Get the free Mortgage Fraud Notary Complaint Form

Get, Create, Make and Sign mortgage fraud notary complaint

How to edit mortgage fraud notary complaint online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage fraud notary complaint

How to fill out mortgage fraud notary complaint

Who needs mortgage fraud notary complaint?

Navigating the Mortgage Fraud Notary Complaint Form

Understanding mortgage fraud as it relates to notaries

Mortgage fraud involves the intentional falsification of information to secure a mortgage loan. This can manifest in various forms, including falsifying income, concealing liabilities, or using a false identity. A crucial player in this process is the notary public, whose role is to verify the identities of parties involved and witness the signing of important documents. Unfortunately, notaries can be complicit in fraudulent activities, making their integrity essential in the mortgage process.

Common examples of mortgage fraud involving notaries include collusion with con artists to forge signatures, or ignoring the necessary identification checks. As a result, mortgage fraud can lead to severe consequences for both financial institutions and unsuspecting victims, including individuals who may find themselves unknowingly burdened with a fraudulent mortgage.

Recognizing signs of mortgage fraud

Recognizing the signs of potential fraud is critical for reducing risk. Indicators that a notary may be involved in fraudulent activities can range from missing signatures to suspiciously quick signature completion times. If a notary is consistently available to notarize documents without proper verification or identification checks, it may suggest involvement in illicit actions.

Fraudulent practices could include notarizing documents without the presence of the signer or failing to witness the signing, a violation of notary laws. Vigilance and scrutiny are paramount; individuals should always question discrepancies or inconsistencies within the mortgage transaction.

Legal ramifications of mortgage fraud

Notaries found involved in mortgage fraud can face serious legal consequences, including fines, license suspension, or even criminal charges. The ramifications can extend to individuals and businesses that relied on the notary's testimony or documentation, leading to potential financial losses and long-lasting legal issues.

Those affected by mortgage fraud may also encounter significant challenges during legal proceedings, including the need to present evidence and potentially being drawn into protracted litigation. Understanding these potential consequences underscores the importance of fully investigating any signs of fraud before engaging in mortgage transactions.

When to file a complaint against a notary

It is essential to understand the right time to file a complaint against a notary. Situations that may trigger a complaint include discovering forgeries, unauthorized signings, or witnessing discrepancies in notarized documents. Victims should act promptly once they suspect criminal activity, as delays may hinder the investigation process.

The complaint process generally involves gathering supporting documentation and submitting it to the appropriate governing body. Keeping a meticulous record of interactions and decisions can prove invaluable as authorities assess claims. Filing complaints swiftly can prompt action against corrupt notaries, ensuring accountability.

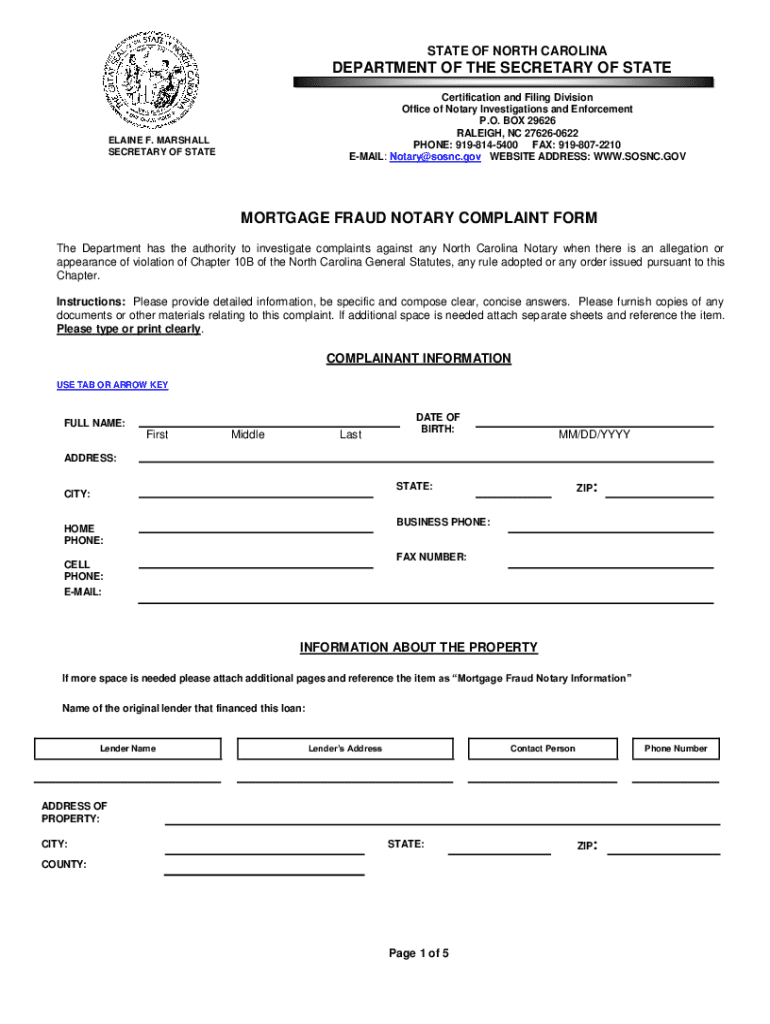

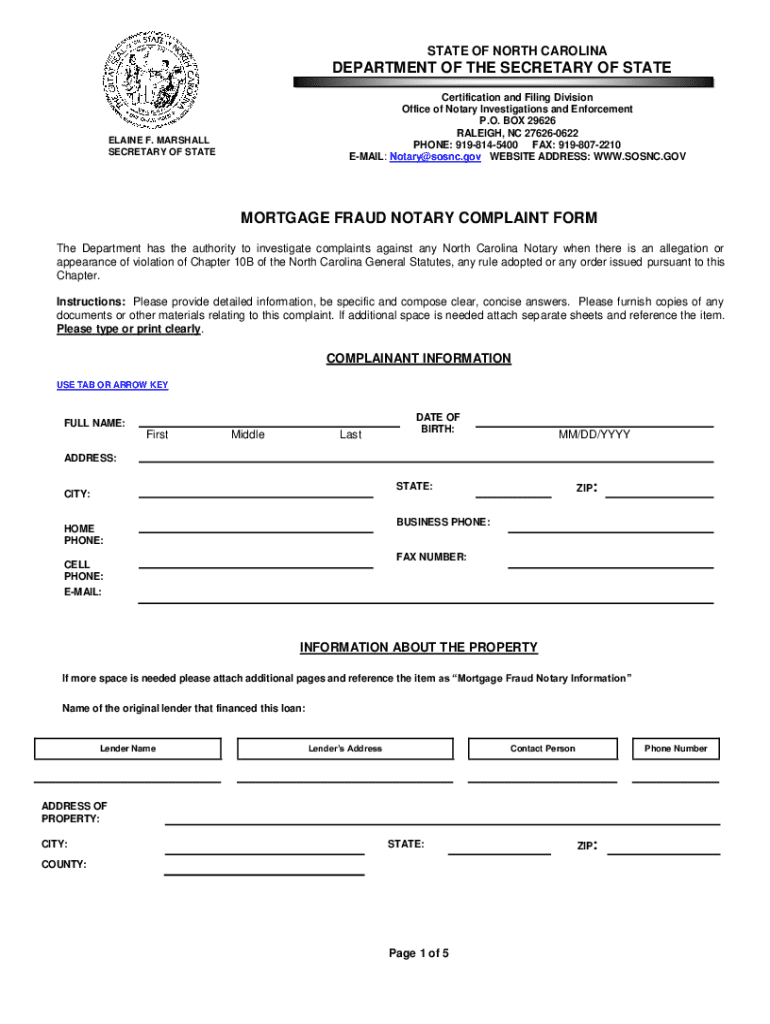

Preparing to file a mortgage fraud notary complaint

Before filing a mortgage fraud notary complaint, prepare essential information for inclusion. Begin with your personal and contact information, followed by the notary public’s details, including their name and license number. Then, provide a thorough description of the incident, detailing the nature of the suspected fraud.

Supporting documentation is critical in substantiating your claims. This could include copies of the fraudulent documents, records of communications, and witness statements. Avoid common mistakes such as providing incomplete information or failing to organize your evidence, which can significantly delay the evaluation of your complaint.

Completing the mortgage fraud notary complaint form

When ready to complete the mortgage fraud notary complaint form, adhere to a structured approach for accuracy. Start with the personal information section, ensuring that all details, including name, address, and contact information, are correct and current. The incident description section requires a clear and concise recounting of events, emphasizing the deceptive practices observed.

Providing evidence and attachments is vital; ensure all documents are legible and relevant to your claims. To help streamline the process, consider using cloud-based solutions like pdfFiller, which allows for easy editing, signing, and sharing of forms, ensuring a professional presentation.

Submitting your mortgage fraud notary complaint

Once your complaint form is complete, knowing where and how to submit it is crucial. Most states allow complaints against notaries to be filed online, which may include specific forms available through the state’s notary regulatory authority. Alternatively, you may choose traditional methods, such as mailing physical copies.

After submission, expect an acknowledgment of receipt, which may come in the form of a confirmation email or letter. Follow the outlined procedures from the governing body regarding any next steps involved in the review of your complaint. Staying informed about your complaint's status is paramount to maintaining awareness throughout the process.

Follow-up procedures after filing a complaint

After filing your mortgage fraud notary complaint, you may wonder what to expect next. Generally, the governing body will notify you of their preliminary findings, which may involve investigating your allegations. Depending on the complexity of your case, this could take several weeks or months.

You should also be proactive by tracking the status of your complaint, which can often be done through online portals provided by state authorities. Engaging with authorities by providing additional information or clarification can help facilitate the review process. Establishing clear communication is crucial during this stage.

Resources for individuals facing mortgage fraud and notary issues

Numerous organizations and government agencies can assist individuals facing mortgage fraud and notary issues. Consider contacting your state’s Department of Consumer Affairs or other relevant regulatory bodies to report fraudulent notaries. Organizations dedicated to combatting housing fraud can also provide guidance and support.

Additionally, legal resources, support groups, or community organizations can guide navigating the complexities of mortgage fraud claims. Having access to these resources can empower victims to advocate effectively for their rights while ensuring that fraudulent practices are addressed.

Staying informed about mortgage fraud trends

Keeping up to date with trends and changes in regulations impacting notaries is vital for both consumers and professionals alike. Regularly consult authoritative sources or attend relevant webinars to stay informed about newly introduced fraud prevention measures and updates to existing statutes.

Understanding potential future risks is essential for effective prevention strategies. Identify educational resources within your locality or online to equip yourself with knowledge about the mortgage fraud landscape and to protect against emerging threats.

Using technology for document management

Leveraging technology can significantly enhance the document management process associated with submitting a mortgage fraud notary complaint form. Cloud-based solutions like pdfFiller empower users to seamlessly edit, sign, and collaborate on documents, ensuring a streamlined approach to complaint submissions.

Features offered by pdfFiller, such as secure document storage and easy sharing capabilities, simplify the entire complaint process, enabling individuals to focus more on gathering evidence and less on technical hurdles. These tools can be invaluable during the often-stressful period following the discovery of fraud.

Feedback and assistance

After your complaint experience, providing feedback can be essential for improving the process for others. Many governing bodies welcome insights from victims to help refine their complaint handling practices. This feedback can aid in identifying areas where additional support may be needed.

Additionally, seeking guidance from legal experts and notary associations can enhance your understanding of subsequent actions necessary to address your complaint. Maintaining open channels for communication with relevant organizations can help ensure that victims of mortgage fraud receive the support they need.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit mortgage fraud notary complaint in Chrome?

How do I edit mortgage fraud notary complaint on an iOS device?

How do I complete mortgage fraud notary complaint on an Android device?

What is mortgage fraud notary complaint?

Who is required to file mortgage fraud notary complaint?

How to fill out mortgage fraud notary complaint?

What is the purpose of mortgage fraud notary complaint?

What information must be reported on mortgage fraud notary complaint?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.