Get the free Form 10-k

Get, Create, Make and Sign form 10-k

Editing form 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-k

How to fill out form 10-k

Who needs form 10-k?

Form 10-K: A Comprehensive Guide for Users of pdfFiller

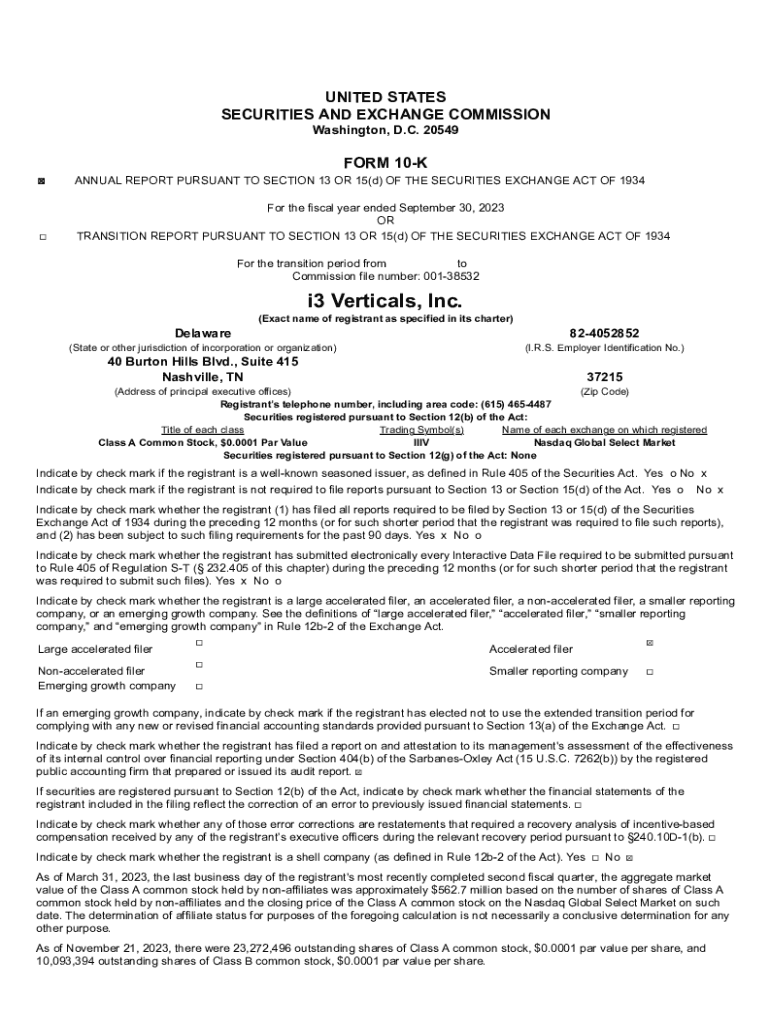

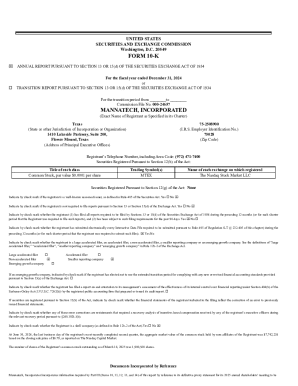

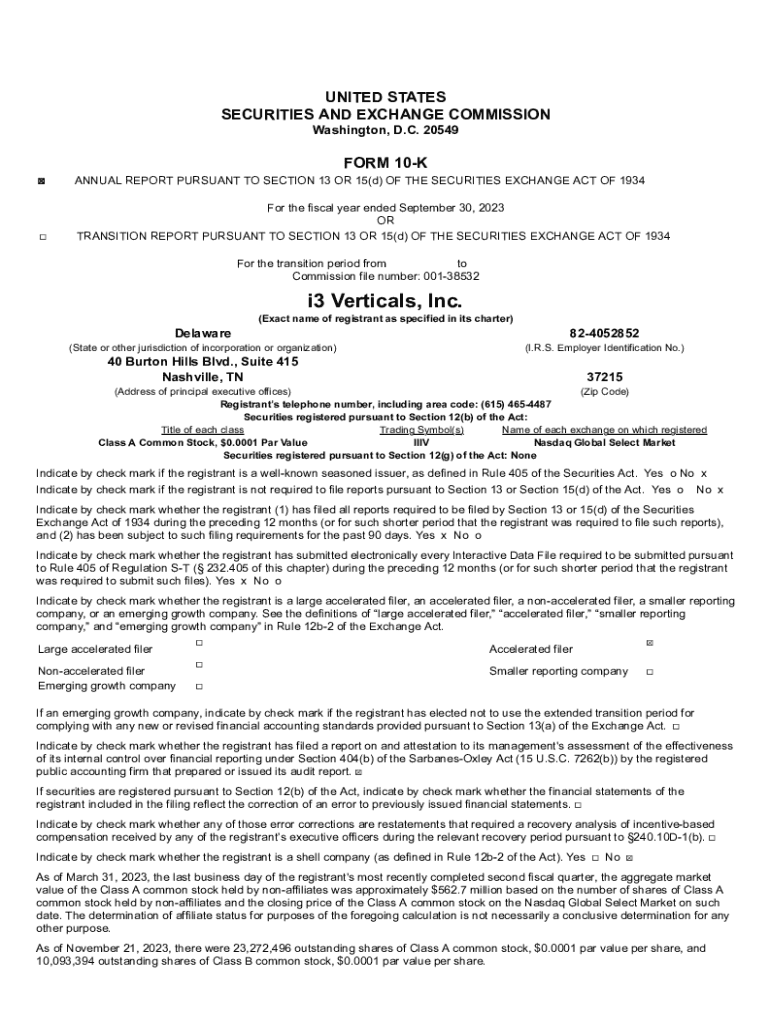

Understanding Form 10-K: A key SEC requirement

Form 10-K is a vital document mandated by the Securities and Exchange Commission (SEC) for public companies. It serves as an extensive annual report that provides detailed information about a company’s financial performance, operations, and risks. Companies are required to submit a Form 10-K to ensure transparency and to give current and potential investors critical insights into their business health.

The importance of filing a Form 10-K cannot be overstated. For investors, it serves as a crucial source of data to assess the financial stability and future prospects of a company. For companies, it is a legal and regulatory requirement that can significantly impact their reputation and stock performance. Essentially, these reports play a fundamental role in maintaining investor trust in publicly traded organizations.

What constitutes a Form 10-K?

A Form 10-K contains comprehensive information and must be filed annually, providing critical data that goes beyond what is typically included in quarterly reports, like Form 10-Q. While Form 10-Q provides interim financial statements and ongoing updates, Form 10-K presents an entire year's worth of information, making it particularly relevant for long-term investors.

The essential components of a Form 10-K include financial statements, management analysis, and disclosures that cover various aspects of the company’s business. Each section of the document is vital for gaining a holistic understanding of the organization—its current standing and future trajectory.

Detailed breakdown of Form 10-K contents

Form 10-K is structured into several key sections, each providing specific insights into a company's operations and financials. One key aspect is the Business Overview, which outlines the core activities and market position of the company. This section gives context to the financial data that follows.

The Management’s Discussion and Analysis (MD&A) offers in-depth insights into the company's financial performance and operational strategies. This part is notably subjective, as it reflects management’s perspective on results and future plans, including potential risks and challenges.

The Financial Statements section consists of audited statements, including the income statement, balance sheet, and cash flow statement. These documents are vital in assessing profitability, liquidity, and financial stability.

Notes to Financial Statements provide explanations of accounting methods used and additional details on financial line items, enhancing transparency and providing context for the numbers presented.

Lastly, the Risk Factors section identifies and explains potential risks that could impact the company's operations, which is crucial for investors to understand the uncertainties associated with their investments.

Navigating Form 10-K filing procedures

Filing a Form 10-K can be done either in paper format or electronically via the SEC's EDGAR system. E-filing is the preferred method, as it streamlines the submission process and increases accessibility for the public. pdfFiller provides an efficient platform to facilitate this process, enabling users to complete their filings digitally.

With pdfFiller, companies can access a user-friendly interface to fill out Form 10-K effortlessly, benefiting from features like editing tools, collaboration capabilities, and eSigning options. Here’s how to leverage pdfFiller for your Form 10-K:

Finding and accessing existing Form 10-Ks

Locating filed Form 10-Ks is straightforward, as these documents are publicly available through the SEC’s EDGAR database. This platform serves as a comprehensive source where investors and other interested parties can retrieve filings from thousands of reporting companies.

In addition to the SEC database, company websites also house these filings, often found in their investor relations sections. To search effectively, it's beneficial to employ specific strategies:

Important deadlines for filing Form 10-K

Companies must be mindful of their annual filing deadlines for Form 10-K, which varies based on company size and public float. Generally, larger companies must file within 60 days of the fiscal year-end, whereas smaller companies have an extended period of 90 days.

In some situations, companies may apply for extensions, allowing additional time to file. However, it’s crucial to understand the implications of missed deadlines as they may lead to penalties or a loss of investor confidence.

Key highlights: What to look for in a Form 10-K

When reviewing a Form 10-K, certain indicators can help gauge the company’s financial health. Key highlights include assessing trends in revenue, profit margins, and cash flow. Furthermore, understanding how management perceives risks and what strategies are outlined for future growth can provide clarity on the company’s trajectory.

Particular sections to pay attention to include the Risk Factors segment, which highlights uncertainties that may affect business performance, and the MD&A, where management critiques past performance and outlines future objectives. These insights can guide investment decisions and risk assessment.

Completing your own Form 10-K: Tips and best practices

When preparing to complete your Form 10-K, a step-by-step approach can simplify the process significantly. Begin by gathering necessary information, including financial data and operational details. Ensure that all data aligns with the requisite SEC regulations for accuracy and compliance.

It’s also crucial to avoid common mistakes that can lead to inaccurate filings. Double-check numerical data, verify the language used in risk disclosures, and ensure all required sections are filled out completely. The use of pdfFiller can assist in managing these tasks smoothly, further reducing the likelihood of errors.

Leveraging pdfFiller for efficient document management

pdfFiller offers an innovative document management solution that centralizes form management in the cloud. By using pdfFiller, users can collaborate seamlessly, edit documents in real-time, and ensure that all necessary changes are recorded efficiently. This is particularly beneficial for teams involved in preparing Form 10-K.

The platform’s eSigning capabilities allow for quick approvals, minimizing delays associated with traditional signing methods. Users can maintain a continuous workflow, making the process of filing Form 10-K more streamlined and hassle-free.

Interactive tools and resources on pdfFiller

pdfFiller enhances usability with a variety of interactive tools and templates available for customization. These tools are designed to empower users during the completion process, ensuring that specific needs are met. For example, to make the Form 10-K completion process as seamless as possible, users can access tailored templates that align with SEC standards.

Additionally, video tutorials are available to guide users through each aspect of using pdfFiller effectively—covering everything from editing to eSigning. This support system ensures users can navigate the platform confidently, helping to mitigate common challenges faced when filing complex documents like the Form 10-K.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 10-k to be eSigned by others?

How do I complete form 10-k online?

Can I sign the form 10-k electronically in Chrome?

What is form 10-k?

Who is required to file form 10-k?

How to fill out form 10-k?

What is the purpose of form 10-k?

What information must be reported on form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.