Get the free Minimum Required Distribution Request Form

Get, Create, Make and Sign minimum required distribution request

Editing minimum required distribution request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out minimum required distribution request

How to fill out minimum required distribution request

Who needs minimum required distribution request?

Your Comprehensive Guide to the Minimum Required Distribution Request Form

Understanding minimum required distribution (MRD)

A Minimum Required Distribution (MRD) is the minimum amount that a retirement plan account owner must withdraw annually, starting at a certain age. This requirement ensures that individuals do not solely rely on tax-deferred accounts for their retirement funds over excessive periods, which can lead to loss of tax revenue for the government. Understanding MRD is crucial for maintaining compliance with IRS regulations and ensuring long-term financial health.

Anyone with certain retirement accounts, such as Traditional IRAs and 401(k)s, is subject to MRD rules once they reach 72 years of age. Individuals should be aware of the implications of MRDs on their overall retirement strategy, especially as these distributions are subject to income tax. A solid grasp of MRD is essential for effective retirement planning and tax management.

Eligibility criteria for MRD

To be eligible for MRDs, account holders must reach age 72 (or 70½ if you were born before July 1, 1949). Different account types have varied specifications. For instance, Traditional IRAs, 401(k)s, and other defined contribution plans require MRDs, while Roth IRAs do not require withdrawals during the owner's lifetime. The type of retirement account influences how MRDs are calculated and when they begin.

Inherited accounts have distinct rules. Beneficiaries must generally take MRDs regardless of age. These distributions can affect tax implications significantly, making it essential for owners of inherited IRAs or 401(k)s to be mindful of the different guidelines.

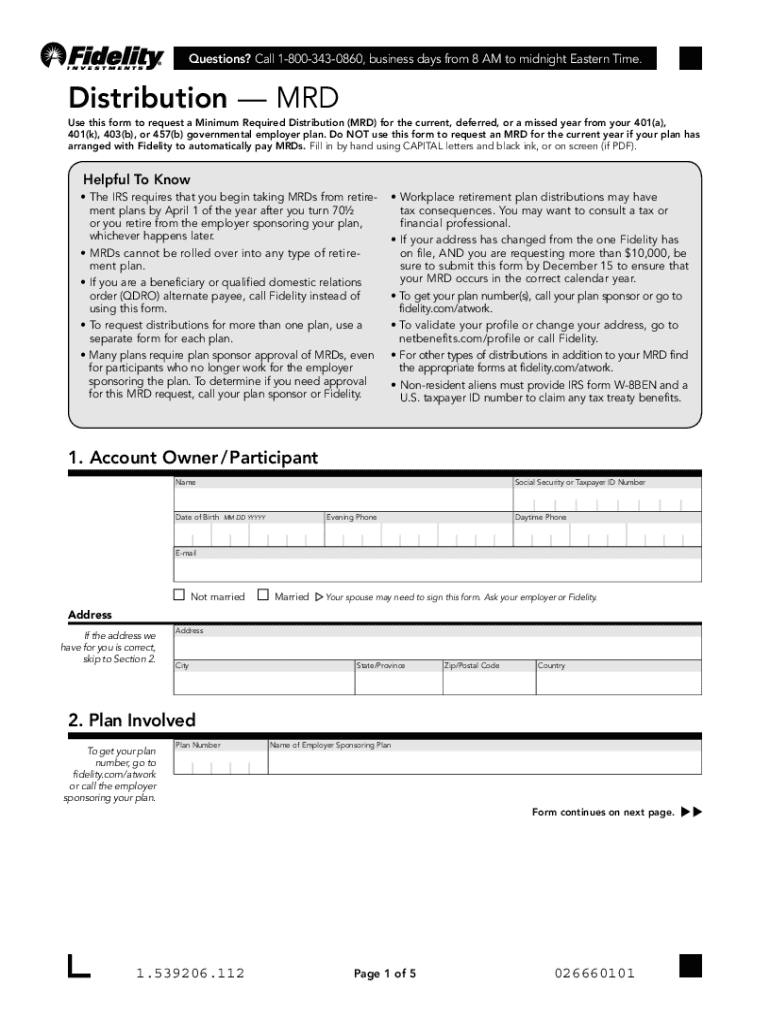

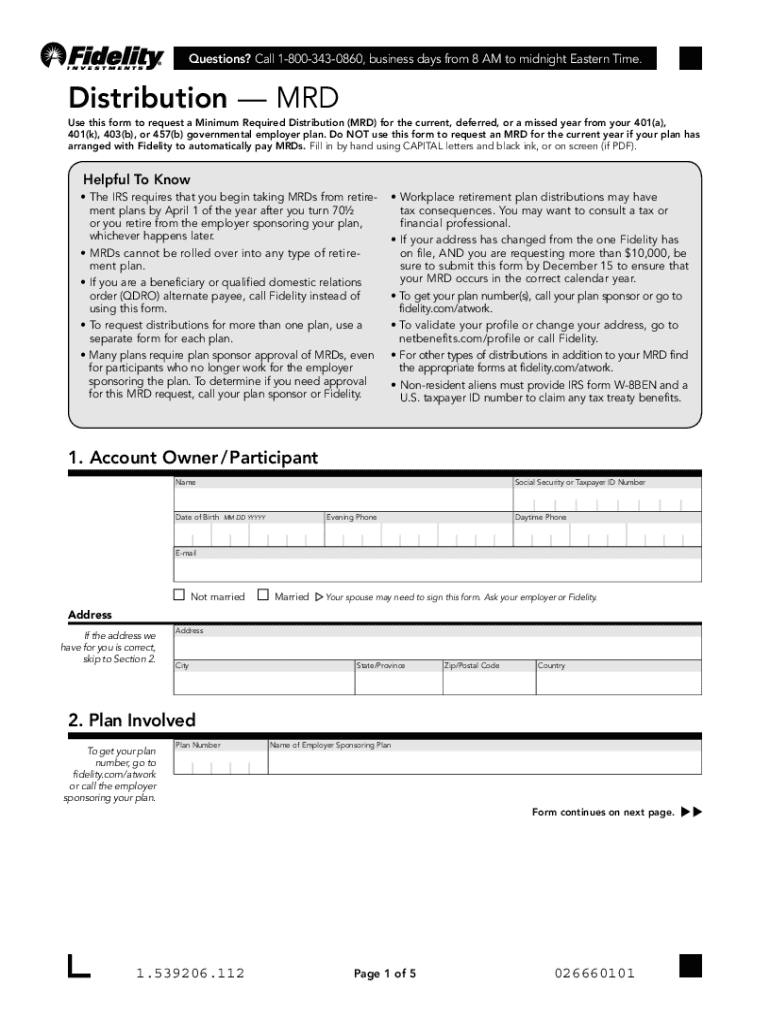

Preparing to complete the minimum required distribution request form

Before filling out the minimum required distribution request form, gather essential information. Personal identification, like your Social Security Number, will be required. Ensure you have all relevant account numbers, types, and specific tax documents that detail your previous distributions. Proper documentation is key to completing your form accurately and on time.

It’s also vital to understand the tax implications and potential penalties associated with missed MRDs. The IRS imposes a steep penalty — 50% of the amount not withdrawn — for failure to take the required distribution. This emphasizes the importance of being organized and proactive in your retirement planning.

Navigating the minimum required distribution request form

The minimum required distribution request form typically includes several key sections that require careful completion: Personal Information, Distribution Amount, Bank Information for Direct Deposits, and Withholding Preferences. Each section serves an essential function, so accuracy is paramount.

In the Personal Information section, accurately enter your name, address, and identification details. For the Distribution Amount section, you may need to calculate the appropriate amount based on your account balance and IRS tables. Provide your bank information for direct deposits to ensure funds reach you promptly. Finally, select your tax withholding preferences carefully, as these can impact your overall tax liability.

Interactive tools to facilitate MRD requests

pdfFiller offers several interactive tools that greatly simplify the MRD request process. Users can fill out forms directly on the site, utilizing PDF editing features that allow for easy data entry and corrections. Additionally, calculators are available that help determine the amount you need to withdraw based on your age and account balance. These tools help streamline the process and minimize errors.

Collaboration features allow multiple users to work together on document submissions, providing a seamless experience for teams managing several accounts. This enhances accuracy and efficiency while avoiding redundant efforts, making it an invaluable resource for individual and team-based users.

How to edit and customize your form

Editing your minimum required distribution request form on pdfFiller is straightforward. First, upload your completed form to the platform. From there, you can easily make changes to text fields, ensuring all information is accurate and up-to-date. Adding eSignatures is simple and secure, allowing you to finalize your request without the need for printing. You can also add notes or comments, which can be helpful for clarifying details.

Version control features allow you to save different iterations of your request, which can be beneficial when filing multiple MRDs over time. These aspects of pdfFiller provide significant flexibility and ease of use for managing necessary documents.

Submitting your minimum required distribution request form

Submitting the completed minimum required distribution request form can be accomplished through several avenues. Options include online submission directly via pdfFiller, mailing the form to your financial institution, or faxing it to the appropriate department. Each submission method has its pros and cons, so select the one that best fits your circumstances.

After submission, follow up to confirm receipt of your request, especially if you opted for mail or fax. Monitoring the status of your distribution ensures timely management of your funds and helps avoid any unnecessary tax penalties.

Managing your distribution requests and future planning

Keeping track of your past distributions is critical for effective financial management. Tracking your withdrawal history can help you plan future distributions more accurately. pdfFiller allows you to manage your documents and track submission statuses conveniently from a single platform, making it easier to plan your retirement strategy regarding future MRDs.

Additionally, consider integrating your MRD planning with broader financial goals, such as investments and savings. This holistic approach will ensure you remain compliant and fully benefit from your retirement accounts.

Common mistakes to avoid with MRD requests

Filling out the minimum required distribution request form is straightforward, but common pitfalls can lead to issues down the line. One prevalent mistake is incorrectly entering personal information, such as misspelled names or wrong Social Security Numbers. Errors in these areas can delay processing and cause serious complications.

Another mistake is miscalculating the required distribution amount. Always use the latest IRS life expectancy tables when determining your MRD. Furthermore, be sure to consider your tax withholding preferences carefully. Overlooking tax implications can lead to unexpected liabilities during tax season, emphasizing the need for caution and accuracy.

FAQs about minimum required distribution requests

Q: How often do I need to submit the form? A: MRD requests generally need to be submitted annually. However, if you have multiple accounts, ensure each institution has the appropriate documentation.

Q: What if I miss the deadline for MRD? A: Missing the deadline comes with significant penalties, so it’s crucial to act promptly. However, you may request a retroactive adjustment in certain circumstances. Consulting a tax expert is advisable.

Q: How can I change my previously submitted request? A: You can often change your request by resubmitting a new form with the updated information. Consult your financial institution for specific policies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my minimum required distribution request in Gmail?

How can I get minimum required distribution request?

Can I edit minimum required distribution request on an iOS device?

What is minimum required distribution request?

Who is required to file minimum required distribution request?

How to fill out minimum required distribution request?

What is the purpose of minimum required distribution request?

What information must be reported on minimum required distribution request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.