Get the free Claim Form

Get, Create, Make and Sign claim form

Editing claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out claim form

How to fill out claim form

Who needs claim form?

Claim Form How-to Guide: Navigating Your Way to Successful Submissions

Understanding the claim form

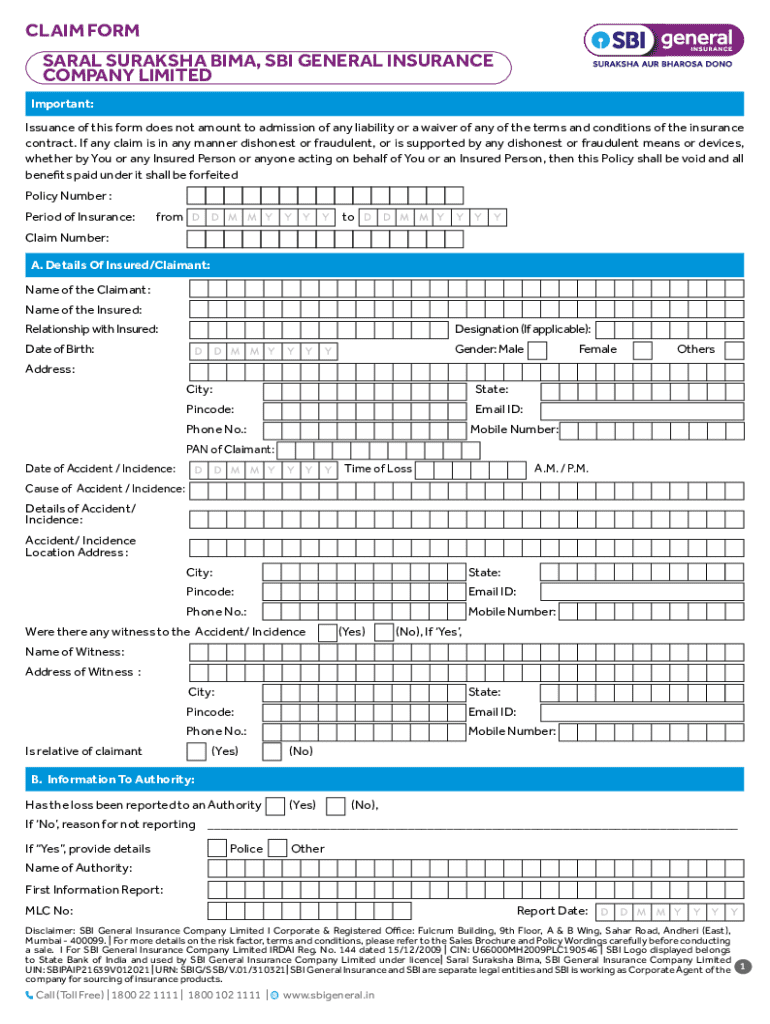

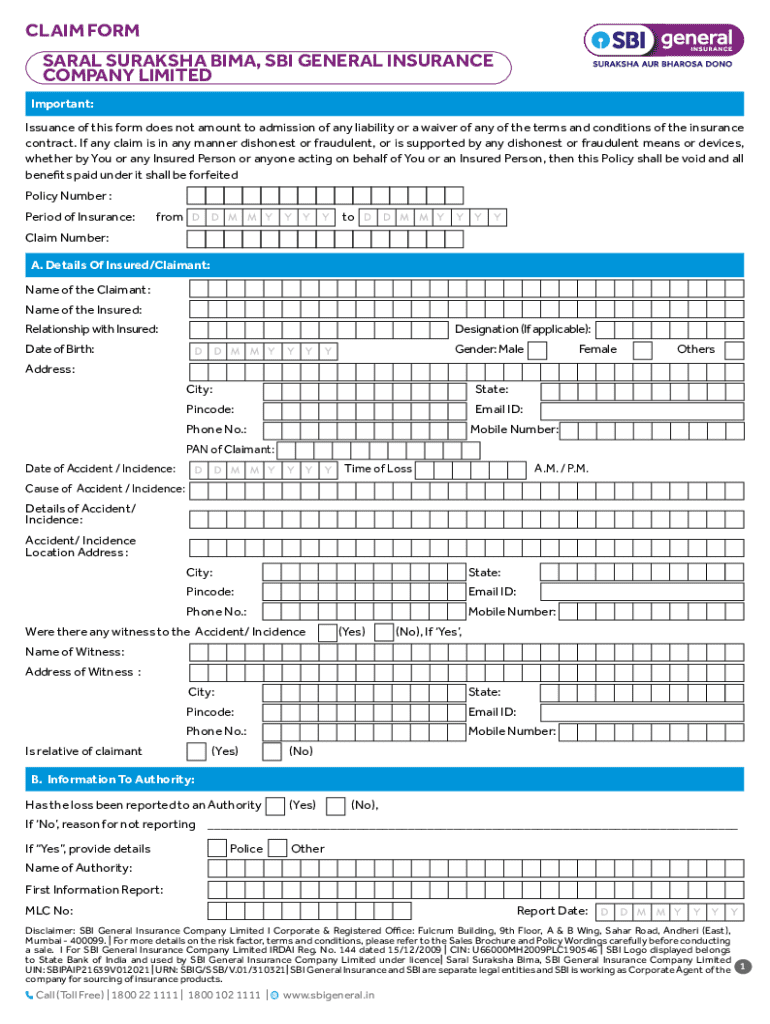

A claim form is a formal document submitted by individuals or healthcare providers to insurance companies or benefit programs to request reimbursement for services rendered. This essential form serves various purposes, such as ensuring that healthcare costs are covered under a service benefit plan or enabling pharmacies to receive payment for prescription therapy claims. Navigating this process can be daunting, but understanding the nuances of claim forms is crucial for ensuring you receive the benefits you’re entitled to.

You’ll need to use a claim form whenever you seek reimbursement for services, whether it's a routine medical check-up, a visit to a specialist, or prescription medication. Depending on your needs, there may be specific claim forms you’ll need to complete, such as medical claim forms for healthcare services, prescription drug claim forms for pharmacy services, or general claim forms applicable to various services.

Key components of a claim form typically include personal information, incident details, provider information, and a description of the services. This information is essential for the insurance provider to determine your eligibility for the requested reimbursement.

Navigating pdfFiller for claim forms

pdfFiller offers an intuitive user interface that makes it easy to access, fill out, and manage claim forms. With its seamless cloud-based platform, users can efficiently navigate through the different features tailored to claim forms. Start by accessing pdfFiller’s library, where you can find a diverse range of claim forms, including those for healthcare and pharmacy services.

Once you've located the right claim form, pdfFiller’s editing tools allow you to fill out the required information easily. You can leverage features such as eSignature capabilities for signing documents digitally, share forms with team members for collaboration, and store completed forms securely within your pdfFiller account.

Step-by-step guide to filling out a claim form

Filling out a claim form requires careful preparation. Before you start, gather all necessary documents and information. This may include your insurance policy details, provider invoices, and any other relevant documentation. Being organized is key to ensuring a smooth submission process.

Begin by filling out the personal information section, which typically requires your name, contact details, and policy number. Next, proceed to the incident details section, documenting the date of service, type of procedure, and any other relevant information. The provider information section is crucial as it identifies who delivered the services, and a detailed description of services will clarify the nature of your claim.

For accurate completion, double-check your entries, ensuring that all fields are filled out and that the information matches any corresponding documentation. This can help prevent delays in reimbursement.

Editing your claim form

Once you've filled out your claim form, pdfFiller provides convenient editing options to make any necessary changes. If you have made a mistake or need to add additional information, easily modify the relevant sections before submission. Taking the time to review and edit your claim ensures compliance with the insurance provider's requirements, reducing the likelihood of delays.

To facilitate this process, familiarize yourself with common mistakes such as missing signatures, incorrect policy numbers, or unverified provider details. Avoid these pitfalls by reviewing your form thoroughly before submission.

Signing and submitting your claim form

After ensuring your claim form is accurate, the next step is to sign it. pdfFiller allows you to electronically sign your claim form, which is often accepted by most insurance providers. After signing, you will have various submission options available. You can choose direct submission through the insurance provider's system or download the completed form and send it via mail.

Tracking your claim submission status is crucial. Many insurers provide tracking portals where you can monitor the status of your claim after submission. Stay informed about the progress to address any additional requests from your insurer promptly.

Managing claim form submissions

After submitting a claim form, effective management is necessary for a smooth claims process. Utilize pdfFiller to organize your claim forms efficiently. You can create folders to categorize different claims or projects, making retrieval easier when needed. Keeping a well-organized record allows you to reference previous claim forms during follow-up inquiries or resubmissions.

If you find it necessary to reopen or resubmit a claim form, having access to your previous submissions can expedite the process. In cases where your claim is denied, understand the reasons for denial, gather any additional documentation, and utilize the exception process effectively to reapply.

FAQs about claim forms

Navigating the world of claim forms can lead to many queries. Commonly asked questions include how to troubleshoot issues related to form submission, steps to take if your claim is denied, and how to seek additional help from customer support when needed. Being informed can save you time and frustration during the claims process.

When troubleshooting, consider checking that all necessary fields are filled and that the attached documentation is complete. If issues persist, engage with your insurance provider's customer service for assistance.

Case studies: Successfully navigating the claim process

Case studies of real-life experiences navigating claim forms reveal insights into common challenges and effective strategies for overcoming them. These accounts highlight the importance of thorough preparation, attention to detail, and timely follow-up. For instance, one individual successfully obtained reimbursement for overseas medical claims through meticulous documentation and by promptly addressing inquiries from their insurer.

Another case focused on a team managing multiple claims for a corporate employee benefits program. Their success stemmed from utilizing collaborative tools to ensure all claims were accurately documented and submitted on time, leading to a streamlined reimbursement process for all members involved.

Interactive tools for enhanced claim form experience

Taking advantage of pdfFiller’s interactive features can significantly improve your claim form experience. Real-time collaboration tools enable team members to work together seamlessly, ensuring that all necessary information is included and verified before submission. This enhances accuracy and can lead to quicker reimbursements.

Moreover, utilizing automated reminders within pdfFiller helps keep track of deadlines and follow-up dates. By integrating these features into your claim submission process, you enhance not only your efficiency but also your compliance with reimbursement protocols, ensuring you stay on the path to receiving your coverage benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the claim form in Gmail?

How do I edit claim form straight from my smartphone?

How do I fill out claim form on an Android device?

What is claim form?

Who is required to file claim form?

How to fill out claim form?

What is the purpose of claim form?

What information must be reported on claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.