Tax Invoice Template Form: A Comprehensive Guide

Understanding tax invoices

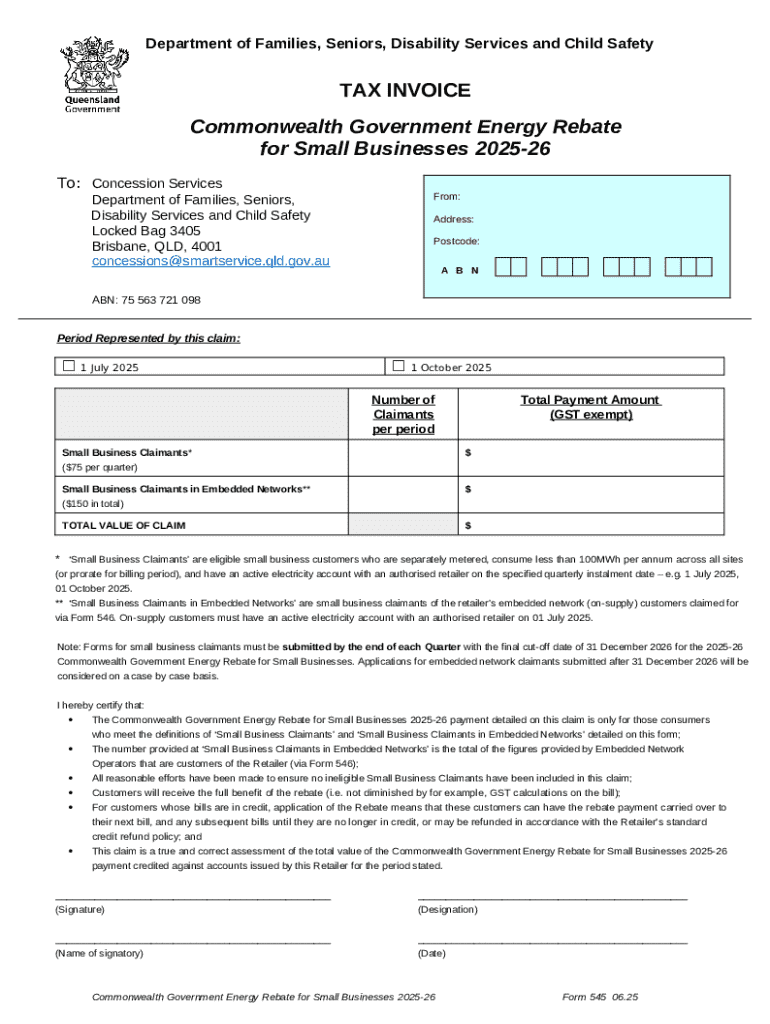

A tax invoice is a detailed document issued by a seller to a buyer, documenting the sale of goods or services and the tax associated with that sale. As an essential element of business transactions, tax invoices ensure that both parties acknowledge the payment and the relevant tax obligations. In many jurisdictions, tax invoices are required to be issued for transactions above a certain threshold.

The importance of tax invoices cannot be overstated, as they serve not only as proof of a transaction but also facilitate the process of tax reporting and compliance. Key components typically included in a tax invoice are the seller's and buyer's contact information, descriptions of goods or services sold, the tax rate applied, total amount due, and payment terms.

Getting started with tax invoice templates

Tax invoice templates provide a structured format that helps businesses produce professional-looking invoices quickly and efficiently. These templates are designed to incorporate all necessary elements of a tax invoice, making the invoicing process straightforward and less prone to errors.

Utilizing a tax invoice template offers numerous benefits. First, it saves time by eliminating the need to create invoices from scratch. Secondly, templates can ensure compliance with tax regulations, reducing the risk of errors that could result in penalties. Furthermore, templates can be easily customized to reflect your brand identity.

Save time with a structured format.

Reduce errors and ensure compliance.

Easily customizable to reflect branding.

Features of the ideal tax invoice template

An ideal tax invoice template should cover all essential elements that confirm the validity of the transaction. At a minimum, it should include your company information, such as the name, address, and contact details, alongside tax identification numbers. This ensures that both sender and receiver are properly identified for tax purposes.

In addition to basic identifying information, essential components include detailed item descriptions and pricing, including any quantity, unit price, and the total amount due. Payment terms outline when payment is due and any penalties for late payments. The flexibility to customize templates—like uploading company logos, selecting appropriate color schemes, and formatting options—is also crucial for businesses looking to present themselves professionally.

Company Contact Information.

Tax Identification Numbers.

Detailed Item Descriptions and Pricing.

Total Amount Due and Payment Terms.

How to access and use pdfFiller's tax invoice template

Accessing pdfFiller's tax invoice template is straightforward and user-friendly. Start by navigating to the pdfFiller website, where you can browse or search for the tax invoice template. By clicking on the desired template, you initiate the editing process.

Once inside the pdfFiller interface, you'll find various editing tools that allow for easy customization of your template. This includes adding your business details, modifying line items, or making layout adjustments to meet your specific needs.

Filling out your tax invoice: a detailed process

Before filling out your tax invoice, ensure you have all the necessary information. Start with your company information, including your logo, name, address, and tax identification number, as this portion should be professional and clear. Next, add client details accurately, including their full name, company name, address, and contact information.

When listing products or services, be thorough but concise. Clearly describe each billable work item, including quantities and rates. For example, 'Consulting Services - 10 hours at $100/hour.' To enhance clarity, consider including any discounts applied and calculations of taxes in an easy-to-understand format. Finally, review your invoice before finalizing, ensuring that all amounts and terms align correctly with your agreement.

Prepare your company information.

Thorough listing of products or services.

Review calculations for accuracy.

Managing your tax invoices effectively

After successfully creating your tax invoice, it’s crucial to manage it effectively. Save your customized template within the pdfFiller platform for future use, ensuring consistency in all your invoicing. Keep your invoices organized in designated folders for easy access and retrieval; this minimizes the time spent searching for past documents.

Utilizing pdfFiller's tools allows you to track invoices sent to clients, monitor payment statuses, and set reminders for follow-ups. When sending invoices, you can email them directly from pdfFiller or use other sharing options for collaborative feedback during the approval process.

Save customized templates for reuse.

Organize invoices in folders.

Track invoices and payment statuses.

Email directly from pdfFiller for convenience.

Region-specific tax considerations

Tax regulations vary significantly between countries and regions, impacting how tax invoices must be generated and formatted. It is vital for businesses to understand the specific tax requirements applicable to their location, including VAT or sales tax obligations, and how these affect invoicing practices.

When using tax invoice templates, businesses can customize them to comply with local regulations. This may include adjusting tax calculations based on jurisdiction, ensuring the required terms and phrases for compliance are included, and adapting the invoice layout to meet local standards.

Understand local tax regulations.

Customize templates for compliance.

Adapt layout to meet regional standards.

Industry-specific tax invoice templates

Different industries may have unique requirements for tax invoices, necessitating tailored templates. For example, the construction industry might require detailed breakdowns of labor and materials, while creative agencies might focus more on project descriptions and milestones.

Recognizing these distinct needs can help businesses enhance their invoicing process. By utilizing or adapting templates that consider industry specifics, businesses can present invoices that align closely with clients' expectations and industry standards.

Tailor templates for unique industry needs.

Enhance invoicing processes for client satisfaction.

Present invoices aligned with industry standards.

Frequently asked questions (FAQs)

Disputes over invoices can arise and should be addressed promptly to maintain client relationships. When a client disputes an invoice, respond calmly, review the details, and clarify any misunderstandings regarding charges. Adjustments may be made if necessary, with clear communication ensuring both parties understand the agreed terms.

Tax rates may need adjustments based on higher or lower rates set by governing bodies. Ensure that your templates are easily editable, allowing for quick changes to remain compliant with tax regulations without hassle. Legal requirements for tax invoices often vary by region, so familiarize yourself with local laws to ensure compliance.

Address invoice disputes promptly.

Make adjustments to tax rates easily.

Understand local legal requirements for invoices.

Advanced tips for getting paid faster

Invoicing is not just about sending bills; it involves strategic practices to ensure timely payment. Best practices include sending invoices as soon as services are rendered or goods delivered, ensuring that terms are clearly stated, and formatting invoices professionally.

Offering various payment options can significantly enhance the likelihood of quick payments. Include payment methods like credit/debit cards, PayPal, or bank transfers. Setting clear payment terms—whether 'Net 30', 'Due Upon Receipt', or '2% discount if paid in 10 days'—can provide clients with clear guidelines prompts for timely payments.

Send invoices promptly after service completion.

Clearly state payment terms.

Offer multiple payment options.

Exploring more template options

pdfFiller offers a variety of invoice templates beyond tax invoices. Depending on your specific business needs, you can access invoice templates suited for receipts, quotations, purchase orders, and more. Having access to diverse templates allows businesses to adapt their document strategies as they grow.

For those on a budget, pdfFiller also provides free invoice templates that are easy to customize. These templates can be an excellent starting point for new businesses or freelancers who may not want to invest in premium features immediately. Customizing templates for different document types can enhance brand consistency across all business communications.

Access a variety of templates on pdfFiller.

Explore free options for budget-conscious users.

Maintain brand consistency in all communications.

Collaborating with your team

Effective collaboration is essential when managing documents like tax invoices. pdfFiller provides functionality that allows teams to manage document permissions, enabling you to control who can edit, view, or share invoices. This is especially important for maintaining the integrity and confidentiality of sensitive financial information.

Utilizing collaborative tools also enables real-time feedback from team members. With pdfFiller, teams can comment on specific parts of invoices, make suggestions for changes, and track edits. This enhances teamwork and allows for better-quality invoices that address all aspects of the business need.

Manage document permissions effectively.

Enable real-time collaboration for feedback.

Track changes and edits seamlessly.