Get the free Cdtfa-890

Get, Create, Make and Sign cdtfa-890

How to edit cdtfa-890 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cdtfa-890

How to fill out cdtfa-890

Who needs cdtfa-890?

A Comprehensive Guide to the CDTFA-890 Form

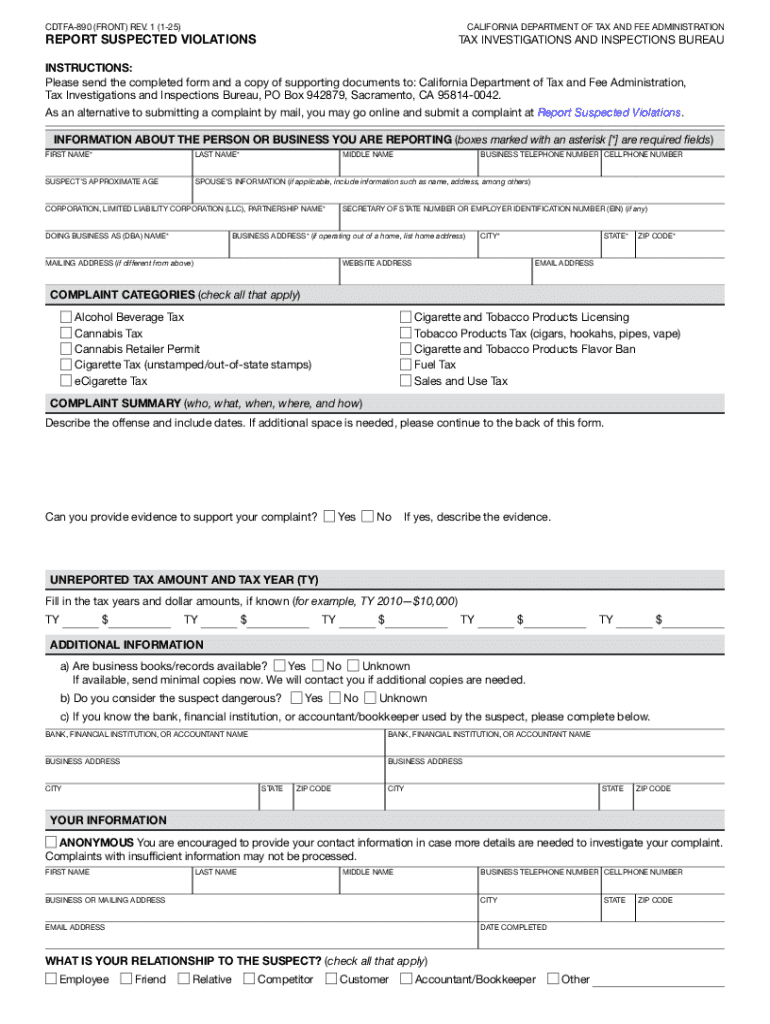

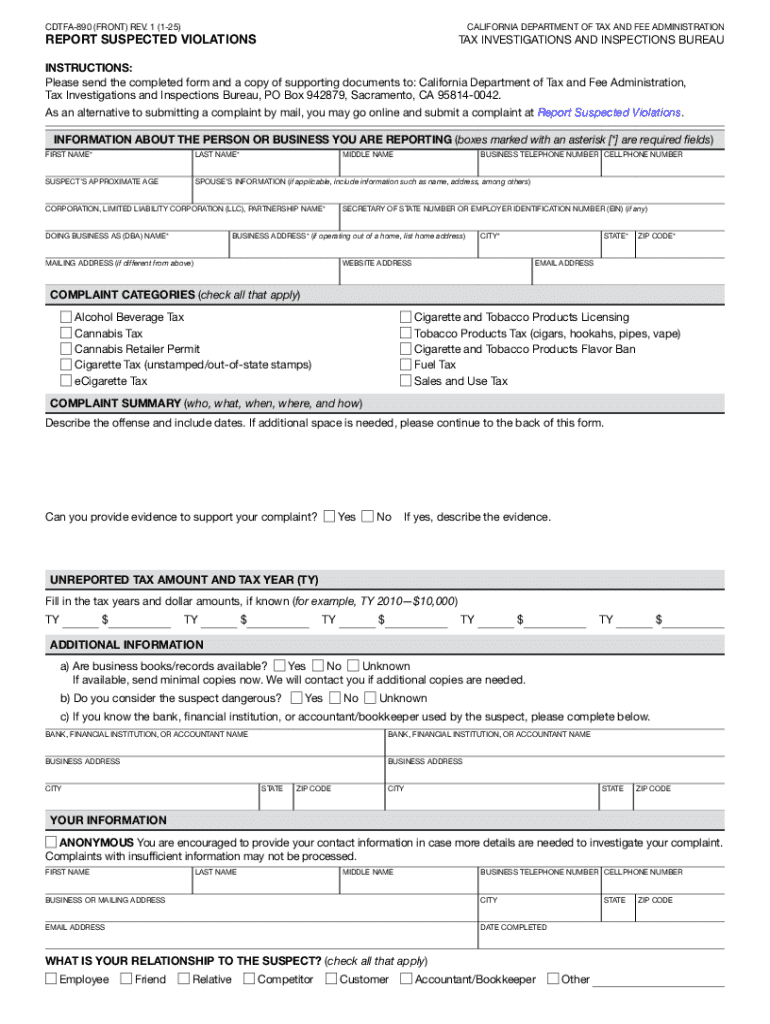

Understanding the CDTFA-890 Form

The CDTFA-890 Form is a crucial document for businesses operating in California. This form specifically addresses the needs of taxpayers when reporting their sales tax obligations to the California Department of Tax and Fee Administration (CDTFA). In essence, it serves as a declaration of sales and use tax collected and directly impacts a business's compliance with state tax laws.

Businesses registered in California that sell tangible products or certain services are typically required to fill out the CDTFA-890 Form. This ensures that they accurately report sales tax collected during a given reporting period, which can be monthly, quarterly, or annually, depending on the size of the business. Understanding the nuances of this form is vital for effective tax management.

The importance of the CDTFA-890 Form cannot be understated. It not only helps businesses remain compliant during audits but also prevents penalties associated with inaccurate reporting of tax dues. With California being home to myriad businesses, the CDTFA-890 Form acts as the cornerstone for efficient tax reporting and management.

Key features of the CDTFA-890 Form

The structure of the CDTFA-890 Form is designed to facilitate clarity and thoroughness. It is typically divided into specific sections, each addressing different aspects of sales tax reporting. Importantly, the form includes sections for both reporting sales data and providing detailed information about the business, ensuring a comprehensive approach to tax compliance.

Each section of the CDTFA-890 Form utilizes clear terminology that is vital for accurate reporting. Common terms include 'gross receipts,' which refers to the total amount of money received from sales prior to any deductions. Such definitions are critical, as errors in understanding can lead to misreporting and subsequent penalties.

Step-by-step instructions for filling out the CDTFA-890 Form

Filling out the CDTFA-890 Form doesn't have to be a daunting task. By taking a systematic approach, anyone can ensure they complete the form accurately and efficiently. The first step is to gather all necessary information and documentation, which can include sales records, receipts, and previous tax filings. Keeping these documents organized can significantly streamline the process.

Upon gathering the necessary documents, the next step involves completing the personal and business information sections of the form. This includes providing details such as the business name, address, and relevant tax identification numbers. Common pitfalls include failing to double-check entry fields, which could lead to inaccuracies in the submission.

Next, it's essential to accurately report sales tax data. This involves calculating the total sales and any applicable exemptions. Keep in mind that different sales tax rates may apply, so it’s advisable to review local rates closely. Including examples of your sales can help provide clarity when it comes to your tax obligations.

Lastly, ensure you include any additional information required by the CDTFA. This may encompass attachments or supplementary forms that provide further detail for your reported sales. Don't forget to sign and date your form, as failure to do so can lead to complications with your submission.

Editing your CDTFA-890 Form with pdfFiller

pdfFiller is an excellent tool for editing your CDTFA-890 Form online. Once you’ve downloaded the form, you can easily upload it to pdfFiller, which allows you to make any necessary corrections or updates without hassle. The platform’s editing tools are user-friendly and designed to enhance your document editing experience.

Using pdfFiller's suite of editing tools effectively can save you time and reduce errors. You can add text, highlight important sections, or erase unwanted text with ease. After making your changes, ensure that you save and store your document securely within the platform's cloud-based storage to prevent data loss.

eSigning the CDTFA-890 Form

One of the significant advantages of using pdfFiller is the ability to eSign your CDTFA-890 Form. Electronic signatures are not only convenient but also legally binding in California, aligning with e-Signature laws. Utilizing this feature eliminates the need for printing, signing, and scanning, making the process seamless.

To add your electronic signature, simply use the tools provided by pdfFiller to create and place your signature on the document. This not only saves time but also helps organize your filing process, allowing for quicker submission of your taxes.

Collaborating on the CDTFA-890 Form

Collaboration is essential when filling out the CDTFA-890 Form, especially if you are working as part of a team. pdfFiller excels in offering real-time collaboration features, allowing team members to share and discuss the document concurrently. This is particularly useful for businesses that may have various departments contributing to the tax reporting process.

By managing comments and revisions within the platform, teams can ensure clarity and alignment on reporting details. Having multiple eyes on the form can help catch errors before submission, which is crucial in avoiding potential complications with the CDTFA.

Submitting the CDTFA-890 Form

Once your CDTFA-890 Form is complete, the next step is submission. You have two options: file online through the CDTFA’s online portal or submit a physical copy by mail. Each method has its benefits; electronic filing is quicker and often provides immediate confirmation of submission, while mail-in submissions require more patience and the risk of delays.

Be mindful of deadlines related to your filing schedule, as timely submission is paramount to avoid penalties. To confirm that your submission was successful, whether online or via mail, tracking resources from the CDTFA can provide peace of mind that your form has been properly processed.

Troubleshooting common issues

As with any form, complications can arise when completing the CDTFA-890 Form. To mitigate such issues, familiarize yourself with common FAQs related to the form. For instance, confusion typically arises around exemptions and the reporting of sales tax, which the CDTFA provides guidance on through their official resources.

Should you encounter persistent issues or have specific questions, contacting the CDTFA directly may be your best course of action. Additionally, utilizing pdfFiller's support resources can expedite your problem-solving process, offering direct assistance tailored to the platform.

Key resources on the CDTFA-890 Form

For those looking to navigate the nuances of the CDTFA-890 Form, many resources are available. Official links to the CDTFA provide you with access to the most current guidelines, instruction manuals, and frequently updated forms. Moreover, tapping into community forums can also yield valuable insights from fellow businesses facing similar challenges.

Exploring additional tax documentation related to the CDTFA-890 can furnish your understanding, further supporting your tax compliance efforts. This comprehensive review ensures you're not only filing the CDTFA-890 Form accurately but also maintaining a solid grasp of your overall tax obligations.

Overview of related forms and publications

Aside from the CDTFA-890 Form, businesses may encounter several related tax documents that are essential for comprehensive tax filing. Understanding forms like the CDTFA-401 or various schedules linked to specific business activities can provide a clearer picture of overall tax obligations.

It’s essential to explore the repository of publications and guides available to business owners aimed at simplifying the tax filing process. By accessing these resources, businesses can ensure they stay ahead of their tax compliance responsibility.

Enhancing your document management with pdfFiller

pdfFiller's suite of features goes beyond just filling out forms. Businesses can benefit from creating reusable templates for common documents, including tax forms like the CDTFA-890. This saves time and fosters efficiency, especially during tax season when deadlines loom.

The cloud-based document solution of pdfFiller empowers users to manage their tax-related documents securely and access them from anywhere. This is particularly beneficial for businesses that operate in multiple locations or require collaborative input on form completion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my cdtfa-890 in Gmail?

How do I fill out cdtfa-890 using my mobile device?

How do I fill out cdtfa-890 on an Android device?

What is cdtfa-890?

Who is required to file cdtfa-890?

How to fill out cdtfa-890?

What is the purpose of cdtfa-890?

What information must be reported on cdtfa-890?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.