Get the free Monthly Return of Transient Room Tax

Get, Create, Make and Sign monthly return of transient

Editing monthly return of transient online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monthly return of transient

How to fill out monthly return of transient

Who needs monthly return of transient?

Monthly Return of Transient Form: A Comprehensive Guide

Understanding the monthly return of transient form

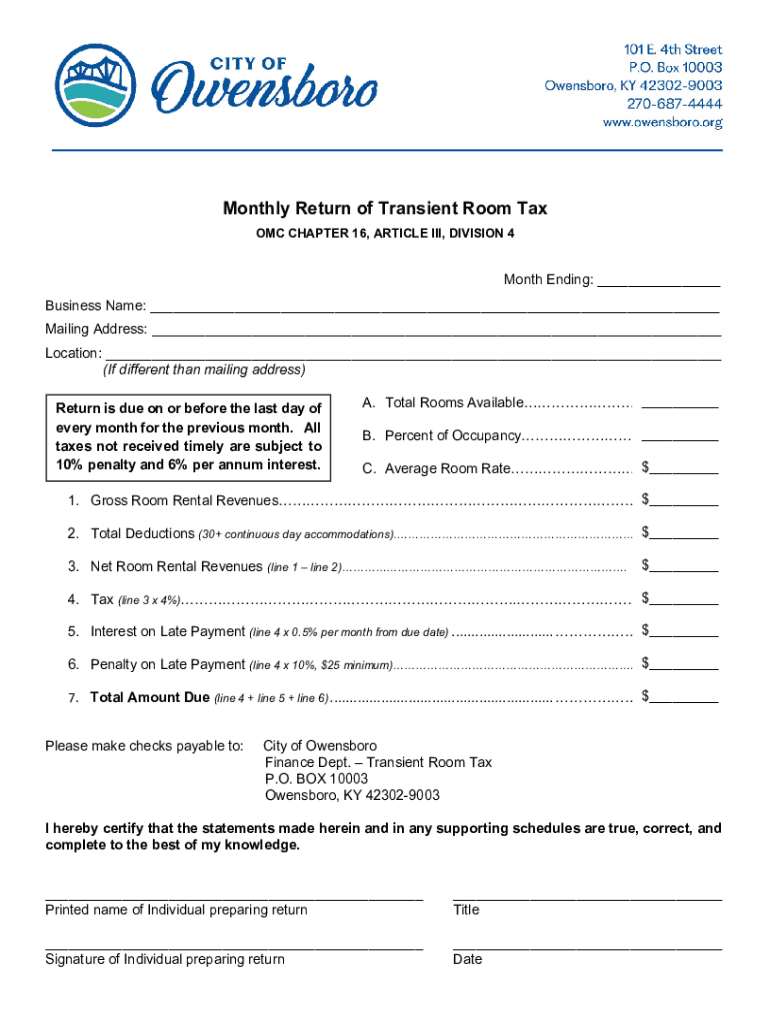

The Monthly Return of Transient Form is a critical document for lodging an accurate assessment of transient room tax. Transient room tax is levied on short-term rentals, a practice that has gained popularity with the rise of platforms like Airbnb. This tax is typically a percentage of the rental fee paid by guests in a transient occupancy. Filing this form is essential for compliance, ensuring that property owners and managers meet legal obligations and contribute to local government revenues.

Submitting the Monthly Return of Transient Form is crucial for both state revenue and the proper functioning of local governments. It facilitates a fair tax structure to support community resources, tourism initiatives, and infrastructure projects among other public services. Generally, businesses operating short-term rentals—including hotels, motels, and private vacation rental companies—are responsible for completing this form.

Key components of the monthly return of transient form

The Monthly Return of Transient Form comprises several essential sections that streamline the tax reporting process. Key components include taxpayer information, reporting period, room rent details, and exemptions or deductions. Each section plays a vital role in ensuring accurate data is recorded and submitted.

In the Taxpayer Information Section, users must provide their name, address, and taxpayer identification number. The Reporting Period section specifies the month being reported. Room Rent Details are where the total income from transient rentals is recorded, while exemptions and deductions might allow certain credits based on local regulations. Ensuring each of these sections is filled accurately is critical for compliance and tax calculations.

Step-by-step guide to completing the monthly return of transient form

Completing the Monthly Return of Transient Form is a structured process that can be streamlined for efficiency. Begin with Step 1: Gathering Necessary Information. Key documents include rental agreements, records of payment received from guests, and details of any exemptions or special deductions related to local governance.

Next, in Step 2, Filling Out the Form, you should complete each section with precision. For the Taxpayer Information portion, ensure all details are current and correct. Documenting the Reporting Period accurately helps in aligning your submitted data with local tax records. In the Room Rent Details section, include gross rents collected before any deductions. In Step 3, it’s vital to review your entries carefully. A checklist can be helpful for verifying accuracy. Finally, in Step 4, consider how you'll submit the form—online submissions are often more efficient, but traditional mail is also an option.

Interactive tools and resources

Utilizing online tools can enhance the experience of preparing and submitting the Monthly Return of Transient Form. Online calculators can aid in estimating transient room tax based on your reported figures, ensuring that you budget accurately for tax obligations. Additionally, accessing examples of completed forms can provide clarity on what a properly filled-out form looks like, making your form preparation more straightforward.

Furthermore, a dedicated FAQ section related to the Monthly Return of Transient Form is invaluable. Here, common questions about exemptions, filing processes, and common mistakes are addressed, helping users navigate potential issues seamlessly.

Managing your submissions

Staying organized is essential when managing your submissions related to the Monthly Return of Transient Form. Maintaining meticulous records helps you track taxable income and ensures you can substantiate your reported figures in case of audits. Utilize cloud-based platforms for accessibility to your records.

Tracking your submissions online allows for quick check-ins in case of discrepancies. If you notice mistakes in your submission, promptly contact the relevant authority to initiate corrections, as timely rectification can prevent penalties.

Relevant legislative changes affecting the monthly return of transient form

Legislative changes can significantly impact the framework governing the Monthly Return of Transient Form. Recent updates, such as House Bill 8, have adjusted the regulations surrounding transient room tax collection and submission processes, which may affect filing dates and tax rates. Staying updated about these changes is imperative for compliance.

It’s essential to review how these changes might influence your submission process and whether new requirements have been introduced. Looking ahead, additional legislation may emerge in response to evolving tourism trends and economic needs, highlighting the importance of ongoing education about local tax laws.

Upcoming deadlines and compliance tips

Filing deadlines for the Monthly Return of Transient Form are often set at the end of each month, requiring strict adherence to ensure compliance. Understanding these timelines is crucial—late submissions can incur penalties that vary by jurisdiction. Some areas may even impose interest fees on unpaid taxes.

To maintain compliance throughout the year, establish a routine for tracking rental income and expenses. Utilizing a digital platform can simplify this process by providing reminders about upcoming deadlines and recording tax obligations seamlessly.

Leveraging pdfFiller for your monthly return of transient form needs

pdfFiller provides an efficient platform for managing your Monthly Return of Transient Form. Its smooth PDF editing capabilities and electronic signing process enable you to handle filings promptly and securely. Cloud-based accessibility means that whether working individually or as part of a team, all users can collaborate on documents from remote locations.

To get started with pdfFiller for completing this form, create an account by following a simple registration process. Once registered, use the user-friendly interface to access templates, edit required fields, and submit directly through the platform, making the entire experience seamless and straightforward.

Related forms and resources

Navigating tax submissions doesn't stop with the Monthly Return of Transient Form. Familiarizing yourself with related forms, such as the Transient Room Tax Exemption Form or the Registration Questionnaire, can provide more comprehensive oversight of your tax responsibilities and potential benefits under local regulations.

pdfFiller also offers a collection of related resources to assist you further in your tax-related filings, ensuring you can quickly access essential materials without hassle.

Community and support

As you embark on your journey to complete the Monthly Return of Transient Form, leveraging community support can immensely enhance your understanding and efficiency. Accessing user support for form completion can clarify complex regulations and answer specific questions that arise during the filing process. Joining community forums allows for the sharing of tips and experiences that can be beneficial when navigating the submission landscape.

For additional assistance, pdfFiller's dedicated support system is available to help with queries related to the Monthly Return of Transient Form. Reaching out for help at any stage ensures that you remain on track with your submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify monthly return of transient without leaving Google Drive?

How do I edit monthly return of transient straight from my smartphone?

Can I edit monthly return of transient on an Android device?

What is monthly return of transient?

Who is required to file monthly return of transient?

How to fill out monthly return of transient?

What is the purpose of monthly return of transient?

What information must be reported on monthly return of transient?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.