Get the free Business Personal Property Report

Get, Create, Make and Sign business personal property report

Editing business personal property report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business personal property report

How to fill out business personal property report

Who needs business personal property report?

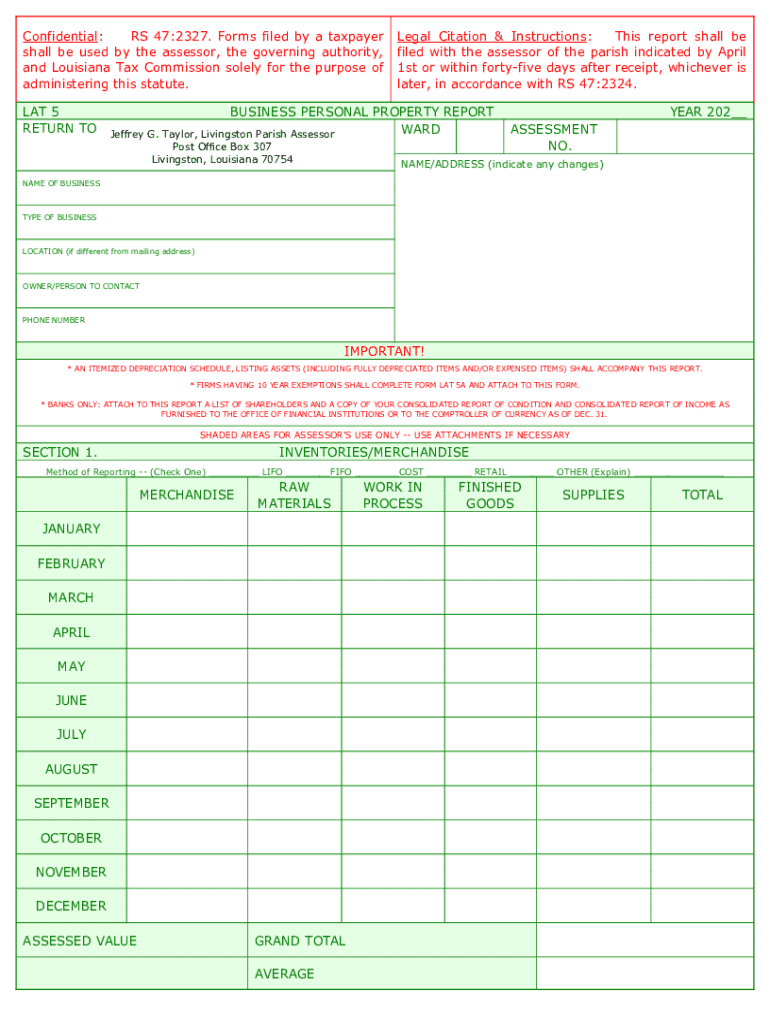

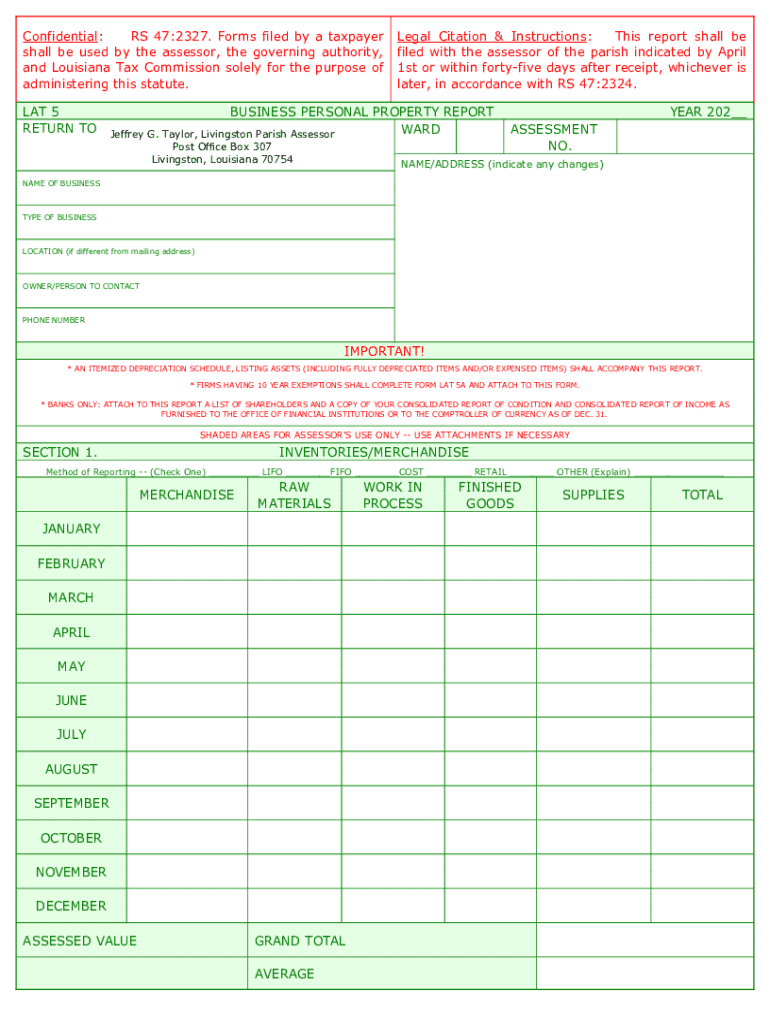

Understanding the Business Personal Property Report Form

Overview of business personal property reports

Business Personal Property (BPP) refers to all physical items owned by a business that are not classified as real estate. This includes items such as furniture, equipment, machinery, and even supplies. Filing a Business Personal Property (BPP) report is crucial for compliance with local tax regulations, as it helps to accurately assess property tax obligations. It's an opportunity for businesses to disclose their owned property to the relevant county offices, thus ensuring proper assessment for taxation.

A business personal property report form serves as an official document that detailing the personal property owned by a business entity. This form is not only necessary for tax purposes but also aids businesses in tracking and managing their assets effectively. Understanding how to complete and manage this form will help streamline financial operations while ensuring adherence to legal requirements.

Understanding the business personal property report form

The business personal property report form is divided into several key components that outline the requirements for accurately declaring business assets. The typical sections include basic business information, a detailed list of owned property, asset valuation methods, and any exemptions that may apply. Each section requires specific data points to properly assess the business's personal property value for tax purposes.

Common terminologies used in the report include asset classification, assessed value, and depreciation. Completing the form requires a thorough understanding of these terms and how they relate to the business's financial standing. Additionally, critical data points must be gathered, such as the age and condition of assets, current market value, and any past filings related to property.

Step-by-step guide to completing the business personal property report form

Gather the necessary information

Before filling out the business personal property report form, it is vital to collect all necessary documentation. This includes financial statements, previous property tax returns, and detailed lists of all business assets. Understanding asset valuation and appropriate categorization is crucial to comply with local taxation policies and ensure that you report the accurate value.

Filling out the form

Begin filling out the report by entering basic business information such as the business name, address, and tax identification number. In the property details section, provide descriptions of each item, including types, purchase dates, and current values. Use a consistent method for asset valuation, whether by cost, market value, or replacement cost, and ensure that every asset listed corresponds to the required detail.

Reviewing your completed form

Once the form is completed, a thorough review is essential. Create a checklist to confirm that all required sections are filled and that there are no discrepancies. Common mistakes to avoid include inaccurate valuations and omitting details about any assets. A well-reviewed report minimizes the risk of audits or penalties from tax authorities.

Filing the business personal property report

Methods for submission

Business owners can submit the business personal property report through various methods. Many counties offer electronic filing options, making the submission process faster and more efficient. Alternatively, traditional mail remains available for those preferring a physical submission of their reports, allowing businesses to retain documents for their records.

Deadlines for filing

Filing deadlines vary by location, so it is crucial to check with local authorities regarding the specific requirements and due dates. Failure to meet these deadlines can lead to penalties or estimates being placed on your property, resulting in increased taxes. Understanding these timelines helps businesses avoid unnecessary financial burdens.

Managing your business personal property report

Updates and amendments

Changes in business assets or property status require timely reporting. If your business acquires new property or makes disposals, it is essential to report these changes through an amended form. Knowing the procedures for filing amendments ensures compliance and maintains accuracy in records.

Record keeping

Maintaining meticulous records is fundamental for effective property management. Keeping documentation for a recommended duration of at least five years after filing is a good practice. This includes receipts for assets, past reports, and any correspondence with tax agencies, which can be invaluable during potential audits.

Troubleshooting common issues

When facing discrepancies in your business personal property report, it’s important to identify and resolve issues promptly. Common problems include misreported asset values or missing items. In such cases, contacting the appropriate county authority can provide guidance and support. If disputes arise, understanding the appeals process can empower you to contest any erroneous assessments.

Additional forms related to business personal property

Besides the primary business personal property report form, various other relevant forms may be necessary. For example, moveable equipment certification and personal property appraisal records are essential for specific asset declarations. Accessing and completing these forms through pdfFiller can simplify the process, ensuring accuracy and compliance with local regulations.

Using pdfFiller’s tools can streamline your form management experience. The platform offers editing capabilities, standard form templates, and resources for proper completions, making it a valuable resource for businesses aiming to enhance their documentation processes.

Why choose pdfFiller for your document management needs

pdfFiller stands out for its convenient, cloud-based access and collaboration features, allowing users to edit, sign, and manage their documents from anywhere. Its user-friendly interface simplifies the business personal property report form completion process, combining essential functions into a single platform.

The exclusive features provided by pdfFiller include robust storage options for sensitive documents, ensuring that all data remains secure. Testimonials from satisfied users highlight how pdfFiller’s solutions have optimized their documentation needs, resulting in better management and compliance with local tax requirements.

FAQs about business personal property reports

Understanding the nuances of the business personal property report form can raise several questions. Common inquiries include how to determine asset valuations, what to do if assets have been sold or disposed of, and how to handle discrepancies after submission. Providing clear answers to these FAQs is vital for empowering businesses to navigate their reporting processes confidently.

Expert tips suggest engaging local tax professionals for guidance, especially for intricate asset categorization and valuation. Using resources available on pdfFiller can further enhance understanding and efficiency, ensuring that businesses adhere to reporting obligations without unnecessary stress.

Upcoming deadlines and announcements

Being aware of upcoming deadlines for business personal property reports is essential for compliance. Many counties outline important dates in local tax announcements, which vary significantly by jurisdiction. Staying informed of these updates not only helps in timely filings but also aids in proactive tax management, preventing missed opportunities or penalties.

Monitoring any legislative changes affecting business personal property reporting is equally important. Such changes can alter filing requirements or deadlines, making proactive research critical for business owners aiming to maintain compliance and avoid complications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out business personal property report using my mobile device?

How do I complete business personal property report on an iOS device?

How do I edit business personal property report on an Android device?

What is business personal property report?

Who is required to file business personal property report?

How to fill out business personal property report?

What is the purpose of business personal property report?

What information must be reported on business personal property report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.