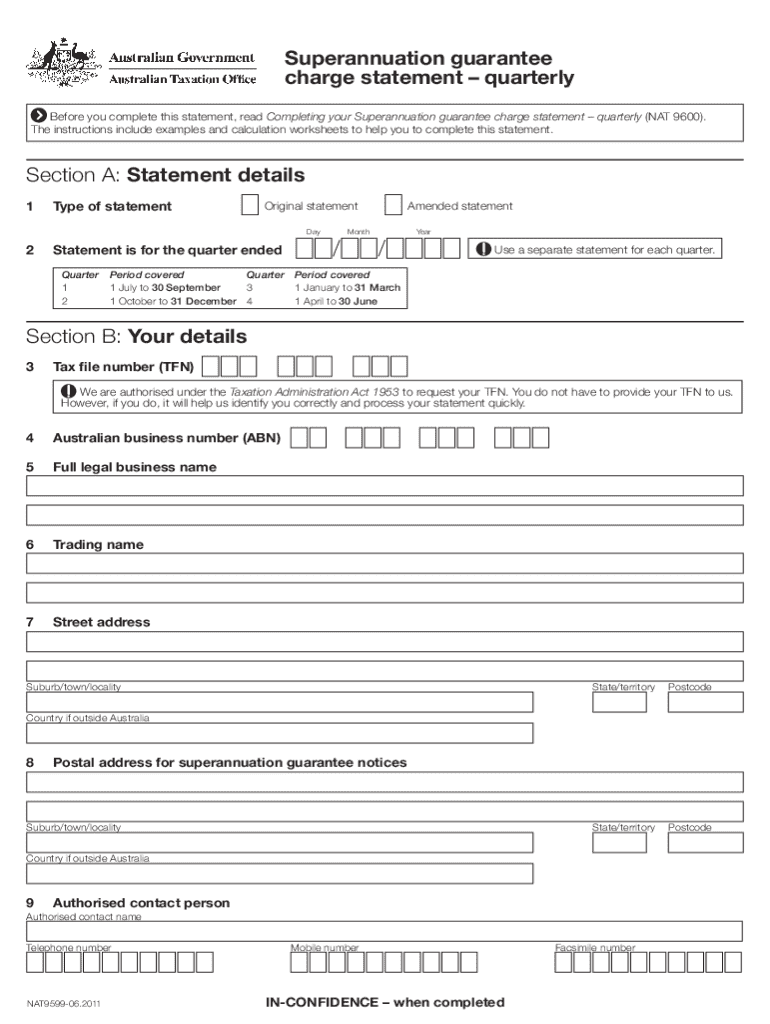

Get the free superannuation guarantee form

Get, Create, Make and Sign super guarantee form

How to edit superannuation guarantee form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out superannuation guarantee form

How to fill out superannuation guarantee charge statement

Who needs superannuation guarantee charge statement?

Superannuation Guarantee Charge Statement Form: A Comprehensive Guide

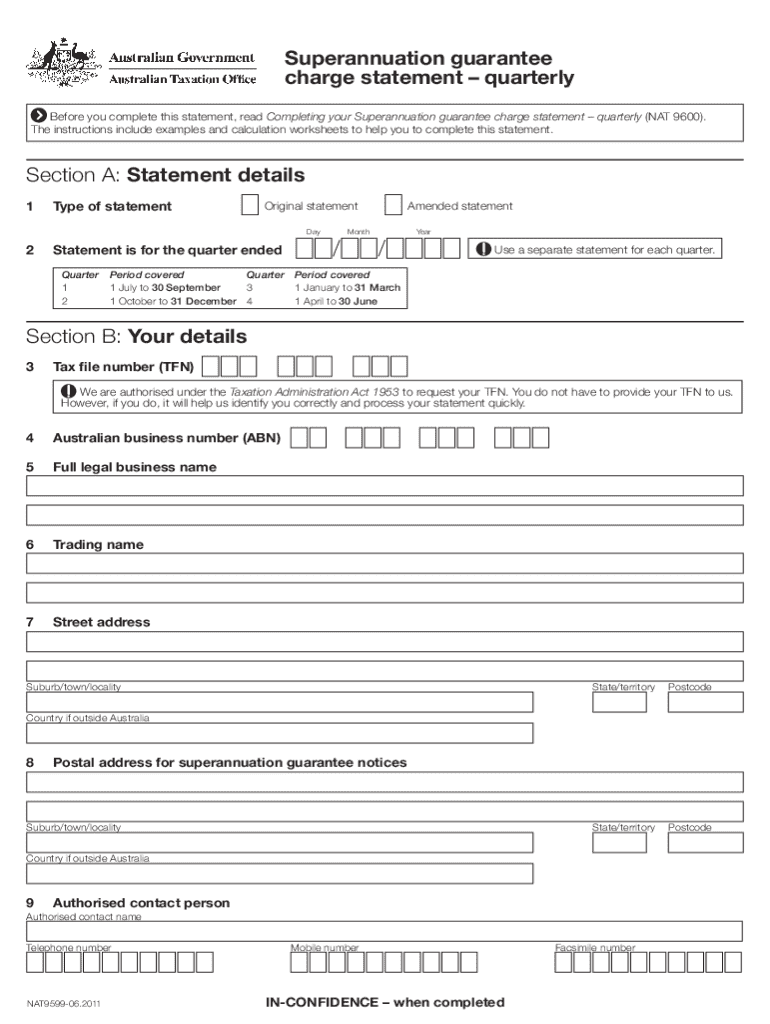

Overview of the Superannuation Guarantee Charge

The Superannuation Guarantee Charge (SGC) is a critical obligation that employers in Australia must fulfill, mandating contributions to an employee's superannuation fund. The SGC aims to ensure that workers save for retirement, thereby having a more financially secure future. Employers are required to contribute a certain percentage of an employee's ordinary time earnings to a superannuation fund, with the percentage typically subject to changes based on government policy.

The importance of the SGC is twofold: it ensures employees have adequate retirement savings while reinforcing the employer's commitment to workforce benefits. To successfully navigate these responsibilities, employers must understand key terms such as 'ordinary time earnings,' 'superannuation fund,' and ‘understanding the SGC’ to avoid costly mistakes.

Understanding the necessity of superannuation guarantee charge statements

Employers are required to file SGC statements as part of their compliance with superannuation obligations. These documents serve as evidence that the requisite contributions have been made to employee super funds. Failing to lodge an SGC statement can lead to financial penalties from the Australian Taxation Office (ATO), including administrative fees and interest on unpaid contributions.

Certain situations necessitate an SGC statement, such as when an employer fails to meet their contribution obligations by the due date or when an employee's superannuation contributions are below the required levels. Understanding these requirements is crucial for maintaining compliance and ensuring timely and accurate financial planning.

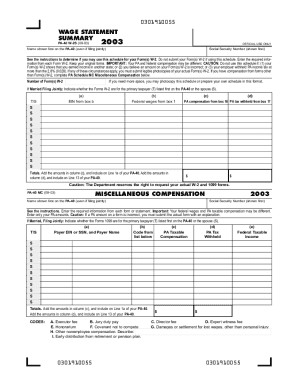

Step-by-step guide to completing the superannuation guarantee charge statement form

Completing the superannuation guarantee charge statement form involves several key steps that ensure accuracy and compliance. Properly addressing each part of this form is imperative to avoid unnecessary complications.

Step 1: Gathering required information

Before filling out the form, employers need to gather specific records. Essential documents include payroll records, employee contribution history, and details regarding the superannuation funds used. Ensure the following information is available:

Step 2: Filling out the SGC statement form

When filling out the form, attention to detail is key. Each section, from identifying the employer to listing the super funds, must be completed accurately. Some common mistakes include miscalculating contribution percentages or entering incorrect employee details, which can lead to delays or penalties.

Step 3: Verifying your entries

After completing the form, it's crucial to verify all entries for accuracy. Double-check calculations and ensure all information aligns with the accounts to prevent errors. Tips include cross-referencing with your payroll records and keeping a checklist of each requirement.

Step 4: Submitting the form

Once the form is completed and verified, it's time to submit it. Employers can submit their SGC statements online via the ATO’s Business Portal or send a paper copy. Due dates for submission are typically within 28 days of the end of the quarter in which the SGC arose, emphasizing the importance of prompt action.

Tools for facilitating SGC statement management

Managing SGC statements can be simplified using various interactive tools. For instance, calculators can assist in determining the exact amount of superannuation due for your staff, ensuring compliance and accuracy. Additionally, utilizing pdfFiller empowers employers to manage their superannuation documents effectively.

pdfFiller’s capabilities to edit, sign, and submit documents online save time and minimize errors. A cloud-based document management system allows teams to remain organized, access documents remotely, and collaborate seamlessly. Such tools enhance the overall experience, promoting efficiency.

Common questions regarding the superannuation guarantee charge statement

Employers may have several questions while navigating the SGC process. For instance, what happens if the submission deadline is missed? Typically, the ATO imposes penalties, and employers may face increased scrutiny if late submissions become habitual.

Another common concern is whether an SGC statement can be amended after submission. Fortunately, SGC statements can be adjusted; however, specific protocols must be followed to rectify any errors. Employers should also understand how to manage any disputes with the ATO, ensuring clear communication and proper guidance are available throughout the process.

Implications of late payments and charge statements

Late payments of superannuation contributions invite serious repercussions. The Australian Taxation Office has a clear policy around penalties for such inconsistencies, which may include interest and additional fees. Understanding how the ATO assesses these penalties is vital for employers to mitigate risks.

Failure to address late payments not only affects current compliance but could influence future obligations as well. Regular audits refresh employer awareness of timelines and contributions, ensuring that proper practices are maintained moving forward.

Best practices for employers

Maintaining accurate records of superannuation contributions should be a priority for every employer. Regular audits of payroll practices can help identify gaps in compliance and ensure timely contributions to super funds. Furthermore, continuous engagement with employees regarding their superannuation rights fosters a culture of transparency and accountability.

Employers should consider investing in training or resources that enhance their understanding of superannuation obligations, ensuring they're equipped to meet requirements effectively. Utilizing tools such as pdfFiller simplifies the document management process, allowing employers to concentrate on their core business.

Working with the ATO: communication and compliance

Engaging early with the ATO is crucial if issues arise regarding superannuation compliance. Clear and proactive communication could help resolve concerns without excessive penalties. Establishing relationships with ATO agents can be beneficial when facing complexities in the SGC submission process.

Resources available for small business owners include guidance from the ATO’s website, where comprehensive material is available to support employers in meeting their obligations. Always consider reaching out for assistance before problems escalate, as proactive measures can mitigate long-term consequences.

Additional considerations for different types of employees

Employers must recognize that superannuation obligations vary depending on the type of employment relationship. For part-time or casual workers, employers may still be required to make super contributions, given they meet set thresholds. Additionally, independent contractors might fall under different regulations, requiring further understanding.

International workers also present unique challenges concerning superannuation. Employers engaging such staff need to be aware of the specific requirements and ensure compliance to foster a productive and positive working environment.

Case studies and real-world examples

Consider a small business that struggled with SGC compliance due to misunderstandings about employee classifications. After engaging with the ATO and rectifying their practices, they submitted their SGC statement on time for the subsequent period, thus avoiding penalties and fostering a better relationship with their employees.

In another scenario, a late submission of an SGC statement led an employer to pay substantial penalties. With proper tools like pdfFiller, the employer eventually learned to manage documentation and submissions effectively, which significantly reduced their risk of non-compliance.

Engaging with documentation resources

Navigating superannuation documentation effectively can save time and reduce anxiety. Utilizing pdfFiller’s tools enhances the process, allowing users to manage, edit, and sign forms digitally, streamlining workflow. Tips for editing include using built-in templates to customize forms to your specifications.

In a collaborative environment, pdfFiller supports teamwork by providing options for sharing documents securely, enabling multiple stakeholders to review and approve essential submissions. Digital collaboration prevents errors often found in traditional document handling and aligns all parties.

Key takeaways for employers and employees

Navigating the superannuation guarantee charge statement form can be intricate, but clear understanding simplifies the process. Employers should maintain a keen awareness of deadlines while ensuring they remain compliant with contribution obligations. Conversely, employees should actively engage with their rights and ensure their superannuation contributions are being met.

Embracing digital tools like those offered by pdfFiller can make these processes far more manageable, leveraging technology to streamline communication and document management. Staying informed and proactive will enable both employers and employees to navigate the superannuation landscape with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send superannuation guarantee form for eSignature?

Can I edit superannuation guarantee form on an iOS device?

Can I edit superannuation guarantee form on an Android device?

What is superannuation guarantee charge statement?

Who is required to file superannuation guarantee charge statement?

How to fill out superannuation guarantee charge statement?

What is the purpose of superannuation guarantee charge statement?

What information must be reported on superannuation guarantee charge statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.