Get the free this document serves as a proposal form for blackout data for discretion add comments and more msockid 06fa55f862b46aef046f434463396b5b

Get, Create, Make and Sign this document serves as

How to edit this document serves as online

Uncompromising security for your PDF editing and eSignature needs

How to fill out this document serves as

How to fill out group personal accident proposal

Who needs group personal accident proposal?

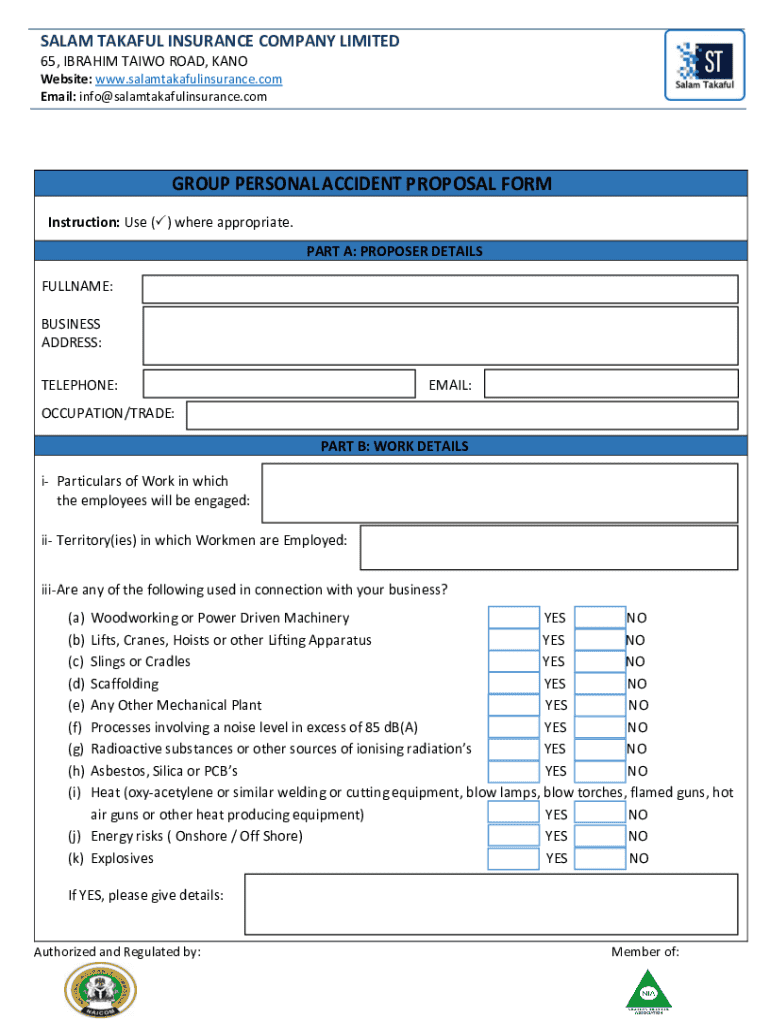

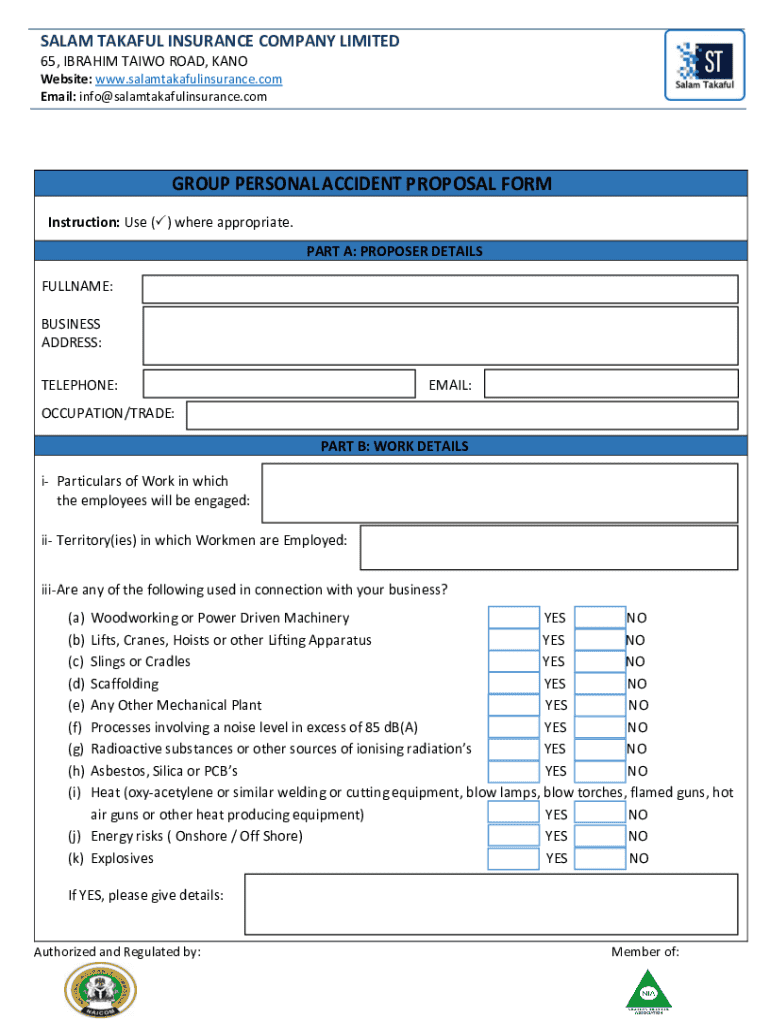

Understanding the Group Personal Accident Proposal Form

Overview of group personal accident insurance

Group personal accident insurance is designed to provide financial protection to members of a group, such as employees or organization members, against accidents resulting in injury or death. Unlike individual policies, this type of insurance covers multiple individuals under one policy, reducing administrative burden and often resulting in lower premiums. The proposal form is a vital first step in obtaining this coverage, as it collects essential information to assess the risk and tailor coverage parameters.

Insurance firms rely heavily on the accuracy of the proposal form to evaluate the group risk and to provide relevant insurance solutions. Incomplete or incorrect information can lead to delays or denials of coverage. Therefore, understanding how to accurately complete a group personal accident proposal form is crucial for any organization seeking to protect its members from unforeseen incidents.

Understanding the group personal accident proposal form

The group personal accident proposal form consists of several key components that gather vital information about the group and coverage requirements. The first section usually involves personal information, capturing essential details about the group members, such as names, contact details, and occupations. This information is crucial as it helps insurers assess risks associated with certain professions or activities.

Next, the coverage details section specifies the types of coverage sought, including death benefits and permanent disability coverage. Additionally, the premium details outline the cost associated with the proposed coverage based on the information provided. Understanding terminologies like 'accidental death', 'permanent total disability', and 'temporary total disability' is important for accurately completing the form and ensuring appropriate protection.

Step-by-step guide to filling out the group personal accident proposal form

Filling out the group personal accident proposal form may seem daunting, but following a systematic approach can simplify the process. Start by gathering necessary information, including identification documents of group members, existing insurance policies, and details of any previous claims. This preparation will facilitate accurate representation on the form and expedite processing.

Once you have the required documents, proceed to fill out the personal information section. Ensure accuracy when entering names, addresses, and occupations, as discrepancies can lead to complications later on. The next step involves specifying coverage requirements by selecting the types of coverage your organization needs. Consider factors like group size and the nature of activities undertaken by members to make informed decisions.

After defining coverage needs, calculate the estimated premium. Insurers usually provide guides or tools to help you estimate the costs based on coverage types and member information. Finally, ensure to sign and date the proposal form, which can now be done electronically using tools like pdfFiller, making the process seamless and environmentally friendly.

Tips for ensuring accuracy and completeness

Accuracy is paramount when filling out the group personal accident proposal form. Common mistakes include typos in personal information or underestimating coverage needs. To minimize errors, double-check all entered information against your gathered documents. It's also advisable to have another pair of eyes review the completed form before submission, ensuring no crucial details are overlooked.

Best practices for reviewing the proposal form include systematically going through each section, especially coverage specifications. Considering the details of what you need, alongside discussing any gaps or needs with stakeholders, will help clarify your needs before submission. Remember that clarity and detail are vital for coverage specifications, as vague descriptions may lead to misunderstood coverage limits, leaving your group exposed in case of an accident.

Managing your group personal accident proposal form on pdfFiller

pdfFiller provides a streamlined experience for managing group personal accident proposal forms. Users can easily upload their completed forms for editing or adjustments. The platform also supports collaborative features, making it easy for team members to review and provide input on the proposal before submission. The ability to store forms securely ensures sensitive information remains protected throughout.

With integrated tools for editing and eSigning documents, pdfFiller empowers organizations to handle the proposal form process efficiently and effectively. Security measures, such as encryption and access controls, ensure that all data remains confidential and secure, instilling confidence among team members and stakeholders.

Frequently asked questions (FAQs)

Navigating the proposal submission process can raise several questions, particularly if challenges arise. A common inquiry is what to do if the proposal is rejected. In such cases, reviewing provided feedback is crucial to understand the reasons behind the rejection. There may be an opportunity to amend the proposal based on this feedback and resubmit it for consideration.

Another frequent question involves making changes after submission. If modifications are necessary, contacting the insurance provider promptly is essential to discuss possible steps for amendment. Lastly, after submission, tracking proposal status may differ based on each insurer's policies; understanding this will help manage expectations regarding when to receive notifications regarding approval or additional information requests.

Interactive tools and resources

pdfFiller offers a variety of interactive tools designed to assist users in creating and managing the group personal accident proposal form. This includes calculators that can test different coverage options based on the group's specific needs. By inputting member details, organizations can quickly estimate potential premiums tailored to their unique circumstances.

Additionally, templates related to similar insurance forms and coverage documentation are easily accessible via pdfFiller, facilitating better navigation and understanding of associated documents. These resources can enhance your organization’s capability to make informed decisions about their group personal accident insurance needs.

Final steps after submission

Once the group personal accident proposal form has been submitted, keeping track of the proposal status becomes crucial. Many insurance providers offer portals where users can check the status in real-time, providing peace of mind regarding the approval process. In the event your proposal is approved, ensure you thoroughly read the policy details and make note of any inclusions or exclusions.

If further documentation is required, responding promptly can facilitate a smooth process. Regardless of the proposal outcome, maintaining records of all submitted documentation is essential for future reference. Having these records readily accessible can streamline any follow-up inquiries or adjustments that may become necessary over time.

Contacting support for assistance

If further assistance is needed regarding the group personal accident proposal form, reaching out to pdfFiller support is straightforward. Users can contact support via email or chat, providing a platform for addressing queries related to the proposal process or technical issues encountered while using the website. Comprehensive help center resources are also available, offering insightful guides and troubleshooting advice for common issues.

Additionally, when utilizing pdfFiller, you'll find a collection of tools and features designed to assist users effectively. This can include online tutorials or webinars that provide deeper insights into fully leveraging the capabilities of the platform to manage your documentation needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my this document serves as in Gmail?

Can I sign the this document serves as electronically in Chrome?

How do I edit this document serves as straight from my smartphone?

What is group personal accident proposal?

Who is required to file group personal accident proposal?

How to fill out group personal accident proposal?

What is the purpose of group personal accident proposal?

What information must be reported on group personal accident proposal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.