Get the free Beneficiary Change Form

Get, Create, Make and Sign beneficiary change form

Editing beneficiary change form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary change form

How to fill out beneficiary change form

Who needs beneficiary change form?

Navigating the Beneficiary Change Form: A Comprehensive How-To Guide

Understanding beneficiary change forms

A beneficiary change form is a vital document used to modify the designated individuals who will receive benefits or assets upon one's death. It is commonly associated with life insurance policies, retirement accounts, and wills. Keeping beneficiary information current is crucial to ensure that the intended recipients, whether they're family members, friends, or organizations, receive their rightful share without complications.

Life events, such as marriage, divorce, or the birth of a child, often prompt individuals to reconsider and update their beneficiary designations. Additionally, organizational changes like new business partnerships or inheritance scenarios also call for revisions to ensure the correct parties are recognized.

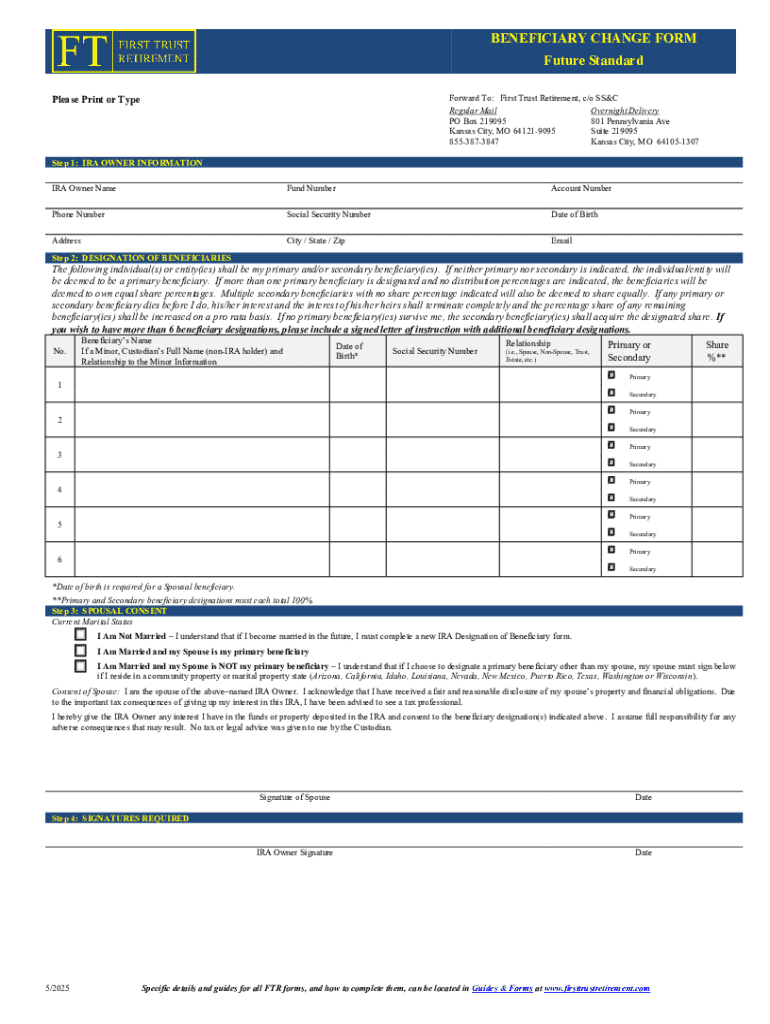

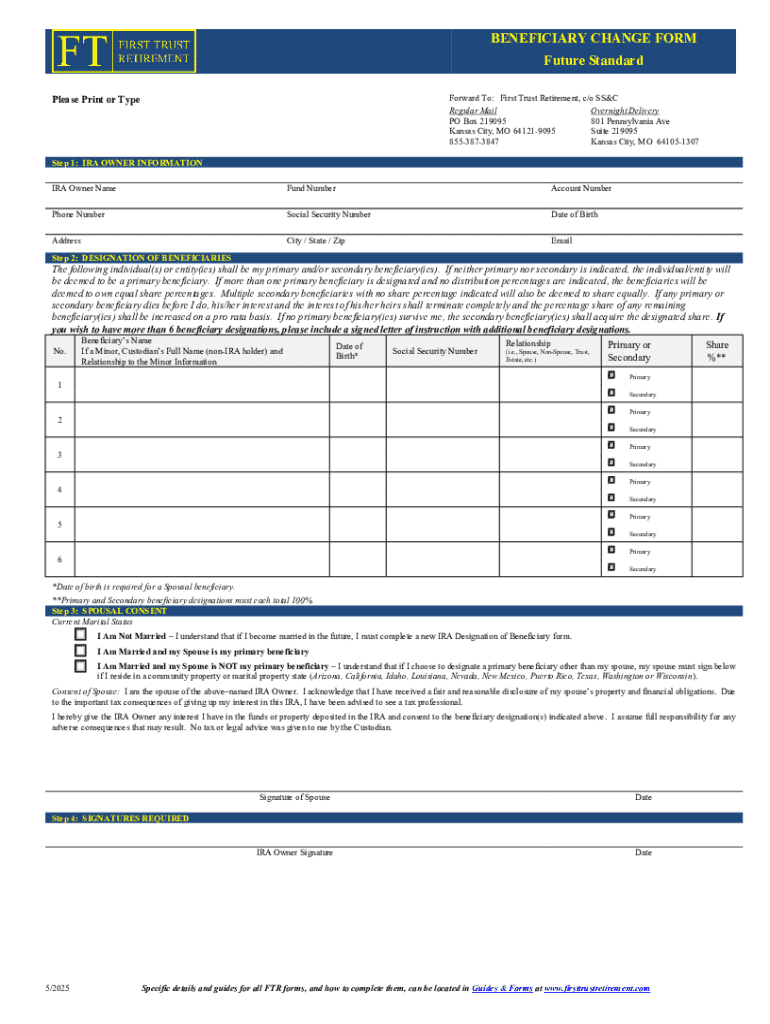

Key components of the beneficiary change form

When completing a beneficiary change form, certain essential information is required. This includes personal details of the policyholder, such as their name and contact information, along with specifics regarding existing beneficiaries. It's important to accurately identify each beneficiary's name, relationship to the policyholder, and contact details to prevent any misunderstandings after the policyholder's passing.

Additionally, understanding the types of beneficiaries is vital. Primary beneficiaries are the first in line to receive benefits, while contingent beneficiaries take effect if the primary beneficiaries cannot receive the proceeds. Furthermore, beneficiaries can be categorized as revocable, where changes can be made anytime, or irrevocable, where changes cannot be made without consent from the designated beneficiary.

Navigating the beneficiary change process

Completing a beneficiary change form involves a systematic approach to ensure accuracy and compliance. Here’s a step-by-step guide:

Managing your beneficiary designations

Ongoing management of your beneficiary designations is essential. Keeping accurate records of changes made, whether it’s through notes or digital files, helps ensure that you always have a clear picture of your current designations. Regular reviews, such as every few years or after major life events, can provide peace of mind that your beneficiaries remain as intended.

When life changes occur—such as a death in the family, marriage, or the birth of a child—consider revisiting and perhaps revising your beneficiary designations. It’s also important to understand the legal implications of making multiple changes to your beneficiaries; some jurisdictions might complicate the beneficiary claims process if not handled properly.

Ensuring compliance and validity

Beneficiary designations must comply with specific legal requirements that vary by state. Some jurisdictions require witnesses or notarization to validate changes to the form, while others may have specific rules governing how beneficiaries can be named. Ensuring adherence to these regulations is critical to avoid disputes after the accident.

Contested beneficiaries can arise, often leading to legal issues that can complicate or extend the settlement process. If disputes occur, seeking legal advice can help navigate the conflicts, outline the rights of all parties involved, and potentially mediate the situation to a resolution.

Digital tools for managing beneficiary changes

pdfFiller offers streamlined tools for handling beneficiary change forms efficiently. Their platform enables users to edit and customize forms easily, ensuring that each field is accurately filled. With cloud-based storage, users can access their documents from anywhere, enhancing document management without worrying about physical storage.

Moreover, pdfFiller fosters collaboration with features that allow for easy sharing and real-time editing among team members. This can be particularly beneficial for organizations needing to manage multiple beneficiary designations, ensuring a cohesive process to handle updates effectively.

Resources for assistance

Navigating beneficiary changes can sometimes feel overwhelming, and knowing when to seek professional guidance is essential. Consulting a financial advisor or attorney can provide clarity on complex changes, especially those involving significant assets or complicated family situations. They can also highlight potential tax implications or other legal considerations.

It's also crucial to have contact information for your insurance providers readily available. Keeping a list of toll-free numbers and helpful FAQs from your providers can elucidate the most common concerns regarding beneficiary changes and ensure you can address any issues as they arise.

Frequently asked questions (FAQ)

Many individuals have questions when filling out a beneficiary change form. Some frequently asked questions include: How do I ensure that my changes are recognized? What should I do if a beneficiary has passed away? Is there a deadline for submitting a change? Understanding these concerns and troubleshooting common issues can empower users to complete their changes smoothly and with assurance of the integrity of their designated beneficiaries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send beneficiary change form for eSignature?

How do I edit beneficiary change form on an iOS device?

How do I complete beneficiary change form on an iOS device?

What is beneficiary change form?

Who is required to file beneficiary change form?

How to fill out beneficiary change form?

What is the purpose of beneficiary change form?

What information must be reported on beneficiary change form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.