Get the free Itr-7 - incometaxindia gov

Get, Create, Make and Sign itr-7 - incometaxindia gov

Editing itr-7 - incometaxindia gov online

Uncompromising security for your PDF editing and eSignature needs

How to fill out itr-7 - incometaxindia gov

How to fill out itr-7

Who needs itr-7?

Understanding ITR-7: A Comprehensive Guide for Taxpayers

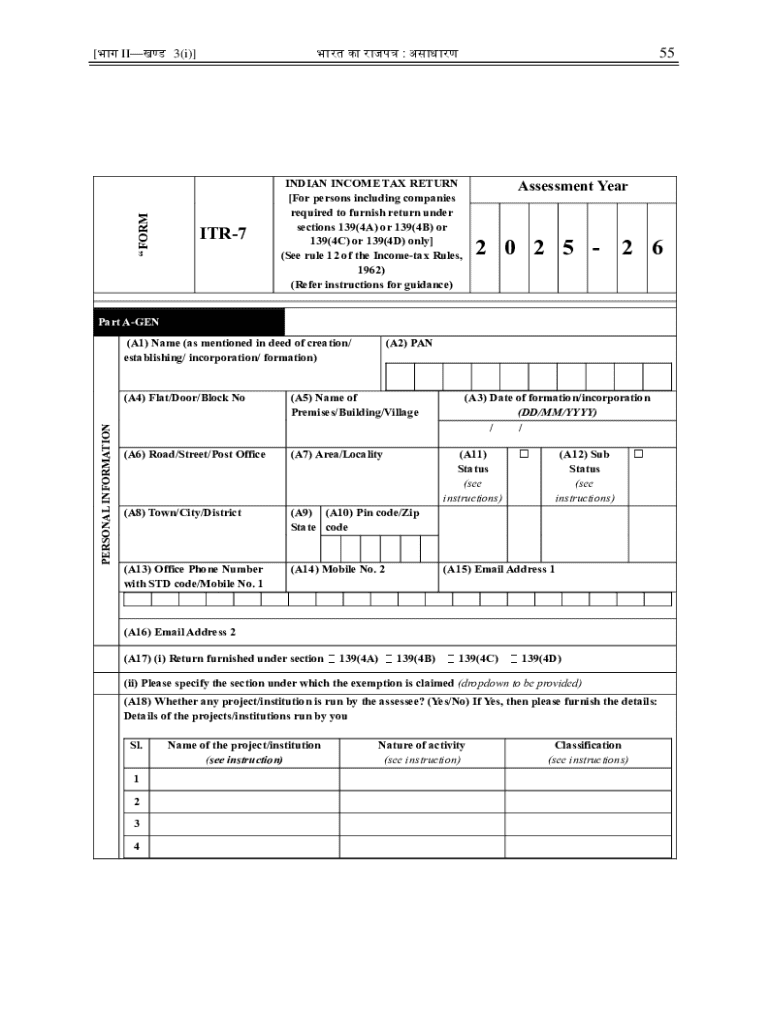

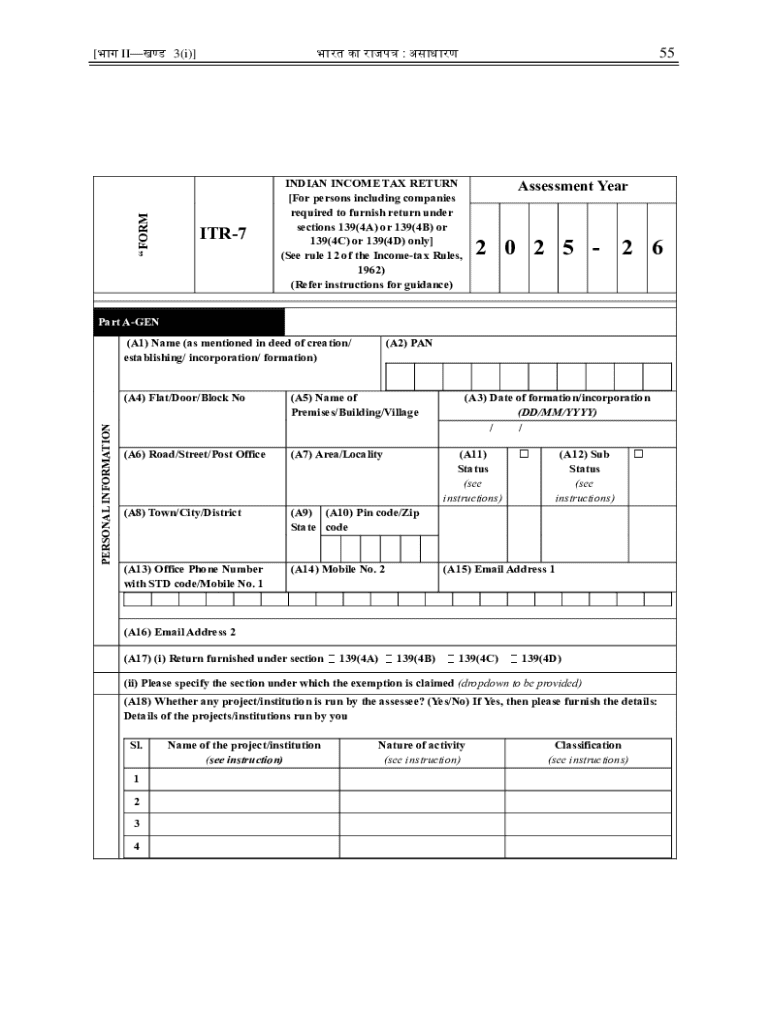

Overview of ITR-7: Understanding the form and its purpose

ITR-7 is a specialized tax return form introduced by the Income Tax Department of India, primarily designed for specific categories of taxpayers. This form plays a crucial role in the Indian tax system as it facilitates the filing of income tax returns for various institutions and non-profit organizations, which are often exempt from tax under specific sections of the Income Tax Act. This includes entities such as educational institutions, charitable trusts, and religious organizations. Since they operate on a non-profit basis, they must ensure compliance with tax regulations to maintain their tax-exempt status.

Entities required to file ITR-7 typically include: trusts or institutions claiming exemption under section 11, political parties, and those who have received income exceeding the prescribed limits in specific sections. Understanding the nuances of ITR-7 is essential for these entities to navigate compliance accurately and avoid potential penalties.

Key features of ITR-7

The ITR-7 form is tailored for a select group of taxpayers, which include: trust organizations, political parties, and needs-based charitable institutions. Unlike other ITR forms such as ITR-1 or ITR-2, which cater to individual taxpayers and families, ITR-7 is uniquely crafted to address the needs and compliance requirements of non-profit organizations, ensuring they provide detailed disclosures about their income and expenses.

Important deadlines for filing ITR-7 typically align with the standard timelines set by the Income Tax Department. For the Financial Year 2024-25 and Assessment Year 2025-26, the deadline for filing returns generally falls on July 31, 2025, unless extended by the authorities.

Recent updates and changes for AY 2025-26

For the Assessment Year 2025-26, several notable amendments have been introduced in the ITR-7 form. These changes aim to enhance transparency and compliance among filers. For instance, new sections may have been introduced to gather more comprehensive details regarding the sources of income, deductions, and claims for exemptions under various sections of the Income Tax Act.

Additionally, updated guidance on the documentation required can help streamline the filing process. Taxpayers must stay informed about these updates to ensure compliance and prepare their returns accurately.

Step-by-step guide to filing ITR-7 online

Diving into the filing process of ITR-7 online, the journey begins with adequate preparation. Gathering the necessary documents ahead of time can significantly ease the process.

Next, access the Income Tax Portal where you will find the ITR-7 form. Log in with your credentials or create a new account if required. Navigate to the 'e-File' section, select 'Income Tax Return,' and then choose 'ITR-7' from the options available.

As you begin filling out ITR-7, pay close attention to each section. It is crucial to accurately report general information, income details, deduction claims, and taxes paid. For instance, in the general information section, you will need to provide the registration number of your entity and other identifying details.

After completing the form, take the time to review your entries. Check for accuracy, consistency, and completeness. Ensure that all required fields are filled out and validate data against your supporting documents.

Using pdfFiller to streamline your ITR-7 filing

Utilizing pdfFiller can significantly ease the process of filling out ITR-7 by allowing for seamless PDF editing and electronic signatures. This powerful tool eliminates the need for printing and scanning, saving valuable time.

The platform provides comprehensive collaboration features, making it ideal for teams working on joint filings. Whether you are part of a large organization or a small trust, pdfFiller helps you track changes and communicate effectively within your team.

To file your ITR-7 using pdfFiller, simply upload your prepared document, edit it as necessary, and submit directly through the platform. This step-by-step workflow ensures that your e-filing is not only efficient but also secure.

Common mistakes to avoid when filling out ITR-7

Taxpayers often encounter unique challenges when filing ITR-7. Common errors arise from incomplete data, discrepancies in reported income, or failure to attach required documents. These mistakes can lead to rejections or penalties imposed by the tax authorities.

To minimize risks, taxpayers should adopt a systematic approach to filing. A checklist can be beneficial to remind you of necessary steps and documents.

Legal references for ITR-7 filing

ITR-7 filing adheres to several key pieces of legislation, primarily the Income Tax Act, 1961. Various sections provide guidelines and stipulations about who must file this form and under what circumstances exemptions can be claimed. For example, section 11 governs the income of charitable or religious trusts.

Referencing these laws when filling out ITR-7 could bolster your rationale for claimed deductions and provide a legal framework that supports your filings. Taxpayers are encouraged to familiarize themselves with these guidelines to ensure compliance.

FAQs related to ITR-7

Taxpayers often have numerous questions regarding ITR-7. Common queries include who is obligated to file, what specific incomes must be reported, and how one should handle discrepancies during the filing process. Such inquiries clarify many uncertainties surrounding tax filings and encourage compliance.

By addressing these questions, taxpayers can further demystify the process of filing ITR-7 and take justifiable steps toward compliance with the law.

Further considerations and best practices

After filing ITR-7, maintaining an organized record of all submitted documents is crucial for future audits or inquiries. Taxpayers should store both soft and hard copies of returns and related documentation securely. This not only aids in potential future scrutiny by the Income Tax Department but also helps to prepare for subsequent years' filings.

Additionally, it is advisable to follow up with the income tax department to ensure the successful processing of your return and to resolve any discrepancies quickly. This proactive approach can alleviate stress and foster a sense of accountability in managing your finances.

Latest articles and updates in taxation

Taxation regulations are dynamic, and staying informed about current changes can empower taxpayers to reap the benefits of new laws. Engaging with resources about tax laws, recent updates, and relevant articles is key. Understanding the implications of GST, ROC filings, and other filing requirements helps establish a holistic financial management strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify itr-7 - incometaxindia gov without leaving Google Drive?

Can I sign the itr-7 - incometaxindia gov electronically in Chrome?

How do I complete itr-7 - incometaxindia gov on an Android device?

What is itr-7?

Who is required to file itr-7?

How to fill out itr-7?

What is the purpose of itr-7?

What information must be reported on itr-7?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.