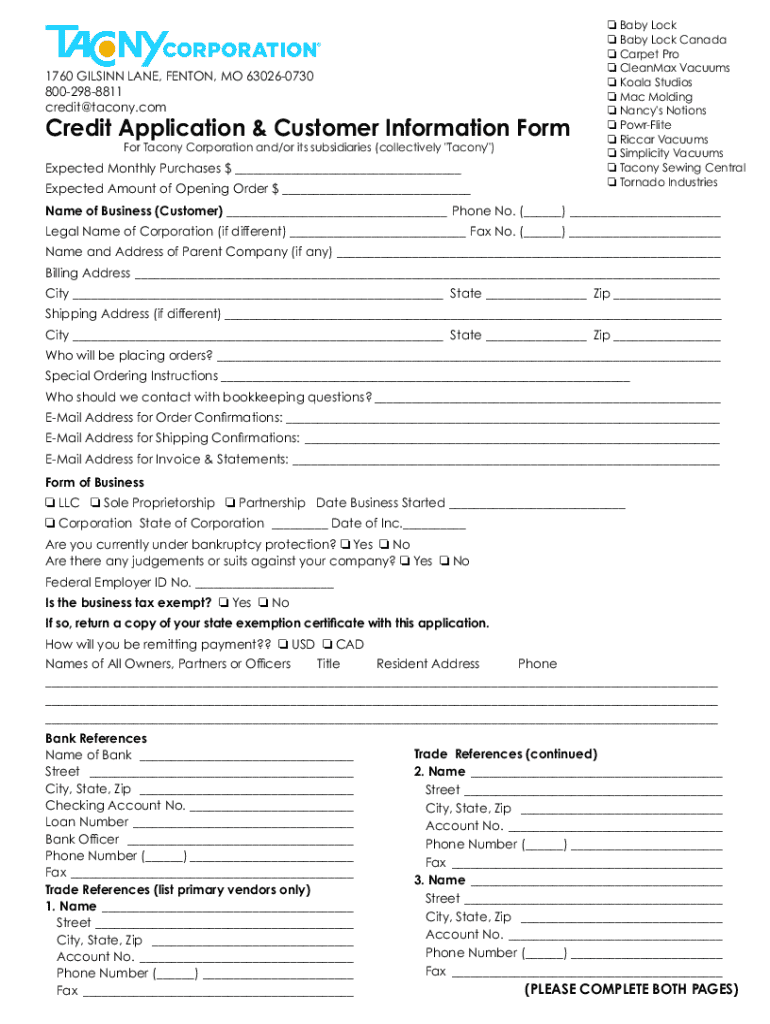

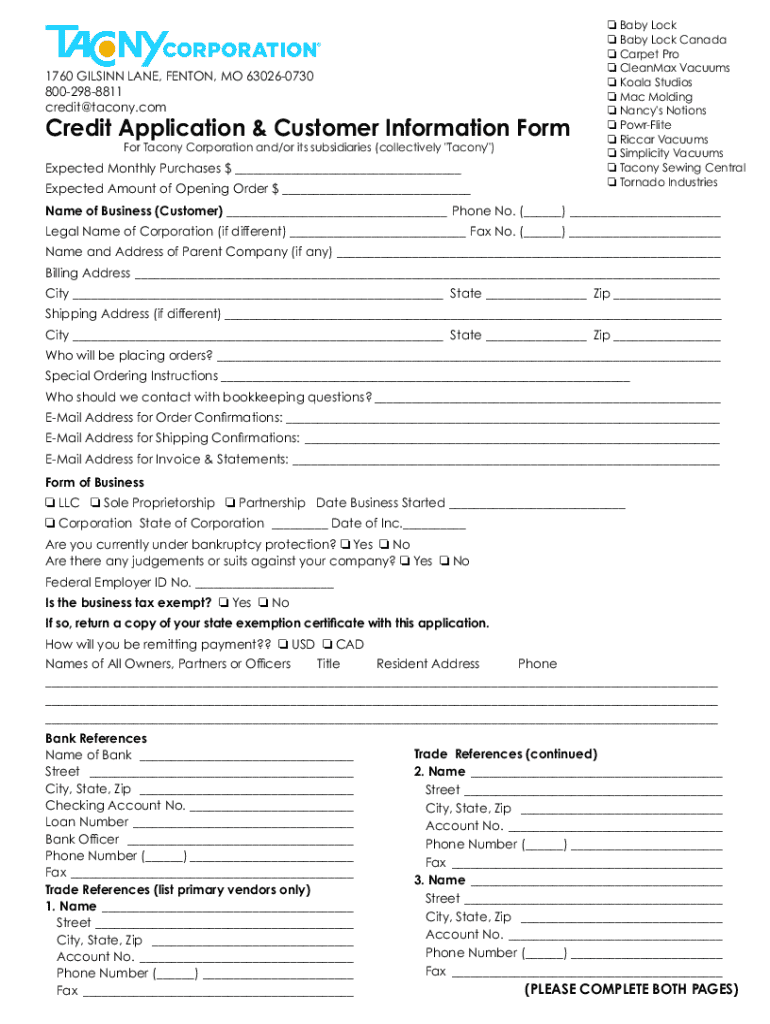

Get the free Credit Application & Customer Information Form

Get, Create, Make and Sign credit application customer information

How to edit credit application customer information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application customer information

How to fill out credit application customer information

Who needs credit application customer information?

Credit application customer information form - How-to guide long-read

Understanding credit application customer information forms

A credit application customer information form is a vital document used by lenders to assess the creditworthiness of individuals applying for credit. This form collects essential information, helping financial institutions determine if potential borrowers can handle additional debt. The accuracy of the customer information submitted in this form can significantly influence credit approval decisions.

Accurate and complete customer information is paramount. Incorrect or incomplete forms can lead to delays in processing applications or even outright denials. Hence, understanding the purpose and components of the credit application customer information form is essential for anyone looking to secure financial products such as loans or credit cards.

Key components of a credit application customer information form

The credit application customer information form consists of several key sections that gather comprehensive details about the applicant. Each section is crucial for the underwriting process and can impact the decision made by the lender.

Step-by-step guide to filling out the form

Filling out a credit application customer information form may seem daunting, but with the right approach, it can be navigated easily. By following these steps, you can ensure that you fill out the application correctly.

Interactive tools for enhanced accuracy

To streamline the filling process and enhance accuracy, tools like pdfFiller offer robust features. These tools not only simplify the form-filling process but also enhance user experience.

Common errors to avoid

When filling out a credit application customer information form, it’s easy to make mistakes. However, being aware of common pitfalls can help improve accuracy.

Editing and managing your credit application form

After submitting your credit application customer information form, you may find that you need to modify or correct certain details. Knowing how to efficiently edit and manage your forms is crucial.

Understanding the review process

Once submitted, your credit application customer information form will undergo review by the financial institution. It’s essential to grasp what happens next in this crucial stage of the lending process.

Resources for further assistance

Navigating the complexities of a credit application customer information form can be challenging. Accessing the right resources can provide the needed support to ensure successful completion.

Advanced tips and best practices

Applying for credit is a pivotal step in managing your financial future. Beyond just filling out a credit application customer information form, there are best practices that can help you bolster your credit profile.

Additional tools and templates

For individuals seeking templates and resources to ease the application process, leveraging additional tools and templates can save time and provide clarity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit application customer information directly from Gmail?

How do I complete credit application customer information online?

Can I edit credit application customer information on an Android device?

What is credit application customer information?

Who is required to file credit application customer information?

How to fill out credit application customer information?

What is the purpose of credit application customer information?

What information must be reported on credit application customer information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.