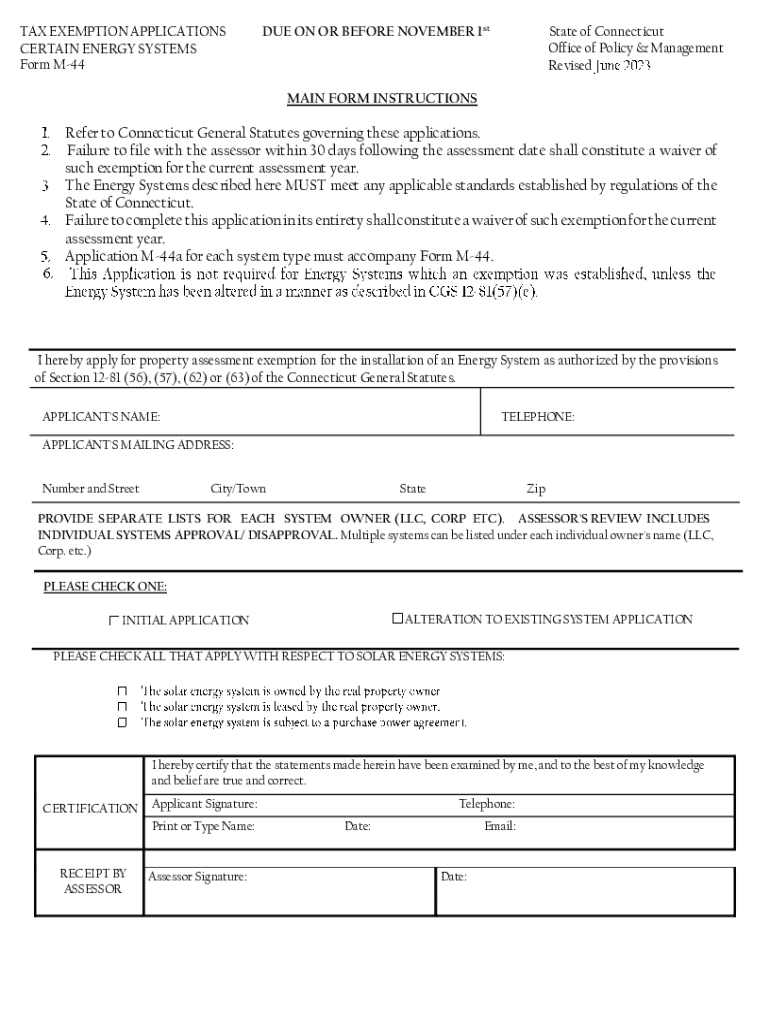

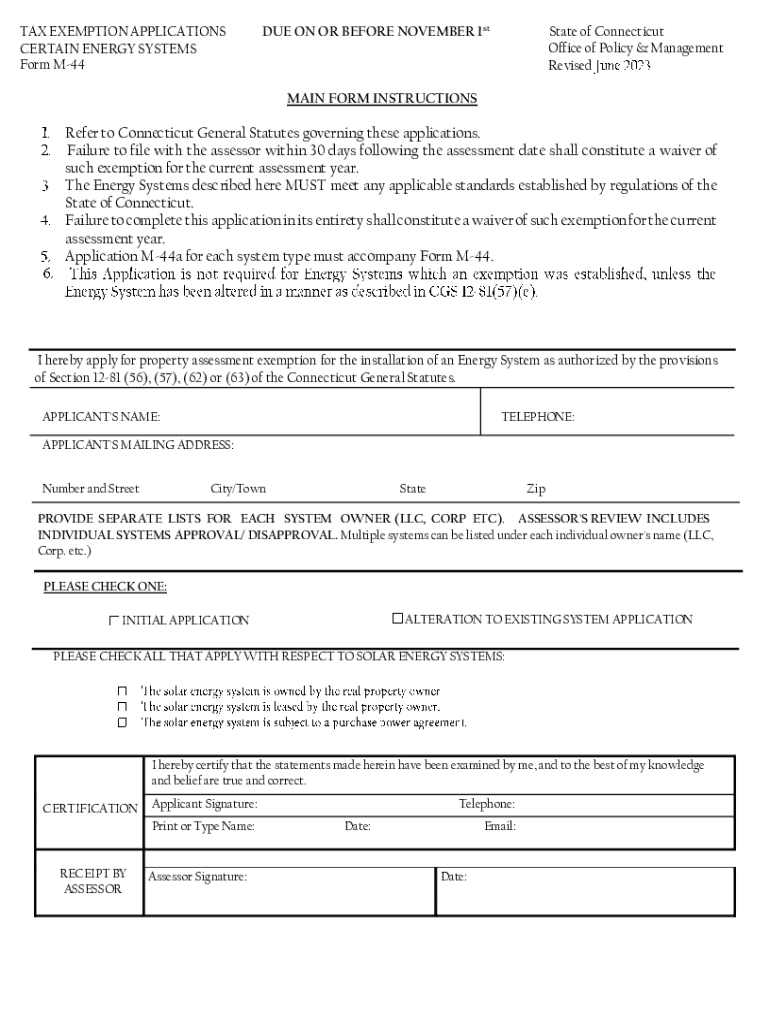

Get the free Tax Exemption Applications

Get, Create, Make and Sign tax exemption applications

How to edit tax exemption applications online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax exemption applications

How to fill out tax exemption applications

Who needs tax exemption applications?

A Comprehensive Guide to Tax Exemption Applications Form

Understanding tax exemption applications

Tax exemption refers to a financial exemption that reduces taxable income, allowing individuals or organizations to retain more of their earnings. This is particularly significant for non-profit organizations, educational institutions, and certain individuals facing economic hardship.

Tax exemption applications serve as a crucial mechanism for obtaining these benefits. They not only assist individuals and organizations in financial relief but also signify compliance with the regulations governing these exemptions. However, numerous misconceptions exist around who qualifies for tax exemptions and the processes involved.

Eligibility criteria for tax exemption

To determine eligibility for tax exemption applications, one must consider the various types of exemptions available. Primarily, these include non-profit organizations, educational institutions, religious entities, and certain individuals, primarily those classified under low-income categories.

Each category has specific key requirements. For instance, non-profits typically need to demonstrate a charitable purpose, while educational institutions must provide evidence of accreditation. Individuals often need to show income levels that fall below a certain threshold.

The tax exemption application process

Navigating the tax exemption application process can be daunting. It's essential to understand the overarching steps involved. Typically, applications are submitted to the Internal Revenue Service (IRS) or respective state agencies, depending on the type of exemption sought.

A step-by-step guide for filling out the application form involves several sections:

Common mistakes to avoid include incorrect information, omitting necessary documents, and misunderstanding eligibility requirements. Thoroughly reviewing your application before submission is crucial.

Required documents and information

A successful tax exemption application hinges on the accuracy and completeness of required documents. Key documents typically include:

Collecting and organizing this documentation can be overwhelming, yet critical for a successful application. Start by gathering all financial records, legal documents, and any communications from the IRS or state tax agency.

Tips for completing the tax exemption application form

Completing the tax exemption application form accurately is paramount to avoid delays or outright denials. Here are practical tips:

Submitting your application

Once you’ve completed your tax exemption application form, the next step is submission. Applications can typically be submitted online or via traditional mail, depending on your preference and the specific rules of your state or the IRS.

Understanding submission deadlines is crucial, as late applications could result in denials. Additionally, once your application is submitted, tracking its status can be done through IRS reporting systems.

After your application is approved

Once your tax exemption application has been approved, it’s vital to understand the next steps. This approval not only grants you tax-exempt status but also comes with ongoing responsibilities.

Maintaining your tax-exempt status involves yearly reports and compliance, which reflects changes in your organization or personal circumstances that might affect your exemption.

Interactive tools and resources

To streamline the process of managing tax exemption applications forms, consider leveraging interactive tools like pdfFiller's solutions. These tools simplify the creation, submission, and management of forms, making the process seamless and efficient.

From customizable templates to team collaboration features, pdfFiller empowers users to manage their forms efficiently.

FAQs about tax exemption applications

Tax exemption applications can raise various questions. Here are some frequently asked questions to guide individuals through the process.

Conclusion of the application journey

Completing the tax exemption applications form is a critical financial maneuver for many individuals and organizations. Understanding the steps involved and ensuring accurate information can facilitate a smoother application process.

Leveraging resources like pdfFiller can enhance efficiency in form creation, submission, and management. This empowers users to focus on their core mission while handling necessary documentation with ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax exemption applications to be eSigned by others?

How do I make changes in tax exemption applications?

How do I complete tax exemption applications on an Android device?

What is tax exemption applications?

Who is required to file tax exemption applications?

How to fill out tax exemption applications?

What is the purpose of tax exemption applications?

What information must be reported on tax exemption applications?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.