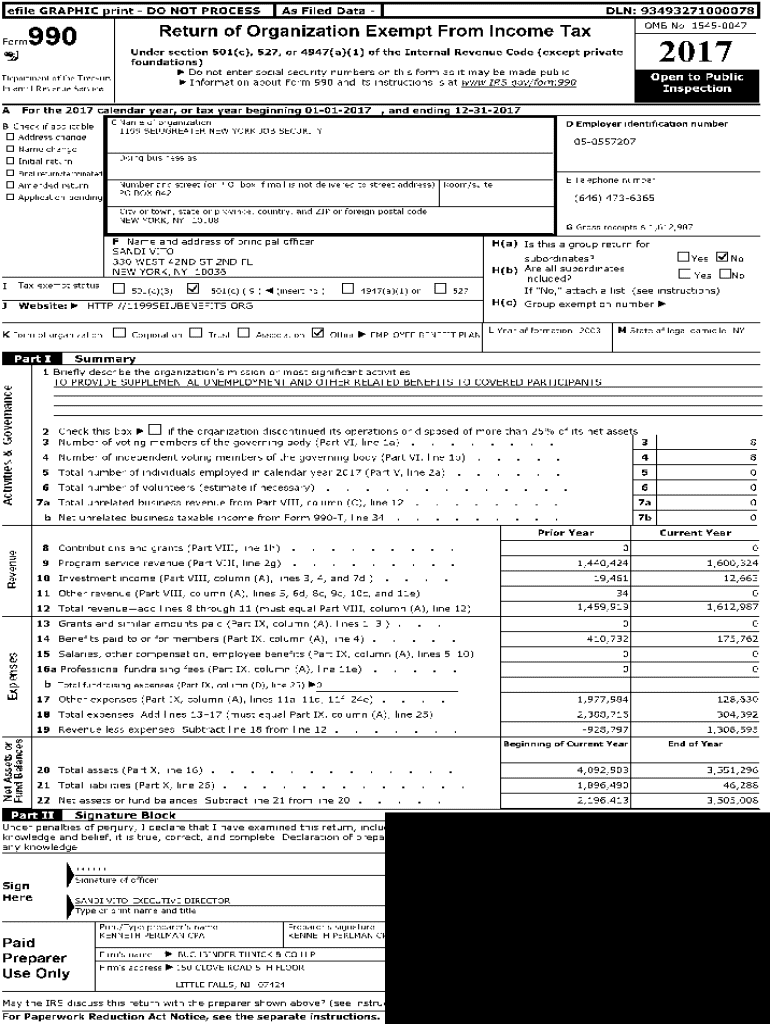

Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Guide to Understanding and Completing Form 990

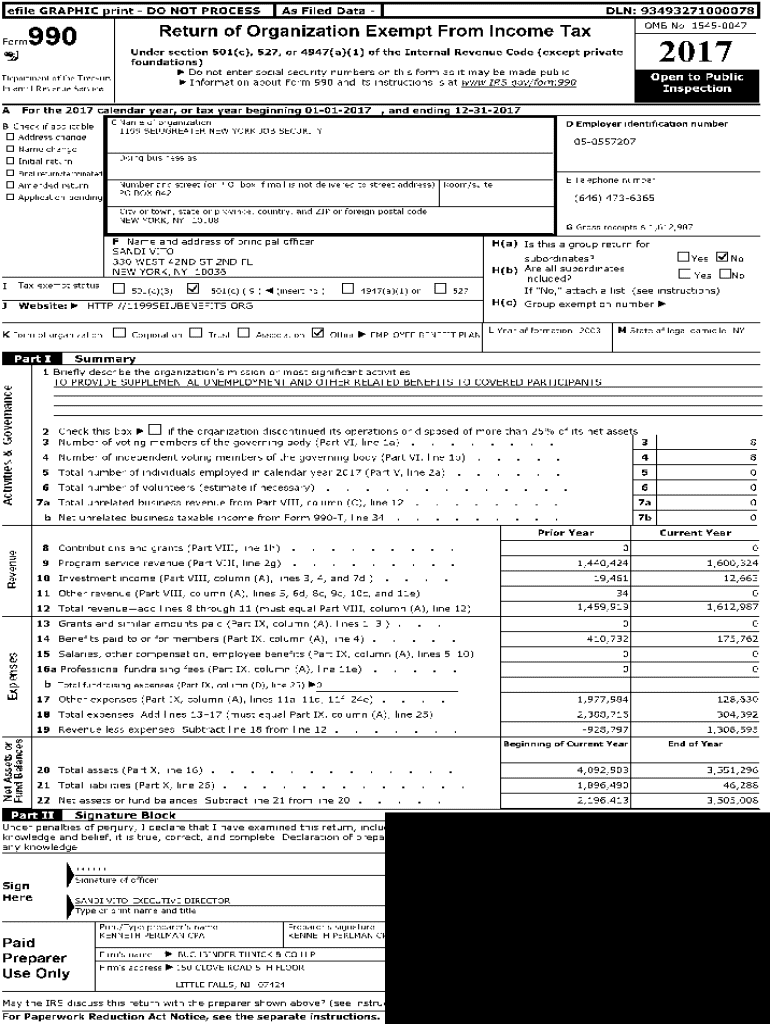

Understanding Form 990: An overview

Form 990 is a crucial document that nonprofit organizations in the United States must file annually with the Internal Revenue Service (IRS). This form provides a detailed overview of the organization’s financial information, governance policies, and operational activities. Its primary purpose is to ensure transparency and accountability within the nonprofit sector. By elucidating an organization's revenue, expenditures, and program accomplishments, Form 990 serves not just as a compliance tool but also as a valuable resource for potential donors and stakeholders who seek to assess the effectiveness and reliability of a nonprofit.

The importance of Form 990 cannot be overstated. It helps protect an organization’s tax-exempt status, which hinges on the accurate reporting of financial data. Nonprofits that fail to file correctly may face penalties or even a revocation of their tax-exempt status. Eligibility to file Form 990 generally includes organizations exempt from federal income tax under Section 501(c)(3) of the Internal Revenue Code, as well as various other 501(c) organizations. However, certain small organizations with annual gross receipts under a specific threshold may be eligible to file a simpler version, Form 990-EZ or the e-Postcard, Form 990-N.

Key components of Form 990

Understanding the structure of Form 990 is essential for effective completion. The form consists of various parts that provide comprehensive insights into an organization’s operations. Each section is designed to gather specific information, necessary for both compliance and transparency, including:

Interactive tools for simplifying the Form 990 process

Navigating Form 990 can be daunting, but a variety of interactive tools are available to streamline the process. For example, online calculators help organizations estimate projected income and expenses, which can greatly aid in planning and reporting accuracy. Additionally, step-by-step guides and templates are very useful when completing each section, ensuring that details are captured correctly.

pdfFiller offers various forms of assistance that enhance document management efforts. Their tools not only help simplify the completion of Form 990 but also provide functionalities for editing and securing documents. From interactive checklists that remind users of required sections to feature enhancements that allow for easy merging of data into the form, pdfFiller supports organizations in filing with confidence and accuracy.

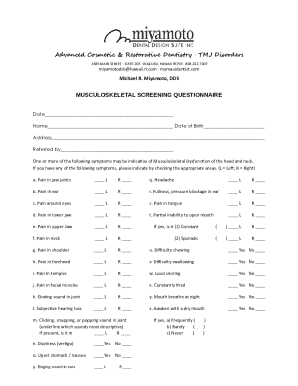

Detailed instructions for filling out Form 990

Filling out Form 990 involves several crucial steps to ensure completeness and accuracy. The first step is gathering necessary documentation, which includes financial statements, IRS determination letters, and minutes from board meetings. These documents serve as the foundation for accurately reporting the organization’s activities and financial standing.

The second step consists of completing the form section by section. Attention to detail is paramount to avoid common pitfalls like misunderstanding terms or misclassifying revenues. Organizations should focus on compliance with IRS guidelines to ensure accurate reporting. Once the form is completed, it’s advisable to review and edit for clarity and accuracy. pdfFiller’s editing tools can greatly aid in this process, facilitating corrections or updates quickly. Finally, after the final reviews, organizations must sign and submit the form within the compliance deadlines to avoid potential penalties.

Best practices for managing document compliance

Staying organized and timely in submitting Form 990 is critical. Setting reminders for annual filing deadlines can help ensure that all necessary documents are prepared and reviewed well in advance. Utilizing cloud-based storage systems is highly recommended as it allows organizations easy access to relevant finances and records anytime, anywhere. This practice not only supports collaboration among team members but also aids in maintaining a historical record of previous years’ Form 990 submissions, which can prove invaluable during audits or future filings.

Moreover, organizations should regularly review their governance practices and financial policies to ensure ongoing compliance with IRS regulations. Conducting periodic internal audits may help organizations identify areas that need attention or improvement, thus ensuring their Form 990 accurately reflects their operational health and qualifications.

Navigating changes in IRS regulations and reporting requirements

The landscape of IRS regulations is always evolving, and keeping up-to-date with changes to Form 990 requirements is crucial for compliance. Recent updates have included changes to reporting thresholds and various required disclosures. Organizations must stay informed about these changes through reliable sources, such as IRS announcements, nonprofit resources, and legal advisories. Being proactive about understanding modifications ensures that organizations can adapt their reporting accordingly.

pdfFiller assists users by offering real-time updates to document templates. By utilizing their platform, organizations can quickly incorporate necessary changes into their forms, ensuring compliance with the latest regulations without the cumbersome task of starting from scratch.

Exploring additional resources for nonprofits

Organizations seeking further support can access a range of additional resources tailored for nonprofits. Several nonprofit support organizations provide guidance on compliance and reporting, offering tools and insights on effectively managing Form 990. This includes educational webinars and workshops that focus on the intricacies of nonprofit compliance, which are often insightful for understanding best practices.

Online community forums serve as an excellent platform for sharing experiences and challenges related to Form 990. Engaging with peers in similar fields can foster knowledge exchange and offer practical tips. Being connected to a network of nonprofits also enables organizations to better navigate the nonprofit landscape.

Your roadmap to success in using Form 990

Achieving success with Form 990 filings hinges on maintaining financial transparency and accountability. Organizations that excel in this area often improve public trust and increase funding opportunities from donors who prioritize transparency in their philanthropic actions. Hence, proactively demonstrating how funds are utilized and how the organization's programs impact the community can create a positive impression.

Implementing best practices in Form 990 filings enables organizations to reinforce good governance and promote greater understanding of their operational impact. Additionally, ensuring clarity and accuracy in reporting can facilitate stronger relationships with stakeholders, ultimately leading to a more engaged and supportive community.

Frequently asked questions about Form 990

Several inquiries frequently arise concerning Form 990, often revolving around filing processes, correcting mistakes, and understanding deadlines. For instance, many organizations ask how to handle amendments if they discover errors in submitted forms. The IRS provides specific guidelines on how to amend Form 990, which generally includes filing a corrected return with the appropriate changes highlighted.

Another common question relates to understanding deadlines; organizations must file Form 990 by the 15th day of the 5th month after the end of their accounting period. Consulting expert resources can provide clarification on these complex topics, ensuring nonprofits can navigate the intricacies of Form 990 without undue stress.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 990 to be eSigned by others?

Where do I find form 990?

Can I edit form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.