Get the free Reporting Agent Authorization

Get, Create, Make and Sign reporting agent authorization

How to edit reporting agent authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out reporting agent authorization

How to fill out reporting agent authorization

Who needs reporting agent authorization?

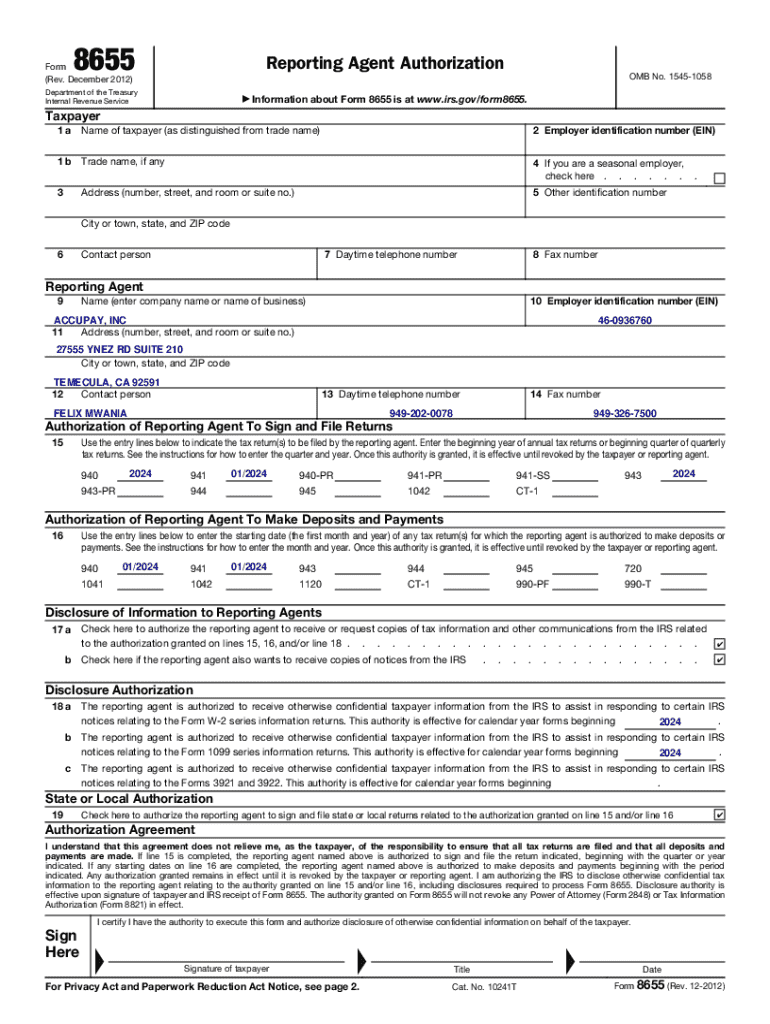

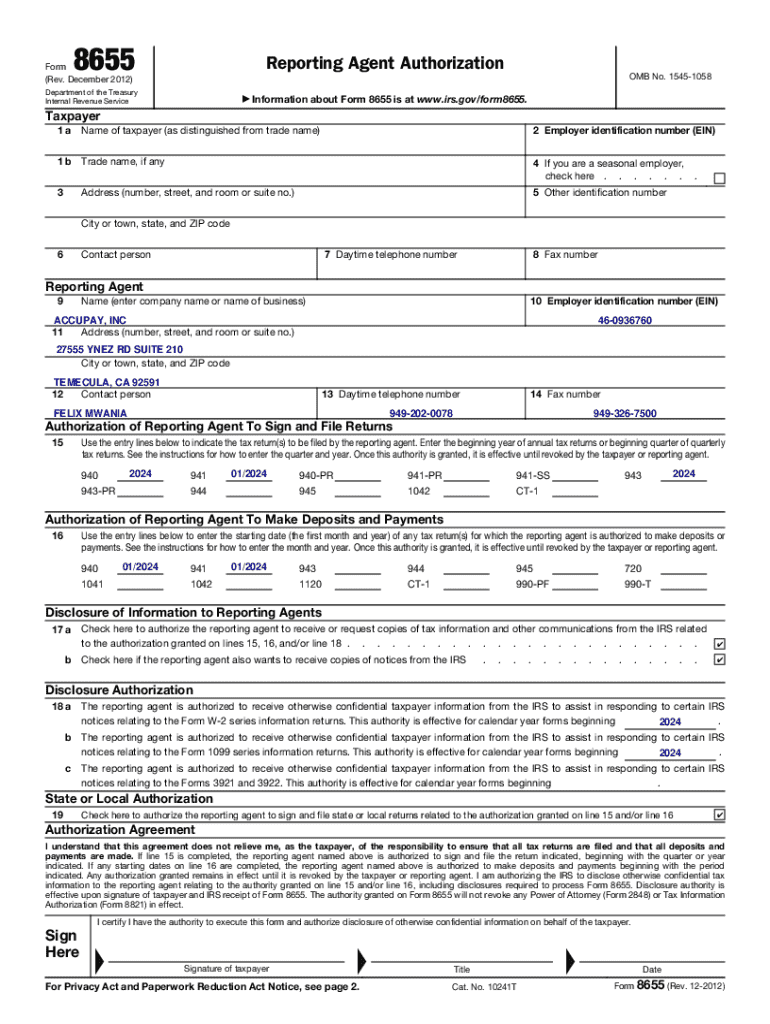

Understanding the Reporting Agent Authorization Form

Understanding the reporting agent authorization form

The reporting agent authorization form, often referenced in tax practices, enables an individual or business to designate an authorized reporting agent to manage tax filings and represent them before the Internal Revenue Service (IRS). This form is particularly significant for streamlining tax processes and ensuring compliance with the complexities of tax laws. By using this form, a taxpayer can delegate responsibilities related to tax submissions, making it easier to manage deadlines and submissions effectively.

For individuals and businesses alike, utilizing the reporting agent authorization form is crucial to effective tax management. This authorization allows the reporting agent to receive sensitive information directly from the IRS, ensuring that vital communications regarding tax liabilities and filings go through the appropriate channels. Without the correct authorization, critical tax information may not reach the intended representative, potentially leading to mismanagement of tax responsibilities.

When to use the reporting agent authorization form

The reporting agent authorization form should be utilized in key situations such as when an individual or business needs assistance with tax filings or when there’s a need for representation before the IRS. This includes instances of managing payroll taxes, income tax filings, and establishing payment plans or disputes with the IRS. Particularly for businesses, having a reporting agent enables easier handling of complex tax matters and aids in having professional oversight over important deadlines.

Eligibility requirements for acting as a reporting agent usually include being a qualified tax professional, such as an enrolled agent, CPA, or tax attorney. These professionals possess the necessary expertise to handle various tax-related issues. To authorize a reporting agent, taxpayers must ensure that their chosen agent meets these prerequisites and is in good standing with the IRS, as this can impact the effectiveness of the representation and filings made on their behalf.

Detailed walkthrough: filling out the reporting agent authorization form

Filling out the reporting agent authorization form can be a straightforward process if approached methodically. Start by gathering all necessary information from both the taxpayer and the reporting agent. This typically includes taxpayer identification numbers, names, addresses, and details about the reporting agent's professional credentials. Ensuring accuracy in this section is critical, as erroneous information can lead to rejection from the IRS.

Next, access the form on pdfFiller, a versatile document management platform. Navigate to the relevant section for tax forms, where you can locate the reporting agent authorization form quickly. Once located, you’ll initiate the completion of each section methodically. Each part requires careful attention; thus, ensure that the details are filled out accurately. This includes confirming that all signature requirements are met. You can utilize the editing tools in pdfFiller to make any necessary adjustments before finalizing the form.

Before submitting, take advantage of pdfFiller’s review features to check for errors. Any mistakes in the form could result in processing delays or complications with tax matters. After thorough review, save a copy of the completed form in the cloud on pdfFiller for easy access and future reference.

Editing and customizing your reporting agent authorization form

One of the advantages of using pdfFiller for your reporting agent authorization form is the platform’s impressive editing capabilities. Users can tailor specific fields, add annotations, or electronically sign the document directly through the platform. These features facilitate a personalized experience and allow for more precise compliance with the IRS requirements.

For those who have unique needs, utilizing templates can simplify the process of customization. PdfFiller offers various templates that can be adapted for different situations, not only enhancing the ease of filling out the reporting agent authorization form but also ensuring it aligns with the necessary legal obligations. This ability to edit and personalize ensures that every document can serve multiple purposes, promoting greater efficiency.

Signing and sending the reporting agent authorization form

Once the reporting agent authorization form is completed, signing it is the next step. Electronic signatures have become increasingly popular due to their convenience and legal acceptance. PdfFiller provides various eSignature options, ensuring a seamless signing process. It’s essential to remember that using an electronic signature maintains compliance with eSignature regulations, ensuring the signed document is valid.

After signing, users have multiple methods available to send the completed form. Whether by fax, email, or utilizing platform-specific submission tools, ensuring the timely delivery of this form is vital for maintaining compliance with IRS timelines. Always keep a copy for personal records and check the receipt of submission, especially if using electronic methods, to confirm the IRS has received your documentation.

Common mistakes and how to avoid them

Several frequent errors can occur while filling out the reporting agent authorization form, which may complicate the submission process. Incomplete sections are a common mistake that can lead to delays in processing. Always ensure that every part of the form is filled out as required, particularly the identification details and signatures. Incorrect or mismatched agent information can also hinder the authorization, so confirming the agent's details is essential.

One effective way to ensure accuracy is developing a checklist that includes all necessary components of the form. This allows for a systematic review before submission. Additionally, leveraging the review tools available in pdfFiller can help catch any discrepancies or errors, helping to double-check before final submission.

Managing and tracking your authorization status

After submitting the reporting agent authorization form, it’s essential to manage and track its status effectively. Be sure to follow up on the submission with the IRS to confirm processing. This can usually be done by contacting the IRS or using their online tools for tracking submission statuses, ensuring that your agent is authorized as planned.

PdfFiller also offers document management features that simplify tracking your authorization status. Users can access past submissions stored on the cloud, making it easy to find and verify information when necessary. This ability to manage documents efficiently promotes peace of mind, particularly during busy tax seasons.

FAQs about the reporting agent authorization form

Common inquiries regarding the reporting agent authorization form often revolve around processing times and renewal requirements. Typically, once submitted, the IRS processes the form within a few weeks, but this timeframe can vary based on the IRS's workload and any issues with the submission. Additionally, if a taxpayer wishes to cancel or update the authorization, they may need to file a new form with the relevant changes, which is a common procedural requirement to consider.

If issues arise after submission, such as not receiving confirmation or if an error is detected, it is crucial to take appropriate steps quickly. Contacting the IRS directly can often provide clarity on issues and assist in resolving them expediently. PdfFiller’s document storage can aid in producing documentation promptly if any concerns must be addressed.

Advanced features of pdfFiller for document management

PdfFiller hosts several advanced features that can greatly enhance the document management experience for users dealing with the reporting agent authorization form. One standout feature is its collaboration tools, which allow users to share forms with team members for collective editing and review. This collaborative approach is particularly beneficial for businesses, as it fosters an environment where multiple individuals can provide input and ensure the accuracy of the documentation.

In addition to collaboration, pdfFiller's integration with other software solutions provides increased efficiency for users who work across different platforms. Whether it's importing data from accounting software or utilizing cloud storage services, these integrations simplify the workflow and enhance the overall experience of managing documents like the reporting agent authorization form.

Conclusion on effective management of the reporting agent authorization form

Effective management of the reporting agent authorization form is essential for ensuring seamless communication with the IRS and handling tax responsibilities efficiently. By leveraging the capabilities of platforms like pdfFiller, users can navigate the complexities of this process with ease. From gathering necessary information to completing, editing, signing, and tracking the form, each step is integral to a successful outcome.

Summarizing best practices, it is crucial to maintain accuracy throughout the completion process, utilize pdfFiller’s tools for editing and eSigning, and keep records of submissions for peace of mind. By following these guidelines, individuals and teams can confidently manage their tax responsibilities and ensure compliance, ultimately facilitating a smoother financial operation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit reporting agent authorization on an iOS device?

Can I edit reporting agent authorization on an Android device?

How do I complete reporting agent authorization on an Android device?

What is reporting agent authorization?

Who is required to file reporting agent authorization?

How to fill out reporting agent authorization?

What is the purpose of reporting agent authorization?

What information must be reported on reporting agent authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.