Get the free Checklist: Petition for Homestead-Formal Administration

Get, Create, Make and Sign checklist petition for homestead-formal

Editing checklist petition for homestead-formal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out checklist petition for homestead-formal

How to fill out checklist petition for homestead-formal

Who needs checklist petition for homestead-formal?

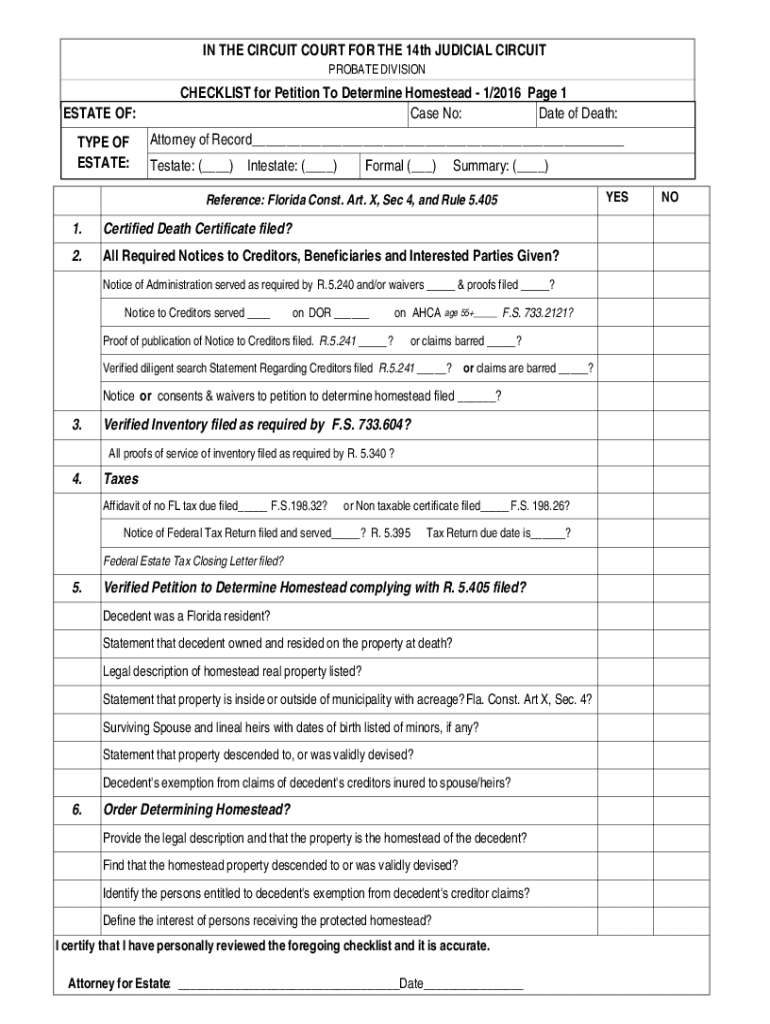

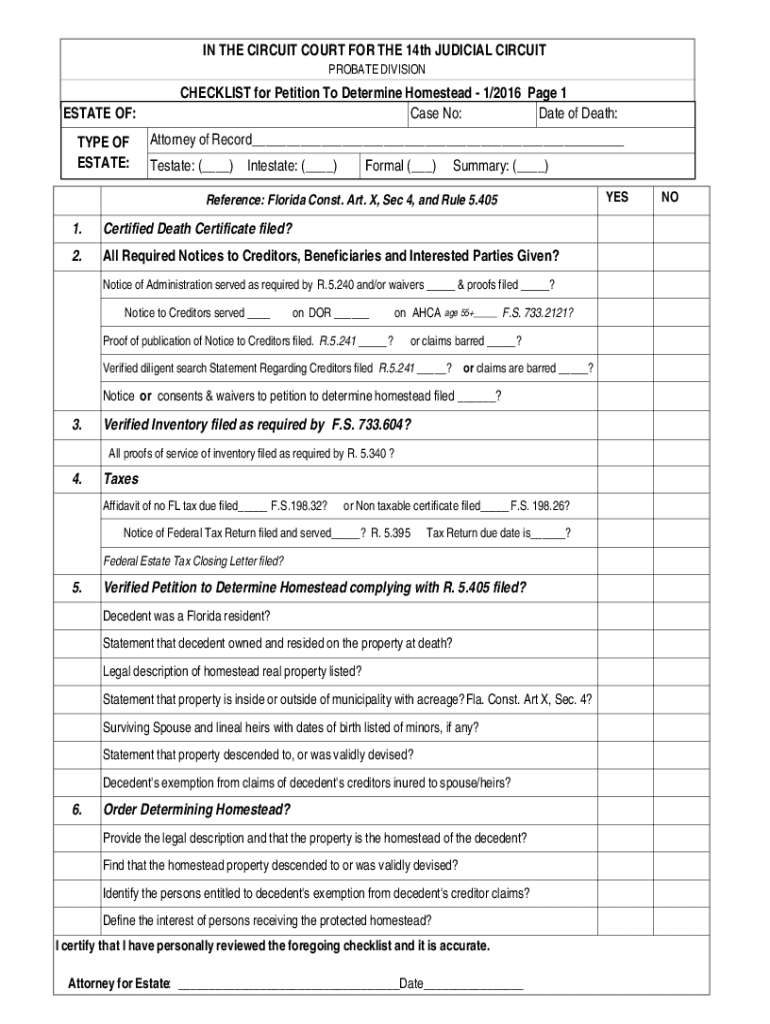

Checklist petition for homestead - formal form

Understanding the homestead exemption

The homestead exemption is a legal provision that helps homeowners protect a portion of their property from creditors, significantly aiding individuals in financial distress. It not only serves as a vital measure for securing a family's residence but also offers potential tax reductions, making homeownership more affordable. By filing for a homestead exemption, homeowners can reduce their taxable property value, which subsequently lowers property tax bills.

Filing a homestead petition can bring a myriad of benefits. Homeowners can enjoy peace of mind knowing their home is safeguarded against unforeseen financial troubles. Additionally, it provides tax benefits that can lead to substantial savings on annual property taxes, particularly beneficial for lower-income individuals and seniors. The eligibility criteria vary by state, but generally, homeowners must reside in the property and demonstrate ownership.

Overview of the checklist petition for homestead

The checklist petition for homestead is a formally structured document designed to guide homeowners through the process of applying for homestead exemptions. This form is essential for ensuring all necessary information is adequately provided to local authorities, aiding in a smooth application process. The checklist serves not only as a reminder of what to include but also helps to prevent common errors that could delay approval.

Completing this form is pivotal during certain periods, such as when seeking to benefit from tax reductions at the beginning of the tax year. Homeowners should use this form if they are new applicants or if there have been changes to their property or ownership status, such as inheritance or significant renovations. The key information required typically includes personal identification details, property specifics, and occupancy declarations.

Step-by-step instructions for completing the homestead petition

Completing the checklist petition for homestead requires thorough preparation. Start by gathering essential documentation that verifies your residency and ownership. This may include utility bills, tax statements, or mortgage information that show your name and address. Financial information demonstrating your income level may also be necessary, as some states use income levels to determine eligibility.

Next, completing the form involves breaking it down section by section. Typically, the first part includes your personal details, such as name, address, and identification number. Following this, you'll need to provide information about the property you're claiming, including its legal description and parcel number. To avoid common mistakes, double-check that all names are spelled correctly and that all asked-for signatures are included. This thoroughness can help mitigate delays in processing your petition.

Tips for editing and finalizing your form

Once you’ve filled out the checklist petition, it’s essential to review and edit the form thoroughly. Utilizing pdfFiller’s editing tools can significantly enhance your document’s professionalism and accuracy. You can easily input corrections, adjust formatting errors, and ensure that the overall presentation reflects a polished final product.

In addition, adding a digital signature via pdfFiller not only improves the form’s credibility but also speeds up the processing time. If you're filing as a part of a family or joint ownership, consider collaborating with others on the form for verification and support to avoid discrepancies. Collaboration features allow team members to input changes and validate information before final submission.

Submitting your checklist petition for homestead

After completing and finalizing your petition, the next step is to submit the form to the appropriate local government office. Depending on your locality, this may be the county assessor's office or the local tax office. It is crucial to verify the submission guidelines as they can vary by state and county. Some areas allow digital submissions, while others require physical copies.

Additionally, keeping tabs on important deadlines is essential, as many jurisdictions have strict cutoff dates for homestead filings, usually aligned with tax filing seasons. After submission, inquire about follow-up procedures, including how to track the status of your petition to ensure it is processed without issues.

Managing your homestead information post-submission

Post-submission, it’s crucial for homeowners to keep track of their petition's status. Many local government offices provide a tracking system or a hotline that can help you monitor the progress of your application. Keeping records of any correspondence, including date-stamped receipts or emails regarding your submission, is also advisable.

Expect a follow-up from your local office, which may take weeks or even months, depending on the volume of applications they receive. Common queries may include clarity on timelines and what happens if documents are found missing or if additional information is required. Preparing for these scenarios ahead of time will help streamline any future communications.

Interactive tools for enhanced document management

Utilizing pdfFiller’s cloud-based features offers immense advantages in document management. The platform allows users to store, edit, and access files securely from any device, so you’re never without the essential documents you need for your homestead petition. Enhanced collaboration tools enable users to work together on forms even when they are miles apart, ensuring everyone contributes accurately.

Additionally, prioritize secure document storage and access, especially since sensitive personal information is involved in the homestead petition process. Regularly updating your passwords and using encryption features provided by pdfFiller can further protect your documentation.

Troubleshooting common issues

Despite thorough preparation, issues might arise during the homestead petition process. Common problems include incomplete submissions or missing mandatory components. Identify these problems early by reviewing rejection letters or feedback from local offices promptly, and ensure to address them swiftly to avoid delays.

If you encounter challenges or require further assistance, local authorities typically have resources available to guide you. Consider reaching out with specific questions, as officials are often willing to assist. Your local tax office may also have informational sessions or websites that address frequently asked questions regarding homestead exemptions.

Alternative forms related to homestead petitions

There are various other forms and checklists associated with the homestead petition that may be required depending on your particular situation. For instance, you might need forms related to tax declarations or qualifications for senior citizen exemptions. Additionally, becoming familiar with requirements specific to your state can prove invaluable.

Cross-referencing with state-specific requirements ensures that you are not only on track with your homestead petition but also compliant with any supplementary filing requirements. Understanding these additional forms will help guarantee a seamless process overall.

Conclusion and next steps

The process of filing a checklist petition for homestead may seem daunting, yet it holds profound benefits for homeowners who navigate it efficiently. Understanding both the purpose and the mechanics of this essential form can safeguard your home while offering financial relief. Leverage the tools available through pdfFiller to streamline your experience and enhance your document management capabilities.

By utilizing the comprehensive features of pdfFiller, you can successfully navigate the complexities of homestead petitions while ensuring your documentation remains organized and secure. Embrace these tools for your ongoing document needs and set yourself up for a successful filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute checklist petition for homestead-formal online?

Can I create an electronic signature for signing my checklist petition for homestead-formal in Gmail?

How can I edit checklist petition for homestead-formal on a smartphone?

What is checklist petition for homestead-formal?

Who is required to file checklist petition for homestead-formal?

How to fill out checklist petition for homestead-formal?

What is the purpose of checklist petition for homestead-formal?

What information must be reported on checklist petition for homestead-formal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.