Get the free Income Tax Return Form Itr-5 - incometaxindia gov

Get, Create, Make and Sign income tax return form

Editing income tax return form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out income tax return form

How to fill out income tax return form

Who needs income tax return form?

Income Tax Return Form: How-to Guide Long-Read

Understanding income tax return forms

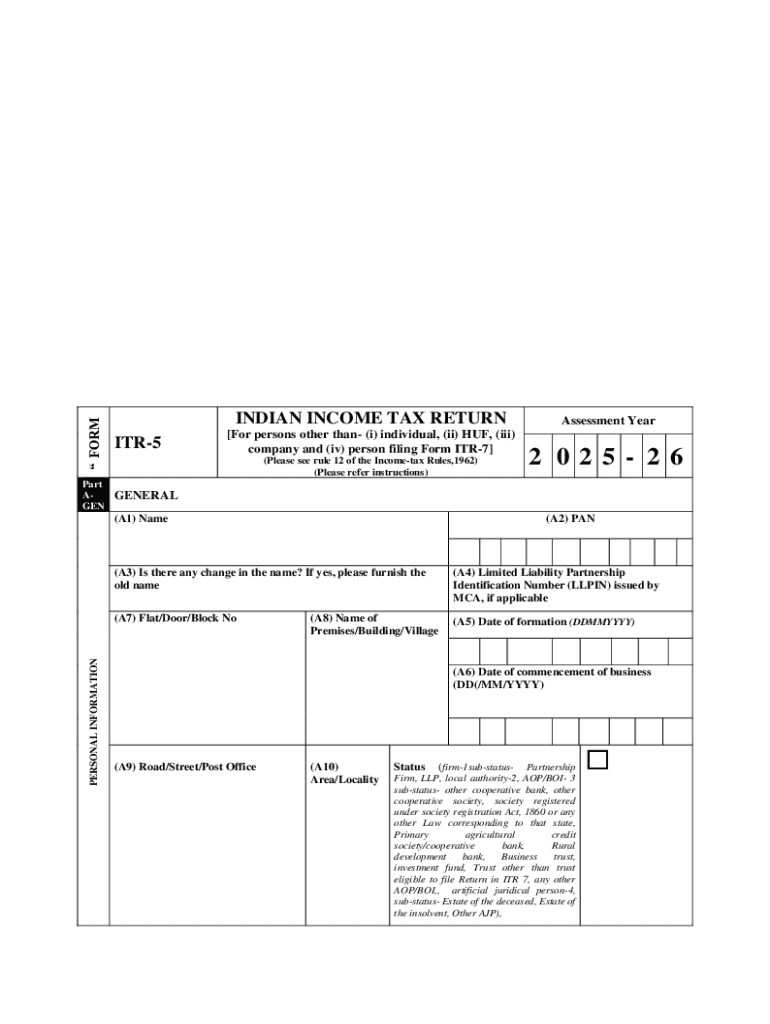

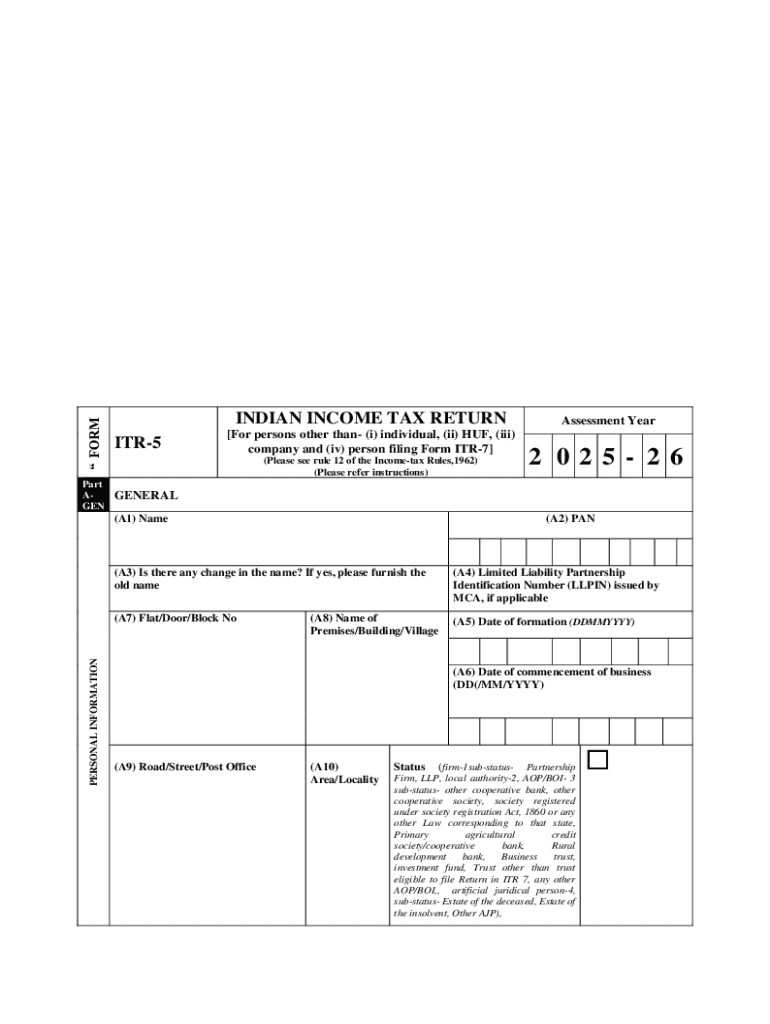

Income tax return forms are official documents used by individuals and businesses to report their income, expenses, and other pertinent tax information to the tax authorities. They ensure that the correct amount of tax is assessed based on earnings and applicable deductions. Filing these forms is a critical aspect of compliance with tax laws.

The importance of filing your income tax return cannot be overstated. It impacts your eligibility for refunds, assists in accurate financial planning, and is necessary to remain compliant with tax obligations. Timely filing also avoids legal repercussions and potential penalties from tax departments, thereby safeguarding your financial health.

Types of income tax return forms

Income tax return forms vary widely based on the taxpayer's situation. The most common forms include Form 1040, 1040A, and 1040EZ. Form 1040 is the standard form for individual income tax returns, allowing taxpayers to report all sources of income and claim various deductions. 1040A and 1040EZ are simplified versions, designed for taxpayers with straightforward financial situations.

Special circumstances require different forms, such as those for business owners, students, or non-residents. Each category has unique requirements; for instance, business owners may need to include detailed profit and loss statements, while students might look for education-related tax credits.

Additionally, state income tax forms vary by jurisdiction. Each state has its own regulations and forms, which can differ significantly from federal forms. It’s essential for taxpayers to familiarize themselves with their specific state's requirements to ensure accurate reporting.

Key components of an income tax return form

The structure of an income tax return form consists of several critical components. The personal information section often requires your full name, mailing address, and Social Security Number (SSN), which are essential for identifying the taxpayer and ensuring accurate processing of your return.

The income section details all sources of income, including wages, interest, dividends, and any other earnings. It is crucial to accurately report all income types to avoid discrepancies with the tax department, which may result in notices or further investigations.

Deductions and credits play a significant role in reducing tax liabilities. Taxpayers can choose between standard deductions and itemized deductions based on their financial situation. Understanding which deductions and credits apply to you can greatly affect your overall tax refund. Filing status is equally important, with categories such as single, married filing jointly, head of household, or married filing separately, dictating tax rates and eligibility for certain deductions.

Step-by-step guide to completing your income tax return form

Completing your income tax return form involves gathering necessary documents such as W-2s, 1099s, and receipts for deductions. It's crucial to have these on hand to fill out your form accurately, as missing information can delay processing and refunds.

Filling out the form requires attention to detail. Start with the personal information section, ensuring that all details are correct before moving on to report your income accurately. Use the income section judiciously, documenting all necessary sources to build a comprehensive financial picture.

When reviewing options for deductions and credits, it's essential to compare the potential savings of standard deductions versus itemized deductions to choose the best route for your situation. Remember to double-check your entries for common errors, such as incorrect Social Security Numbers or mismatched income figures, to ensure a smooth filing process.

Tools for managing your income tax return forms

Navigating income tax return forms can be simplified by using tools like pdfFiller. This platform allows users to create and manage documents effectively, offering the ability to fill out forms electronically, making adjustments as needed, and saving time.

eSignature solutions available through pdfFiller add another layer of convenience, allowing the electronic signing of documents directly within the platform, enhancing efficiency and security for your tax submissions. Collaborating with tax professionals becomes easier too, as sharing documents for advice or review is seamless within the pdfFiller ecosystem.

FAQs about income tax return forms

Answering these questions can help taxpayers navigate their situations more effectively. If you miss the filing deadline, it’s essential to file as soon as possible to minimize penalties. To amend a submitted return, you would generally file Form 1040X. Online filing is widely available and often expedited via platforms like pdfFiller. After filing, it's prudent to monitor your application status through your online services account summary.

Additional support and resources

Many resources are available for taxpayers needing help with common tax issues. The IRS provides a wealth of information, including hotlines and localized help centers for direct assistance. Their official website also contains numerous FAQs and guides that can be invaluable for understanding your filing obligations.

For non-English speakers, language assistance options are available to ensure that everyone can access crucial tax information. Furthermore, connecting with tax professionals for personalized advice is recommended, as they can offer tailored support and strategies based on individual financial situations.

Staying up-to-date with tax law changes

Tax laws are not static; they change frequently due to new legislation. Staying informed about recent legislative changes is essential for any taxpayer, as these can significantly impact tax filing and obligations. Understanding how these changes affect your filing process can help optimize your return.

Resources for continued learning about tax laws include the IRS website, local libraries, and specialized tax seminars. Regularly checking these resources can help taxpayers stay ahead and ensure compliance with any new reporting requirements or deductions that may arise.

Interactive tools and templates

Utilizing pdfFiller's interactive tools can enhance your experience when filling out an income tax return form. These tools allow for easy edits, filling, and management of your documents, ensuring that taxpayers can access their forms conveniently from anywhere.

The template gallery offered by pdfFiller is another valuable resource. This feature showcases available templates tailored for particularly common tax scenarios, allowing users to find the appropriate form with ease. By leveraging these tools, taxpayers can not only streamline their filing processes but also minimize errors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my income tax return form in Gmail?

How do I edit income tax return form straight from my smartphone?

How do I complete income tax return form on an Android device?

What is income tax return form?

Who is required to file income tax return form?

How to fill out income tax return form?

What is the purpose of income tax return form?

What information must be reported on income tax return form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.