Get the free Standard Verification Form

Get, Create, Make and Sign standard verification form

How to edit standard verification form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out standard verification form

How to fill out standard verification form

Who needs standard verification form?

A comprehensive guide to the standard verification form

Understanding the standard verification form

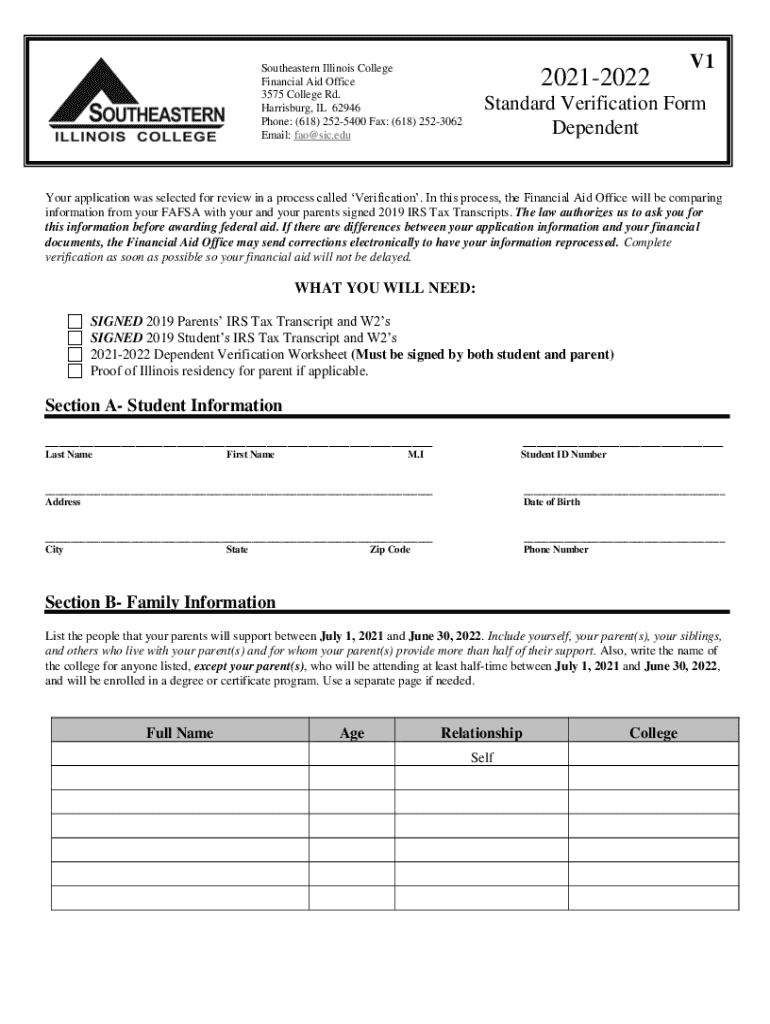

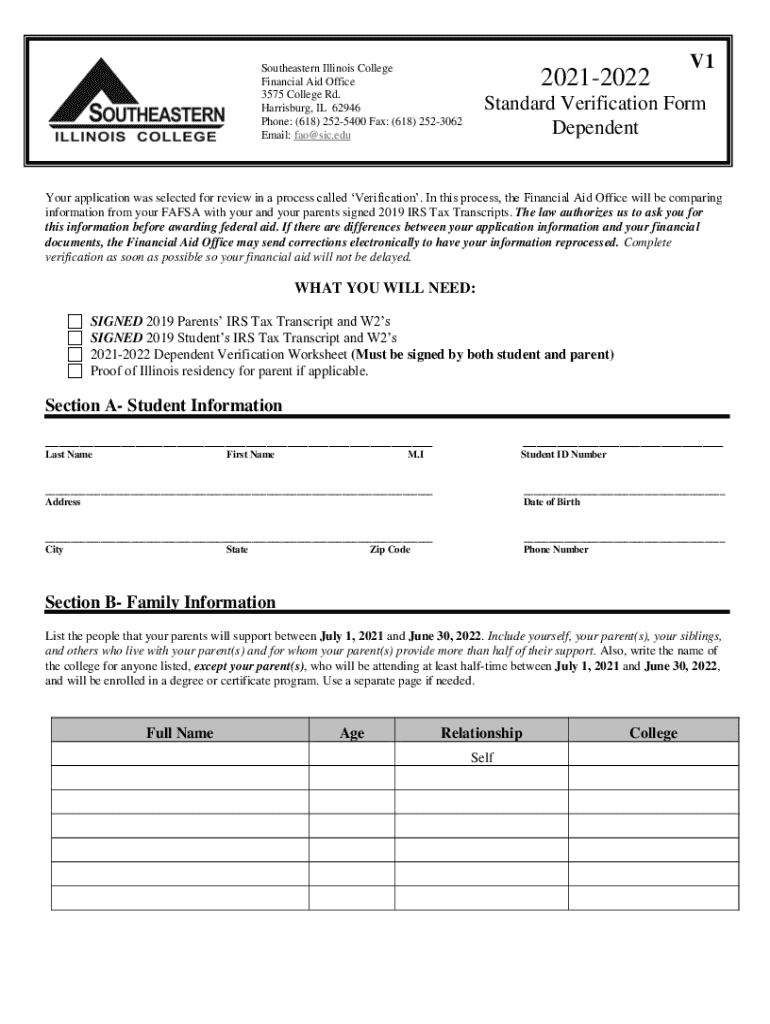

The standard verification form is a key document in the financial aid process for students attending post-secondary institutions in the United States. This form is utilized to confirm the information provided on the Free Application for Federal Student Aid (FAFSA), ensuring that institutions can accurately determine a student's eligibility for federal and state aid programs. The verification process plays an essential role in maintaining the integrity of the financial aid system by preventing errors and minimizing fraud.

For students and families, understanding the importance of the standard verification form is crucial. Completing this form correctly can significantly impact the amount of financial assistance awarded, ultimately helping to alleviate the burden of educational costs. Institutions, particularly schools and departments of education, rely on this verification to uphold compliance with federal regulations and ensure that resources are allocated to eligible recipients.

Who needs to complete the standard verification form?

Typically, students who submit a FAFSA may be selected for verification. This process can also extend to parents or guardians, especially if the student is considered dependent. Eligibility criteria often include income levels, changes in financial circumstances, or discrepancies noted during the application review. Students attending public or private colleges, universities, or vocational schools may all require this form, regardless of their financial situation.

It's essential for families to communicate closely with their educational institutions since each school may have its own requirements regarding the standard verification form. They might ask for additional documentation or specific details relevant to their funding programs. Understanding who needs to complete the verification is critical for ensuring that no vital steps are overlooked.

Key components of the standard verification form

The standard verification form comprises several critical components, each serving a unique purpose. First, the personal information section gathers details about the student and their identity. This ensures the institution can accurately match the form with the corresponding FAFSA application.

The family information section collects relevant data regarding the student's family, such as household size and demographics. This part is vital for assessing the overall financial need. Finally, the income information section is perhaps the most crucial; it verifies the financial data reported on the FAFSA, such as adjusted gross income (AGI) from tax returns. Completing these sections accurately is imperative, as any discrepancies can lead to delays in receiving financial aid.

Preparing to fill out your standard verification form

Before initiating the completion of the standard verification form, it's essential to gather necessary documentation. A checklist of required items can simplify this process and ensure that all information is accurate. Key documents include recent tax returns (such as IRS Form 1040), W-2 forms for income verification, and any other income documentation like 1099s if applicable.

Gaining access to accurate information is vital. Make sure to double-check tax documents and any records related to income, as these will form the basis for the information entered on the standard verification form. Taking the time to prepare thoroughly can lead to a smoother submission process.

Step-by-step instructions for completing the standard verification form

Filling out the standard verification form can seem daunting; however, with a step-by-step approach, it becomes manageable. Start with the personal information section, ensuring all names, addresses, and contact details are entered accurately. Pay close attention to properly identifying dependent or independent status because this significantly affects eligibility.

Common pitfalls during this process include omitting essential details or providing incorrect figures. When filling out the standard verification form, take your time and consider cross-referencing with the original FAFSA for consistency. This can help to minimize errors and ensure a more complete submission.

Acceptable documentation for verification

Documentation is integral to the verification process. Schools and departments of education require specific types of documents to substantiate the information reported. The most commonly accepted items include tax returns, W-2 forms, and verification of income statements from employers.

Make sure you consult your financial aid office if you have questions about which documents are acceptable or if you're unsure how to interpret what is needed. Providing the appropriate documentation is key to avoiding delays in your financial aid processing.

Special considerations in the verification process

Verification processes can vary based on individual circumstances. For instance, students who are confined or incarcerated often have different verification needs given their unique situations. In some cases, additional documentation may be required to establish identity or eligibility.

Furthermore, if there are changes to the FAFSA information after submission, updates must be handled carefully to avoid complications with the verification process. This could include reporting income changes or family size adjustments. Being proactive about these updates ensures a smoother experience when it comes to financial aid processing.

Understanding interim disbursements is also a critical consideration. Students may receive temporary funds while awaiting final verification, but it’s essential to keep in mind that incorrect information or failure to provide documentation could lead to the recovery of those funds later on.

Frequently asked questions about the standard verification form

Navigating the verification process can lead to many common inquiries. For example, if someone finds themselves unable to locate the necessary financial documents, they should contact the relevant financial institutions for reprints or visit the IRS for tax-related transcripts.

These frequently asked questions encapsulate key concerns that applicants may face. Having clear answers can alleviate stress and keep the verification process moving forward efficiently.

Troubleshooting common issues with the standard verification form

Despite careful preparation, issues can arise during the verification process. One common challenge includes delays in processing, which can stem from a variety of reasons, such as missing documentation or excessive workload at financial aid offices. If your application appears stalled, reaching out directly to the office can expedite resolution.

Discrepancies in submitted information are another common problem. It's critical to review all documents carefully and check for consistency. In the case of insufficient documentation, the financial aid office will typically provide guidance on what additional information is required to complete the verification.

Working with financial aid offices

Effective communication with your financial aid office can facilitate a smoother verification experience. Initiate your communication early by providing all required documents promptly. Clarity is key—make sure your submissions are organized and labeled correctly.

Best practices include keeping records of communications and submitted documents. This diligence will aid in making sure nothing is lost and you'll have a thorough history should any questions arise later.

The role of pdfFiller in managing your standard verification form

pdfFiller plays a transformative role in the document creation process, especially for forms like the standard verification form. This platform enables users to seamlessly edit PDFs, sign electronically, and collaborate with mentors and peers, all from a single, cloud-based solution.

Specific features offered by pdfFiller assist users through filling, signing, and submitting forms efficiently. Users can also create templates to reuse for future submissions, further streamlining the verification process. The collaborative tools available make it easy to work with team members or advisors on documentation, reducing the likelihood of errors.

Conclusion: maximizing your financial aid potential through proper verification

Completing the standard verification form correctly is paramount to securing financial aid. By understanding each component and gathering the necessary documentation, you can position yourself favorably in the financial aid landscape. Remember to utilize all available resources, including platforms like pdfFiller, to support you in managing important forms efficiently.

Ultimately, approaching the verification process with care and organization can make a significant difference in your educational funding. Applying the insights gathered in this guide can help ensure that you maximize your financial aid potential and navigate the requirements with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute standard verification form online?

How do I edit standard verification form straight from my smartphone?

How do I fill out the standard verification form form on my smartphone?

What is standard verification form?

Who is required to file standard verification form?

How to fill out standard verification form?

What is the purpose of standard verification form?

What information must be reported on standard verification form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.