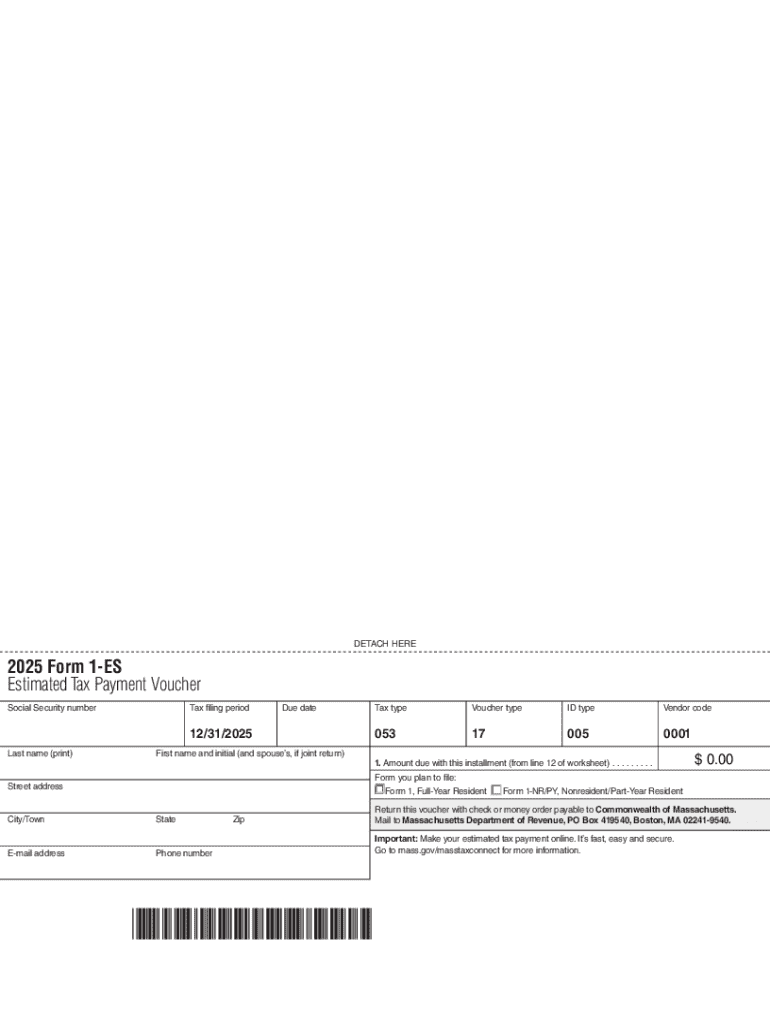

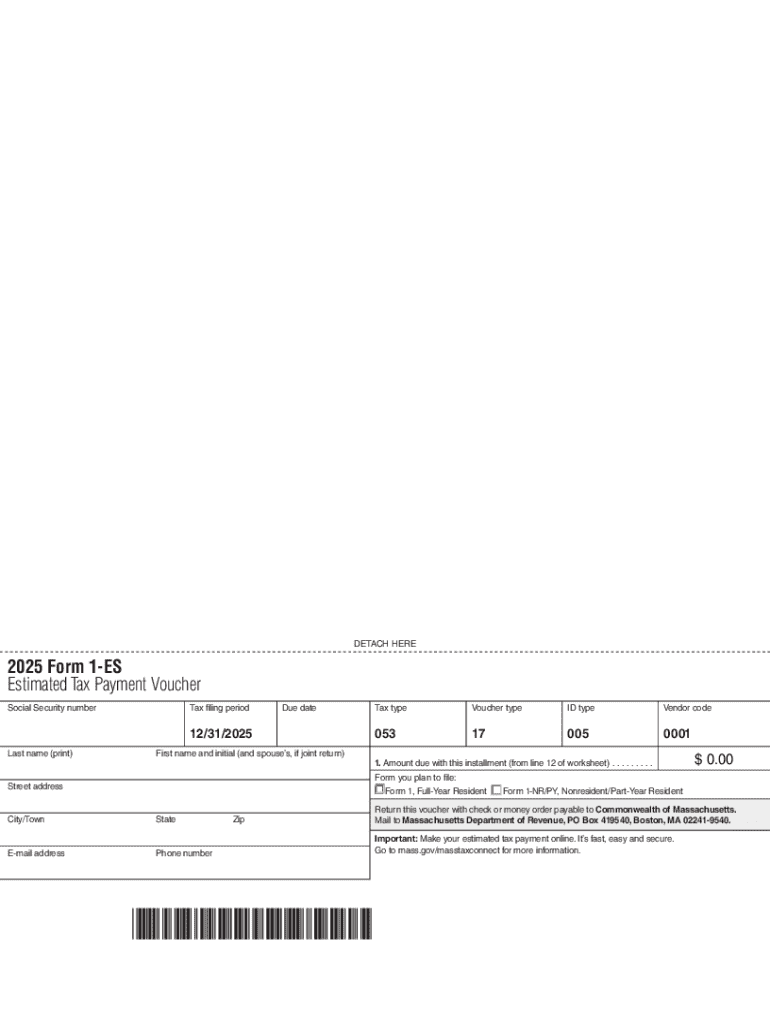

Get the free 2025 Form 1-es

Get, Create, Make and Sign 2025 form 1-es

Editing 2025 form 1-es online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 form 1-es

How to fill out 2025 form 1-es

Who needs 2025 form 1-es?

2025 Form 1-es Form: A Comprehensive How-to Guide

Overview of the 2025 Form 1-es Form

The 2025 Form 1-es Form serves as an essential document for taxpayers, encapsulating the necessary information required to compute their tax obligations for the given financial year. This form is particularly significant due to the evolving tax landscape and regulatory requirements for accurate reporting. By utilizing this form, individuals can maintain compliance, ensuring they meet federal and state obligations while maximizing potential deductions and credits.

The importance of compliance in 2025 cannot be overstated, especially given the increasing scrutiny from governing bodies. Accurate reporting and timely submission of the 2025 Form 1-es Form help avoid potential penalties and facilitate a smoother filing experience. Key features of this form include detailed sections for income declaration, deductions, tax credits, and concise calculations, all aimed at simplifying the taxpayer's journey.

Preparing to fill out the 2025 Form 1-es Form

Preparation is key to successfully completing the 2025 Form 1-es Form without errors or omissions. Begin by gathering the necessary documents and information that will inform your entries. Essential documents include W-2s, 1099s, and proof of other income sources. Additionally, have documentation for any relevant deductions or credits at hand to streamline the process.

Here are the steps to gather the necessary data effectively:

Filling out the 2025 Form 1-es Form

Filling out the 2025 Form 1-es Form involves several structured sections, each requiring specific information. Follow this step-by-step approach to ensure you complete each part accurately:

Editing your 2025 Form 1-es Form

Make any necessary adjustments to your 2025 Form 1-es Form to ensure all information is accurate. Utilizing pdfFiller's editing tools allows you to easily modify fields, add or remove information, and correct any mistakes that may have been made during the initial input.

You can enhance your editing experience by following these steps:

Make sure to save your changes regularly during the editing process to avoid loss of data.

eSigning the 2025 Form 1-es Form

eSigning the 2025 Form 1-es Form is essential for confirming the authenticity of your filing. Digital signatures enhance the security and integrity of the document while streamlining the submission process. Here’s a structured approach to eSign efficiently through pdfFiller:

Submitting the 2025 Form 1-es Form

Once you've completed and signed your 2025 Form 1-es Form, submitting it is your next critical step. There are various options for submission depending on your preference and situation.

Remember to keep an eye on submission deadlines for 2025 to avoid late penalties.

Common mistakes to avoid

Filing your 2025 Form 1-es Form can be daunting, but by being aware of common pitfalls, you can navigate the process more smoothly. Here are some common mistakes to avoid:

Tracking your submission

After submitting your 2025 Form 1-es Form, it’s wise to verify its receipt to ensure everything was processed correctly. Confirmation can usually be achieved by checking your account on the relevant tax agency website.

If you encounter any issues, consider these steps:

Frequently asked questions about the 2025 Form 1-es Form

As you navigate the complexities of the 2025 Form 1-es Form, it’s common to have questions. Here are some frequently asked queries and concerns:

About pdfFiller

pdfFiller provides a robust document management solution, making it easier for users to create, edit, eSign, and manage forms like the 2025 Form 1-es Form. Its comprehensive functionalities streamline the entire process, allowing users to focus on what matters most — accurate and timely submissions.

With user-friendly features and a commitment to accessibility, pdfFiller empowers individuals and teams to navigate the complexities of document management from anywhere.

Language assistance options

For users requiring assistance in languages other than English, pdfFiller provides multilingual support options. Accessing language assistance can enhance your experience and ensure that you accurately fill out the 2025 Form 1-es Form.

To access this support, look for language options on the platform during form completion.

Connect with us

Stay updated and connected with pdfFiller through our social media platforms. Follow us for the latest updates, tips, and resources focused on document management.

For direct inquiries, customer support details can also be found on our website, along with access to our community forums where users share experiences and seek advice.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 2025 form 1-es?

How do I edit 2025 form 1-es in Chrome?

How do I fill out 2025 form 1-es using my mobile device?

What is form 1-es?

Who is required to file form 1-es?

How to fill out form 1-es?

What is the purpose of form 1-es?

What information must be reported on form 1-es?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.