Get the free Business Tax Return

Get, Create, Make and Sign business tax return

How to edit business tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business tax return

How to fill out business tax return

Who needs business tax return?

Comprehensive Guide to Business Tax Return Forms

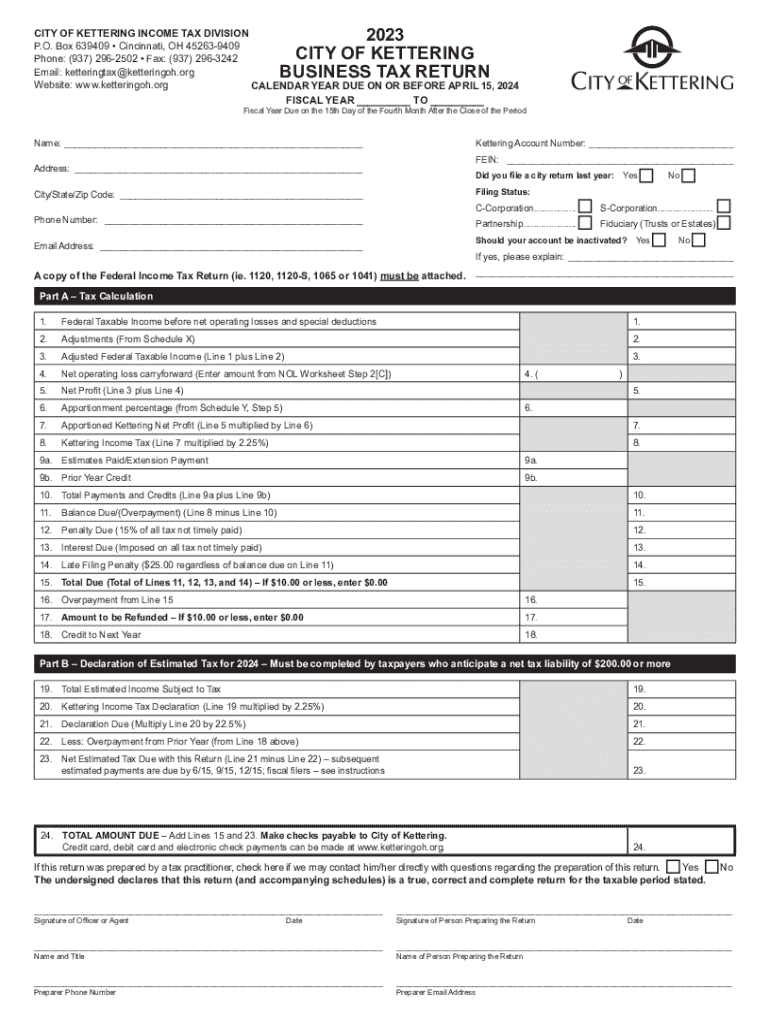

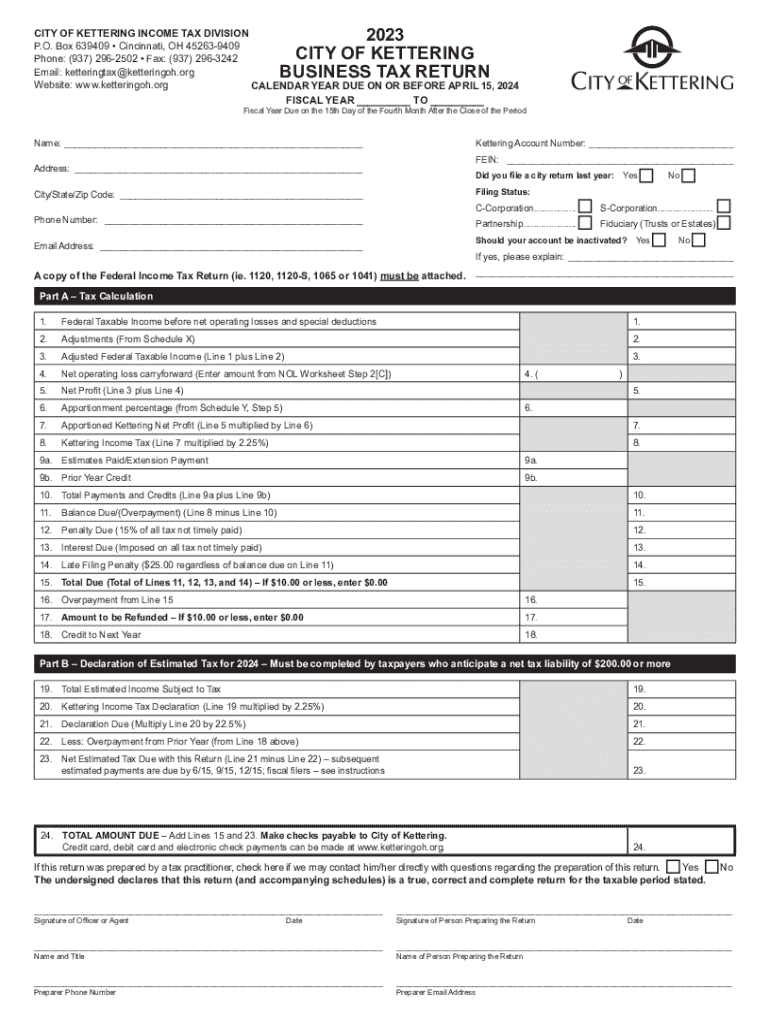

Overview of business tax return forms

Business tax return forms are crucial documents that every business entity must file annually to report earnings, calculate taxes owed, and comply with government regulations. These forms play an essential role in ensuring transparency and accountability, providing authorities with a clear overview of a business's financial performance. Whether you operate as a sole proprietor, partner, corporation, LLC, or a nonprofit organization, understanding how to properly prepare and file your business tax return form is paramount.

The significance of these forms extends beyond merely fulfilling legal obligations; they offer insights into a business's financial health, which can guide entrepreneurs in making informed future strategic decisions. When managed well, a business's tax returns can also affect its access to funding, impacting its capital structure and growth opportunities.

Understanding the key components of a business tax return form

A well-prepared business tax return form includes several key components, primarily focused on income reporting, deductions, credits, tax calculation, and a signature requirement. Understanding each of these parts is essential for successful completion. First and foremost, income reporting entails detailing all revenue streams your business has generated, be it sales, service income, or any other capital receipts.

Following income is a focus on deductions and credits. Businesses are eligible for various deductions that can lower taxable income. Common deductions include operating expenses like rent, utilities, salaries, and many more specific items unique to an industry. Tax credits can also aid in reducing total tax liability, such as credits for energy-efficient investments or hiring from certain classes of employees.

The next crucial aspect is the tax calculation itself, which outlines the tax amount owed based on taxable income. Lastly, the form requires a signature, signifying the accuracy of the information provided and confirming that it was prepared with due diligence. This declaration acts not only as a legal formality but also as an affirmation of responsibility for the provided information.

Essential business tax forms by entity type

Different business entities require specific forms when filing their tax returns. For sole proprietors, Schedule C is the standard form, detailing business income and expenses. It's essential to meticulously complete this to avoid common pitfalls, including underreporting income or overestimating deductions. Entrepreneurs can mitigate errors by utilizing tools that guide them through the process of filling out this form.

For partnerships, Form 1065 must be completed while partnership income is reported on each partner's respective Schedule K-1. Utilizing interactive tools can greatly simplify the K-1 preparation process, ensuring accuracy and adherence to deadlines. Corporations, on the other hand, use Form 1120 for C corporations and Form 1120S for S corporations, with different implications regarding taxation. Similarly, for LLCs, the decision to file as a corporation or partnership is crucial and based on specific operational structures.

Step-by-step guide to completing your business tax return form

Completing your business tax return form is an organized process best approached step-by-step. Start by gathering all necessary documentation, including income statements, expense reports, and previous tax returns. This financial statements overview is pivotal for an accurate reflection of your business’s performance over the tax period.

Next, focus on filling out the form section by section. Each section must be carefully completed, ensuring that all details align with the documentation gathered earlier. Common mistakes to avoid include misreporting income, failing to claim eligible deductions, and neglecting the signature requirement. A thorough review checklist can be invaluable in this phase, helping you catch errors before submission.

When satisfied with the completion of your tax form, you can submit it. Filing options typically include e-filing and paper filing, with e-filing being the more efficient and often quicker method. Remember to note important deadlines for your specific business type to avoid penalties and interest accrued from late submission.

Understanding business tax deadlines

Awareness of significant business tax deadlines is crucial for compliance and can ease the stress of tax season. Sole proprietors and partnerships typically face a filing deadline on March 15, while C corporations may file by April 15. Notably, failure to file on time can lead to severe consequences, including penalties ranging from 5% to 25% of the unpaid tax amount.

Additionally, late payment of taxes incurs interest, compounding the overall financial burden on the business. Proactive planning to meet these deadlines can help avoid such pitfalls, ensuring business operations continue to run smoothly.

Managing multi-year returns: what you need to know

For businesses that need to manage multi-year returns, understanding how to amend past returns is critical. The IRS allows taxpayers to correct errors using Form 1040X for personal returns and the equivalent correction forms for business returns. It's crucial to maintain thorough records in case of audits. Establishing a record retention policy can help ensure that essential documents are available for reference and compliance.

Additionally, planning strategies for future tax filings should consider the implications of past years’ transactions and any anticipated changes in tax laws that could impact your business structure and tax obligations. Consulting with a tax professional can offer valuable insight, assisting in both correcting past issues and in planning for future success.

Utilizing pdfFiller for your business tax return needs

Navigating the complexities of business tax returns can be simplified through the use of pdfFiller. This cloud-based platform allows users to edit and sign tax return forms seamlessly, enabling entrepreneurs to manage their documents with ease, from anywhere. Features like collaboration tools are especially beneficial for teams, ensuring that all members can contribute and verify critical information before submission.

Moreover, the ability to access forms and previously completed documents enhances efficiency, allowing users to build upon past filings. Security measures integrated into the platform also guarantee that sensitive financial data remains protected, providing peace of mind as users engage in digital document management.

Tips for efficient business tax return management

Efficient management of business tax returns hinges upon leveraging technology, ensuring that the latest tools and solutions are employed. Implementing accounting software can streamline bookkeeping, while tax preparation applications can assist in maintaining up-to-date knowledge of applicable tax laws and deductions available. Tracking changes in tax regulations is vital, as compliance requirements can shift from year to year.

Engaging with tax professionals offers an additional layer of support, providing expert advice tailored to your specific business needs. While some entrepreneurs may choose the DIY route, outsourcing tax preparation to experts with proficiency in your industry can save both time and potential headaches during tax season.

Frequently asked questions about business tax returns

When filing business tax returns, questions often arise about procedures and implications. A common query involves missed deadlines; businesses should seek to file as soon as possible, as exemptions and mitigation of penalties may be available if steps are taken proactively. Changes in business entity types can also be challenging, requiring careful consideration of tax implications and legal responsibilities.

In the event of an audit, understanding the process and having records in order is crucial. Businesses should maintain comprehensive documentation to substantiate reported income and expenses. Resources extending from the IRS site to tax preparation firms can be invaluable for advice and assistance tailored to your situation.

Considerations for future business growth and tax strategy

As businesses grow, evolving tax obligations must be understood and managed actively. Staying informed about changing tax laws can significantly affect a company's strategic decisions concerning hiring practices, capital investment, and risk management. Entrepreneurs must plan for future expansion and the potential tax implications that may arise from such moves, as these can directly impact profitability and cash flow.

Moreover, the impact of tax incentives and grants on tax filings should be strategically considered. Properly navigating these opportunities can enhance financial outcomes and competitiveness within your industry. By aligning tax strategies with business objectives, entrepreneurs can set their organizations up for sustainable growth while managing tax liabilities effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my business tax return directly from Gmail?

How can I send business tax return to be eSigned by others?

How do I make changes in business tax return?

What is business tax return?

Who is required to file business tax return?

How to fill out business tax return?

What is the purpose of business tax return?

What information must be reported on business tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.