Get the free Tenant Guarantor Form - centralproperties co

Get, Create, Make and Sign tenant guarantor form

How to edit tenant guarantor form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tenant guarantor form

How to fill out tenant guarantor form

Who needs tenant guarantor form?

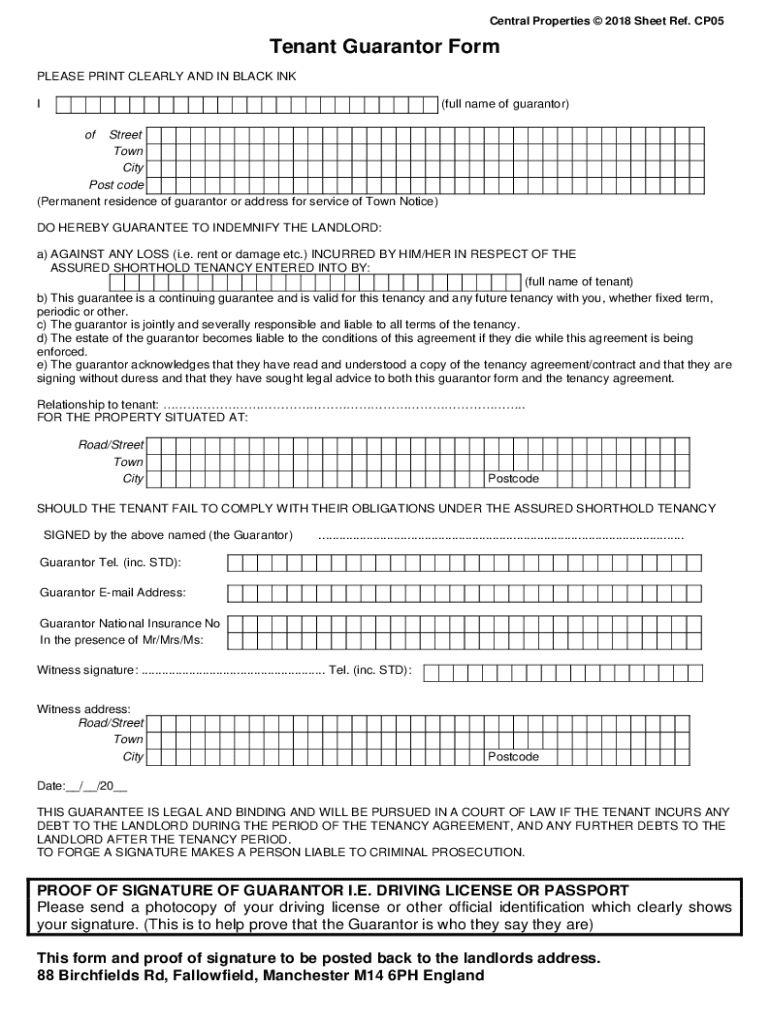

Understanding the Tenant Guarantor Form: A Comprehensive Guide

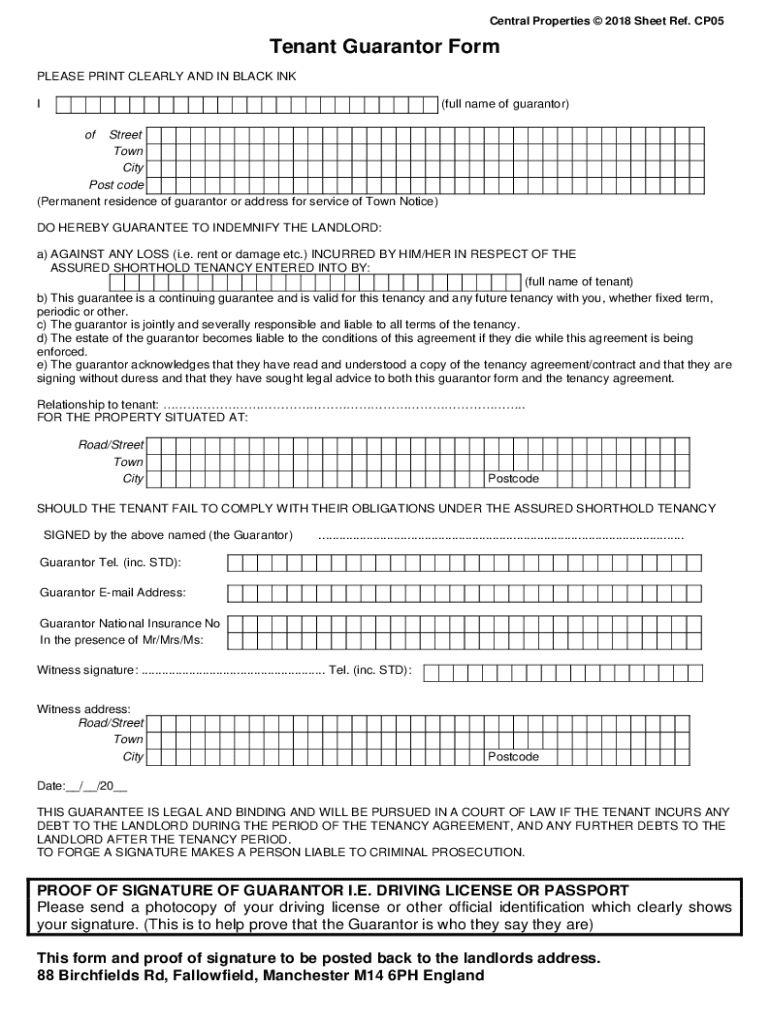

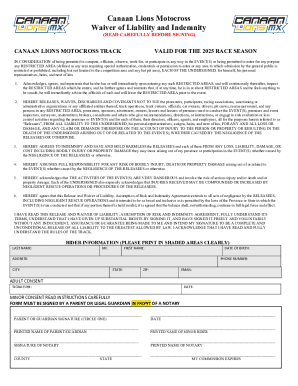

What is a tenant guarantor form?

A tenant guarantor form is a legal document that establishes a third-party individual's responsibility to cover a tenant's financial obligations, particularly rent payments. This form is often utilized by landlords when a tenant's financial status does not meet the criteria for leasing a property independently, typically requiring validation of income, creditworthiness, and stability.

The primary purpose of the tenant guarantor form is to provide landlords with a safety net. It assures them that should the tenant default on their rental payments, the guarantor will fulfill the financial obligations, thereby minimizing risks associated with non-payment or lease violations.

When is a tenant guarantor form necessary?

A tenant guarantor form is particularly crucial in several situations: when a tenant has a low credit score, unstable employment history, or insufficient income to cover rent, a guarantor can bridge the gap. These forms are vital for individuals who are new to renting, such as students or young professionals, who may not yet have an established credit history.

Signs that indicate the necessity for a guarantor include repeated rental rejections, the need for co-signers to meet lease requirements, or exceeding a landlord’s debt-to-income ratio threshold. Utilizing a guarantor can be essential in safeguarding rental agreements, especially for higher-risk tenants.

Who can be a guarantor?

Not just anyone can act as a guarantor; specific eligibility criteria must be met. Generally, a guarantor should have a stable income, good credit history, and a strong understanding of the obligations they are assuming. Common misconceptions include the belief that only family members can be guarantors. Friends or professional guarantors, such as real estate agents, can also provide this service.

Legal obligations of a guarantor can vary by jurisdiction and should be fully understood before signing. Engage in open discussions about responsibilities to preserve relationships and establish clear expectations.

What are the responsibilities of a guarantor?

The tenant guarantor form explicitly outlines the financial responsibilities of the guarantor, including agreeing to cover unpaid rent, damages, and potential legal fees arising from eviction proceedings. If the tenant defaults, the guarantor becomes liable to settle those debts, which can substantially impact their financial stability.

Understanding the rights and limitations as a guarantor is equally important. While the guarantor can demand information about the tenant's payments, they typically have reduced interference in tenant-landlord relationships, barring a failure to meet financial commitments. This balance seeks to protect both parties involved.

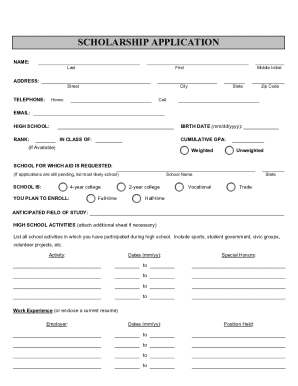

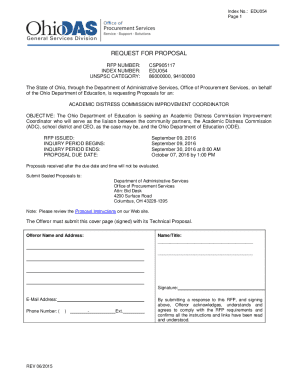

Key details included in a guarantor agreement

When drafting a tenant guarantor form, ensure it contains several key components. These typically include personal details of both tenant and guarantor, the financial responsibilities outlined distinctly, and the specific lease duration. Clearly delineating timeframes and conditions for the agreement can prevent misunderstandings and facilitate smoother interactions among landlords, tenants, and guarantors.

How to fill out the tenant guarantor form

Completing a tenant guarantor form may seem daunting, but breaking it down into manageable steps ensures accuracy. Begin by filling out personal identification details, confirming that all information is current and accurate. Next, discuss the financial obligations with the tenant to set clear expectations. Ensure both parties understand the implications of signing the form, as it will become a legally binding contract.

Common pitfalls include leaving sections incomplete or misrepresenting financial statuses. Avoid these mistakes through double-checking all entries and communicating openly about the terms involved. Clear and precise wording strengthens the agreement while preventing potential misunderstandings.

Editing and managing the tenant guarantor form

Managing your tenant guarantor form digitally provides an efficient way to keep track of obligations. Using platforms like pdfFiller, you can edit existing PDFs easily, ensuring that any changes in circumstances are captured. The interactive tools offered enable users to fill, sign, and share the document, all within a secure cloud-based environment.

eSigning features further streamline the process, allowing for rapid execution without the need for physical documents. This not only saves time but also ensures that necessary parties can efficiently submit and receive documents, enhancing the overall rental experience.

Frequently asked questions about guarantors

One common query pertains to the duration of a guarantor's responsibility. Generally, a guarantor remains liable until the tenant successfully fulfills the lease, unless otherwise specified in the agreement. Additionally, many wonder if a guarantor can be released from their obligations. This largely depends on specific terms discussed in the form, which can include conditions for release.

Furthermore, disputes can arise between tenants and guarantors regarding financial obligations or damages. In such cases, having a clearly defined tenant guarantor form can facilitate resolution. Open communication alongside the established agreement can help in resolving any misunderstandings.

Related resources for landlords and tenants

Many additional documents intertwine with the tenant guarantor form within the rental process. Considering other forms, such as tenancy agreements and rental applications, can provide a broader context of responsibilities for both parties. Resources featuring tenant rights and landlord obligations can help navigate any challenges that arise, making them invaluable for tenants seeking understanding.

For enhanced support, platforms such as pdfFiller provide access to customer support specialists who can guide you through the management of significant documents, ensuring you feel empowered in all dealings regarding your rental agreements.

Additional tools for managing rental documents

Leveraging digital platforms like pdfFiller allows individuals to track and manage documents seamlessly. Tracking features enable both tenants and guarantors to maintain an overview of rent payments and records, thereby preventing potential disputes and misunderstandings regarding finances. The Rent Tracker tool, in particular, allows users to monitor payments comprehensively, ensuring timely adherence to obligations.

For new renters seeking guidance, educational resources offered on user-friendly platforms can enhance the overall experience. The information shared through reliable sources ensures that all involved parties understand their respective responsibilities clearly before entering into any rental agreements.

Key features of pdfFiller

pdfFiller stands out as a cloud-based solution for document creation and management, specifically aimed at simplifying interactions for tenants and guarantors. Its features enable users to create documents, store them electronically, and access them anytime from anywhere, making it an ideal choice for busy individuals managing tenants or rental properties.

The platform also facilitates seamless collaborations for teams handling rental documentation, ensuring that everyone involved stays informed and engaged throughout the process. By streamlining the documentation process, pdfFiller upholds its commitment to simplifying tenants' experiences while effectively managing all necessary forms, including the vital tenant guarantor form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tenant guarantor form for eSignature?

How can I fill out tenant guarantor form on an iOS device?

How do I complete tenant guarantor form on an Android device?

What is tenant guarantor form?

Who is required to file tenant guarantor form?

How to fill out tenant guarantor form?

What is the purpose of tenant guarantor form?

What information must be reported on tenant guarantor form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.