Get the free Self Employment Income Report

Get, Create, Make and Sign self employment income report

How to edit self employment income report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out self employment income report

How to fill out self employment income report

Who needs self employment income report?

Self Employment Income Report Form - A Comprehensive How-to Guide

Understanding self employment income reports

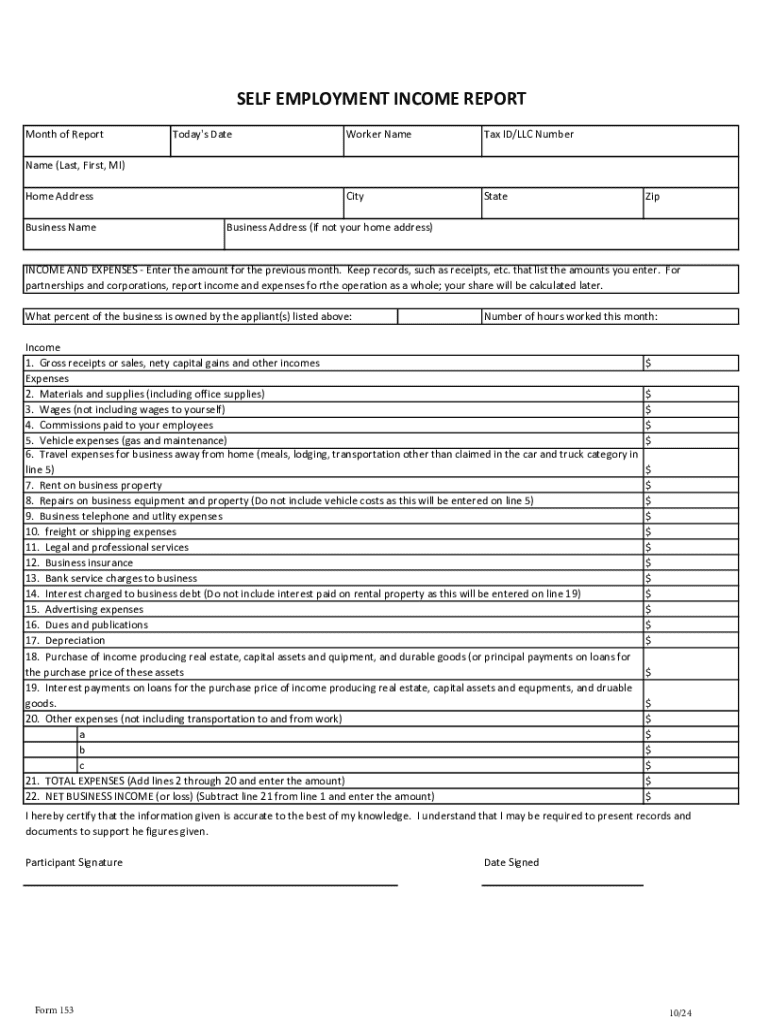

Self employment income refers to money earned by an individual through business activities as opposed to a traditional salaried position. For many entrepreneurs and freelancers, accurate reporting of this income is not just a matter of good business practice, but a crucial step in complying with tax laws. Every self-employed individual must prepare a self employment income report form, which summarizes earnings and expenses over a specific period, typically aligning with the tax year.

Accurate reporting ensures that one pays the correct amount of taxes while also maximizing eligible deductions. Failing to report income correctly can lead to penalties from tax authorities, which can be daunting for individuals. The self employment income report form is a structured way to document all necessary financial details concerning your business income and expenses, thus playing a vital role in financial and tax management.

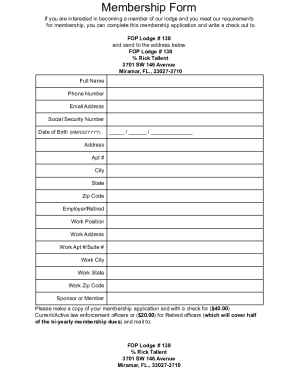

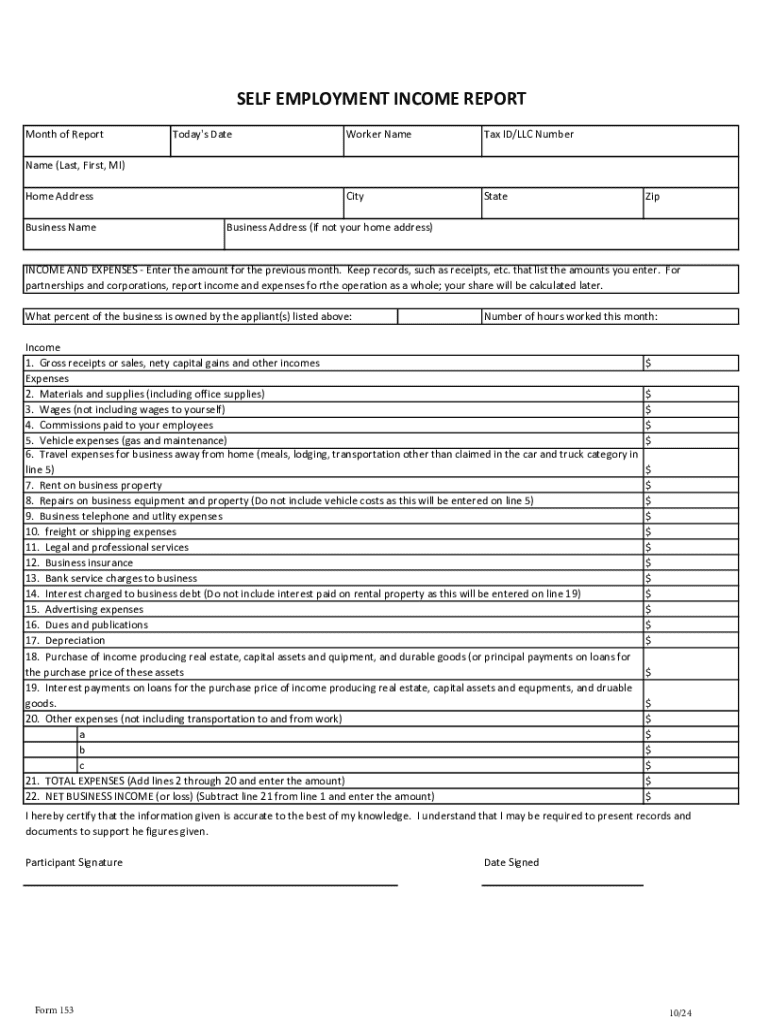

Key components of the self employment income report form

A self employment income report form encompasses several essential sections that ensure seamless reporting of your business's financial activities. First and foremost, the form will require personal information such as your name, address, and Social Security number. This is crucial for identification purposes within the tax framework.

Following personal details, you will find a business information section where you’ll list your business name, its nature, and possibly a business identification number. Income reporting fields are a major component, clearly structured for you to document your gross income, detailing every dollar earned during the reporting period. Additionally, the form includes areas where you can report deductions and business expenses, which are necessary to calculate your net profit.

Sample completed form breakdown

Understanding how to correctly fill out the self employment income report form is fundamental to getting it right. For instance, let’s consider a freelance graphic designer. In the personal information section, they would enter their name and SSN. Under business details, they would detail their title and describe the services provided. In the income section, they can list total earnings derived from various clients, while the deductions section allows for expenses like software purchases or office supplies.

Common mistakes include underreporting income or failing to substantiate expenses with proper receipts, leading to potential audits. Ensuring each entry is accurate and supported by documentation will prevent these issues.

Preparing your financial information

Preparing the necessary financial documentation is crucial for accurately completing the self employment income report form. This includes various income statements such as invoices, which provide proof of earnings received from clients. Additionally, maintaining receipts for all business-related expenses enhances your validity in reporting deductions, safeguarding against disputes or audits by tax authorities.

Your task is to categorize each expense meticulously, which allows you to present clear declarations. Utilizing spreadsheets is recommended; creating separate tabs for income and expenses can greatly simplify tracking over the year. In doing so, self employed individuals can be organized and efficient in preparing financial information.

Detailed instructions for filling out the self employment income report form

Filling out the self employment income report form becomes straightforward once you have your documents at hand. Start by gathering your personal information—this includes your full name, Social Security number, and address, which are essential for tax compliance.

After that, document your business details. This can also involve the nature of your business to provide further context. Carefully reporting your income next, detail all income sources, paying attention to precise amounts to eliminate errors. Once income is reported, itemize your business expenses in separate areas, ensuring you capture deductions accurately. Calculating your total deductions subsequently requires totaling all claimed expenses, effectively reducing your taxable income.

To ensure accuracy, make it a habit to double-check all entries. You can also utilize tools like pdfFiller’s editing options to streamline your processes and minimize errors.

Common challenges and solutions

Self employed individuals often encounter unique challenges when filling out the self employment income report form, particularly under time constraints. One effective strategy is to allocate dedicated time blocks specifically for this task, allowing for focused attention. Skipping the rush will ensure the thoroughness required for accurate reporting.

Understanding complex income types can also be daunting. Differentiating between freelance and contracted work includes understanding tax implications for each. Moreover, managing multiple streams of income necessitates diligent tracking of each source, which can lead to mistakes. Staying updated on tax law changes further enhances your ability to report correctly and efficiently. Utilizing tools that highlight relevant updates can be invaluable.

Submitting your self employment income report

The submission of your self employment income report form is your last step in this comprehensive process. Knowing your options for submission is vital; you can either file electronically or send the form via mail. Many individuals prefer electronic filing due to its immediacy and potential for instant confirmation. The IRS has specific deadlines—usually by April 15th—that must be adhered to ensure timely payment of any taxes due.

After submission, ensuring your form has been successfully processed is paramount. For electronic filings, tracking confirmation emails or references numbers is advised. Should you encounter any issues, it’s essential to address them immediately by reaching out to the IRS or using helplines provided.

Understanding taxes related to self employment income

Self employment taxes can be confusing, especially for those just beginning their journey as independent workers. A crucial understanding is that self employment income is subject to both income tax and self employment tax, totaling approximately 15.3% for Social Security and Medicare taxes. Knowing the applicable tax rates can save individuals from later surprises during tax season.

Moreover, recognizing common deductions available for self employed individuals is equally important. Potential deductions include home office expenses, health insurance premiums, retirement contributions, and depreciation of business assets among others. By accurately calculating these deductions, self employed individuals can significantly lower their tax burdens. Technologies like pdfFiller can assist in identifying deductible expenses, making tax preparation far less daunting.

Resources for self employed individuals

An array of interactive tools and calculators exist for self employed individuals to streamline their financial management. For example, online estimated tax payment calculators can help you project what you owe, while profit and loss statement templates facilitate clearer financial assessments.

In addition to these tools, various educational resources are available. Online courses and certifications tailored for financial literacy or business management can enhance your understanding and preparedness. Tax preparation workshops also present invaluable opportunities for learning best practices in managing self employment income and filing taxes.

Furthermore, becoming involved in communities and support networks is highly beneficial. Both local and online forums can provide insights from experienced professionals ranging in expertise. Deciding whether to seek professional help can also be examined through networking; weighing the pros and cons can guide you in deciding the best course of action for your unique situation.

Leveraging pdfFiller for document management

One effective way to manage your self employment income report form is by utilizing pdfFiller’s cloud-based platform. This offers seamless document editing capabilities, allowing users to fill out required forms without dealing with complicated software installations. Everything you need is accessible with just an internet connection.

Additionally, pdfFiller includes collaboration features that facilitate teamwork on financial reporting. For teams managing multiple projects or income sources, communicating effectively about financial documents is essential. With built-in eSignature capabilities, pdfFiller allows for secure, compliant document handling, ensuring both signatories and submitters can trace and confirm each step efficiently.

Frequently asked questions (FAQs)

Many individuals have common concerns related to the self employment income report form. Questions often arise regarding how to handle amendments after submission, or what to do if errors come to light after you’ve filed. Typically, it’s advisable to file an amended return promptly to rectify discrepancies. Moreover, if you receive a notice from the IRS post-filing, understanding how to respond appropriately will aid in alleviating concerns and managing compliance efficiently.

Glossary of key terms

Understanding terminology is crucial for navigating the self employment income report form smoothly. Terms like 'gross income,' which refers to a total of all income received before deductions, and 'net income,' which is the income after all expenses are deducted, are foundational. Knowing these terms enhances comprehension and prevents errors in reporting.

Other important terms include 'tax deductions,' which are expenses subtracted from gross income, and 'self employment tax,' which is the tax owed on self employment income. Familiarizing yourself with this vocabulary will empower you to complete your self employment income report form accurately and with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute self employment income report online?

How can I fill out self employment income report on an iOS device?

How do I complete self employment income report on an Android device?

What is self employment income report?

Who is required to file self employment income report?

How to fill out self employment income report?

What is the purpose of self employment income report?

What information must be reported on self employment income report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.