Get the free Dr-17

Get, Create, Make and Sign dr-17

Editing dr-17 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dr-17

How to fill out dr-17

Who needs dr-17?

Comprehensive Guide to the dr-17 Form: Everything You Need to Know

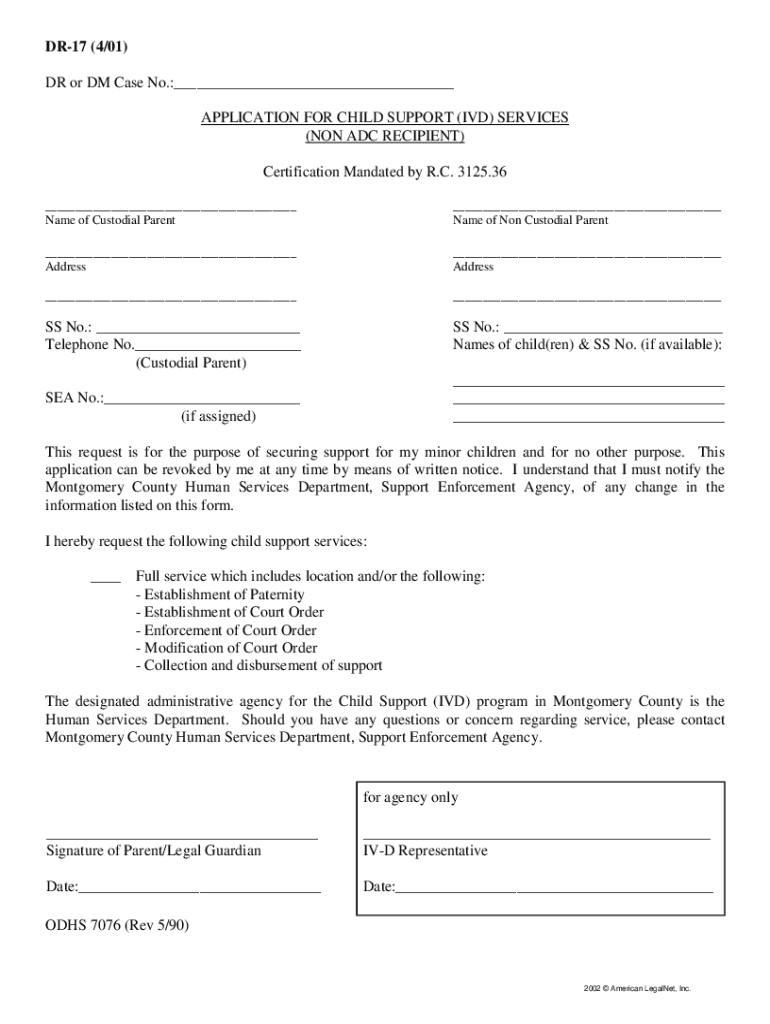

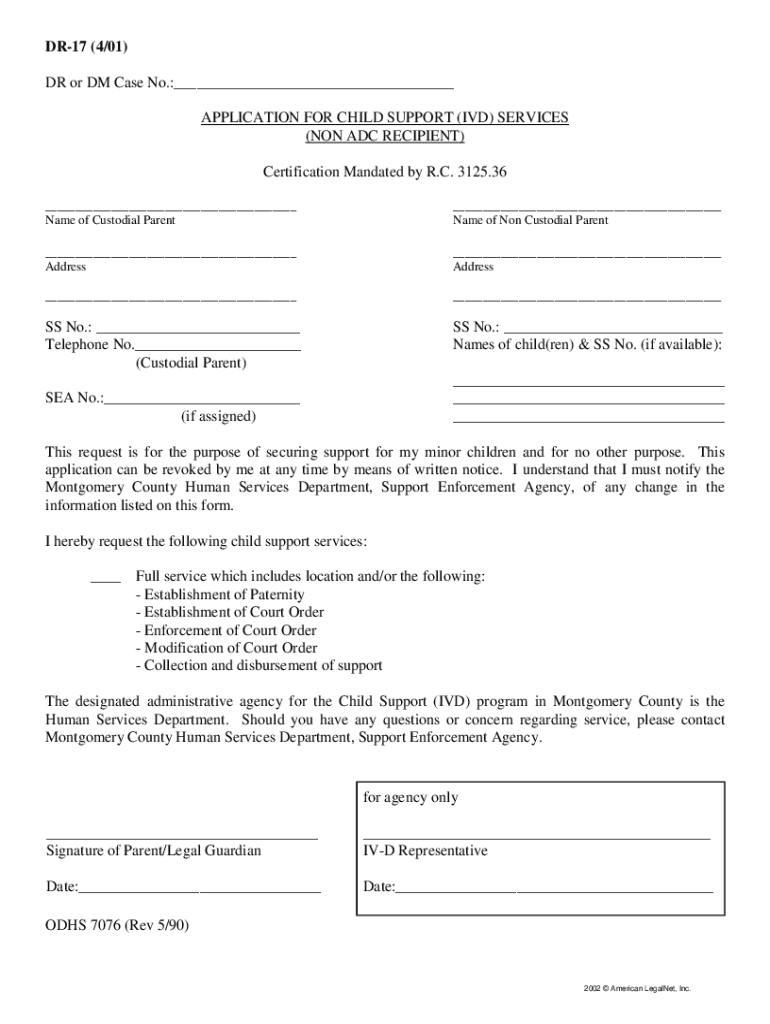

Understanding the dr-17 form

The dr-17 form is a critical document in the realm of tax management. Primarily utilized in Florida, this form serves as a means for reporting, calculating, and paying various taxes, including the elusive ad valorem tax and documentary stamp tax. It is essential for individuals and businesses alike to grasp not only the requirements but also the purpose behind the use of the dr-17 form. Essentially, it reinforces compliance with state regulations and ensures that taxes owed, such as sales tax, are accurately documented and remitted.

Tax professionals and regular citizens alike may find themselves reaching for the dr-17 form, especially when addressing tax category obligations or those related to government fees. Proper use of this form can facilitate smoother dealings with tax agencies, potentially resulting in financial benefits like tax credits. Understanding who needs to utilize this form is equally crucial, as misfiling or neglecting it can lead to penalties and interest on overdue taxes.

The benefits of using the dr-17 form include enhanced clarity in financial reporting, the facilitation of state compliance, and the prevention of potential audits. When properly executed, this form stands as a protective measure, ensuring that the relevant taxes such as the utility services tax and insurance premium tax are accurately assessed.

Preparing to fill out the dr-17 form

To fill out the dr-17 form accurately, proper preparation is essential. Start by gathering all required information and documentation, which provides a clear foundation for your submission. This will include personal information like your full name, address, and Social Security number, as well as essential financial information. The latter might consist of any taxable sales data from your records, along with details regarding previously claimed taxes like unused sales tax credits.

Additionally, having a complete overview of the financial aspects you need to report – such as any taxable services, sales, or gross receipts taxes related to business interactions – is paramount. Organizing this data in advance can prevent mistakes and enhance the overall effectiveness of your submission. Utilize spreadsheets, checklists, and other organizational tools to keep track of the different tax categories and the specific amounts owed. This preparation can save significant time and headache later during the completion process.

Step-by-step instructions for completing the dr-17 form

Filling out the dr-17 form correctly involves several systematic steps. Start by downloading the dr-17 form from reliable sources such as pdfFiller, where you can choose from editable formats. Once you’ve accessed the form, begin with the personal information section. This requires entering your full legal name, contact details, and identification numbers accurately to avoid follow-up queries from tax authorities.

In the financial information section, ensure you detail each line accurately, as each field corresponds to specific tax liabilities. Common pitfalls to avoid include miscalculating amounts owed or omitting supplementary data necessary for clarity, such as documentary stamp tax or utility services. After populating all required fields, it’s essential to review the completed form thoroughly. Double-check calculations, spelling, and the association of tax rates to ensure everything is precise before submission.

Editing and customizing the dr-17 form

pdfFiller offers invaluable editing tools that allow you to customize the dr-17 form to your needs seamlessly. Whether you need to add signatures, comments, or make specific corrections, these tools enhance the main form’s functionality. After completing the form, be sure to utilize the 'review' feature within pdfFiller, which assists in identifying any potential errors or areas that require adjustment.

Moreover, if working with a team, pdfFiller’s collaboration features enable multiple users to edit the form in real time, allowing for efficient workflows. Sharing options are particularly useful for discussions on revisions and updates, and capturing input from team members can lead to sharper, more accurate submissions. By leveraging the collaborative capabilities, you can ensure that all aspects of the filing meet both your standards as an individual and align with organizational requirements.

Signing the dr-17 form

Signing the dr-17 form electronically is a straightforward process when using pdfFiller. After filling out and reviewing your form, you can apply your signature using pdfFiller’s e-signature feature, which ensures a legally binding document without the need for printing. The platform user-friendly interface guides you through the process step-by-step, simplifying the signature generation.

Additionally, security is a top priority in electronic submissions. pdfFiller employs advanced encryption technologies to protect your data, ensuring that only authorized users can access documents. Furthermore, authentication measures provide peace of mind that your electronic signature is secure and verifiable, preserving the integrity of your form submission.

Submitting the dr-17 form

Submission of the dr-17 form can be handled in multiple ways, offering flexibility depending on your preference. Online submission through pdfFiller is the most efficient option, allowing for direct sending to the relevant tax department. This method not only saves time but also minimizes the chances of errors associated with paperwork.

For those preferring traditional methods, you can submit your completed form via mail or in person. Regardless of the method chosen, it’s vital to pay attention to any deadlines associated with your submission. This includes tax filing dates specific to your jurisdiction, as failing to meet these can lead to penalties. Once submitted, monitoring your form's status may become necessary, especially if it includes refunds or credits due to you.

Managing and storing your completed dr-17 form

Once your dr-17 form is completed and submitted, managing and storing that document securely becomes the next priority. pdfFiller facilitates efficient storage solutions through its integrated cloud capabilities, allowing you to access your documents from anywhere, anytime. This cloud environment not only secures your data but also simplifies retrieval whenever needed.

Beyond just storage, pdfFiller enhances document management with tools that allow you to organize your files effectively. You can categorize forms, share them with colleagues, and even set reminders for renewal submissions. This proactive management technique is especially crucial for businesses who regularly deal with various tax categories, such as employment taxes or utility services taxes.

Common FAQs about the dr-17 form

Navigating the dr-17 form can raise several questions. One common query is regarding mistakes made during submission. In such a scenario, promptly contacting the relevant tax authority for guidance on corrections is essential. Most tax offices have specific procedures for amending submitted forms that can help mitigate any potential penalties.

Another frequent concern revolves around tracking the status of the dr-17 form after submission. It’s advisable to keep a copy for your records and use any tracking features available via your submission platform or the relevant tax office. Staying informed reduces anxiety and equips you with information on any potential actions needed.

Related forms and documentation

In addition to the dr-17 form, various other forms and documents may relate to tax obligations within Florida. These include forms associated with local taxes such as the tourist development tax and specialty taxes like the metals recyclers or secondhand dealers registration forms. Each document serves a specific purpose and plays a vital role in maintaining compliance with state legislative requirements.

Exploring these related forms may enhance your understanding of the broader tax landscape, allowing you to identify potential deductions or credits. pdfFiller offers extensive access to other important documents, helping individuals and teams navigate their obligations effectively. This interconnected knowledge not only supports compliance but can also optimize financial efficiency.

Final tips for using pdfFiller for document management

To maximize your experience with pdfFiller and streamline document management, consider best practices that enhance usability and efficiency. Utilize the platform’s templates for recurring forms to save time. Additionally, explore its various editing and annotation tools to ensure clarity in any documents you edit or create. Collaboration features should also be leveraged to gather feedback seamlessly.

Moreover, taking advantage of pdfFiller’s cloud capabilities provides a safety net for your critical documents. Regularly back up files and implement a standardized naming convention for easy retrieval. This focus on organization will save you time and prevent issues related to lost or misfiled documents in the future. As laws and regulations evolve, utilizing such digital solutions will keep your operations agile and compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit dr-17 from Google Drive?

How do I fill out the dr-17 form on my smartphone?

Can I edit dr-17 on an iOS device?

What is dr-17?

Who is required to file dr-17?

How to fill out dr-17?

What is the purpose of dr-17?

What information must be reported on dr-17?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.