Get the free Deed of Full Reconveyance

Get, Create, Make and Sign deed of full reconveyance

Editing deed of full reconveyance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out deed of full reconveyance

How to fill out deed of full reconveyance

Who needs deed of full reconveyance?

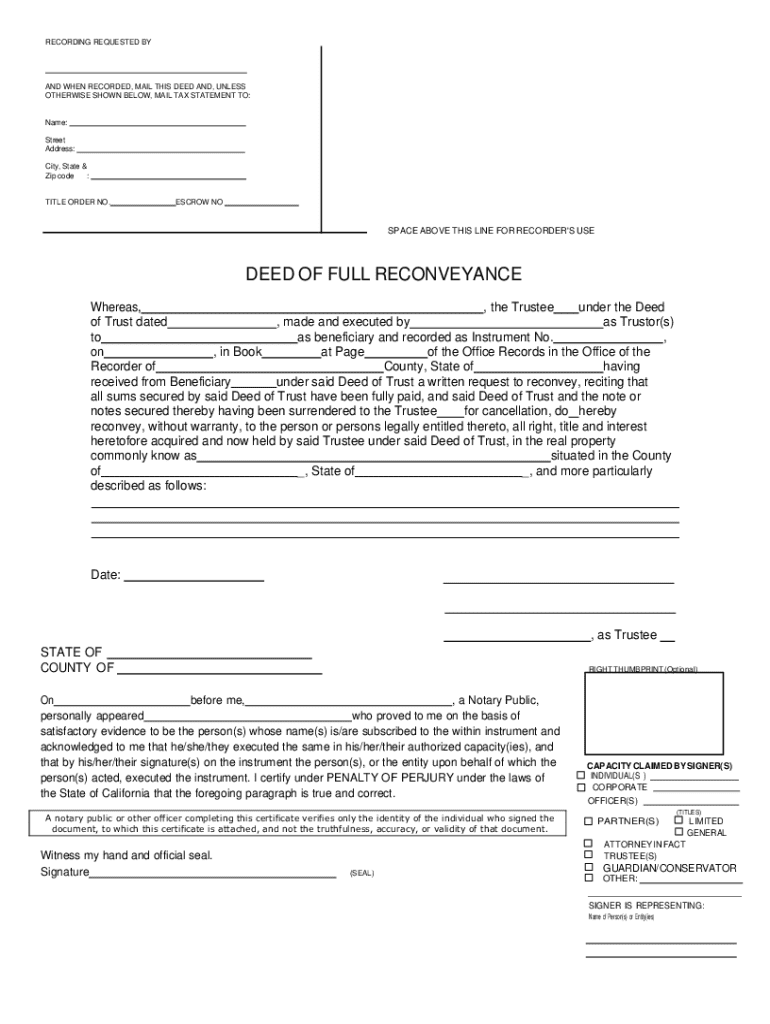

Understanding the Deed of Full Reconveyance Form

Understanding the deed of full reconveyance

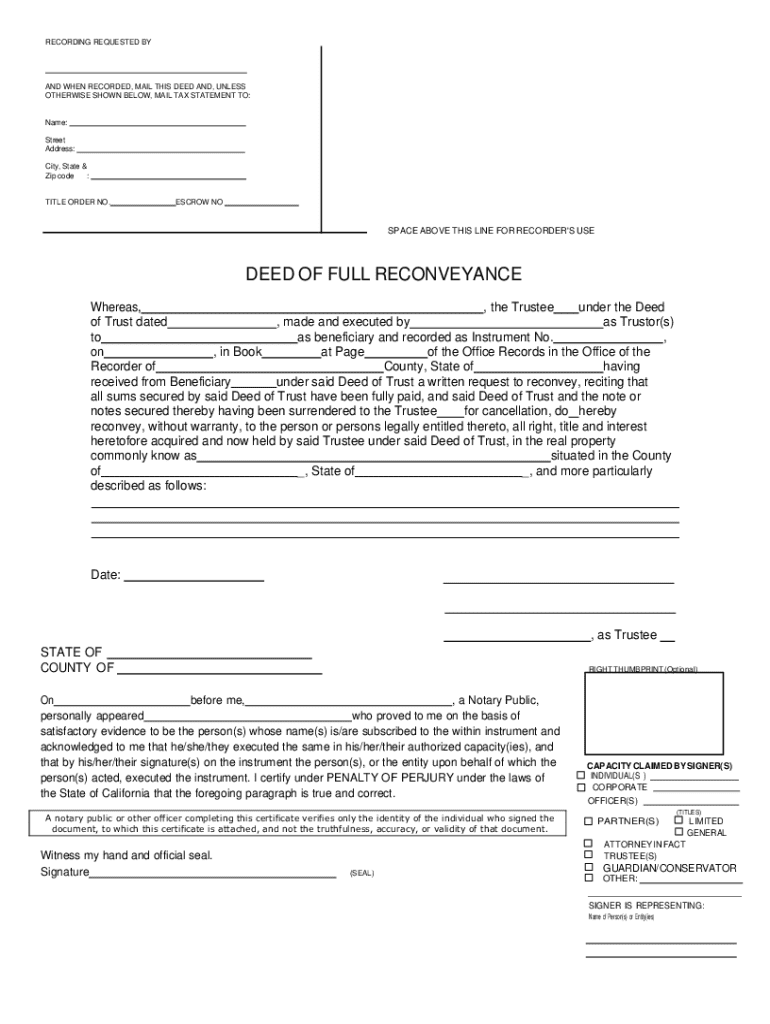

A deed of full reconveyance is a legal document that signifies the release of a mortgage lien on a property. This form is crucial in property transactions, as it provides a formal declaration that the borrower has fulfilled their mortgage obligations. Once the borrower pays off their loan, the lender must issue this deed, officially transferring the property's title back to the borrower. This process not only dispels any financial claim the lender has over the property but also solidifies the owner's title.

The deed of full reconveyance serves as a protective measure for property owners. By recording this document, the owners safeguard against potential disputes regarding ownership or claims from creditors in the future. Legal terminology associated with this document, such as 'trustee' (the party holding the title until the debt is paid) and 'beneficiary' (the lender), is essential to understand to navigate real estate and lending processes effectively.

When is a deed of full reconveyance needed?

A deed of full reconveyance is necessary in specific situations to ensure the borrower’s rights and interests are protected. The primary reasons include the completion of loan payments, a transfer of property ownership, and the release of a lien. Once all payments on a mortgage are made, the lender must conduct a reconveyance to release their claim on the property. Additionally, when transferring property, a reconveyance can provide clarity and proof that the new owner holds no existing financial encumbrances.

Failing to file a deed of full reconveyance can lead to serious consequences. Without this document, the lender may still have a claim against the property. This situation can create complications in future transactions, causing delays and potential legal disputes. Thus, understanding when to file this form can save property owners from significant headaches down the road.

Key components of the deed of full reconveyance form

The deed of full reconveyance form contains several key components that must be completed accurately. Required information typically includes the borrower's name, lender's name, property description, and any relevant dates. Essential clauses specify that the mortgage has been paid in full and detail the trustee's role in the transaction. Signatures from both the borrower and the trustee are necessary, along with a notary's acknowledgment to validate the document.

Common mistakes to avoid when filling out the form include incorrect property descriptions or failure to include necessary signatures. It's crucial to double-check each entry against official property records to ensure accuracy and avoid issues during the filing process. Missing details can lead to delays in processing or even rejection of the form, causing potential complications in property ownership clarity.

How to fill out the deed of full reconveyance form

Filling out the deed of full reconveyance form requires careful attention to detail. Start by gathering all necessary documents, such as the original loan agreement and payment records. Once you have this information, you can begin completing the form. Focus on the property information section first; ensure that the description includes specific details like address, parcel number, and any other distinguishing features to avoid confusion.

Next, accurately input the lender and borrower details. Include full legal names and contact information. After filling in all sections, review the document for accuracy. Ensure the signatures are in the designated areas, and that a notary can verify the document's authenticity. By following these steps diligently, you can minimize errors and facilitate a smoother filing process.

Tips for editing and signing your deed of full reconveyance

Using pdfFiller's editing tools streamlines the process of adjusting your deed of full reconveyance form. The platform includes text editing features that allow you to modify any inaccuracies before finalizing the document. You can add digital signatures directly within the platform, making it convenient for all involved parties to sign without needing to print and scan documents.

Moreover, pdfFiller provides collaboration options for multiple signers, enabling team members or trustees to review the document and sign it efficiently. Security features are also in place to protect your document from unauthorized access, ensuring that your sensitive information remains confidential. Using a secure and efficient editing platform like pdfFiller can save time and prevent potential disputes over document accuracy.

Managing your deed of full reconveyance document

Once you've completed your deed of full reconveyance, managing the document properly is crucial. Save and store your document securely in cloud-based storage to prevent loss or damage. Utilize pdfFiller’s platform to access and share your document from anywhere, ensuring you and concerned parties can view the document whenever needed.

Tracking document changes and versions is another significant advantage of using pdfFiller. The platform keeps historical versions, allowing you to revert to previous drafts if necessary. This feature not only enhances your document management capabilities but also ensures you always have an accurate and up-to-date copy of essential transactions and agreements.

Filing the deed of full reconveyance

Filing the deed of full reconveyance is a straightforward process, but it requires careful attention to detail. Typically, the document must be filed with the appropriate authority, which is often the county clerk’s office or the registrar of voters, depending on local regulations. Before filing, you may need to pay a small filing fee, which can vary by location.

Processing times for the filing can differ based on the office's workload; therefore, you should check with your local office for specific timelines. Once filed, a confirmation is usually issued, which signifies that your reconveyance has been duly recognized. It's always wise to keep this confirmation for your records to avoid any future disputes regarding the status of your property.

Frequently asked questions (FAQs) about deed of full reconveyance

After filing a deed of full reconveyance, many property owners have questions about what happens next. Primarily, the mortgage lender is no longer able to claim any rights to the property, thus granting complete ownership to the borrower. However, it is always good practice to keep a copy of the filed document in a safe place for future reference.

Some potential challenges can arise, such as disputes over the validity of the deed or an attempt by a lender to argue against the reconveyance. If this occurs, consult with a legal professional specializing in property law for guidance. Alternatives to filing a deed of full reconveyance generally include a lien release document, but these alternatives may not provide the same level of clarity regarding property ownership.

Additional considerations

Each state may have specific regulations regarding the deed of full reconveyance, so it is vital to familiarize yourself with local laws and requirements. Consulting with a legal professional can not only ensure compliance with laws but also provide additional insights into the implications of filing the deed of full reconveyance. Understanding the future implications for property owners is crucial, as this deed affects their legal standing and property rights.

Given the complexities involved in property transactions, being proactive about understanding and managing your deed of full reconveyance significantly enhances your protection as a property owner, ensuring clarity and minimizing future risks related to ownership disputes.

Leveraging pdfFiller for document solutions

pdfFiller’s cloud-based platform provides a comprehensive solution for your deed of full reconveyance form and other essential documents. The platform’s user-friendly interface allows seamless editing and management of various document types involved in property transactions. Its integration capabilities mean that you can upload various forms or documents to consolidate your filing processes.

Moreover, leveraging pdfFiller for document management in property transactions provides efficiency and security at every stage. The ability to collaborate with various parties enhances communication, reducing the chances of errors during the process. Streamlining the management of the deed of full reconveyance form and its associated documents ultimately enables users to maintain better control over their property transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute deed of full reconveyance online?

How do I edit deed of full reconveyance on an iOS device?

How do I complete deed of full reconveyance on an iOS device?

What is deed of full reconveyance?

Who is required to file deed of full reconveyance?

How to fill out deed of full reconveyance?

What is the purpose of deed of full reconveyance?

What information must be reported on deed of full reconveyance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.